More Orchids, Singapore Botanic Gardens

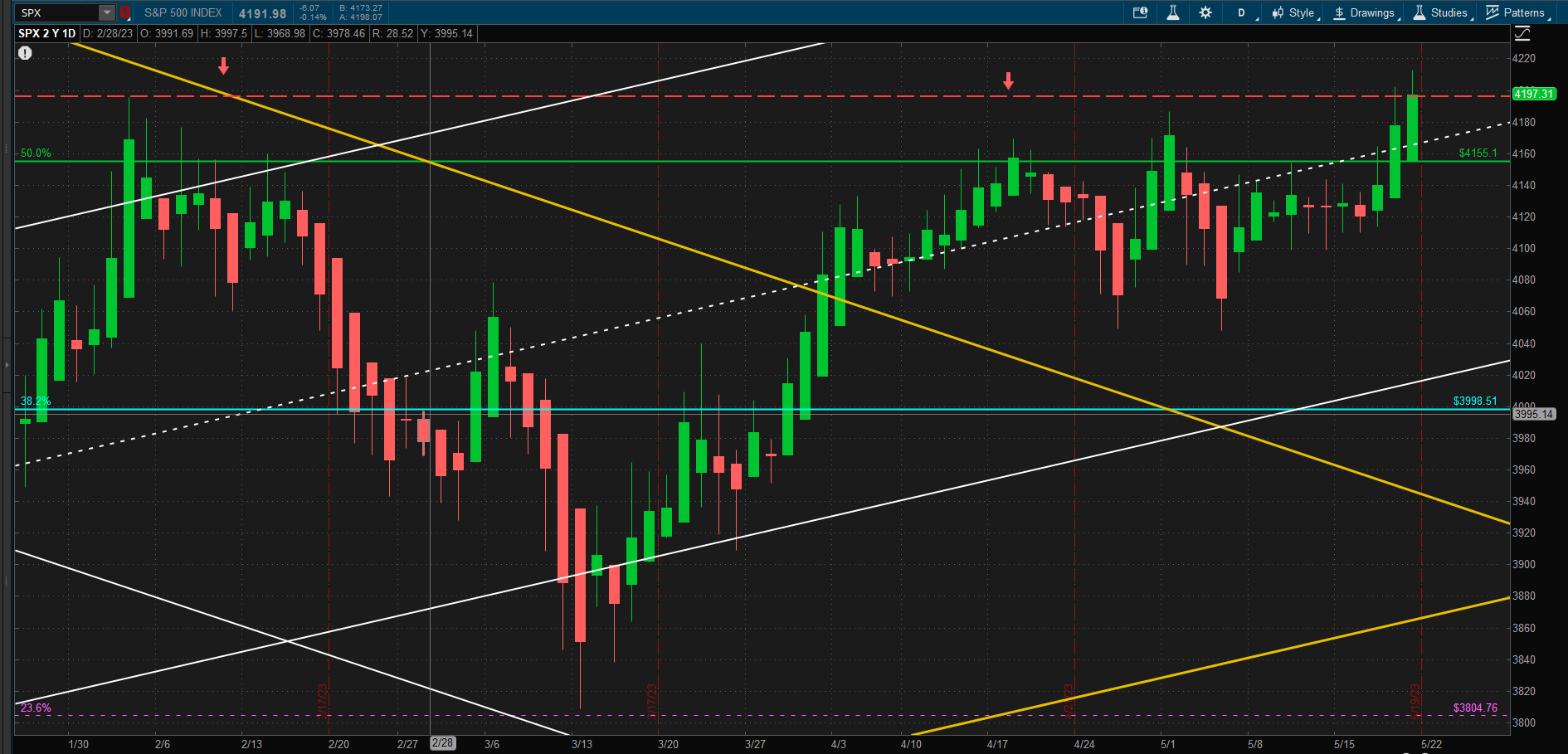

US equities showed strong performance over the past week – particularly in the last 2 days:

and price seems to be moving nicely in the uptrend channel that began last October. However, although we seem to be through the 50% retracement line at ~4150 we have still not closed above the February high of ~4200 – so we are still not clear of the strong resistance area that we have been testing for almost a year:

and price seems to be moving nicely in the uptrend channel that began last October. However, although we seem to be through the 50% retracement line at ~4150 we have still not closed above the February high of ~4200 – so we are still not clear of the strong resistance area that we have been testing for almost a year:

