Leaving Sydney and The Harbor Bridge, Australia

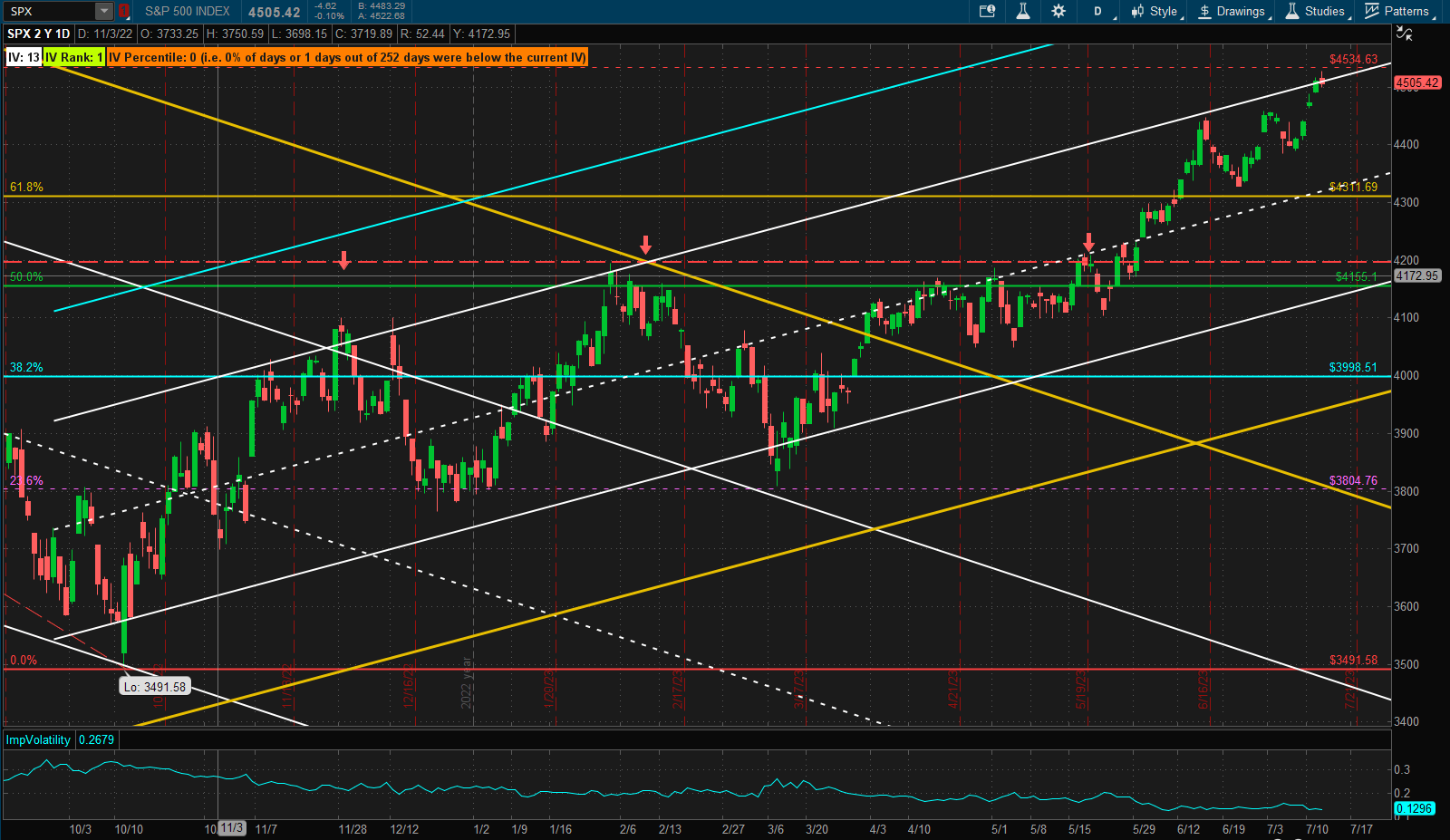

Despite a pullback on Friday it was a bullish week in US equities with prices closing ~2.7% higher than last week’s close and still sitting at the upper 1 SD boundary of the uptrend channel with volatility at it’s lowese level in the past 12 months:

