Shoshone Falls Park – Twin Fall, Idaho

Now that the second quarter is history, portfolios lagging in performance are under scrutiny. The Bohr is one such portfolio. With all the positive signals emanating from the Sector BPI investing model. with permission from the owner, I am in the process of slowly migrating the income driven Bohr over to the Sector BPI Plus model. Rather than sell the CEFs at market, I have established limit orders for each. It will likely be a slow process shifting to the new investing model.

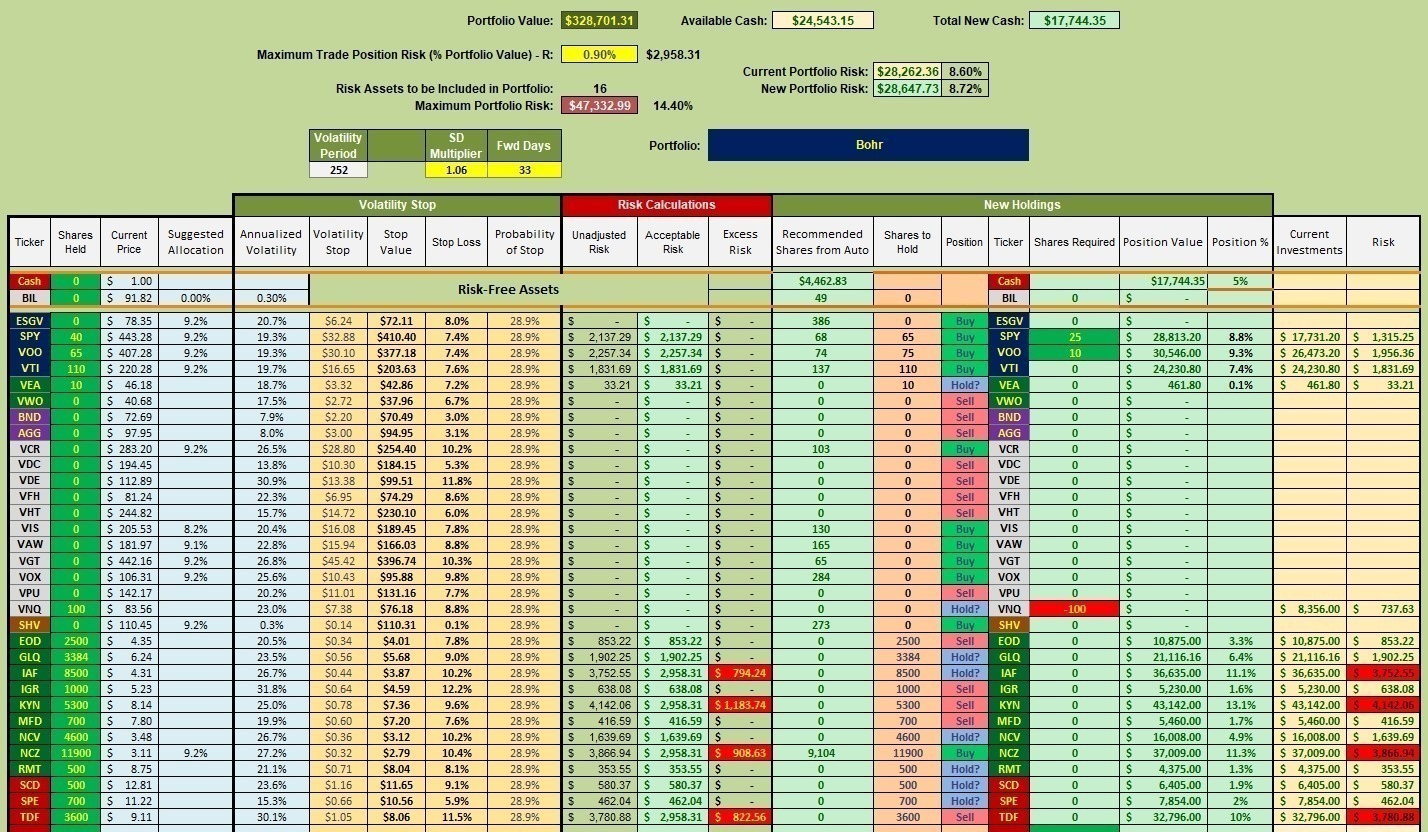

Bohr Security Recommendations

Below is the current makeup of the Bohr. The portfolio holds only one sector ETF and that is Real Estate (VNQ). Real Estate is one of four sectors calling for a Sell so a 3% TSLO is in place to move VNQ out of the Bohr.

Limit orders are in place to sell all the CEFs. Limit orders are also in place to pick up shares of VOO as it is the highest ranked ETF among ESGV, SPY, VOO, VTI, VEA, VWO, BND, AGG, and SHV.

Bohr Manual Risk Adjustments

Ten more shares of VOO will meet the current recommendation. A limit order is in place to purchase those 10 shares and two more limit orders were struck earlier this morning as I was writing this blog.

