Red-Necked Grebe sitting on Nest

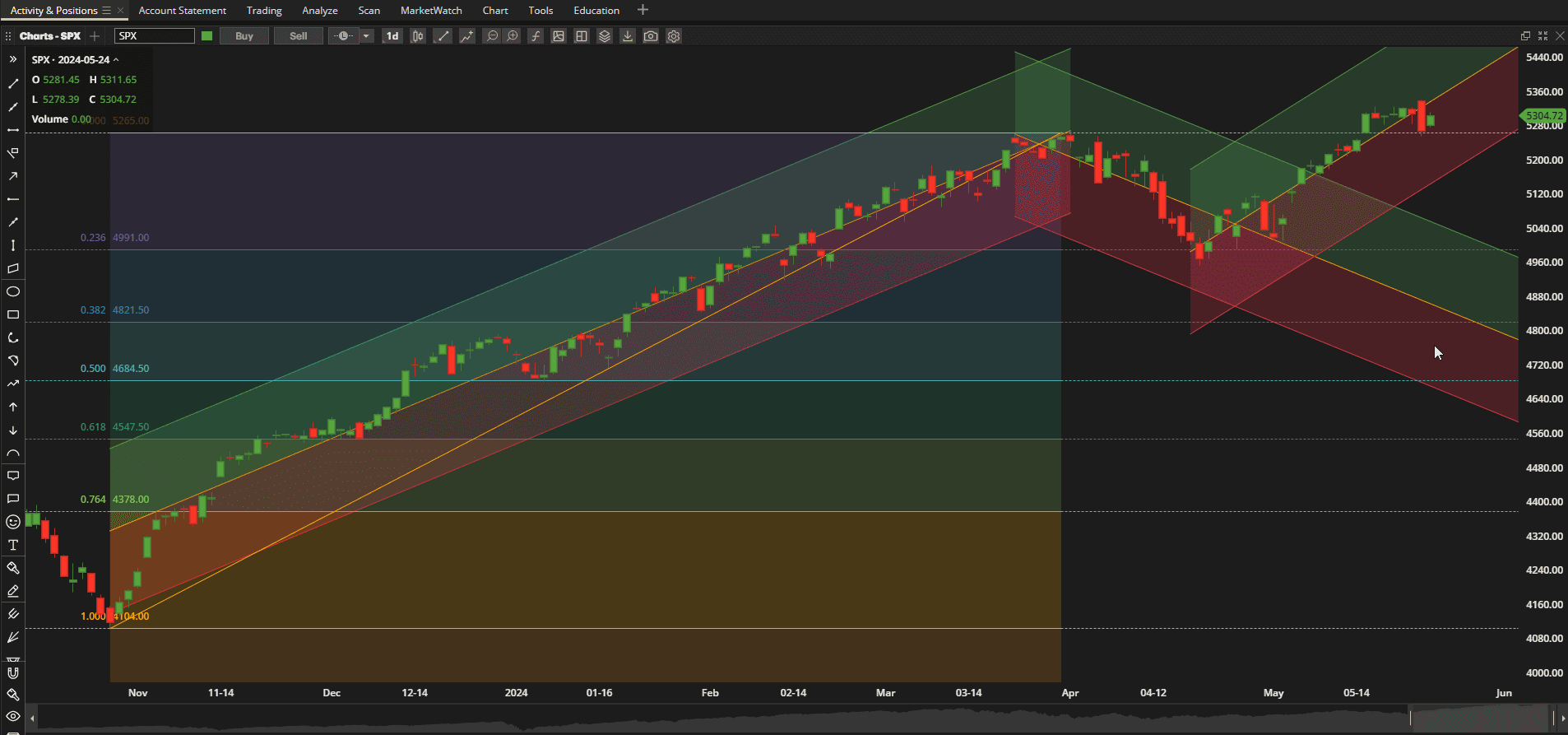

It was not a good week for US Equities as the S&P 500 Index banged it’s head against the 5300 barrier all week and closed ~0.2% lower than last weeks close:

Prices are still in an uptrend channel and sitting near the all-time highs. It will be interesting to see whether the “seasonal” bullish trend, seen in previous election years, continues into the November elections. Nvidia (NVDA), that has been leading the markets higher, reported strong earnings and a 10:1 stock split after the close on Wednesday but, after following NVDA and gapping higher on Thursday’s Open the SPX dropped significantly for the rest of the day.

Prices are still in an uptrend channel and sitting near the all-time highs. It will be interesting to see whether the “seasonal” bullish trend, seen in previous election years, continues into the November elections. Nvidia (NVDA), that has been leading the markets higher, reported strong earnings and a 10:1 stock split after the close on Wednesday but, after following NVDA and gapping higher on Thursday’s Open the SPX dropped significantly for the rest of the day.

