Bangkok Market, Thailand

US equity markets started the week quietly but showed more volatility towards the end of the week closing up modestly from last week’s close:

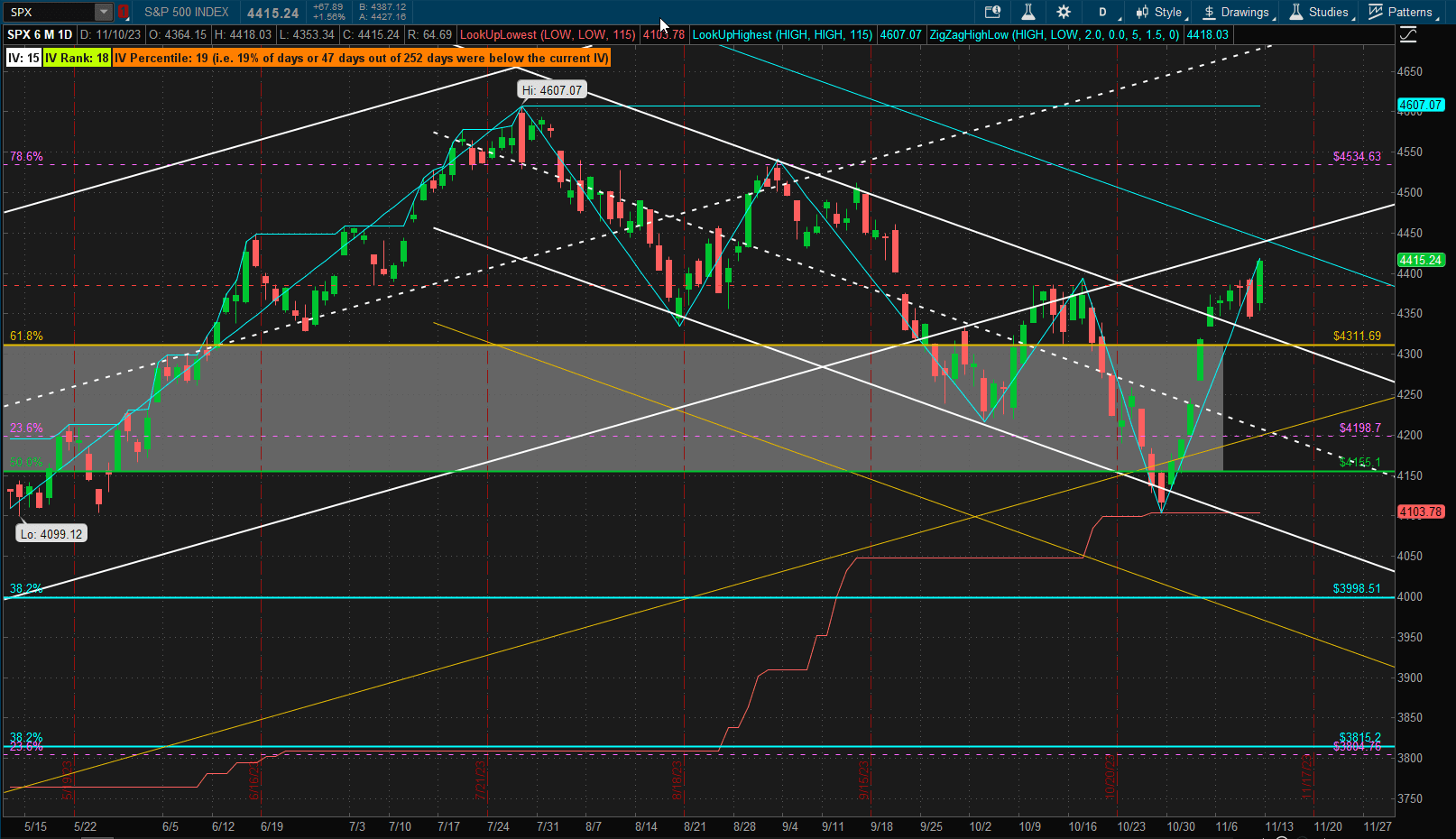

Although we closed slightly above resistance (and the prior high) at ~4400 we are still within the 2SD boundary of the downtrend channel – so I am not ready to call a change in trend just yet – we’ll wait and see what next week brings and whether Santa is loading up his sleigh.