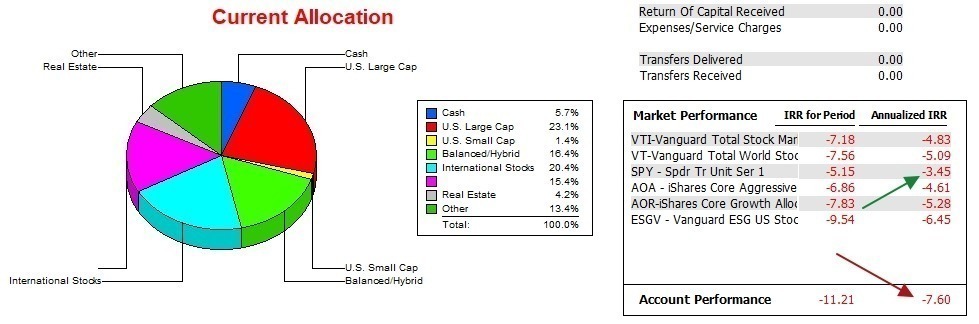

Bohr Performance Data

Over the past 18 months the Bohr lagged the benchmark by 4.2% annualized or 6.1% over the entire period. This delta is the reason for making the investing model change.

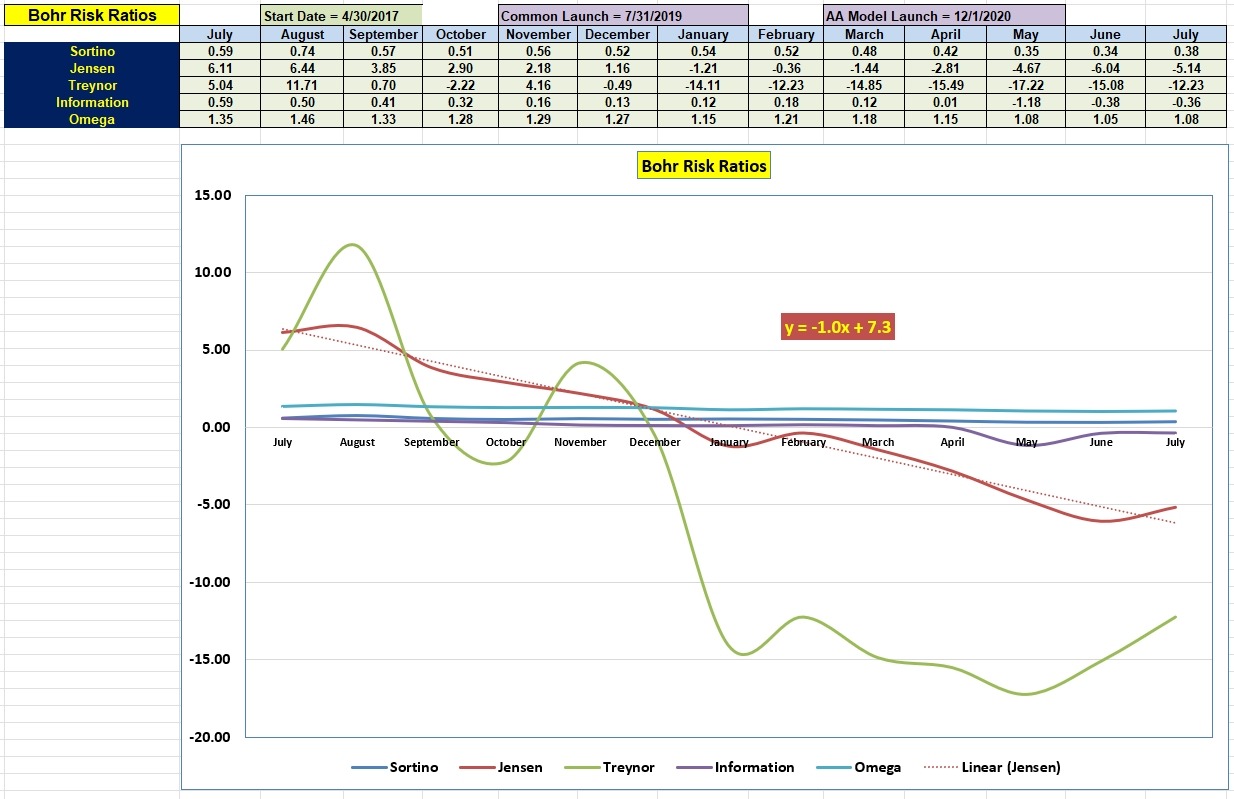

Bohr Risk Ratios

June was a strong month for the Bohr and that accounts for the uptick in the Jensen Alpha. However, it is still in negative territory and the slope of the Jensen is well below the zero mark. The goal is to turn these negative values into positive ones over the next six months.

Tweaking Sector BPI Plus Model: 20 May 2023

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.