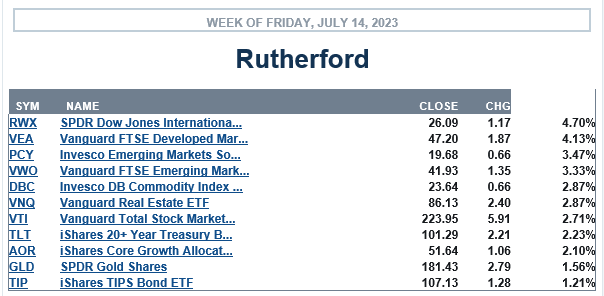

Deespite this nice performance, US equities did not make it into the top half of major asset classes in terms of performance over the past week:

Deespite this nice performance, US equities did not make it into the top half of major asset classes in terms of performance over the past week:

International equities (Developed and Emerging Markets) and Real Estate all outperformed US equities. All major asset classes showed gains on the week.

International equities (Developed and Emerging Markets) and Real Estate all outperformed US equities. All major asset classes showed gains on the week.

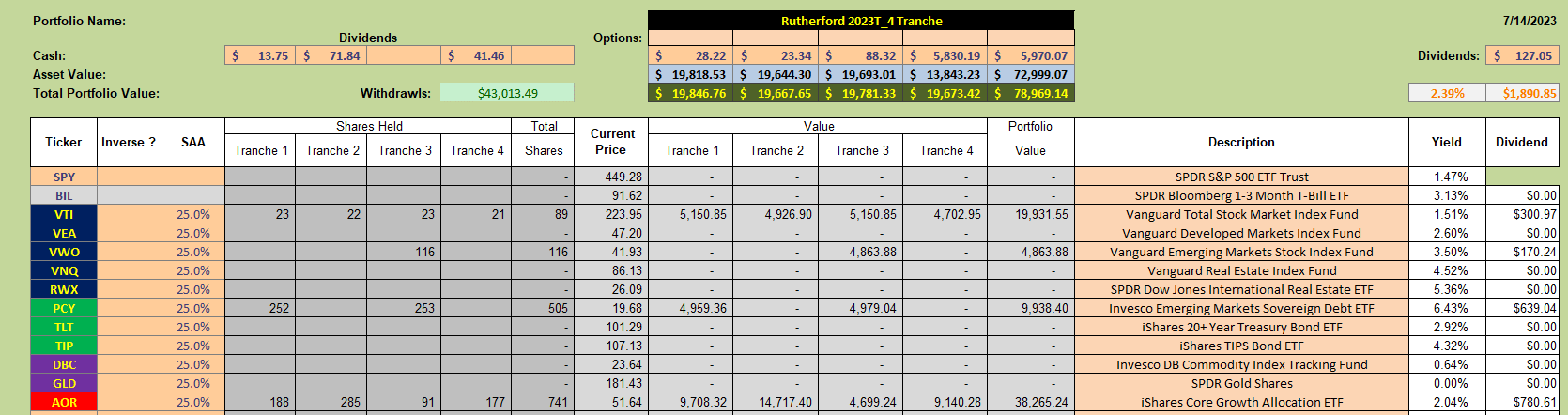

Holdings in the Rutherford Portfolio look like this:

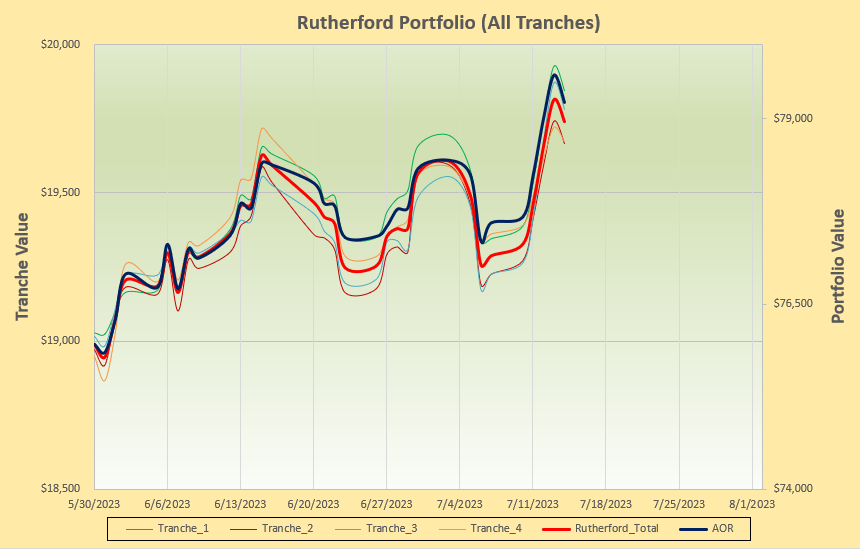

with performance matching/slightly ouperforming the benchmark AOR Fund:

with performance matching/slightly ouperforming the benchmark AOR Fund:

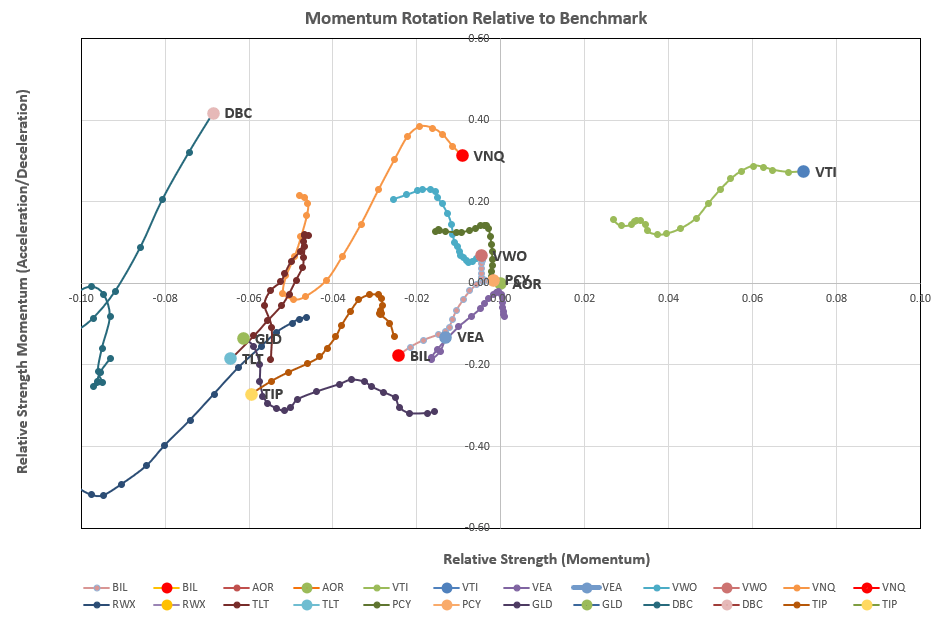

This week we take a look at Tranche 3 and decide whether any adjustments are necessary based on the momentum rotation system:

This week we take a look at Tranche 3 and decide whether any adjustments are necessary based on the momentum rotation system:

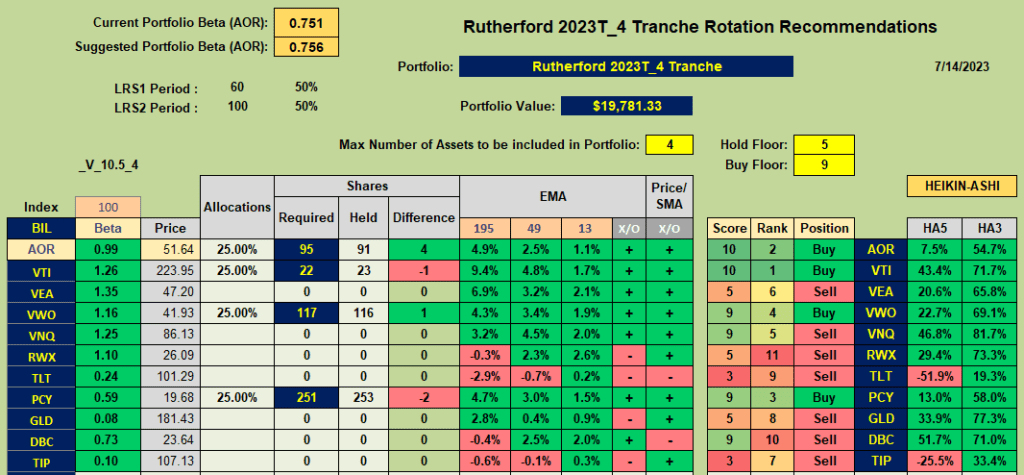

From the above plots in the rotation graphs we still see VTI as a standout in the desirable upper right quadrant and suggested holdings in the portfolio look like this:

From the above plots in the rotation graphs we still see VTI as a standout in the desirable upper right quadrant and suggested holdings in the portfolio look like this:

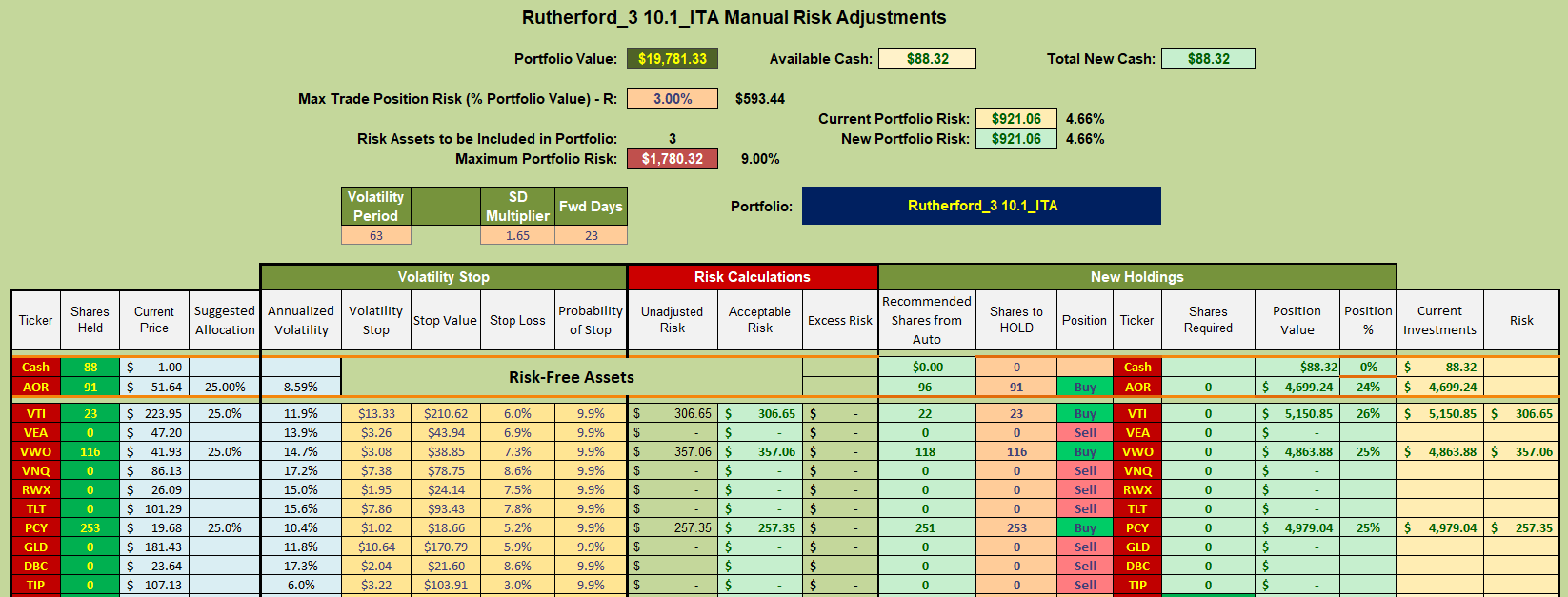

i.e since we are already holding all the assets with Buy recommendations we will continue to hold these ETFs and no adjustments are necessary (ignoring small differences in share allocation numbers):

i.e since we are already holding all the assets with Buy recommendations we will continue to hold these ETFs and no adjustments are necessary (ignoring small differences in share allocation numbers):

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.