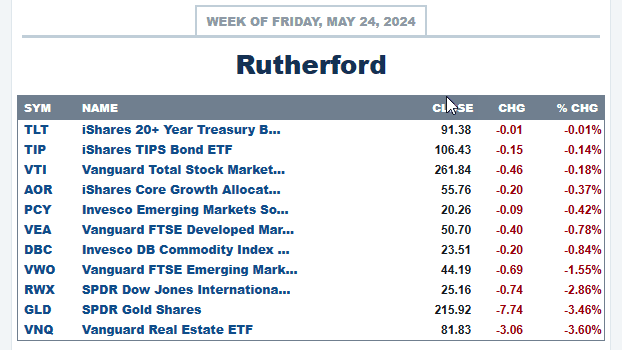

Despite the weak performance, US Equities remained near the top of the major asset class list on a relative basis with all major asset classes in negative territory on the week:

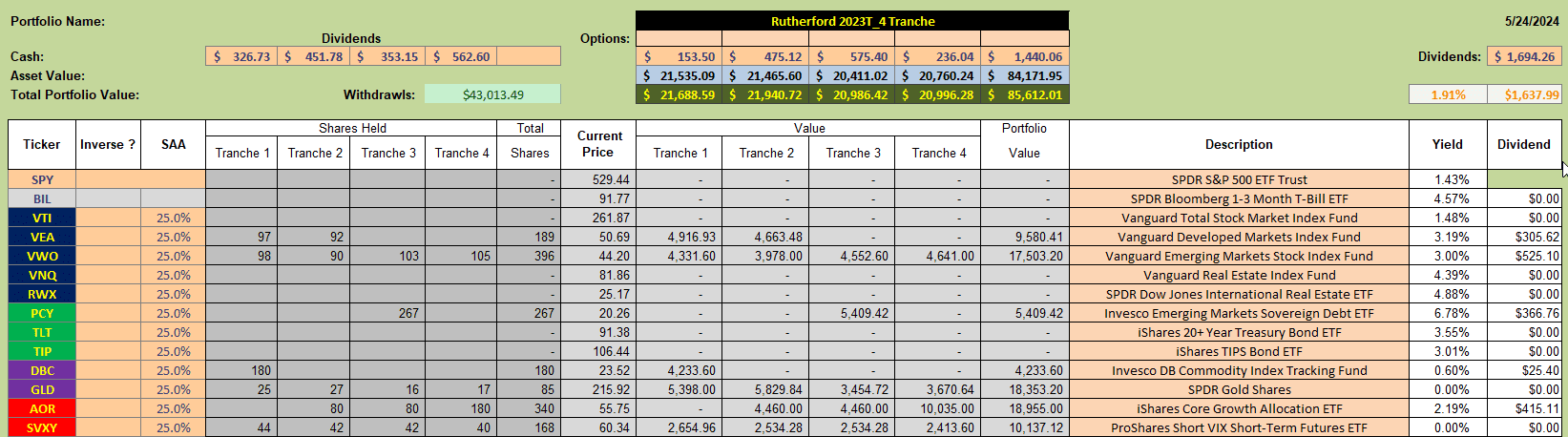

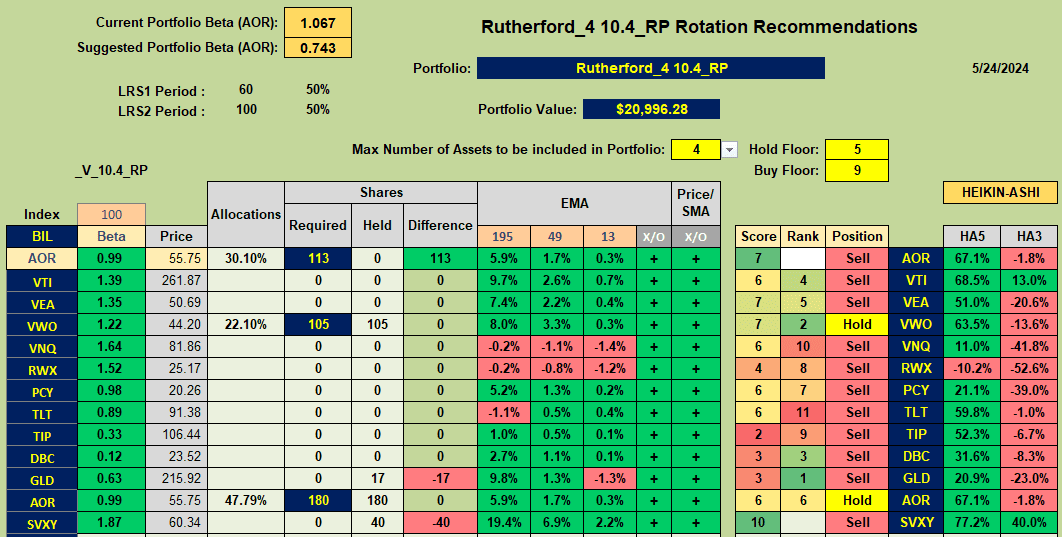

The Rutherford Portfolio is fairly well diversified:

The Rutherford Portfolio is fairly well diversified:

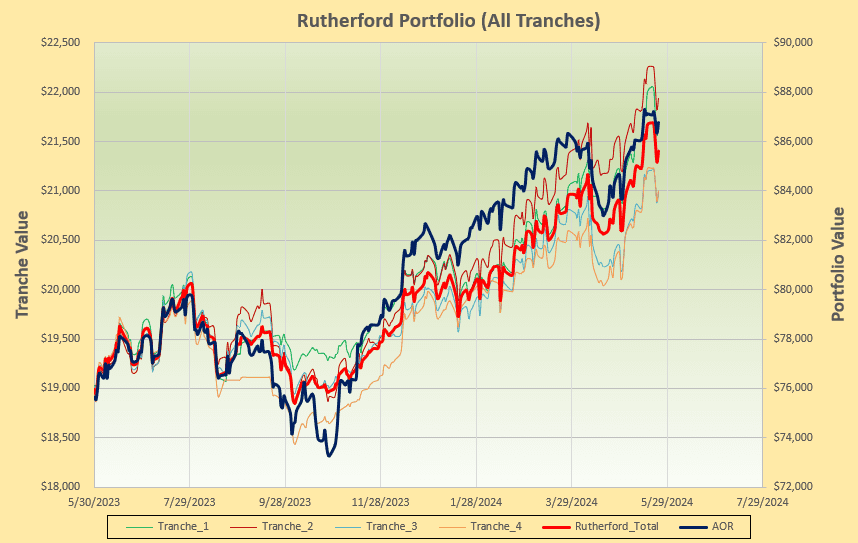

but did lose a little ground to the benchmark AOR Fund over the past week:

but did lose a little ground to the benchmark AOR Fund over the past week:

Being short Volatility (long SVXY) was the only winning “asset class” this week but even that added diversity was insufficient to compensate for weaknesses elsewhere.

Being short Volatility (long SVXY) was the only winning “asset class” this week but even that added diversity was insufficient to compensate for weaknesses elsewhere.

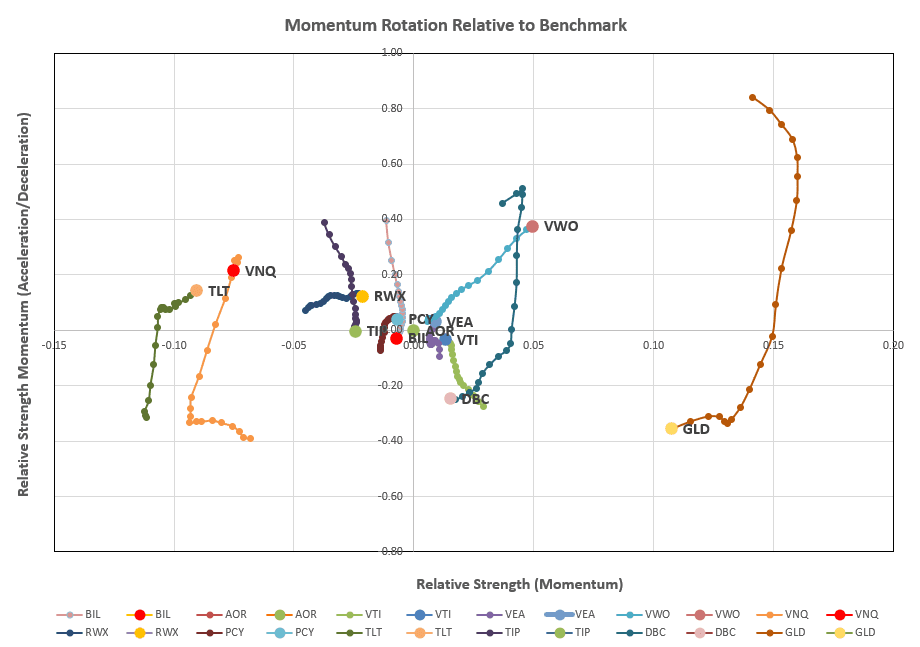

Checking the current rotation graphs:

we continue to see Gold (GLD) and Commodities (DBC) in strong decline and Emerging Market Equities (VWO) as the only asset class showing strength in the top right quadrant.

we continue to see Gold (GLD) and Commodities (DBC) in strong decline and Emerging Market Equities (VWO) as the only asset class showing strength in the top right quadrant.

