Rainbow through the “Mist” at Niagara Falls, Canada

It was a relatively quiet week in US markets as many investors celebrated Thanksgiving:

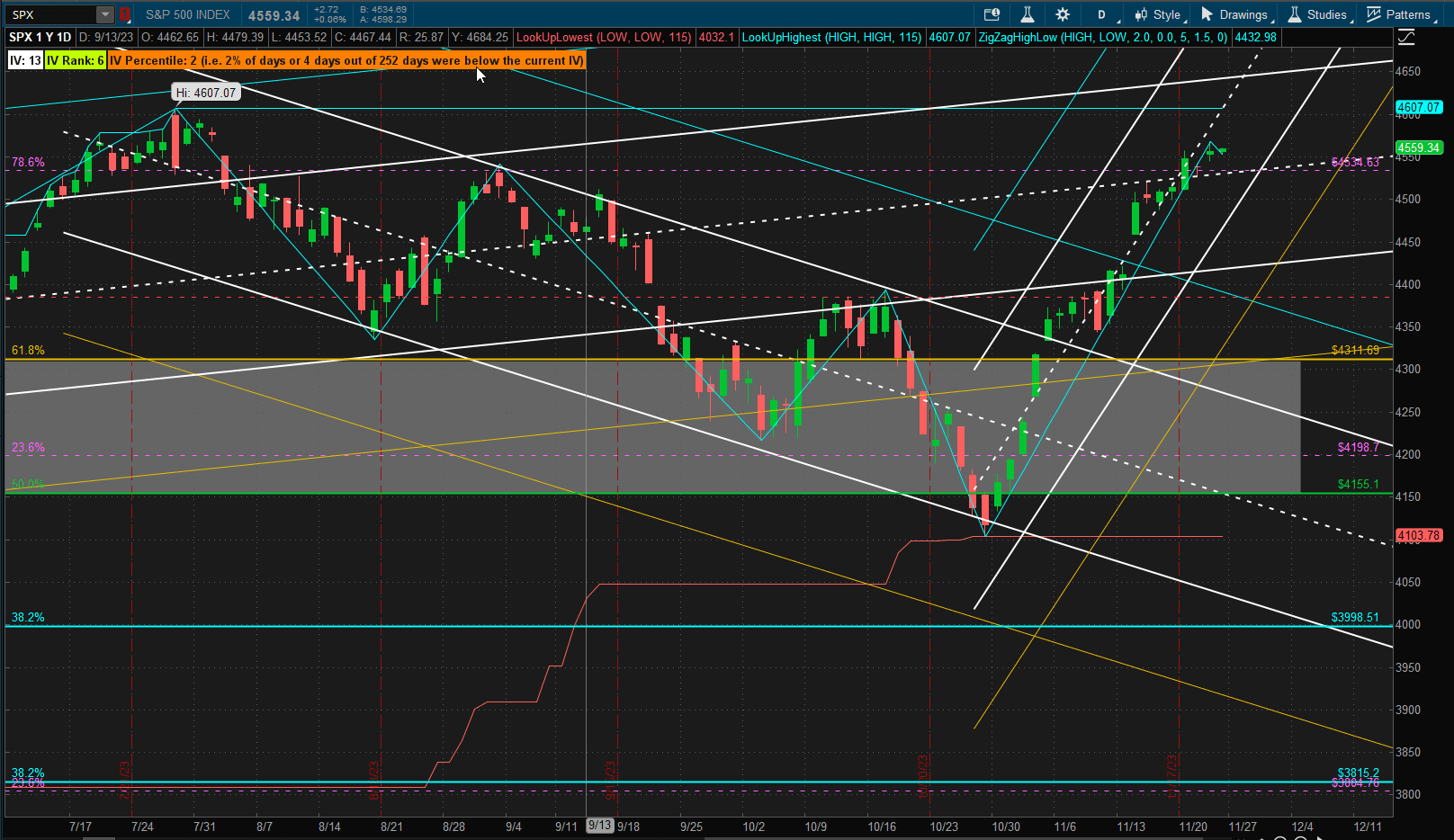

The SPX is still sitting below the resistance zone at ~4600 that we really need to see broken before the recent uptrend channel can be considered sustainable.

The SPX is still sitting below the resistance zone at ~4600 that we really need to see broken before the recent uptrend channel can be considered sustainable.

