Grand Avenue – Redwoods

Gauss is one of five Sector BPI portfolios tracked here on the ITA blog. Launched in December of 2022 we are closing in on two years of data. The initial results look promising, but we still need more oversold and overbought cycles to give this model a real test. The most recent draw-down moved three sectors into the oversold zone and I was able to fill Discretionary, Energy, and Technology. More on this later.

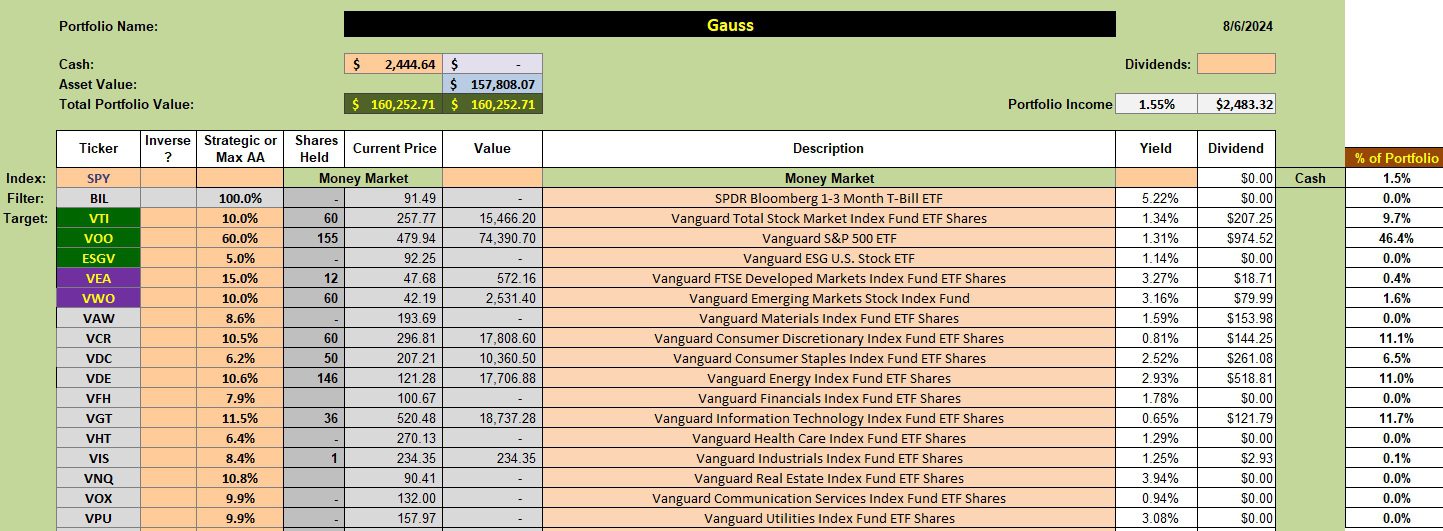

Gauss Security Holdings

The Gauss contains a different investment quiver as I’ve included VEA and VWO in addition to the three equity ETFs. I’m not sure this is the best move. The last table is one that will help make future decisions as to which ETFs are best to include in addition to the eleven sector ETFs.