It is therefore not too surprising to see no Buy recommendations and only VWO and AOR (the benchmark fund) with Hold recommendations:

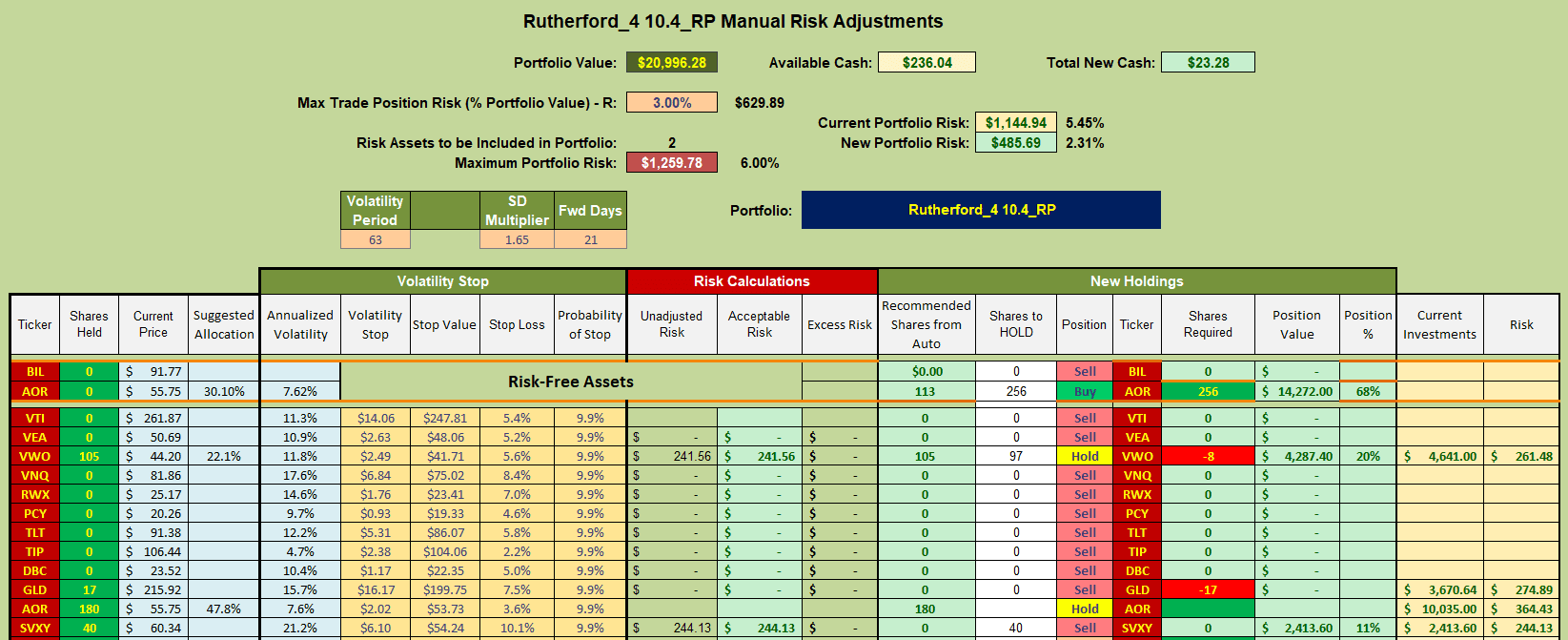

Based on the above, adjustments for this week will look something like this:

Based on the above, adjustments for this week will look something like this:

where I shall be selling shares of GLD out of Tranche 4 (the focus of this week’s review) and using the cash to add shares of AOR. Although AOR is only a Hold recommendation rather than a Buy, momentum is stronger in AOR than in BIL that would be my other option. I will not make the small suggested adjustment to VWO to avoid trading costs.

where I shall be selling shares of GLD out of Tranche 4 (the focus of this week’s review) and using the cash to add shares of AOR. Although AOR is only a Hold recommendation rather than a Buy, momentum is stronger in AOR than in BIL that would be my other option. I will not make the small suggested adjustment to VWO to avoid trading costs.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.