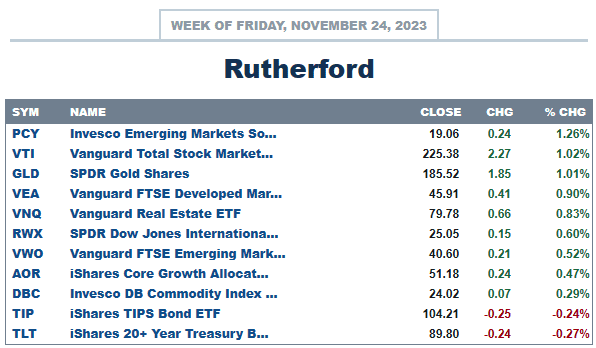

Most other markets/asset classes were also quiet, leaving US equities near the top of the list:

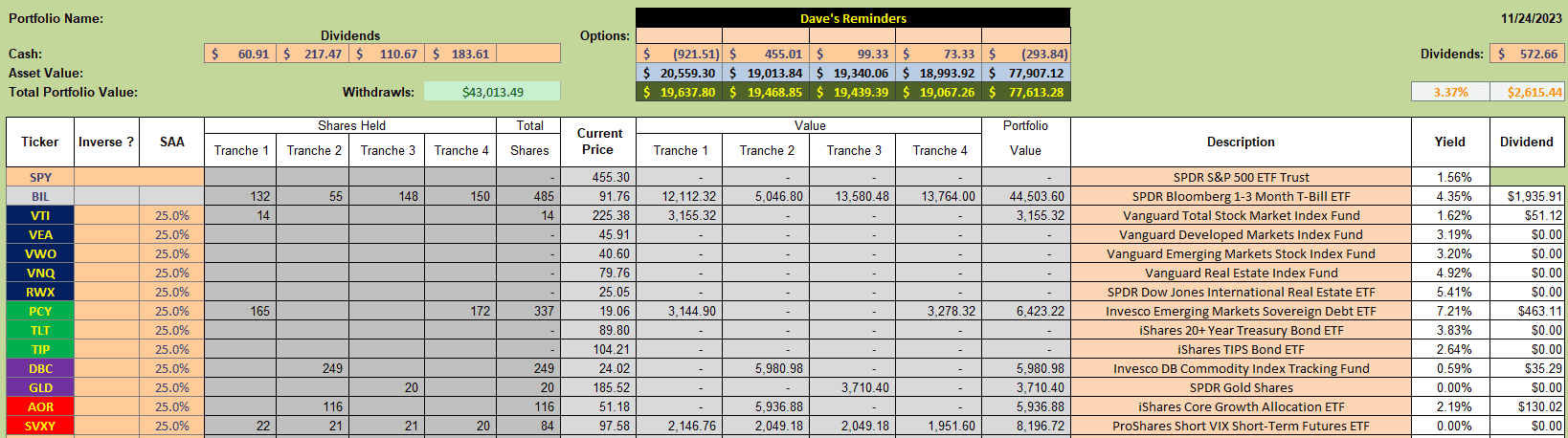

With the Rutherford Portfolio positioned very conservatively with significant cash:

With the Rutherford Portfolio positioned very conservatively with significant cash:

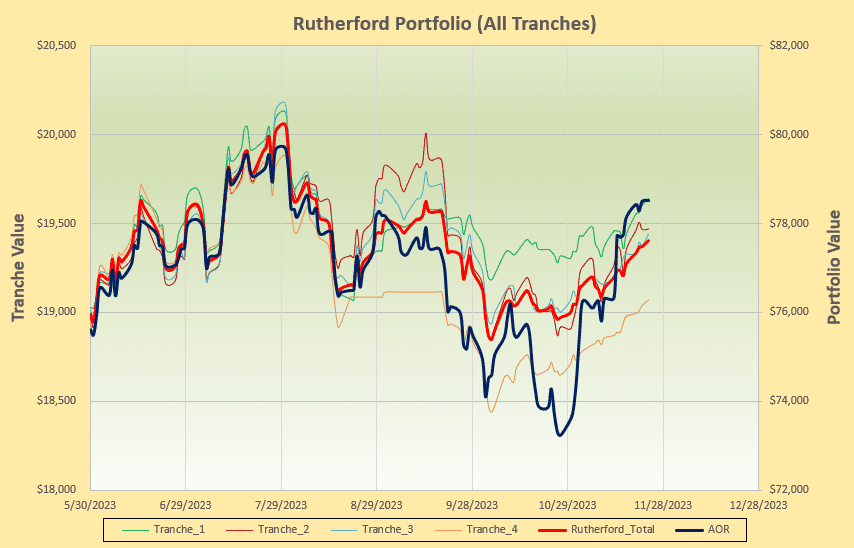

returns continued their slow upward grind but are still slightly below the benchmark level of the AOR Fund.

returns continued their slow upward grind but are still slightly below the benchmark level of the AOR Fund.

