Japanese Gardens, Dunedin, New Zealand

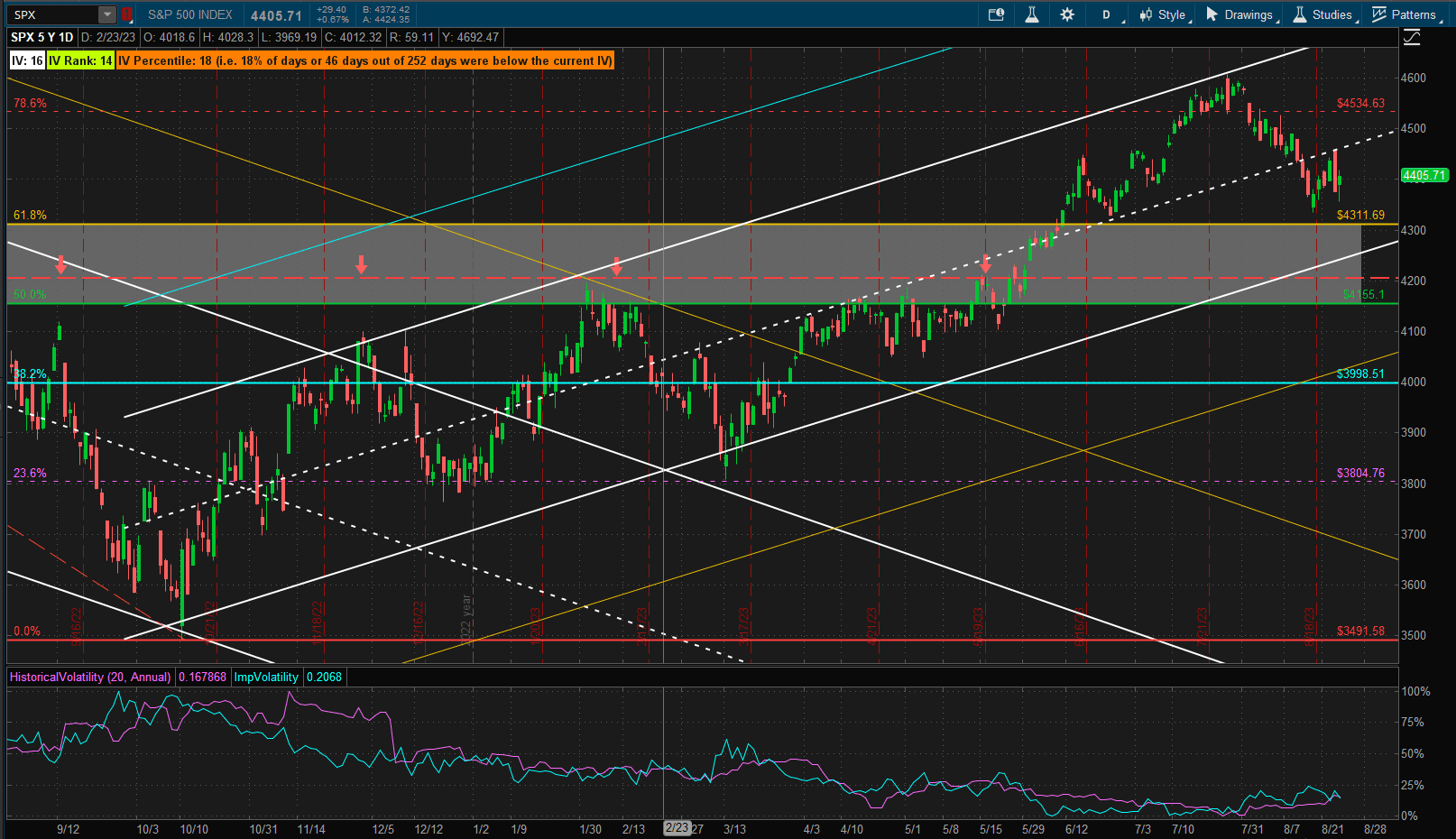

It was a rather confusing week in US equity markets with the SPX (S&P 500 Index) closing up ~0.8% over last week’s close:

However, Thursday was a strong down day and it may be that the apparent early week strength was a bit of a “head fake”. A bullish day on Friday following Thursday’s weakness was not too convincing so we will have to see whether we see a retest of the 4300 level or whether the longer term bullish trend persists going forward.

However, Thursday was a strong down day and it may be that the apparent early week strength was a bit of a “head fake”. A bullish day on Friday following Thursday’s weakness was not too convincing so we will have to see whether we see a retest of the 4300 level or whether the longer term bullish trend persists going forward.

