Indigenous Sculpture at Botanic Gardens, Auckland, New Zealand

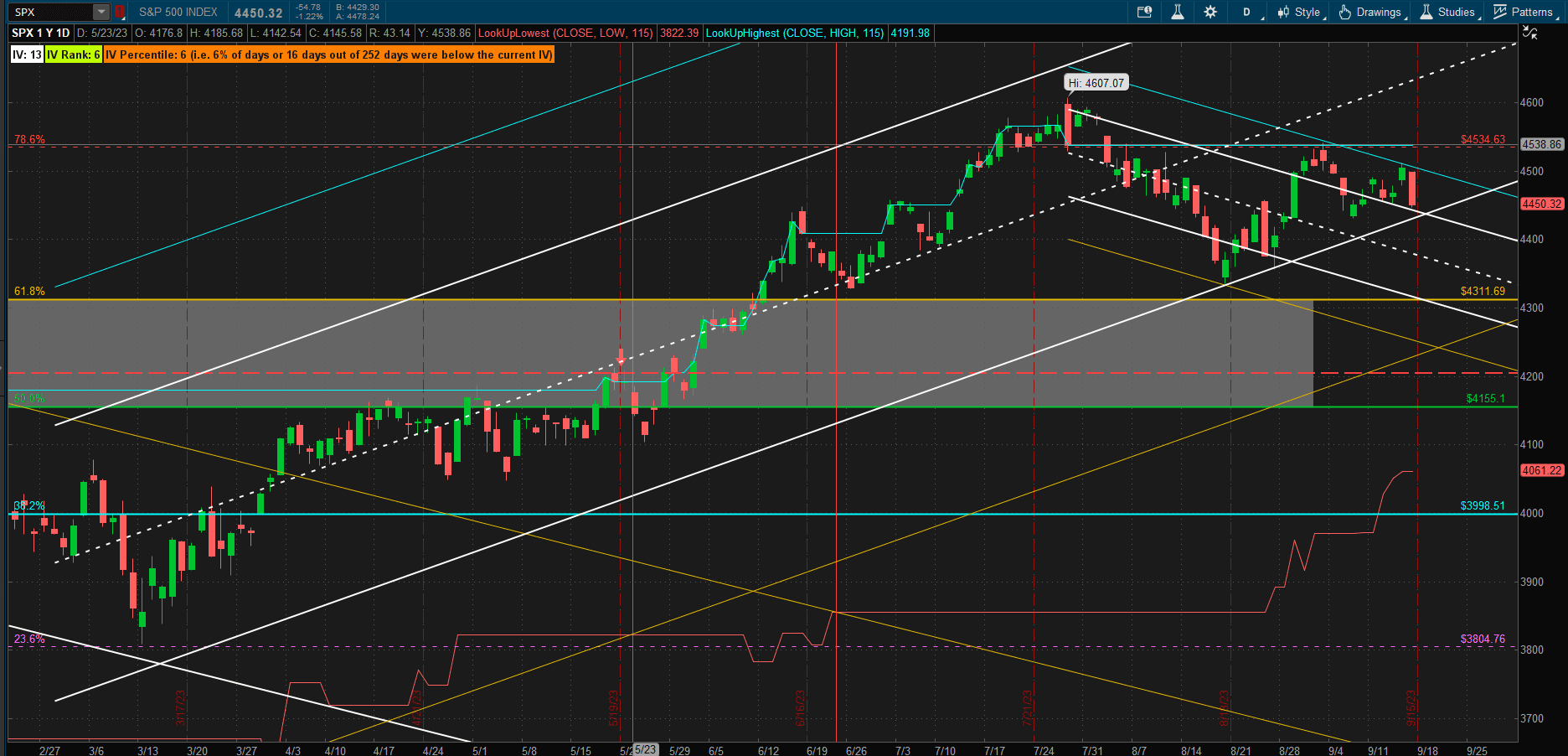

It was a relatively quiet week in US equity markets with the SPX (S&P 500 Index) closing down slightly on the week after an end of week selloff on Friday:

This still leaves us within the boundaries of the pendant pattern defined by uptrend and downtrend channels with no clear indication of future market direction. It seems inevitable that we will see a breakout either to the upside or downside within the next week – how strong this might be remains to be seen. A breakout above 4530 or below ~4320 is required before we might feel comfortable accepting a directional trend – meanwhile we are in a sideways consolidation channel.

