Presently floating around somewhere in the Atlantic in this mega ship with ~4,000 other passengers.

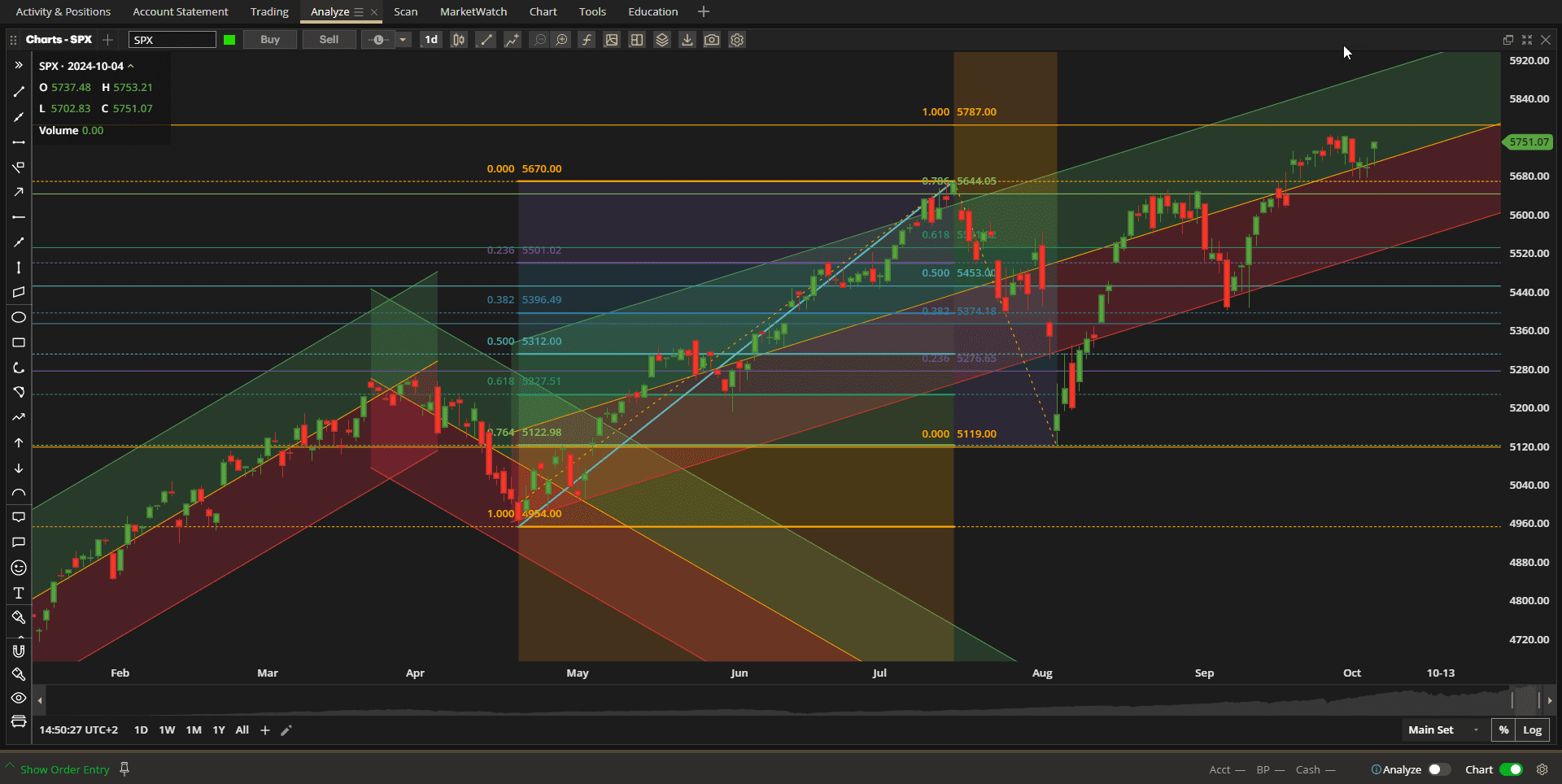

It was a rocky week until Friday when we saw a gap up in prices with the SPX (S&P 500 Index) closing higher on the week but still not breaking through the ~5790 resistance level:

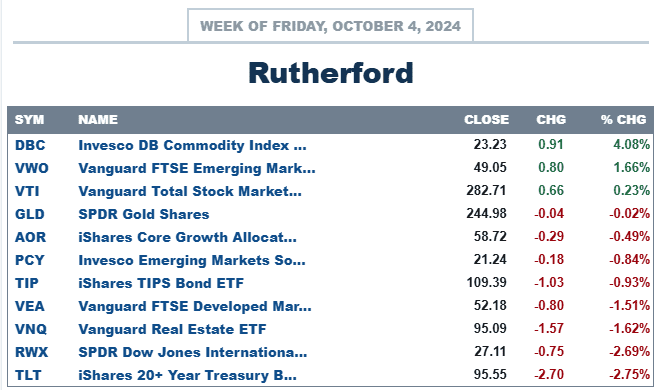

Relative to other major asset classes, US equities fared reasonably well:

Relative to other major asset classes, US equities fared reasonably well:

although Commodities was the clear winner, likely due to tensions in the Middle East and potential supply chain issues created by a threatened strike at US Ports.

although Commodities was the clear winner, likely due to tensions in the Middle East and potential supply chain issues created by a threatened strike at US Ports.

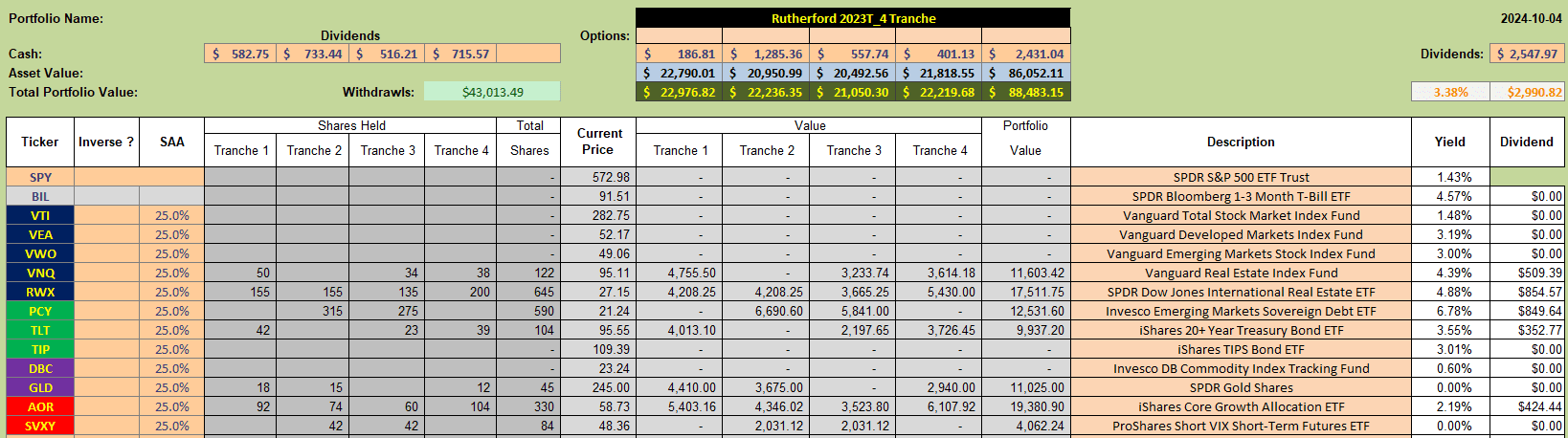

Current holdings in the Rutherford Portfolio look like this:

with Tranche 3 (the focus of this week’s review) holding positions in VNQ and RWX (Real Estate), PCY and TLT (Bonds).

with Tranche 3 (the focus of this week’s review) holding positions in VNQ and RWX (Real Estate), PCY and TLT (Bonds).