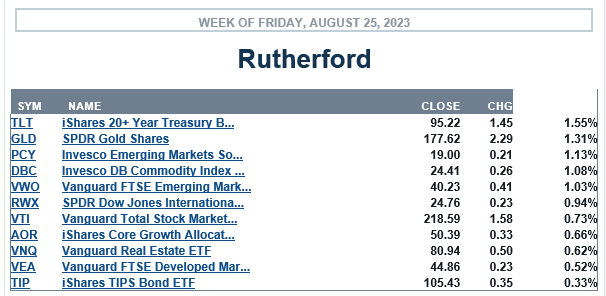

In terms of relative performance:

US equities (VTI) came in at the center of the pack but, unlike recent weeks, all major asset classes closed in positive return territory with bonds and commodities at the top of the list.

US equities (VTI) came in at the center of the pack but, unlike recent weeks, all major asset classes closed in positive return territory with bonds and commodities at the top of the list.

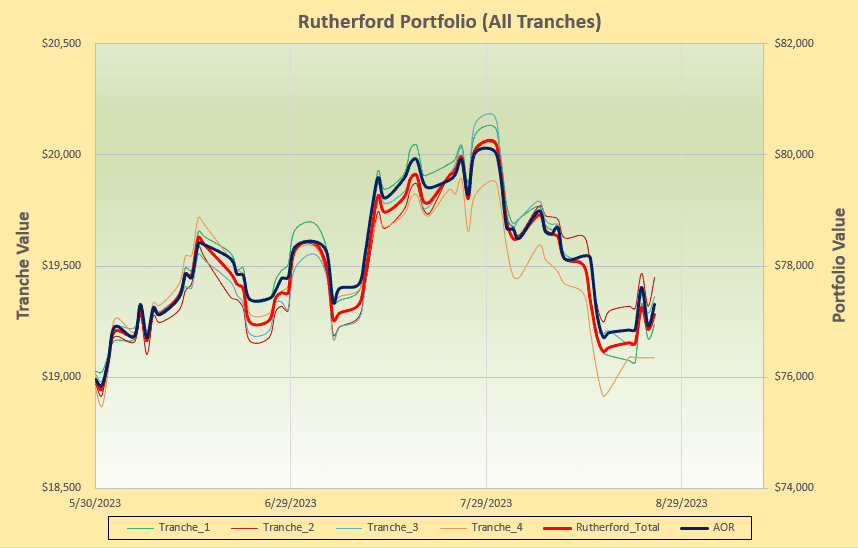

This is all a little confusing so we’ll first check the performance of the Rutherford portfolio (that moved to 100% Cash in Tranche 4 following last week’s review):

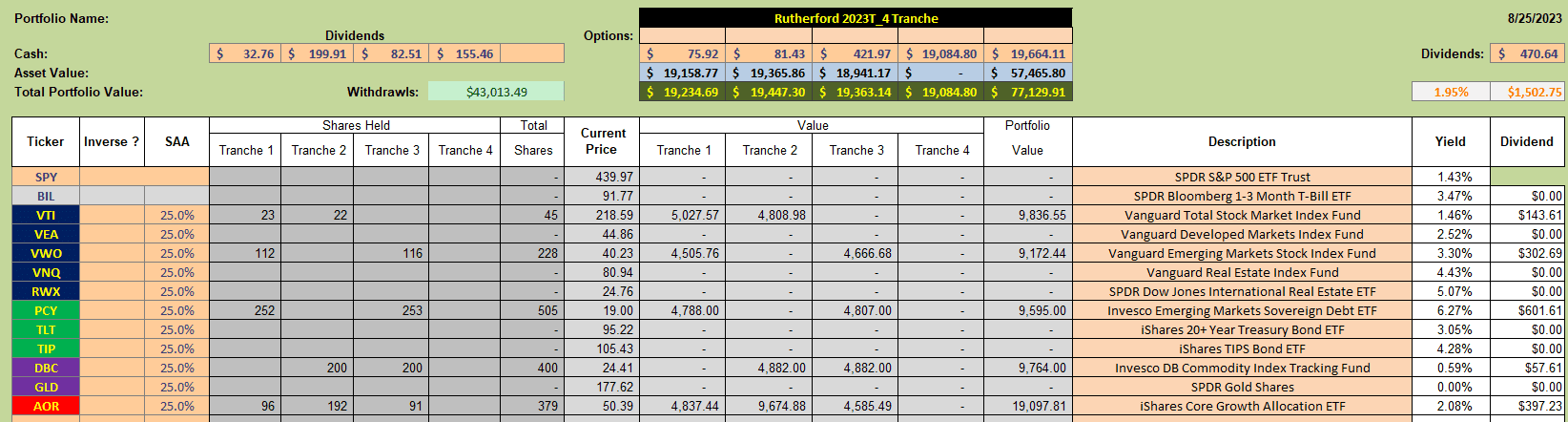

with holdings looking like this:

with holdings looking like this:

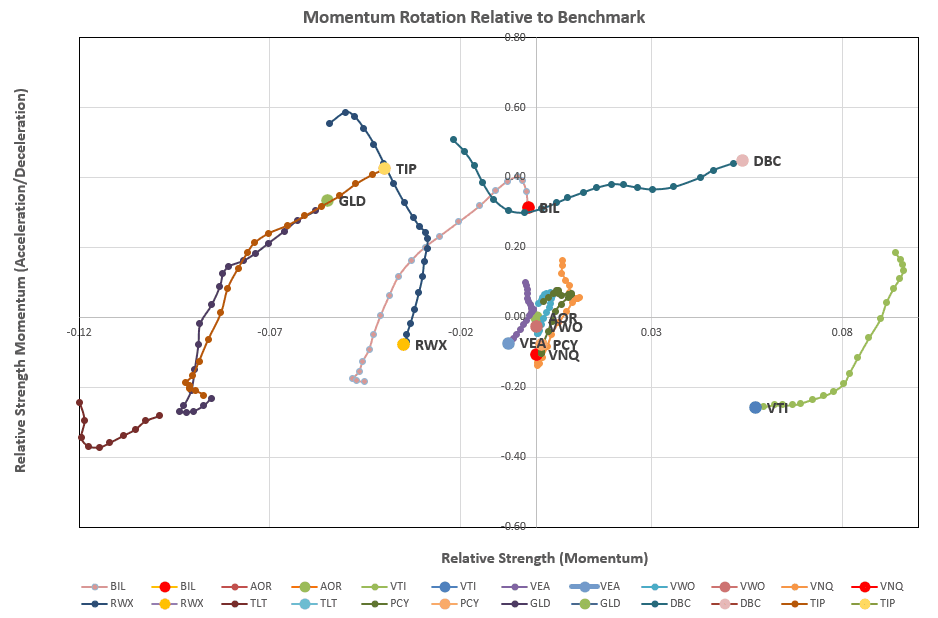

Next we’ll take a look at the rotation graphs:

Next we’ll take a look at the rotation graphs:

where only DBC (Commodities) is showing any real relative strength both long- and short-term.

where only DBC (Commodities) is showing any real relative strength both long- and short-term.

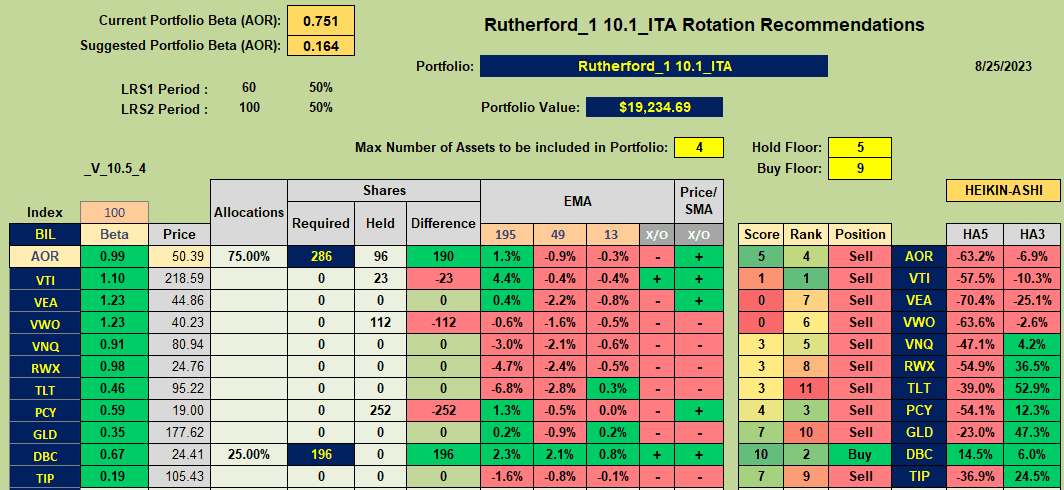

We’ll confirm this in the rankings/recommendations sheet:

where DBC is the only Buy recommendation with Sells everywhere else. As suggested above, this is all a little confusing since VTI is ranked #1 but with a Sell recommendation despite the fact that it is the only other asset with a positive 13/49 EMA cross-over. However, the short-term weakness generates 2 negative HA signals and a Score of only 1 out of 10. I think the message here is that we are currently in very uncertain times.

where DBC is the only Buy recommendation with Sells everywhere else. As suggested above, this is all a little confusing since VTI is ranked #1 but with a Sell recommendation despite the fact that it is the only other asset with a positive 13/49 EMA cross-over. However, the short-term weakness generates 2 negative HA signals and a Score of only 1 out of 10. I think the message here is that we are currently in very uncertain times.