This still leaves us within the boundaries of the pendant pattern defined by uptrend and downtrend channels with no clear indication of future market direction. It seems inevitable that we will see a breakout either to the upside or downside within the next week – how strong this might be remains to be seen. A breakout above 4530 or below ~4320 is required before we might feel comfortable accepting a directional trend – meanwhile we are in a sideways consolidation channel.

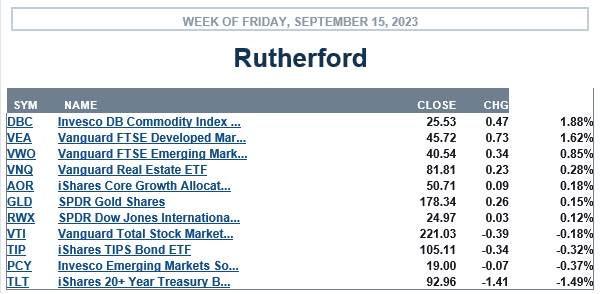

A Comparison with the performance of other major asset classes:

reveals that US equities have slightly underperformed other asset classes over the past week only beating out bonds.

reveals that US equities have slightly underperformed other asset classes over the past week only beating out bonds.

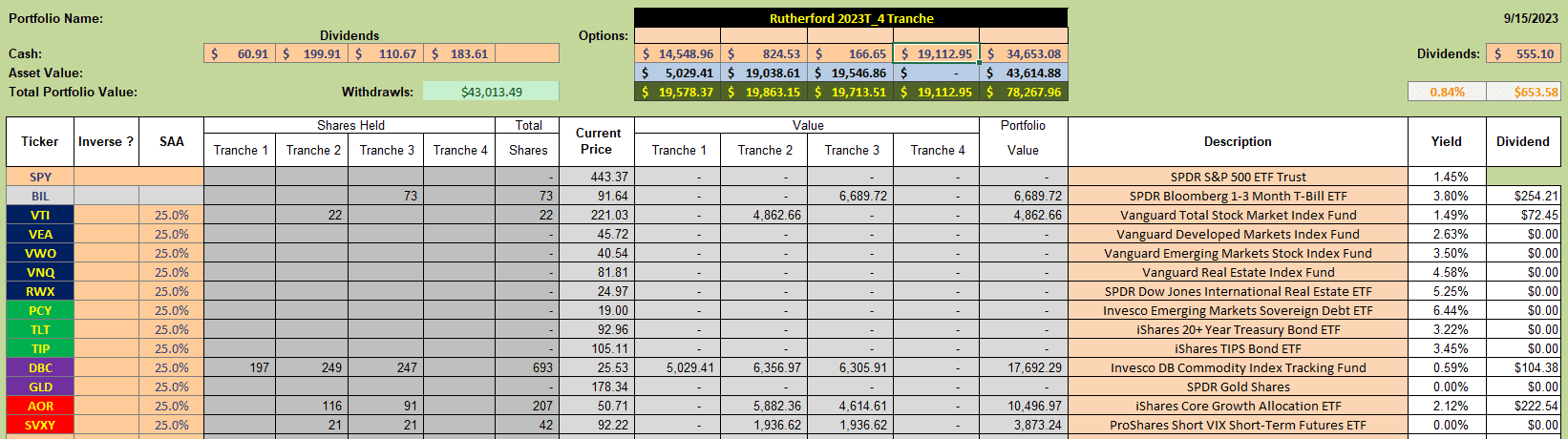

Current holdings in the Rutherford Portfolio look like this:

with Tranche 4 (the focus of this week’s review holding 100% Cash. This has resulted in the following portfolio performance:

with Tranche 4 (the focus of this week’s review holding 100% Cash. This has resulted in the following portfolio performance:

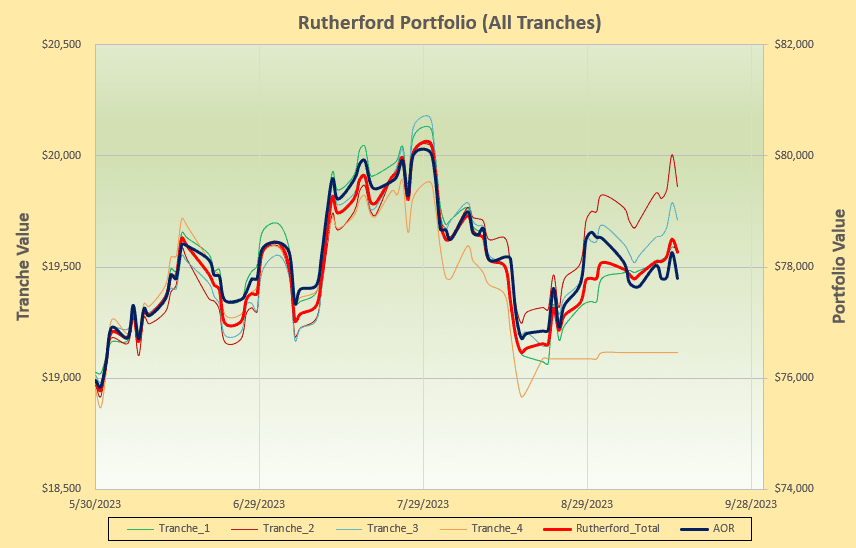

where we can see that the overall performance remains slightly ahead of the benchmark AOR Fund but that Tranche 4 has missed out on gains over the past month and lags the performance of the other 3 tranches and the portfolio as a whole. This is just an example of timing/review date luck.

where we can see that the overall performance remains slightly ahead of the benchmark AOR Fund but that Tranche 4 has missed out on gains over the past month and lags the performance of the other 3 tranches and the portfolio as a whole. This is just an example of timing/review date luck.

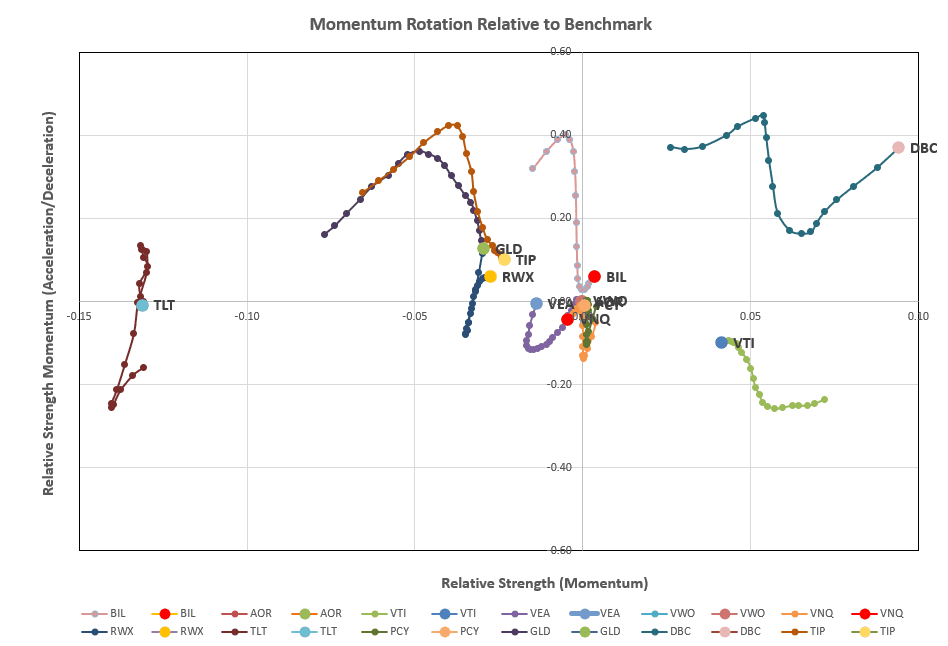

So we take a look at the rotation graphs to see whether we have any strong contenders for inclusion in the portfolio:

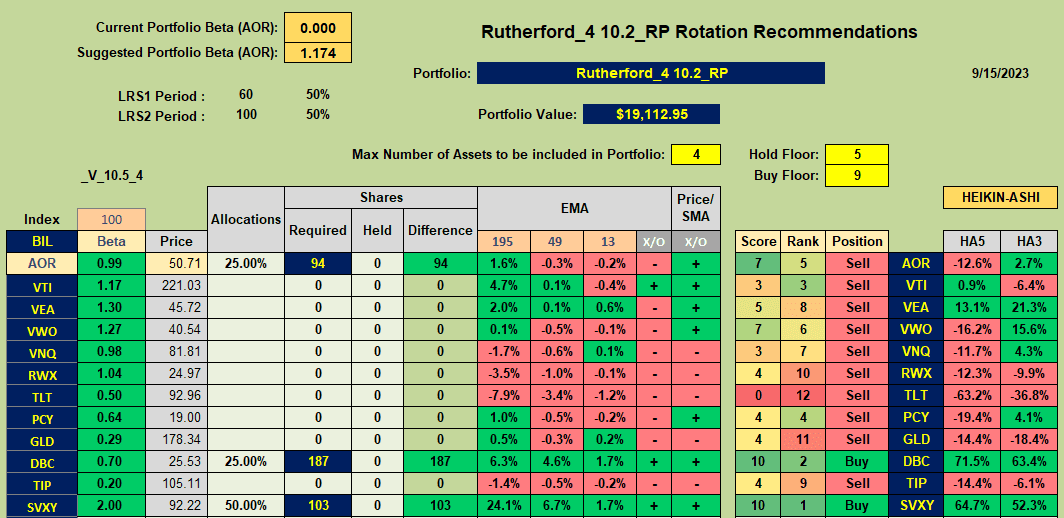

We see strength in Commodities (DBC) in the desirable top right quadrant with US equities still showing relative (but weakening) long-term strength but with negative relative short-term strength. Checking the recommendations from the rotation model algorithm:

We see strength in Commodities (DBC) in the desirable top right quadrant with US equities still showing relative (but weakening) long-term strength but with negative relative short-term strength. Checking the recommendations from the rotation model algorithm:

we get confirmation of the DBC strength with a Buy recommendation – but VTI remains a Sell (or no Buy). SVXY, the volatility ETF is still a buy recommendation but this is not included in the Risk Parity allocation calculations but is initially assigned a 10% allocation that will only be adjusted if/when it gets obviously out of balance or a Sell is considered necessary (that woild be related to a very weak market or market “crash”).

we get confirmation of the DBC strength with a Buy recommendation – but VTI remains a Sell (or no Buy). SVXY, the volatility ETF is still a buy recommendation but this is not included in the Risk Parity allocation calculations but is initially assigned a 10% allocation that will only be adjusted if/when it gets obviously out of balance or a Sell is considered necessary (that woild be related to a very weak market or market “crash”).

