Arches National Park – Utah

Schrodinger is the passively managed portfolio up for review this morning. As a Robo Advisor or computer managed portfolio the owner of this portfolio does nothing except save or withdrawal from the account. On rare occasions the Stock/Bond ratio may be altered, but I don’t think the owner of the portfolio has done this since the initial setup.

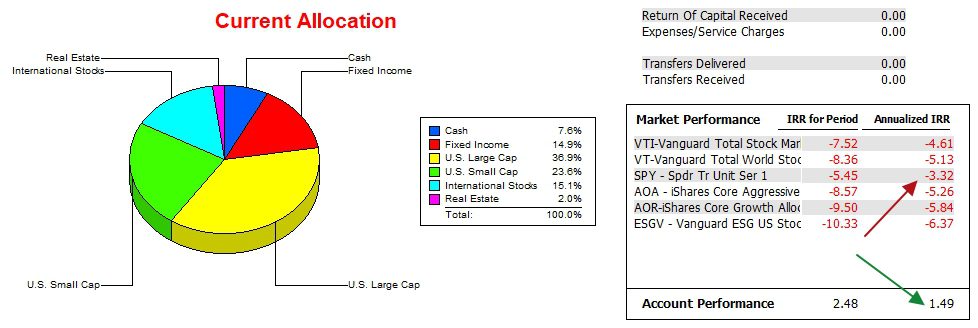

As readers can see from the pie chart, the Stock/(Bond-Cash) ratio is approximately 80/20. This is certainly on the aggressive end of the S/B ratio, but as I’ve shown in several Risk-Parity blogs, it is not much riskier than a 40/60 Stock/Bond ratio.

Schrodinger updates are shorter as there are no decisions as to which ETFs to buy or sell. All those decisions are made by computer.

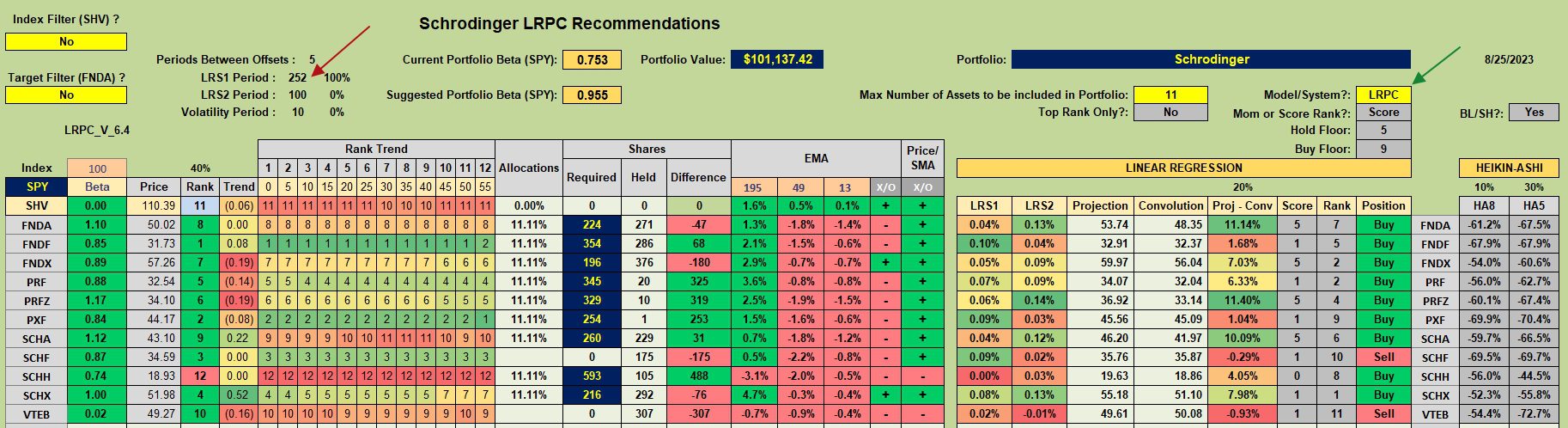

Schrodinger Security Recommendation

The following worksheet from the Kipling spreadsheet shows the ETFs that make up the Schrodinger portfolio. The look-back combination and LRPC investing models are long-term in their outlook as the Schrodinger is the type of portfolio one uses to build for retirement with minimum of work on the part of the owner. The Schrodinger is truly a passive portfolio.