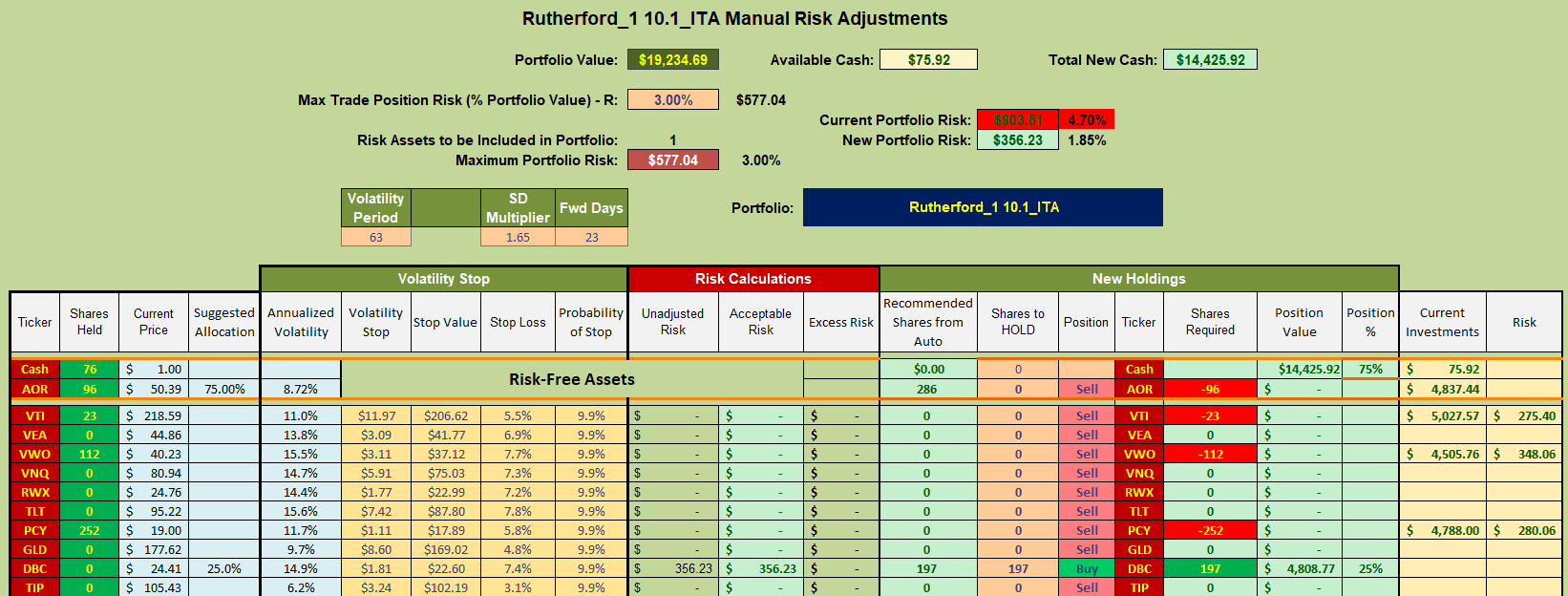

Although it is with some reluctance I will exercise some discipline and stick with the system recommendations and adjust as follows:

i.e. I will sell all current holdings and use 25% of the Cash to purchase shares in DBC – the 75% balance staying in Cash.

i.e. I will sell all current holdings and use 25% of the Cash to purchase shares in DBC – the 75% balance staying in Cash.

David

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Hi Lowell,

Why have you switched to cash (MM I assume) in the Rutherford portfolio instead of Bil as is used in other portfolios. Does it have anything to do with rising treasury rates which make Bil less attractive?

Thank you,

Bill

Bill,

Hedgehunter will need to answer this question as he manages the Rutherford portfolio.

Lowell

Bill.

Nothing that inelligent Bill, it’s just that in my rotation model the long term momentum of BIL relative to the benchmark (AOR) is negative. Short Term is positive however, so, since I would only anticipate in being in Cash/BIL for about a month that might be equally ok – neither option is going to make a big difference to overall portfolio performance so I am being lazy, or, if I wanted to feel better, saving a few pennies in trading costs by just going to Cash/MM 🙂

David