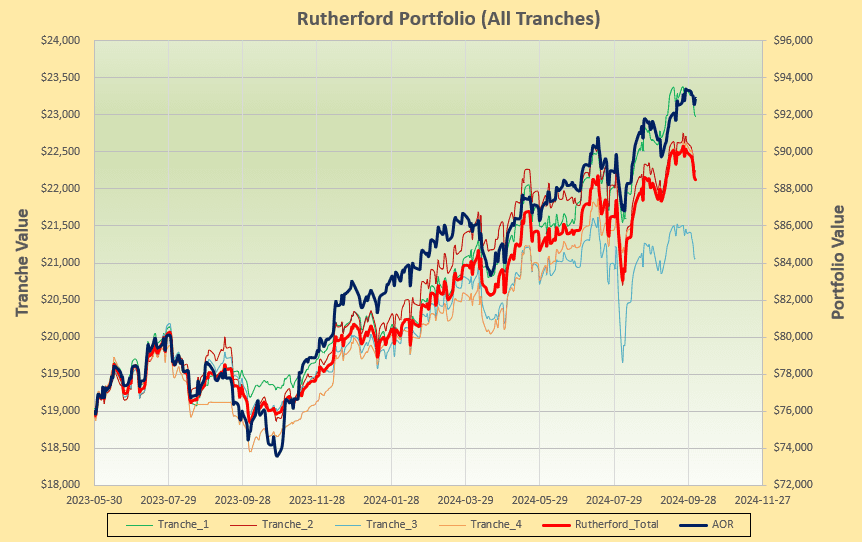

Performance of the portfolio to date looks like this:

with Tranche 3 clearly being the poorest performing tranche (timing/review date luck).

with Tranche 3 clearly being the poorest performing tranche (timing/review date luck).

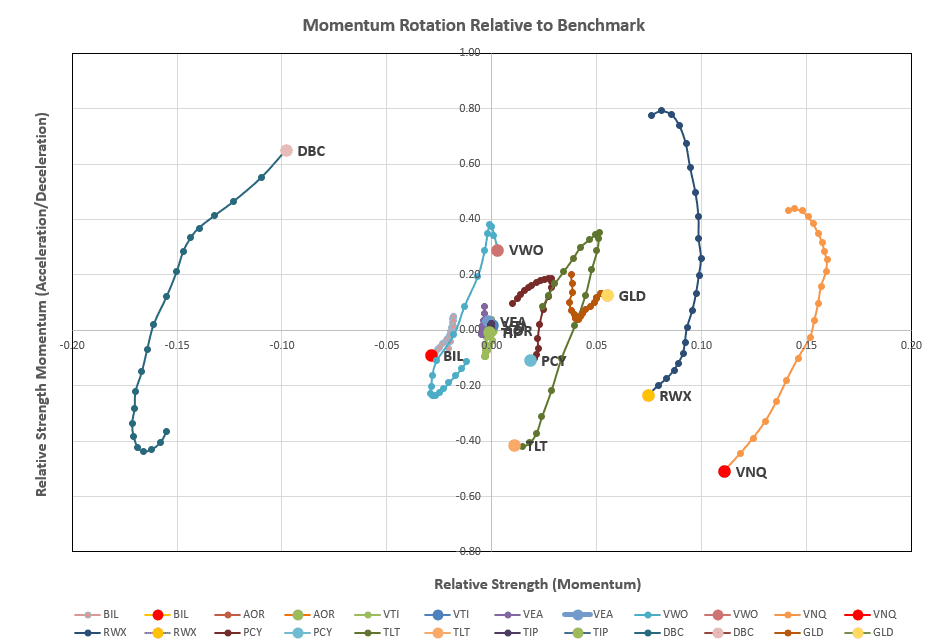

Taking a look at current rotation graphs:

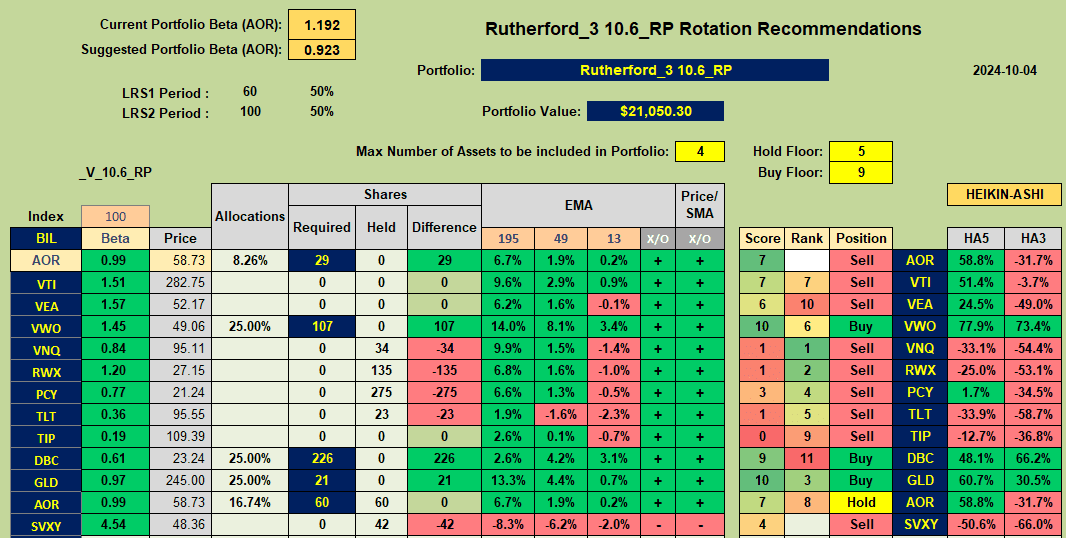

we see the demise of Real Estate and Bonds over the past month and check out current rankings and recommendations from the rotation model:

we see the demise of Real Estate and Bonds over the past month and check out current rankings and recommendations from the rotation model:

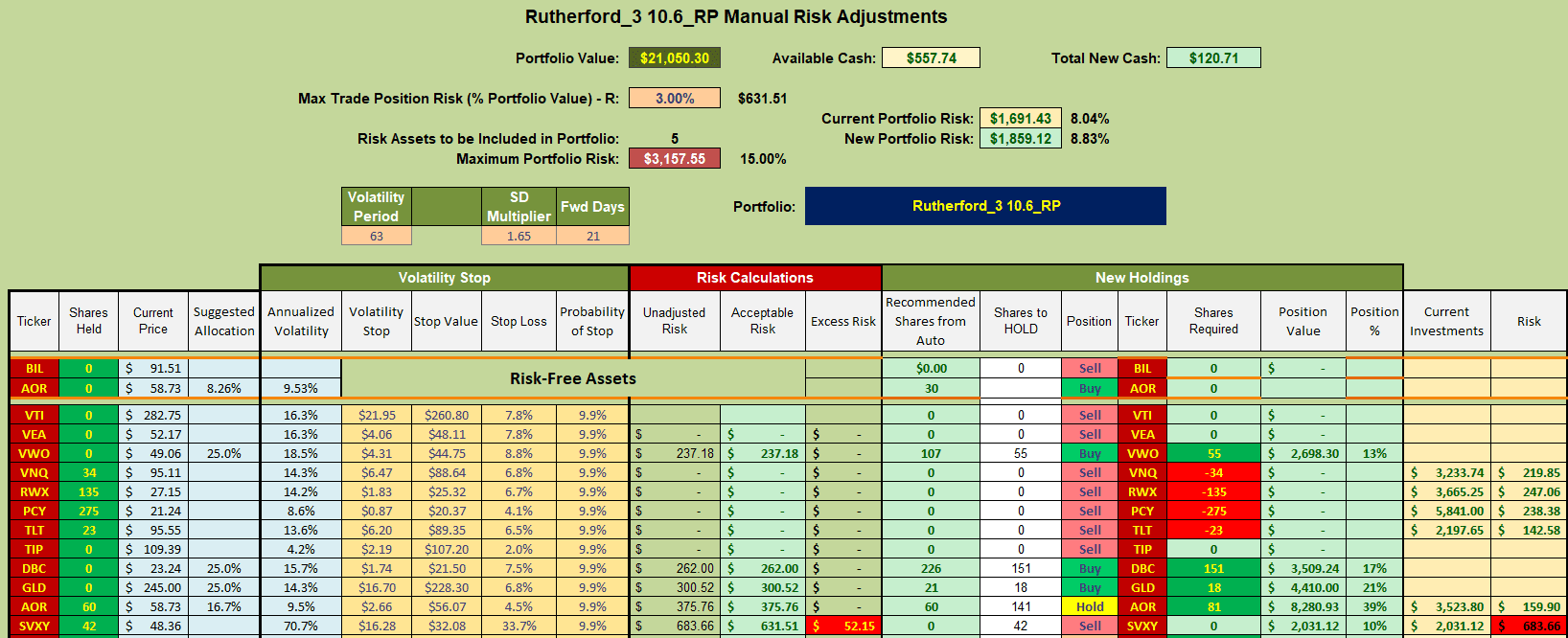

where we see that the recommendations are to sell all current holdings and replace them with positions in VWO (Emerging Market Equities), DBC, GLD (Commodities and Gold) and AOR (the benchmark Fund). Consequently, current adjustments for next week will look something like this:

where we see that the recommendations are to sell all current holdings and replace them with positions in VWO (Emerging Market Equities), DBC, GLD (Commodities and Gold) and AOR (the benchmark Fund). Consequently, current adjustments for next week will look something like this:

assuming we reach landfall in Florida before the threatening hurricane/tropical storm hits land 🙂

assuming we reach landfall in Florida before the threatening hurricane/tropical storm hits land 🙂

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question