Action at Clackamas County Fair

The Copernicus follows Warren Buffett’s advice to invest the major port of the portfolio in a low-cost index fund that tracks the S&P 500. Over the last 3.7 years this management approach has paid off very well as readers will see in a moment. The owner of this portfolios adds a few dollars each month and with those dollars buys a share or two of VOO or a similar low-cost index ETF.

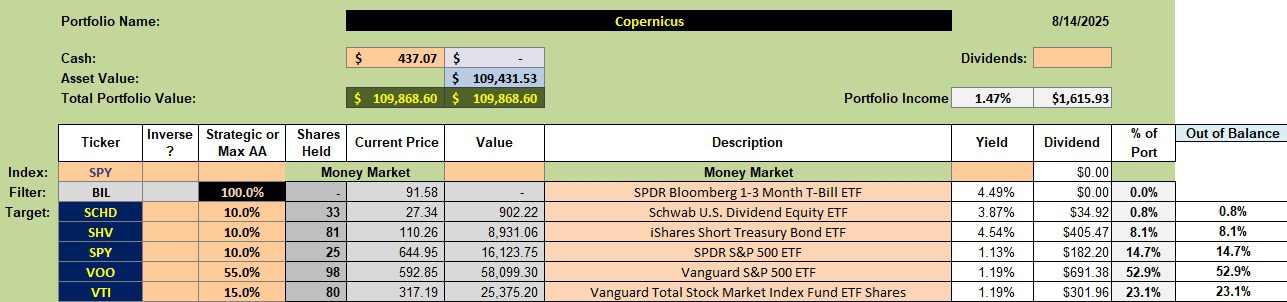

Copernicus Security Holdings

Eighty percent of the Copernicus is invested in U.S. Equity ETFs and the remaining 20% in lower volatile and income oriented ETFs. At least that is the goal. Currently, the portfolio is tilted toward equities.

The management style is definitely passive and it takes only a few minutes per month to add a few shares of VOO or SPY when cash becomes available. If there is insufficient cash to add to equities, purchase a few shares of SHV to increase income. The approach is quite simple.

To keep it very simple one could narrow the holdings down to two ETFs, VOO and SHV.

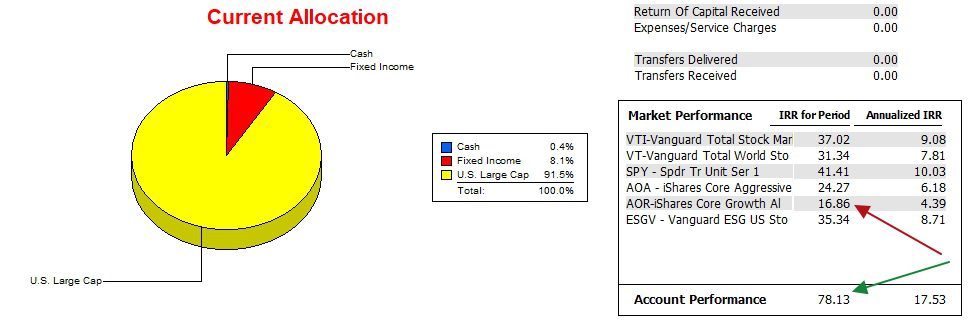

Copernicus Performance Data

Since 12/31/2021 the Copernicus has outperformed, by a wide margin, all the potential benchmarks including the S&P 500 (SPY).

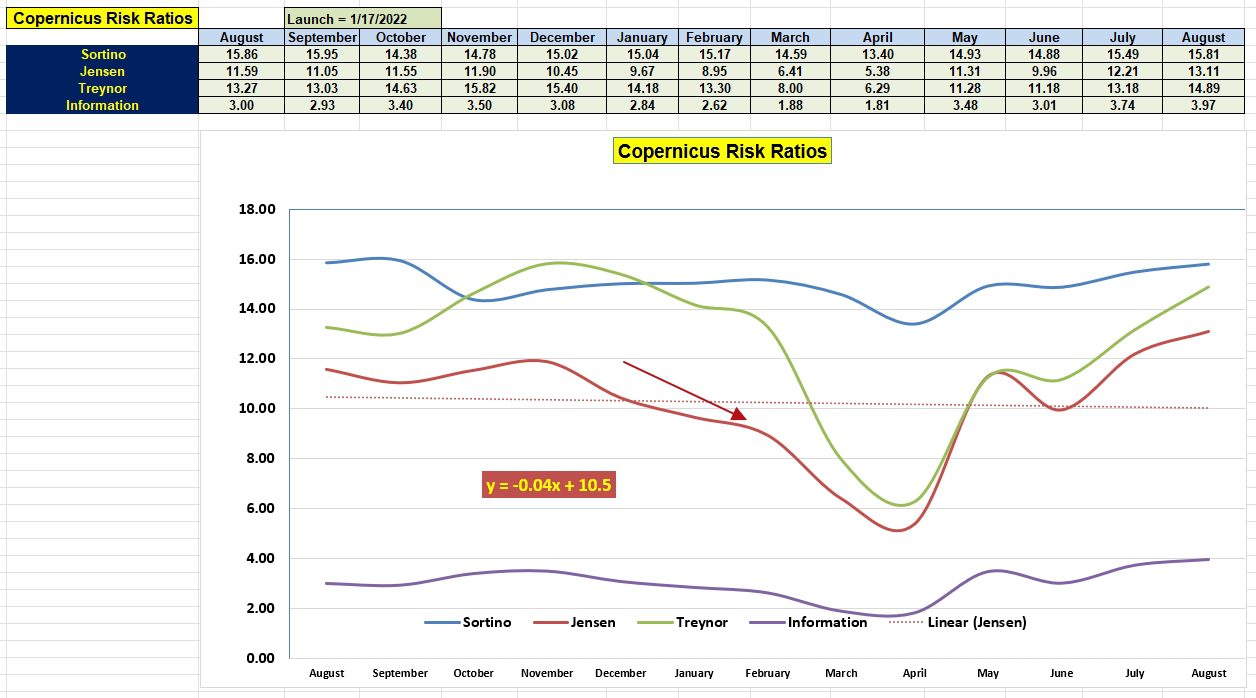

Copernicus Risk Ratios

How is the portfolio performing based on the high risk management style? The Sortino Ratio is holding steady while the all important Jensen Alpha is showing improvement since last winter. Both the Treynor and Information Ratios are higher than they were a year ago as one might expect considering the very strong U.S. stock market.

Copernicus Portfolio Review: 24 February 2025

Questions To Ask Your Money Manager

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question