Eastern Oregon

The Schrodinger is a portfolio for all seasons. Individuals preparing for retirement, and this applies to young folks in their 20s, would do well to take a close look at this Robo Advisor computer managed portfolio. If one is still working and has little time to spend on portfolio management, the Schrodinger requires zero attention. One can set up a monthly or two week money transfer to this Intelligent Portfolio and forget it. Schwab takes each new deposit and purchases shares in one or more of nine ETFs that covers the entire globe of investing. As the owner of a Robo Advisor account, you do nothing except save. That is the only requirement.

Schrodinger Investment Quiver and Current Holdings

Below is the tranche worksheet extracted from the Kipling spreadsheet. If the money manager were using the LRPC investing model with a one-year (252 trading days) look-back period, all but FNDX is a Buy. Since the Schrodinger is passively managed, we pay no attention to the Buy-Sell-Hold recommendations. As mentioned above, the only requirement for the Schrodinger is to save as much as you can as early as you can and the operative word is EARLY. Take advantage of compounding while you are young.

Schrodinger Performance Data

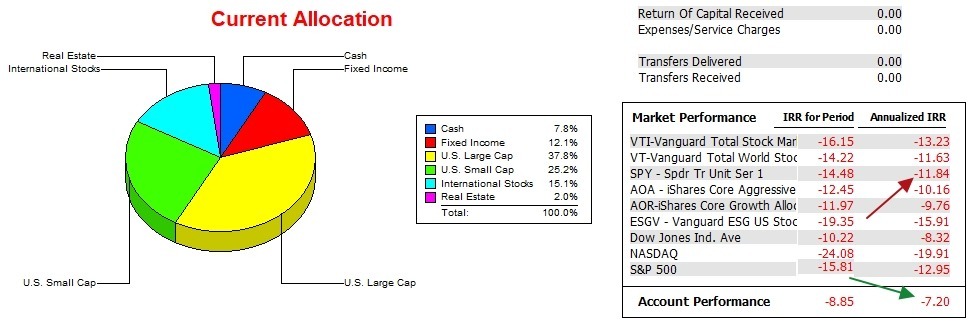

The following data is important as the Schrodinger is used as a portfolio benchmark. In other words, I compare the other 14 portfolios I track here at ITA with the Schrodinger. As a rule, the Schrodinger is found in the top 1/3 of all portfolios based on Return and Risk. I’ll be posting a portfolio comparison data table early in April.

Over the past 15 months the Schrodinger outperformed all benchmarks listed. Possibly the most appropriate benchmark is VT as VT is Vanguard’s Total World Index ETF and the Schrodinger covers the entire globe. As you can see, SPY closely tracks VT over the past 15 months.

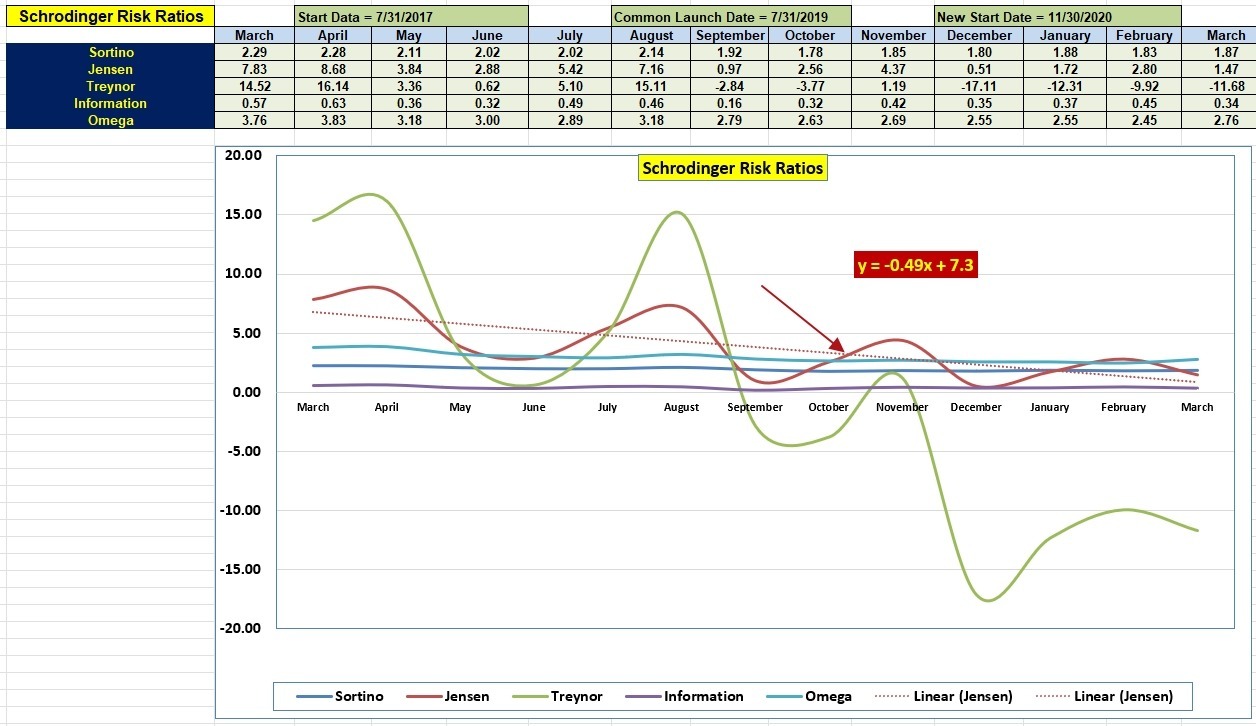

Schrodinger Risk Ratios

Knowing the Schrodinger commands a 4.6% annualized IRR lead over SPY, how is this portfolio performing based on the underlying risk? The slope of the Jensen Performance Index tells us the portfolio is slowly losing ground as the slope is a negative 0.49. This is not unexpected as the Schrodinger will mirror the world market and 2022 was a poor year for equities. Will 2023 be a repeat of 2022 or will we see stocks recover this year?

If we check the Information Ratio we see the Schrodinger is holding up rather well with respect to its SPY benchmark.

Look for a portfolio comparison blog post to show up early in April as I too am interested in observing how the various investing models compare with this computer managed portfolio.

Post your questions and comments in the Comment space provided below and send this link on to your friends and family found in your e-mail list. This post is not protected so all can read is assuming they have the URL.

Schrodinger Interim Update: 19 October 2022

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.