Shakespeare’s Stratford-on-Avon, England – No Joking!

It was a holiday-shortened week in the US equity markets but stocks followed the seasonal bullish trend often seen over the days going into Thanksgiving:

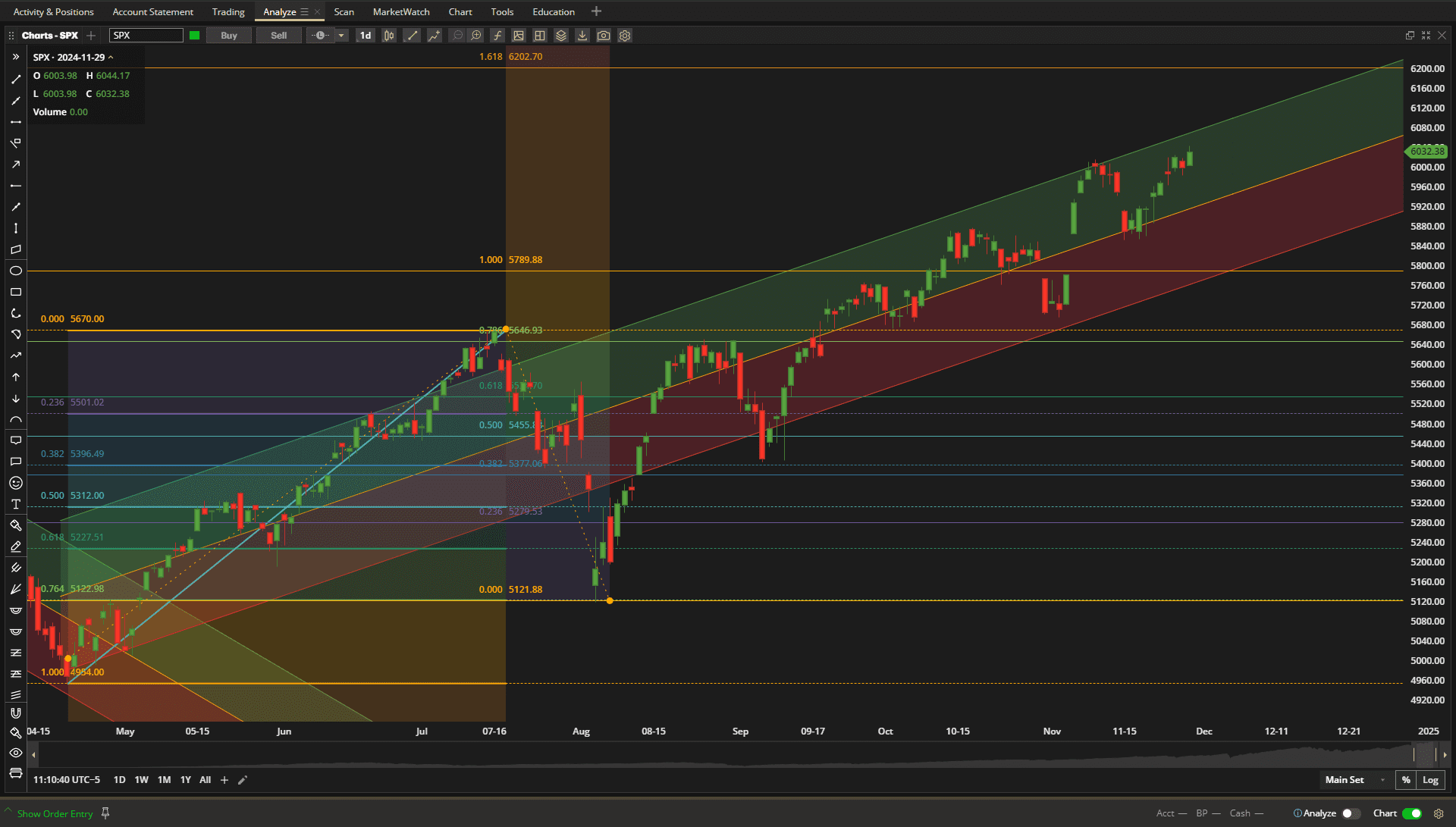

The SPX (S&P 500 Index) was up ~1.4% from last week’s close and is sitting at 6032 and re-testing the psychologically significant 6000 resistance level. If Santa gives the market a bit of a push we could still hit the 1.618 Fibonacci extention level at 6200 by the end of the year.