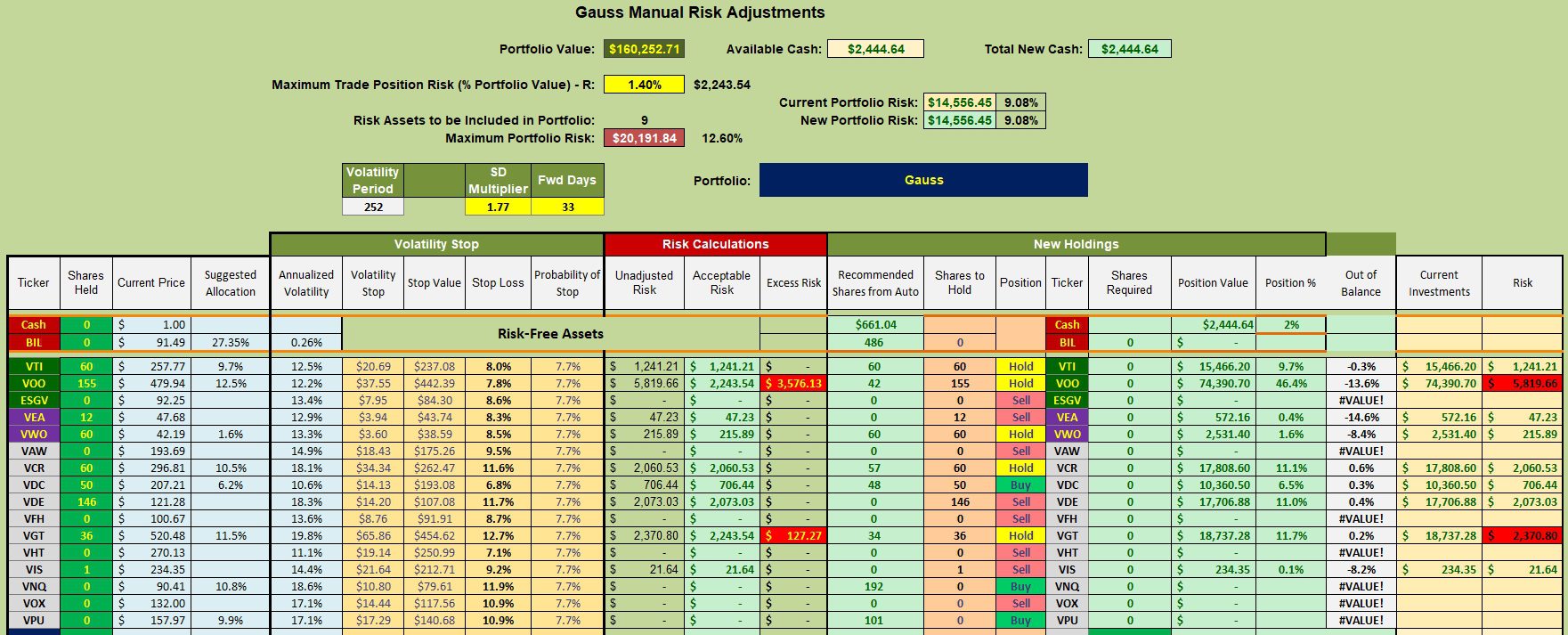

Gauss Manual Risk Adjustments

If you check the third column from the right you will see that Discretionary (VCR), Energy (VDE), and Technology (VGT) are fully populated. None of the other five ETF options (VTI, VOO, ESGV, VEA, or VWO) are recommended for purchase. To use up the available cash I placed one order for five shares of VOO. The limit order is placed well below the current price.

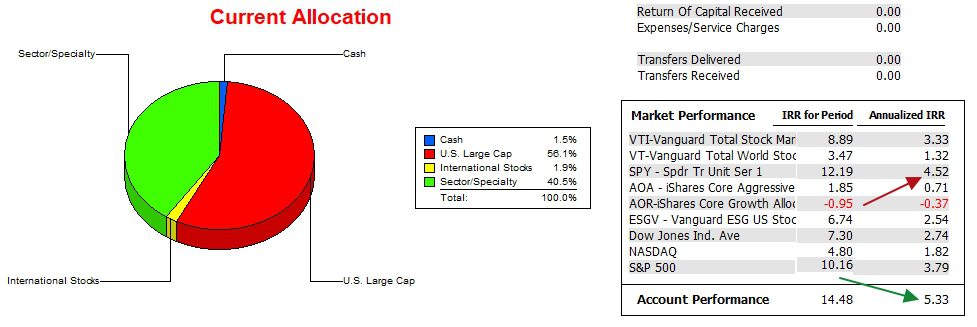

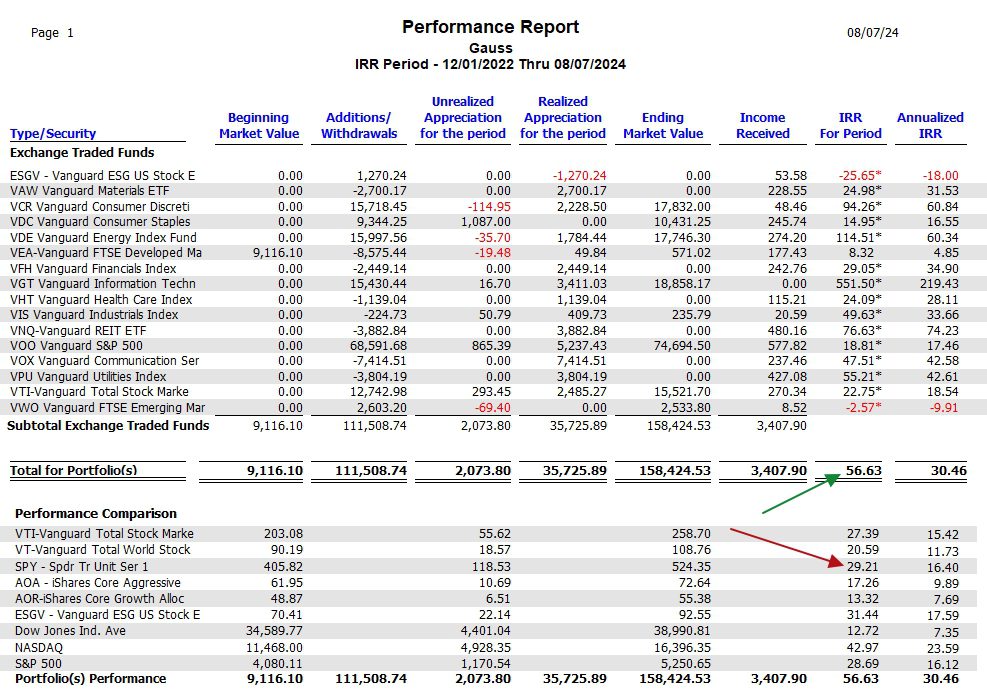

Gauss Performance Data

Since 12/31/2021 the Gauss managed to edge out the SPY benchmark. None of the other potential benchmarks are close to the Gauss when it come to IRR percentages.

Gauss Risk Ratios

Despite losses in August the Jensen and Information Ratios improved slightly and the slope (0.01) of the Jensen is barely positive. While the August values are not great, at least they are positive in the Dog Days of Summer.

Gauss Sector Portfolio Report

Looking over the data I see where ESGV, VEA, and VWO add little value to the Gauss. I may eliminate those three ETFs from the investment quiver and go back to or stick with VTI and VOO as the go-to ETFs when the sectors are out of favor.

Overall, the Sector BPI investment model is working with the Gauss as it is with the other portfolios following this model of investing.

If additional explanations are required as to how the Sector BPI model works, let me know. If I hear nothing I’ll assume the rules are clear.

Gauss Sector BPI Portfolio Update: 3 January 2024

Millikan Sector BPI Update: 20 July 2023

Franklin Portfolio Review: 21 July 2023

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.