China – Scene from Yangtze River

“Asset allocation is the process of dividing your investment portfolio among different asset classes, such as stocks, bonds, and cash. It is an important part of any investment strategy, as it helps to reduce risk and improve your chances of achieving your financial goals.

Schwab Intelligent Portfolios is an automated investment advisory service that can help you with asset allocation. The service uses an advanced algorithm to create a diversified portfolio that is tailored to your individual needs and risk tolerance.

Here are some of the benefits of using Schwab Intelligent Portfolios for asset allocation:

- Diversification: Schwab Intelligent Portfolios uses a variety of asset classes to create a diversified portfolio. This helps to reduce risk and improve your chances of achieving your financial goals.

- Professional management: Schwab Intelligent Portfolios is managed by a team of experienced investment professionals. This ensures that your portfolio is properly managed and that you are always on track to reach your financial goals.

- Low fees: Schwab Intelligent Portfolios charges low fees, which can help you save money on your investments.

If you are looking for a way to improve your investment portfolio, Schwab Intelligent Portfolios is a great option. The service can help you with asset allocation, professional management, and low fees.

Here are some additional tips for asset allocation:

- Start by determining your risk tolerance. Your risk tolerance is the amount of risk you are comfortable taking with your investments. There is no right or wrong answer when it comes to risk tolerance, as it is a personal decision. However, it is important to be honest with yourself about your risk tolerance, as this will help you create an appropriate investment portfolio.

- Consider your time horizon. Your time horizon is the length of time you have to invest your money. If you are investing for a short-term goal, such as buying a car in a few years, you will want to take on less risk. If you are investing for a long-term goal, such as retirement, you can afford to take on more risk.

- Rebalance your portfolio regularly. Rebalancing your portfolio means selling some of your winning investments and buying more of your losing investments. This helps to keep your portfolio diversified and in line with your risk tolerance.

- Don’t try to time the market. Trying to time the market is a fool’s errand. It is impossible to predict when the market will go up or down. Instead, focus on investing for the long term and let the market do its thing.

Asset allocation is an important part of any investment strategy. By following these tips, you can create a diversified portfolio that is tailored to your individual needs and risk tolerance.”

The above material was composed by Bard, Google’s artificial intelligent software program. The prompt was to write an asset allocation blog using as a model, Schwab’s Intelligent Portfolio. Bard did an excellent job of answering the prompt.

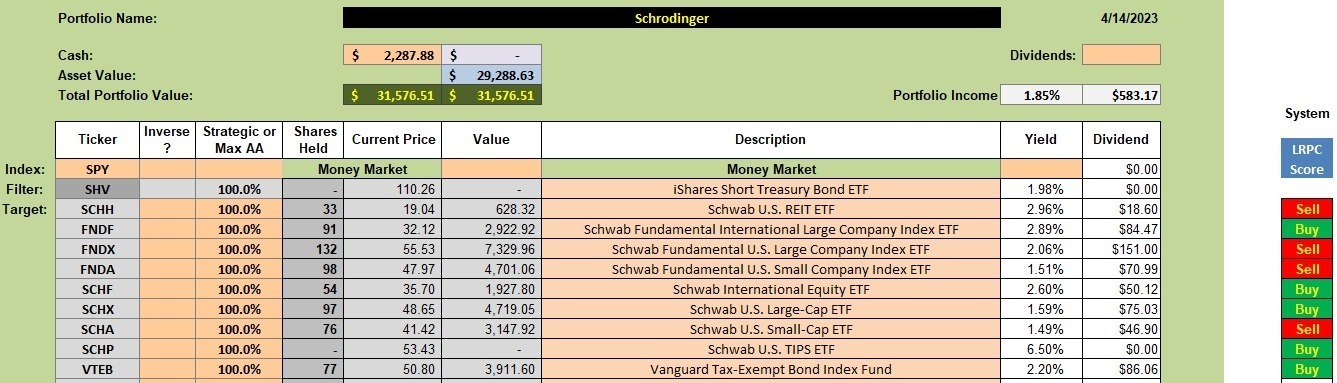

And now for a look at the Schrodinger portfolio asset allocation or what I call the investment quiver.

Schrodinger Investment Quiver

The computer algorithm used to manage the Schrodinger rarely makes changes in the asset allocation. Since the last Schrodinger update, a change was made as the computer sold all shares of the inflation protection ETF, SCHP. The cash was used to purchase shares of VTEB.

The current Schrodinger portfolio is shown below. For readers unfamiliar with this Robo Advisor portfolio, there is no easier portfolio to manage than the Schrodinger. After working with Schwab to set up an Intelligent Portfolio, all one does is save and electronically send money to Schwab. Within a business day you see changes in the portfolios as the computer will kick in and allocate shares based on a specific asset allocation designed to fit your age and risk tolerance.