The SPX (S&P 500 Index) was up ~1.4% from last week’s close and is sitting at 6032 and re-testing the psychologically significant 6000 resistance level. If Santa gives the market a bit of a push we could still hit the 1.618 Fibonacci extention level at 6200 by the end of the year.

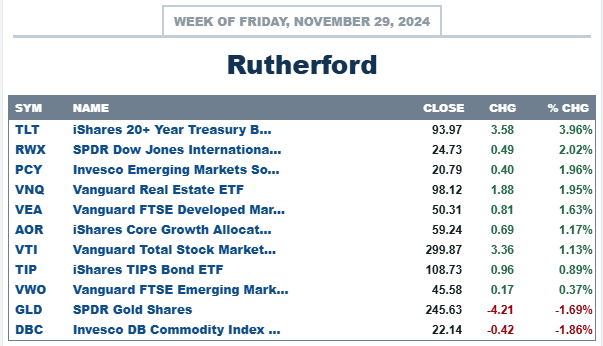

In terms of relative oerformance:

US Equities landed in the middle of the pack with Bonds and Real Estate leading the charge.

US Equities landed in the middle of the pack with Bonds and Real Estate leading the charge.

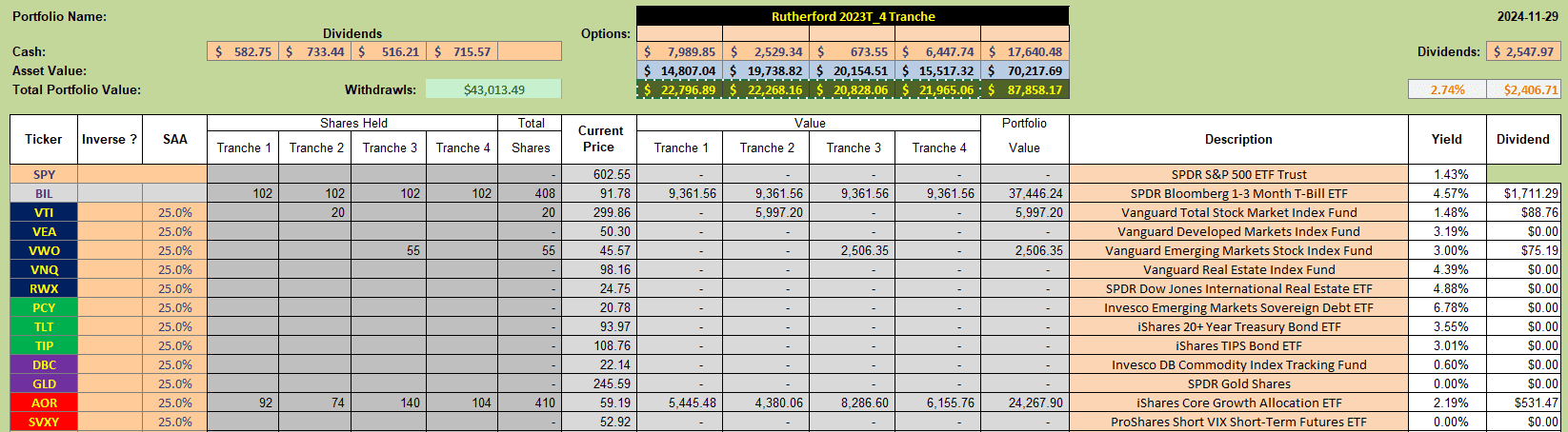

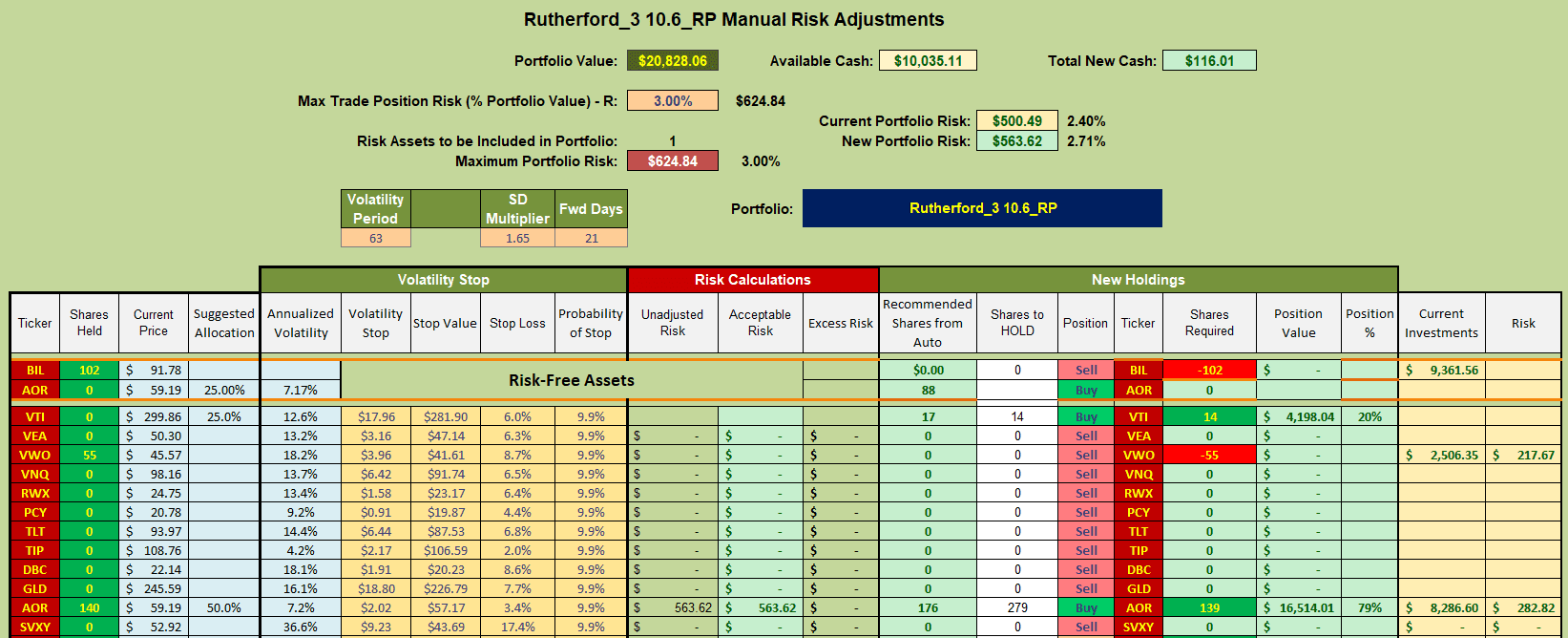

Current holdings in the Rutherford Portfolio look like this:

as I wind the portfolio down before deciding how I will manage it next year.

as I wind the portfolio down before deciding how I will manage it next year.

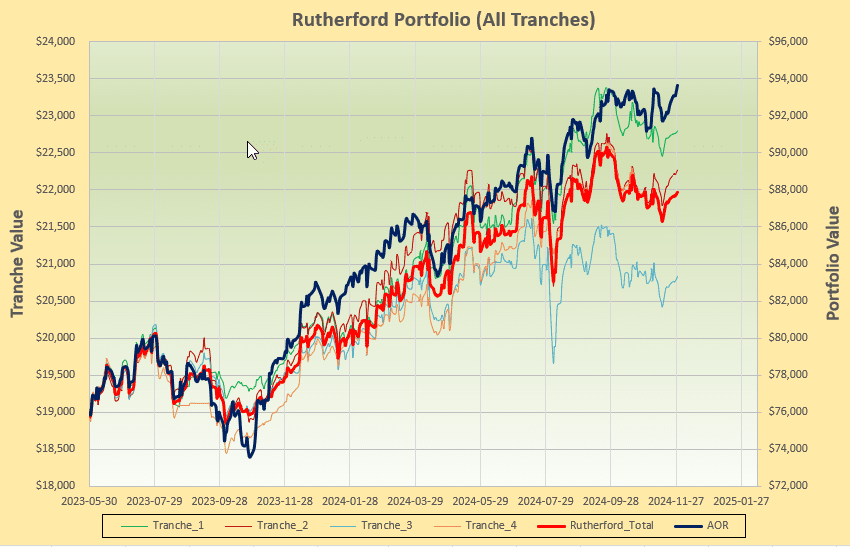

Performance is obviously muted:

as I step out of the markets.

as I step out of the markets.

