Amsterdam

The Schrodinger is an excellent portfolio to lead off June as it is a “no decision” portfolio designed for investors who have no interest in the workings of the stock market. Managed by computers at Schwab, the Schrodinger is known as a Robo Advisor account. Schwab calls these accounts Intelligent Portfolios. This portfolio was initially set up for a spouse who frequently asked the question, “How do I manage the family portfolio when you die?” Schwab’s Intelligent Portfolio system is designed to answer that question.

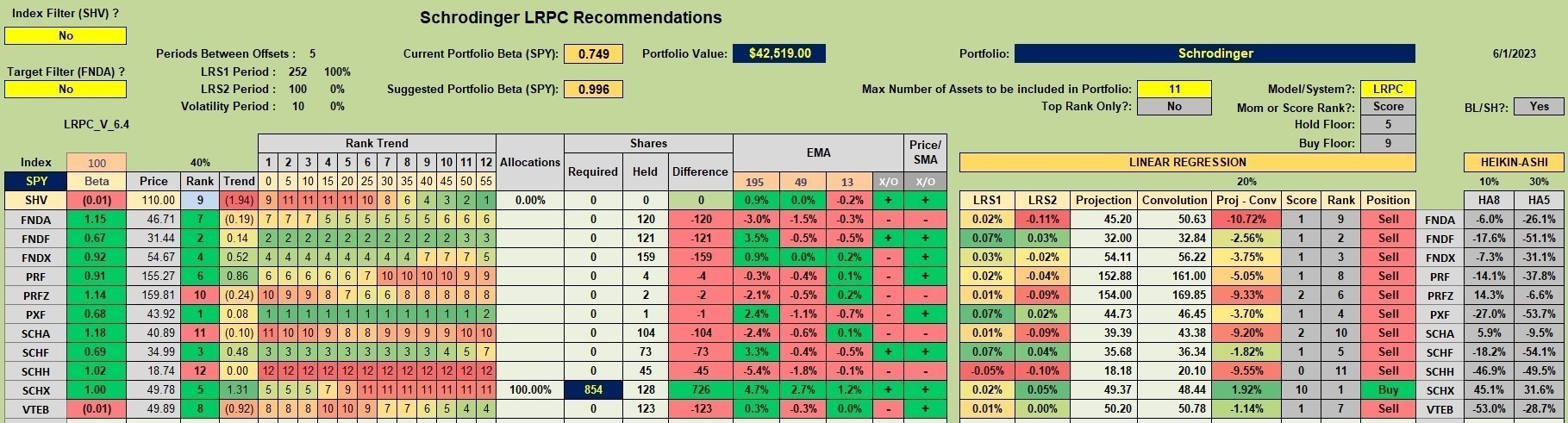

Schrodinger Investment Holdings

Below is a worksheet showing the current holdings for the Schrodinger. Pay no attention to the Kipling worksheet recommendations as they play no role in the management of the Schrodinger. I use this worksheet to show readers how the Schrodinger is distributed among eleven different asset classes using a variety of ETFs. All management decisions are made by computer after humans establish the asset allocation algorithms.

It is somewhat of a mystery why the portfolio holds PRF, PRFZ, and PXF as so few shares impact the performance of the portfolio. More shares will likely be added as the portfolio increases in size.

I’ve encouraged the owner to boost the size of the Schrodinger to something over $50,000 so Schwab will tax manage the portfolio. The Schrodinger is held in a taxable account so tax management should benefit the performance of this portfolio.

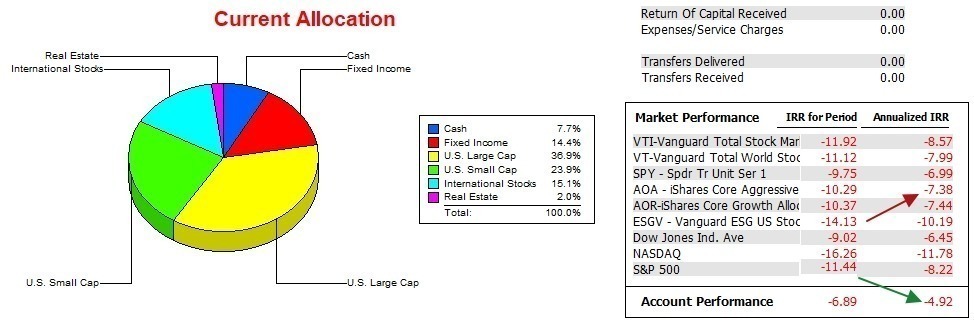

Schrodinger Performance Data

Below is seventeen (17) months of performance. As readers can see, neither the Schrodinger or any of the benchmarks have yet to recover from 2022 which was a poor year for equities. The Schrodinger holds a small annualized lead over the S&P 500 (SPY). This margin will likely vanish in a strong bull market as the current allocation is not set up to match SPY.