Although we closed slightly above resistance (and the prior high) at ~4400 we are still within the 2SD boundary of the downtrend channel – so I am not ready to call a change in trend just yet – we’ll wait and see what next week brings and whether Santa is loading up his sleigh.

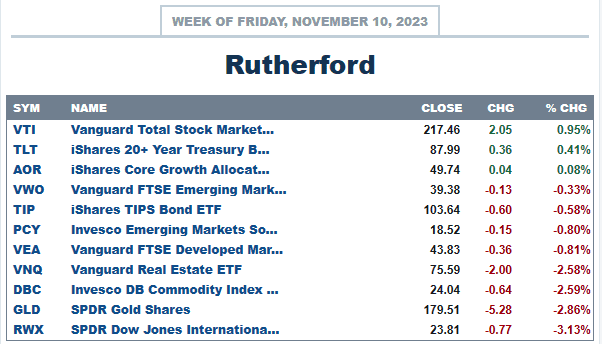

US equities were, in fact, the best performing major asset class over the past week:

with most other asset classes showing losses.

with most other asset classes showing losses.

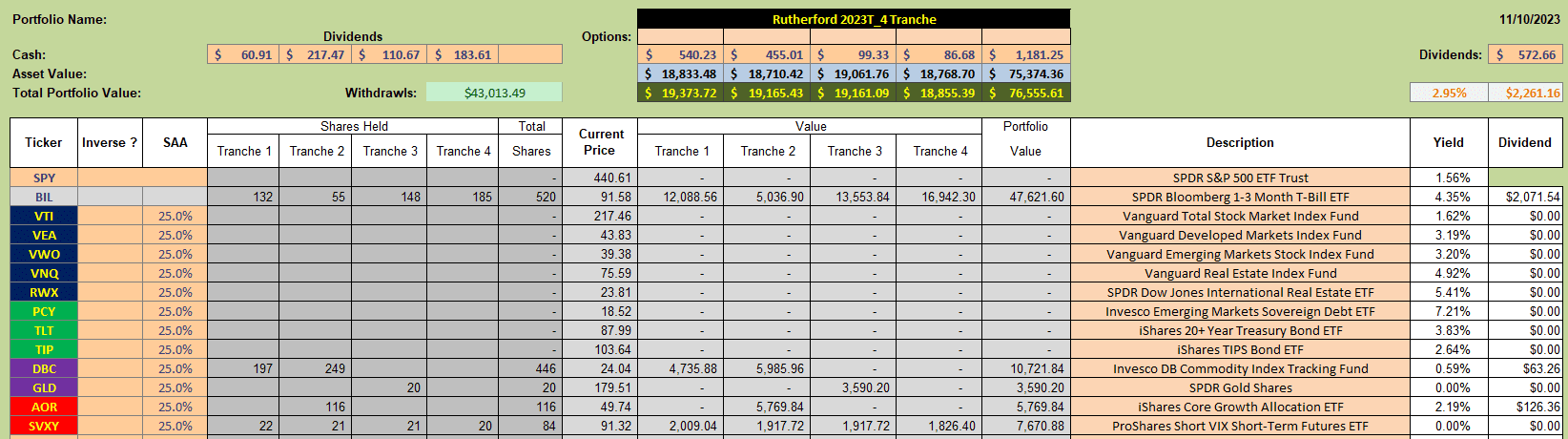

The impact of this on the Rutherford Portfolio that is not holding equities:

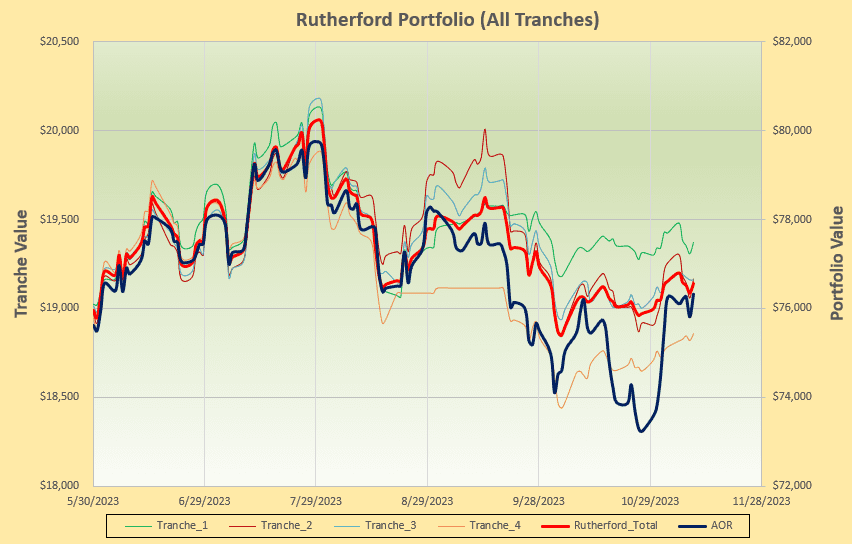

is that we lost a little in relative performance although remain slightly ahead of the benchmark AOR fund:

is that we lost a little in relative performance although remain slightly ahead of the benchmark AOR fund:

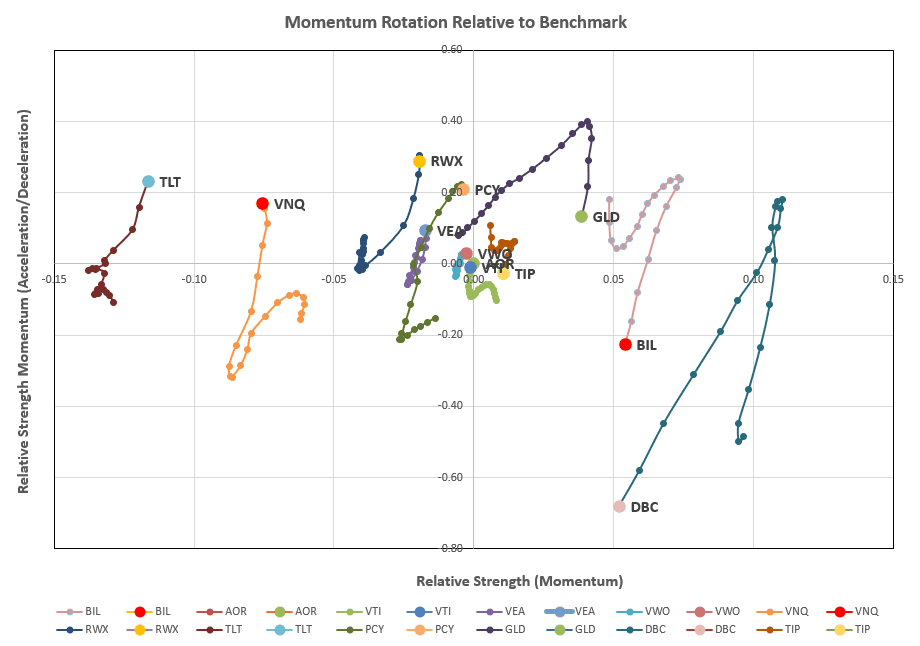

Checking the current rotation graphs:

Checking the current rotation graphs:

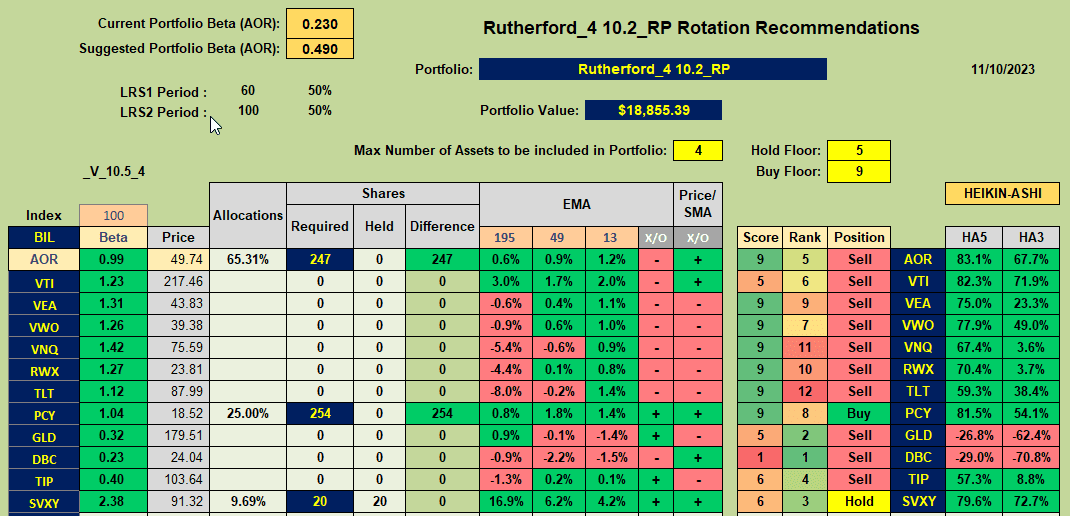

we see the demise of Commodities, Gold and the zero-based short-term treasury note market with little obvious strength anywhere. Moving to the recommendation sheet:

we see the demise of Commodities, Gold and the zero-based short-term treasury note market with little obvious strength anywhere. Moving to the recommendation sheet:

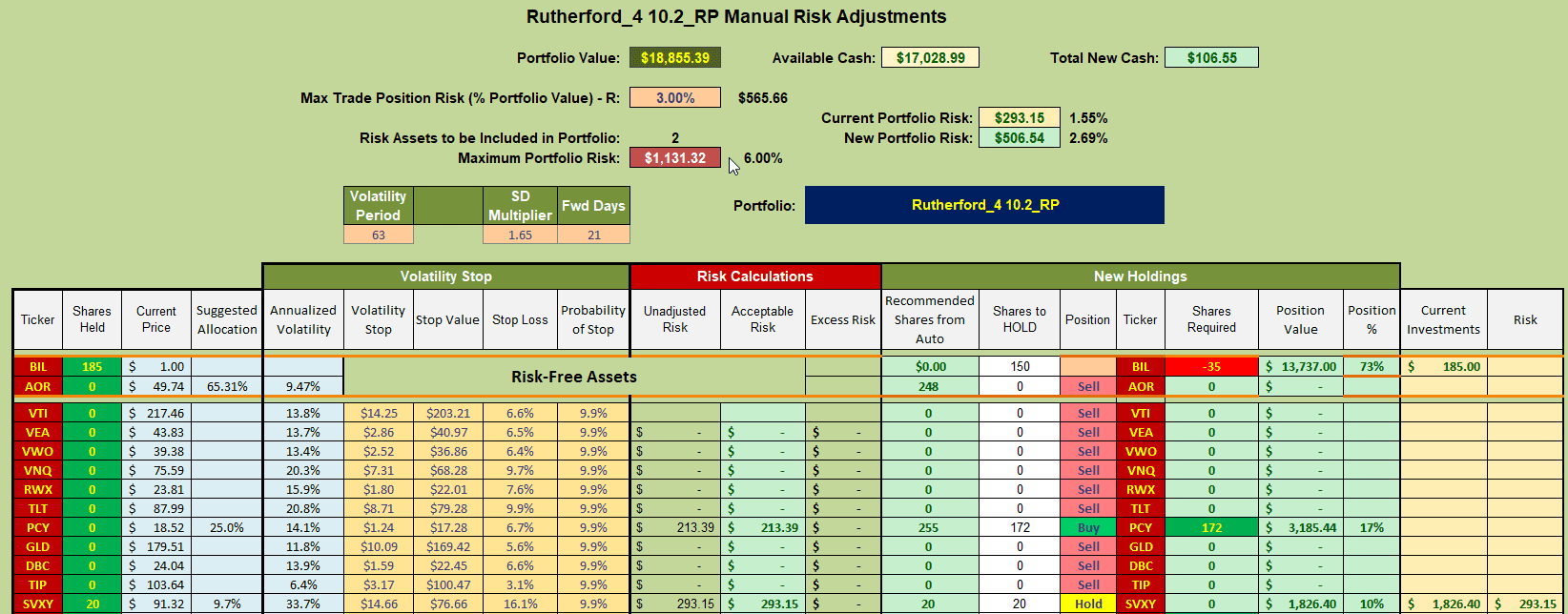

we do see a Buy recommendation for PCY – so I’ll cash in a few shares of T-Notes (BIL) and open a small position in P

we do see a Buy recommendation for PCY – so I’ll cash in a few shares of T-Notes (BIL) and open a small position in P and that will be it for this week.

and that will be it for this week.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.