Schrodinger Performance Data

Thus far in August the Schrodinger lost ground to the S&P 500 (SPY) yet maintains a comfortable margin. The lead is larger if one compares the IRR of the Schrodinger to the other five potential benchmarks.

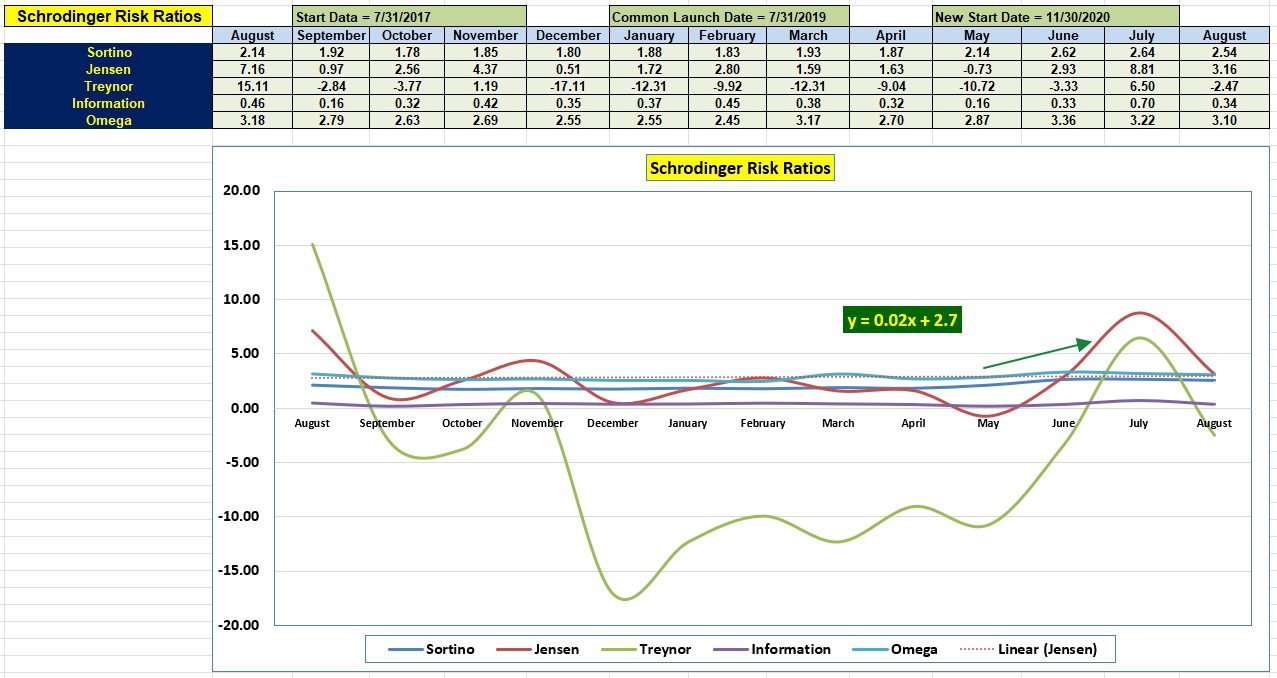

Schrodinger Risk Ratios

In this lack-luster stock market I thought the Schrodinger would perform a tad better than what is shown below. While the Jensen Performance Index is higher than it was for many months dating back to December of 2022, the drop since July is significant. The good news is that the slope of the Jensen is still positive and should remain that way once we drop the August 2022 data in September.

Another positive indicator of the Schrodinger is the Information Ratio as it has remained positive over the past 13 months.

As a reminder, the key data values are: 1) Jensen 2) Information Ratio 3) Sortino Ratio.

Schrodinger Interim Update: 19 October 2022

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.