Note: The red arrow should point to SPY, not AOA.

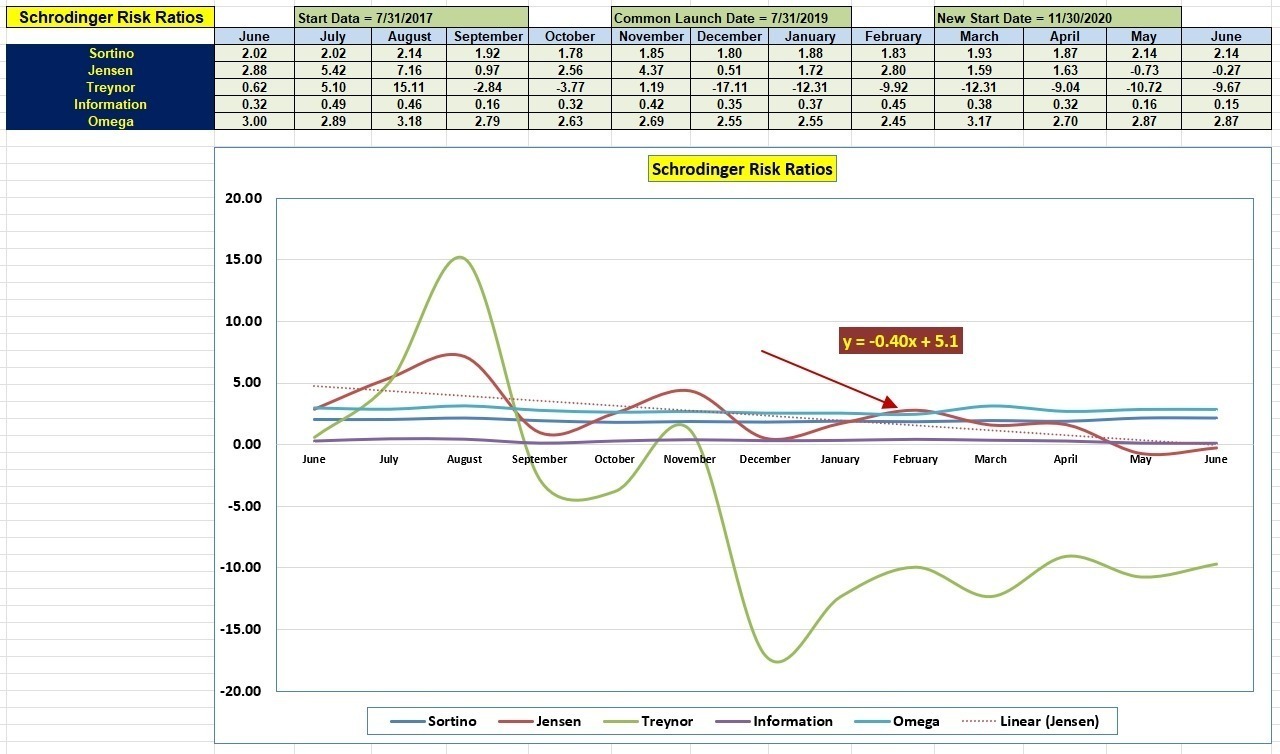

Schrodinger Risk Ratios

Pay little attention to the far right or June column. The May column provides useful information as to how the Schrodinger is performing. Based on the Information Ratio we see the Schrodinger holds a small margin over SPY. Yet the Jensen is a negative value. This in part is due to a rather high interest rate for the “risk-free” short-term treasury and the current portfolio beta.

I’m hoping this portfolio will reach the $50,000 level before too many more reviews. Then we will see how Schwab’s tax management method works.

Schrodinger Interim Update: 19 October 2022

The Elements of Investing: Part II

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.