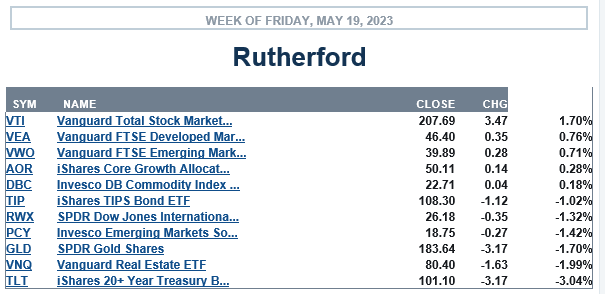

Global equities, generally, were the best performing asset classes over the past week:

Global equities, generally, were the best performing asset classes over the past week:

with bonds finally showing that inverse relationship that we expect for diversification.

with bonds finally showing that inverse relationship that we expect for diversification.

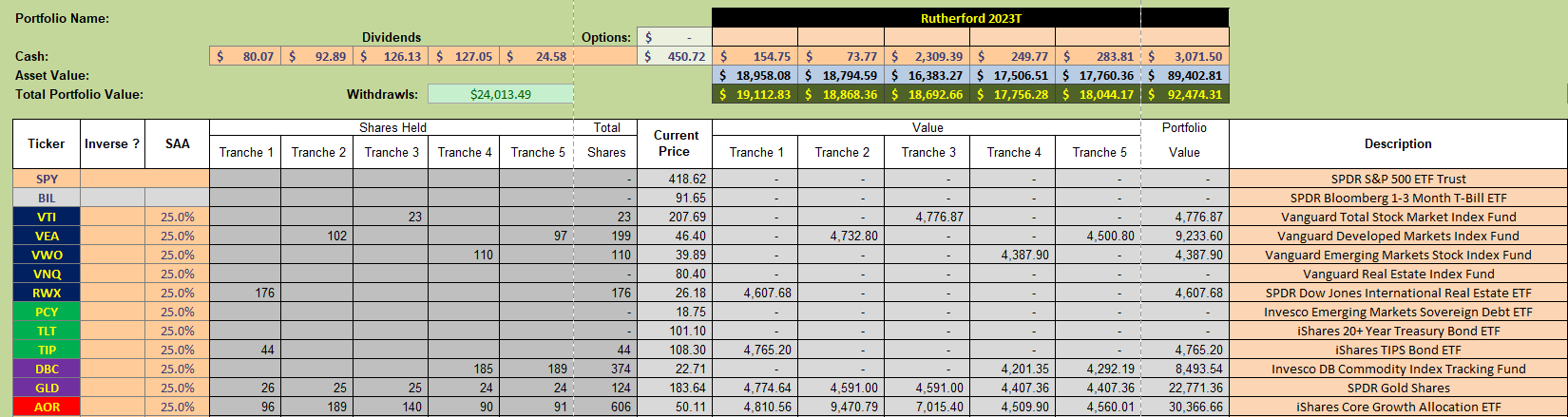

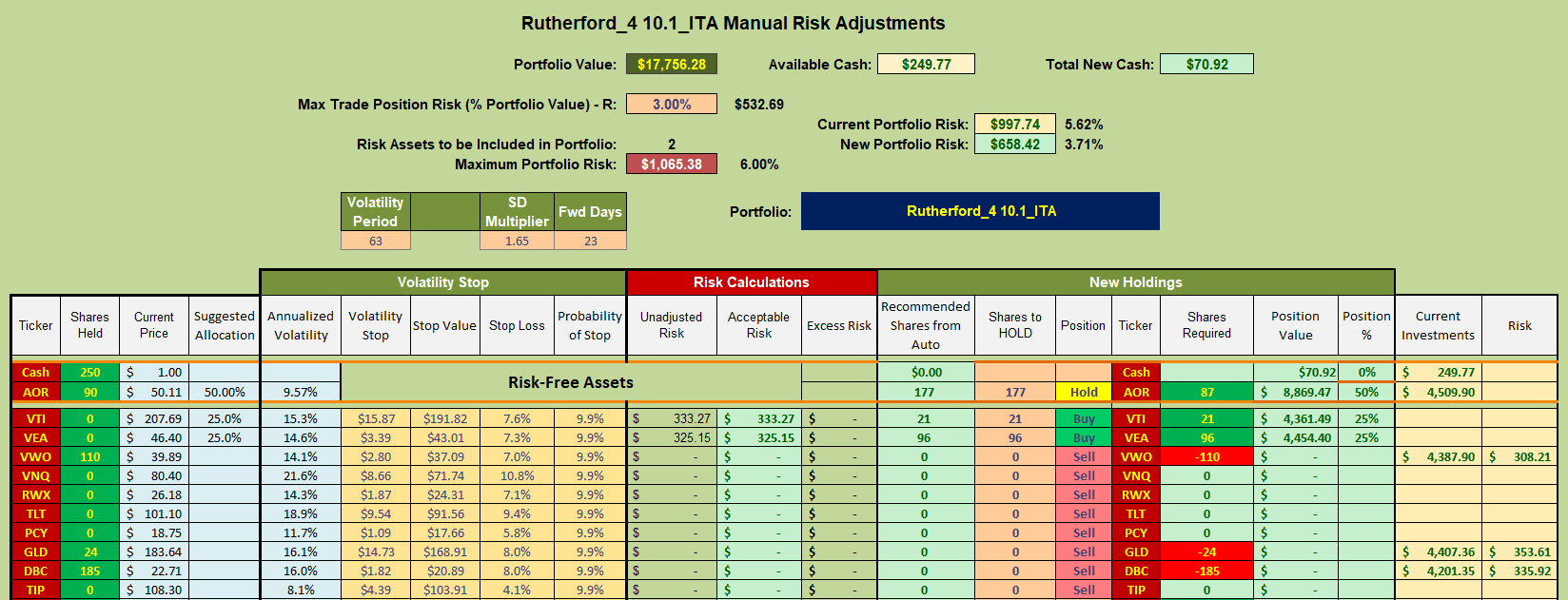

Current holdings in the Rutherford Portfolio look like this:

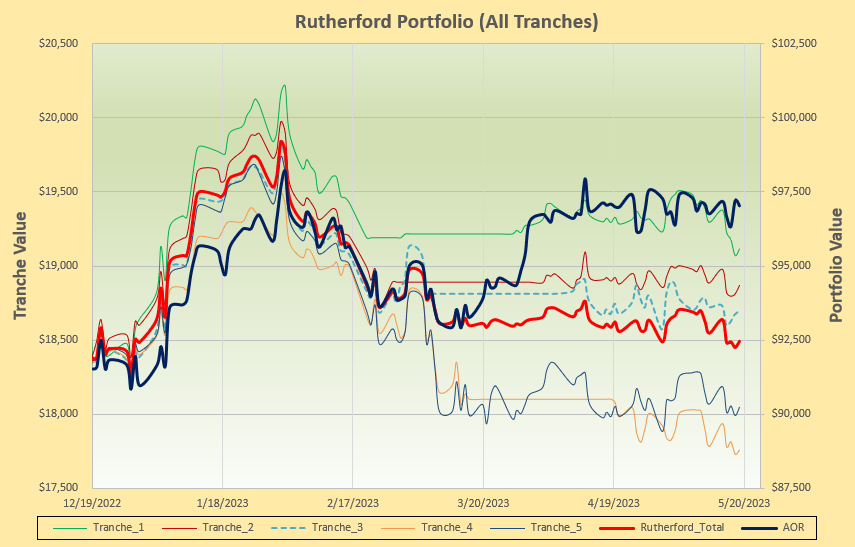

where we are pretty well equally balanced between equities and other asset classes. This has resulted in the following performance:

where we are pretty well equally balanced between equities and other asset classes. This has resulted in the following performance:

….. a little disappointing due to the fact that we have been rotating only slowly into equities over the past 2 weeks (review date luck) – however, we do have some exposure due to the more frequent reviews of the separate tranches.

….. a little disappointing due to the fact that we have been rotating only slowly into equities over the past 2 weeks (review date luck) – however, we do have some exposure due to the more frequent reviews of the separate tranches.