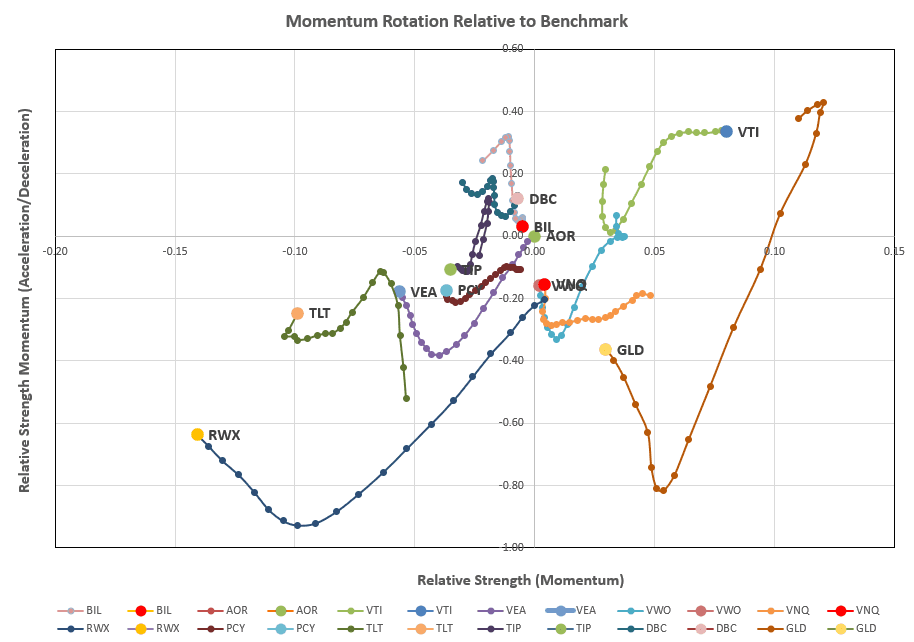

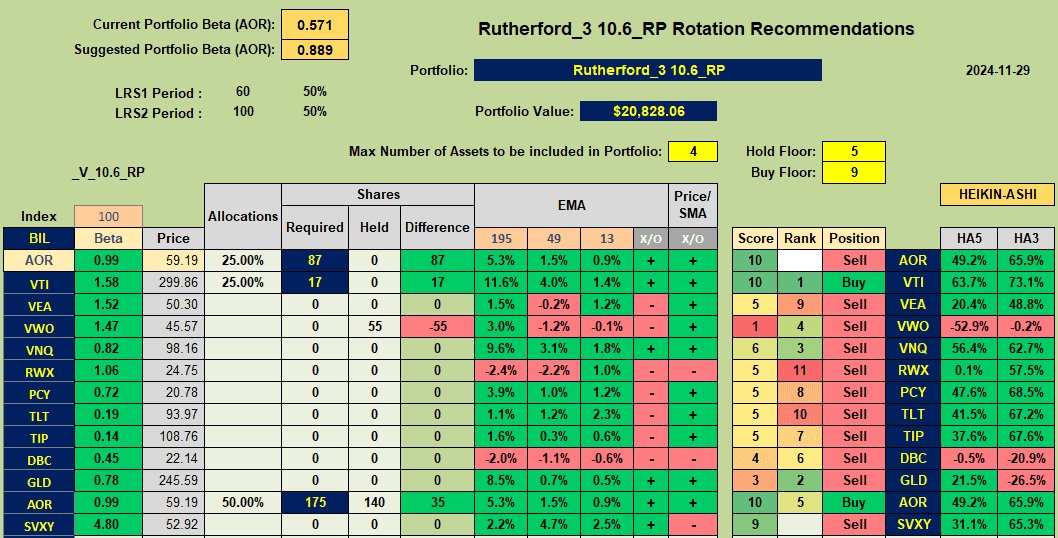

Checking the rotation graphs:

only VTI looks strong in terms of longer term momentum and this is reflected in the recommendations:

only VTI looks strong in terms of longer term momentum and this is reflected in the recommendations:

where VTI and AOR (the benchmark fund) are the only Buy recommendations.

where VTI and AOR (the benchmark fund) are the only Buy recommendations.

I will therefore be selling my current holdings in VWO (in Tranche 3) and using the funds to buy shares in VTI, VWO or BIL before closing out at the end of the year. I will see what the market is looking like on Monday, after the holiday.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question