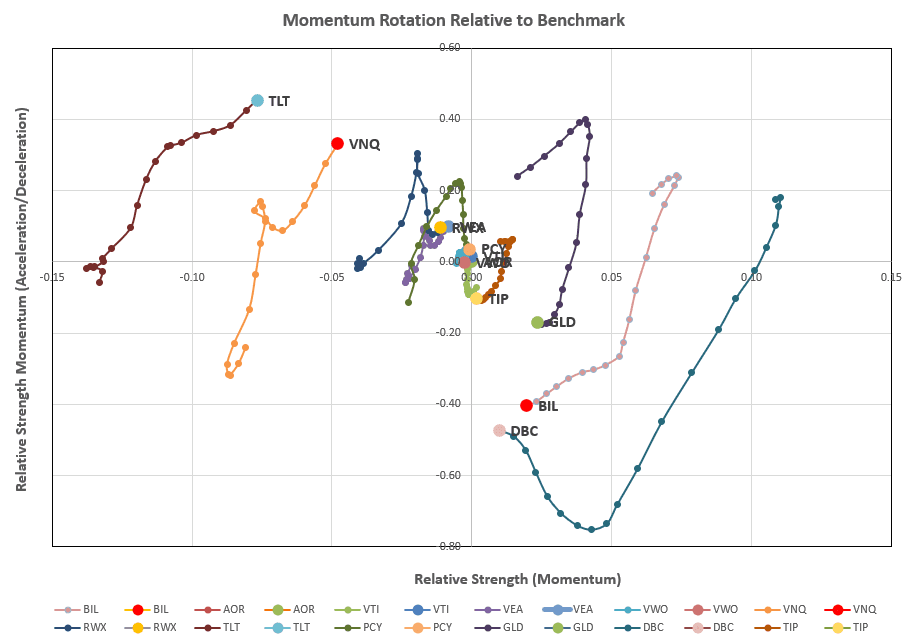

Checking the rotation graphs:

we are still not seeing any significant positive movement in the desirable top right quadrant that would suggest significant strength. Moving to the recommendations generated from the rotation algorithm:

we are still not seeing any significant positive movement in the desirable top right quadrant that would suggest significant strength. Moving to the recommendations generated from the rotation algorithm:

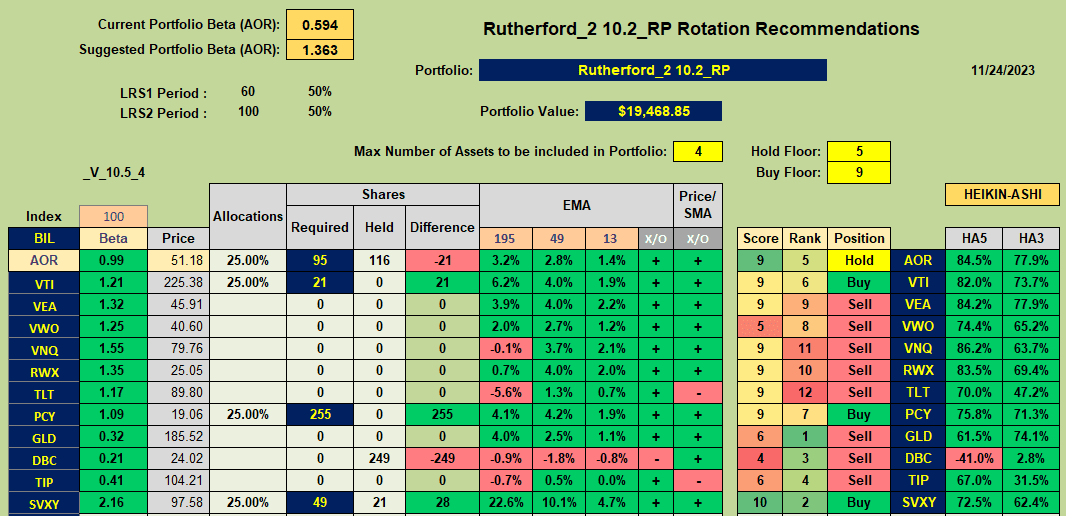

we see Buy recommendations for PCY and VTI and a Hold recommendation for AOR. Thus, of the current holdings in Tranche 2 (the focus of this week’s review), only DBC (Commodities) is a recommended Sell.

we see Buy recommendations for PCY and VTI and a Hold recommendation for AOR. Thus, of the current holdings in Tranche 2 (the focus of this week’s review), only DBC (Commodities) is a recommended Sell.

Consequently, this week’s adjustments will look something like this:

although I will only be selling 249 shares of DBC and enough shares of AOR to generate the cash required to Buy the recommended holdings in PCY and VTI. I will continue to hold the balance of shares in AOR and will not add to holings in BIL. This will save a little in commissions withought significantly adding to risk.

although I will only be selling 249 shares of DBC and enough shares of AOR to generate the cash required to Buy the recommended holdings in PCY and VTI. I will continue to hold the balance of shares in AOR and will not add to holings in BIL. This will save a little in commissions withought significantly adding to risk.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.