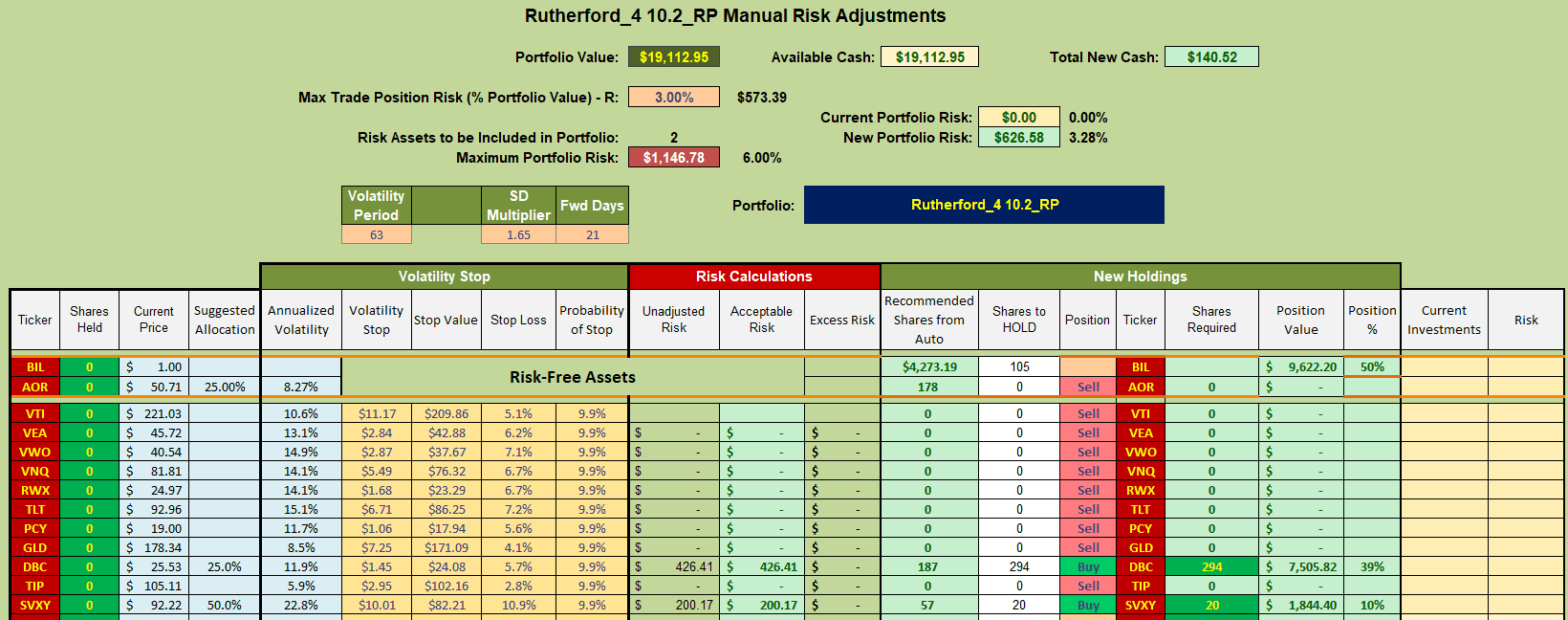

Based on the above, adjustments for this week look like this:

i.e. I will be adding shares of DBC and SVXY to the portfolio and using 50% of the Cash to buy shares in BIL, the short-term bond ETF.

i.e. I will be adding shares of DBC and SVXY to the portfolio and using 50% of the Cash to buy shares in BIL, the short-term bond ETF.

[I haven’t forgotten the request for a more detailed explanation as to why I include SVXY in many of my portfolios – but I am still trying to find the time to put something together – it’s a little complicated.]

David

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

David,

Have you made any changes to the Hawling lately? New securities? Deleted securities? Investments? Etc.

~jim

Jim,

I think the only significant change that I’ve made is allocating 10% to SVXY, the Volatility ETF – to add a little more diversity.

TIP was added some time ago because I wanted a lower volatility bond in the quiver – but that was probably over 12 months ago – and I don’t think there have been any/too many Buy recommendations in that time frame.

And, Of course, I’m presently using a rotation model/algorithm to manage the portfolio and have recently changed to Risk Parity allocations rather than equal weighting with 25% max allocation.

David

David,

Thanks for the update.

~jim