Don’t expect to see your portfolio look the same as the Schrodinger as the Schrodinger asset allocation is set to take on more risk than Schwab recommends for someone the age of the owner of this portfolio. The owner has other income so is willing to take on more risk with this portfolio. This small portfolio was set up as an example to answer the question – Who Will Manage the Family Portfolio When I Die?

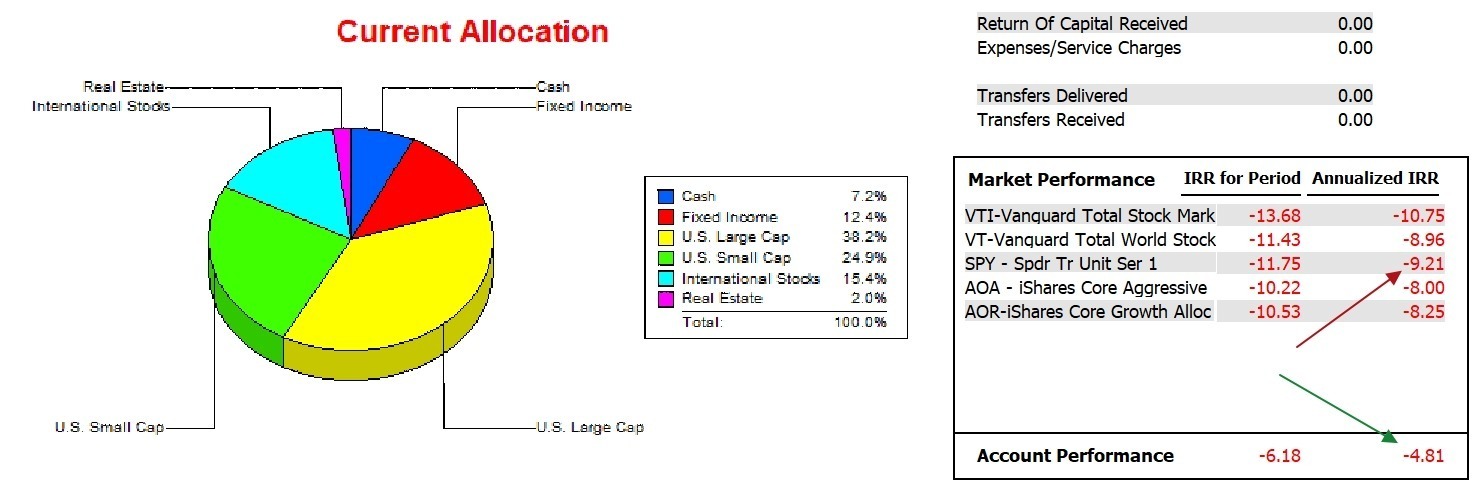

Schrodinger Performance Data

How is the Schrodinger performing over the past 15.5 months? Listed below are five possible benchmarks. I’m using the S&P 500 (SPY) with the Schrodinger and over this period the portfolio is performing much better than the U.S. Equities market. Over the lifetime of the Schrodinger, which goes back to 7/31/2017, SPY is performing significantly better than the Schrodinger.

The reason for the differences are quite simple. The Schrodinger is set up to reduce risk. Therefore it will not perform as well in bull markets, but will likely generate a higher Internal Rate of Return (IRR) than the S&P 500 in bear markets. 2022 was a bear market year and that is why we see the Schrodinger performing relatively well over the past 15.5 months.

The following data was generated by the Investment Account Manager commercial software program.

Schrodinger Risk Ratios

And now for a look into risk ratios, something you will not see in any other investment blogs. The following data is unique to ITA Wealth Management.

As frequently stated, the most important risk measurements are: Jensen, Information, and Sortino in that order. The Treynor is too dependent on the portfolio beta. Jensen’s Alpha or the Jensen Performance Index is holding relatively steady since last September. Over the past year the trend (slope = -0.41) of the Jensen is down. Not surprising as 2022 was a bummer of a year for the U.S Equities market.

Checking in on the Information Ratio, we see where the Schrodinger has consistently outperformed its benchmark. Not once do we see a negative value. This will be difficult to maintain during the next bull market.

Within the next month watch for a blog post on portfolio performance where the 15 portfolios I track will compare IRR performance data as well as risk comparisons between the various portfolio. The Schrodinger is used as a benchmark for the other portfolios. Since I have been posting these comparisons, the Schrodinger generally ranks among the top 1/3 to 1/4 of all portfolios.

ITA Portfolios: Summarizing Investing Approaches

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.