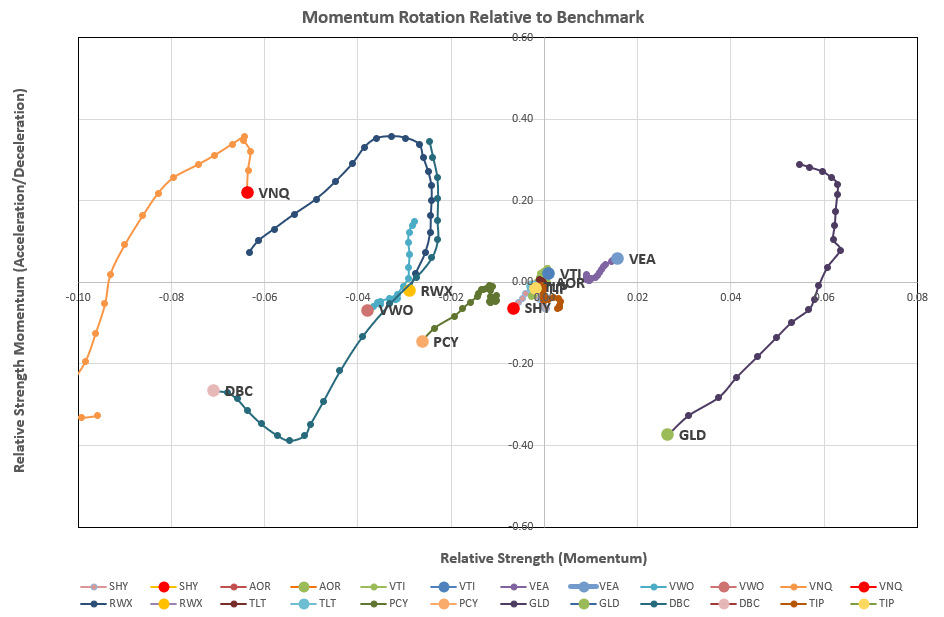

So we’ll take a look at the current rotation graphs:

where we see the demise of GLD (in which we have a ~25% allocation) and tentative progress of VEA and VTI. So we’ll check the current recommendations from the rotation model:

where we see the demise of GLD (in which we have a ~25% allocation) and tentative progress of VEA and VTI. So we’ll check the current recommendations from the rotation model:

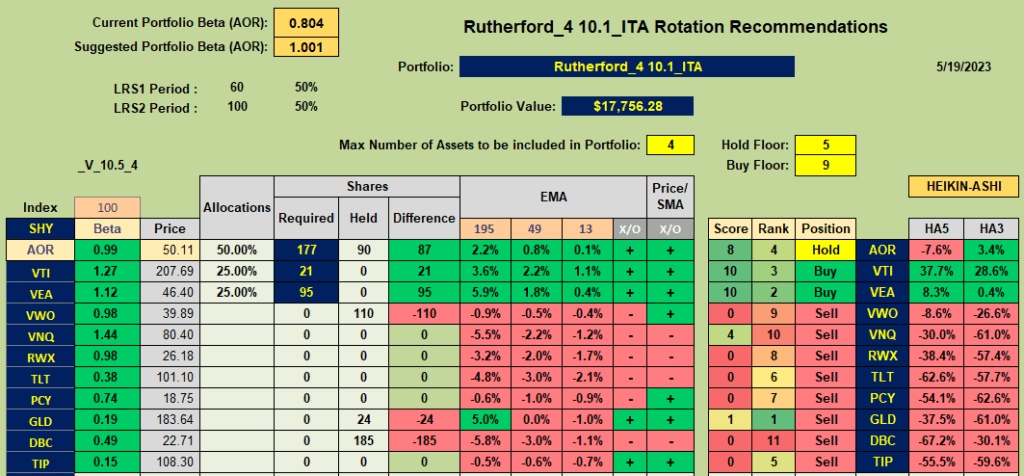

where we see a strong recommendation to move to equities with Buy recommendations for VTI, VEA and AOR (our benchmark fund) and Sell recommendations for GLD, DBC and VWO that are currently held in Tranche 4 (the focus of this week’s review).

where we see a strong recommendation to move to equities with Buy recommendations for VTI, VEA and AOR (our benchmark fund) and Sell recommendations for GLD, DBC and VWO that are currently held in Tranche 4 (the focus of this week’s review).

This leads to the following significant adjustments for this week:

Since the Rutherford is held in a tax sheltered account, from which I am required to withdraw funds each year, I plan to close down Tranche 5 at next week’s review. This will leave me with only 4 tranches that will continue to be reviewed on a weekly rotation schedule – but will mean that each tranche is reviewed every 4 weeks rather than every 5 weeks. This may help (or hurt) performance since it will change the review date timing luck somewhat. We’ll see how it goes.

Since the Rutherford is held in a tax sheltered account, from which I am required to withdraw funds each year, I plan to close down Tranche 5 at next week’s review. This will leave me with only 4 tranches that will continue to be reviewed on a weekly rotation schedule – but will mean that each tranche is reviewed every 4 weeks rather than every 5 weeks. This may help (or hurt) performance since it will change the review date timing luck somewhat. We’ll see how it goes.

David

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.