Vineyard near Walla Walla, Washington

Schwab’s Intelligent Portfolio, the Schrodinger, is up for review today. This portfolio was launched a number of years ago to answer the question, “Who Will Manage the Family Portfolio When I Die?” Of the three portfolio investment strategies tracked here at ITA Wealth Management, the Schrodinger is by far the easiest to manage. All one does is set up an Intelligent Portfolio with Schwab, save and sit back and let their computer(s) manage the portfolio. There are no management fees other than the expense ratios associated with the individual ETFs. I made two requests of Schwab.

- Emphasize U.S. Stocks rather than hold a high percentage of International Equities. In my opinion the Schwab computers were tilting the portfolio too heavily toward non-U.S. Equities.

- I needed to convince Schwab to be more aggressive so the portfolio was tilted heavily in stocks rather than bonds. This should not be a problem for a young investor when answering the initial questions.

I mentioned there are three portfolio investment strategies employed here on the ITA blog. Here are the three.

- Intelligent Portfolio or what I call a Robo Advisor model. The Schrodinger is the single portfolio using this model.

- The second model calls for investing only in U.S. Equities. Never sell unless there is an emergency. The portfolio following this model is the Copernicus.

- A little over a year ago I developed the Sector BPI investing model. Thirteen portfolios are currently using this model, but I only report on eleven. If interested, check on the Carson as it is the oldest of the Sector BPI portfolios. Interested readers may need to register as a Guest and wait to be elevated to the Platinum level as many of the blogs are protected.

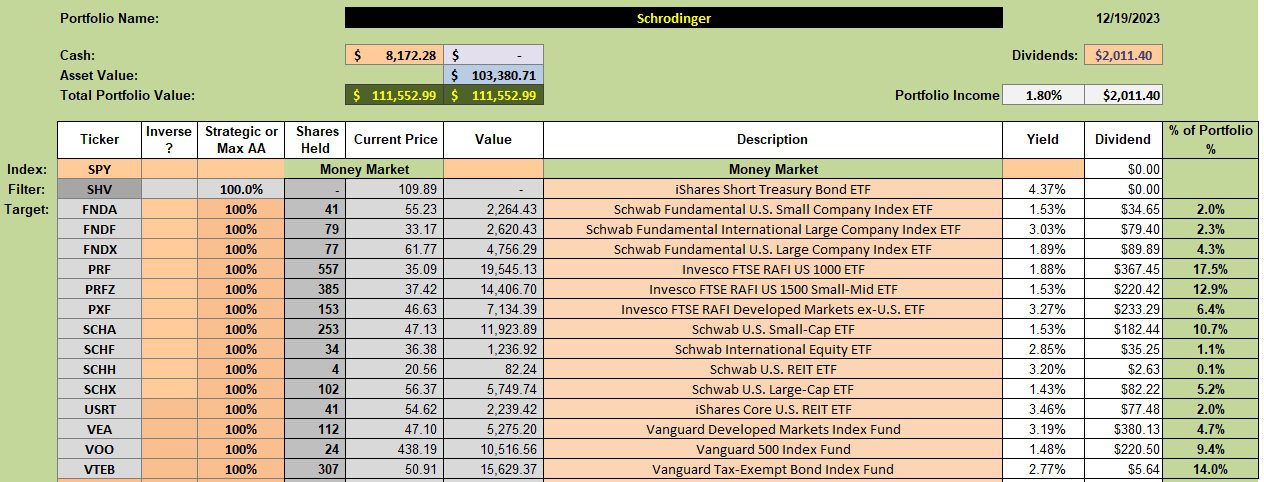

Schrodinger Holdings

Below are the current holdings for the Schrodinger. The portfolio is getting a little heavy in cash, but Schwab may be holding off purchasing more equity shares once all the 2023 dividends are paid.

I should mention that portfolios in excess of $50,000 are tax managed. One might need to request this option. The Schrodinger is currently tax managed so it will be interesting to see what the computers do near the end of the calendar year and early in 2024. The next review will make these moves clearer.

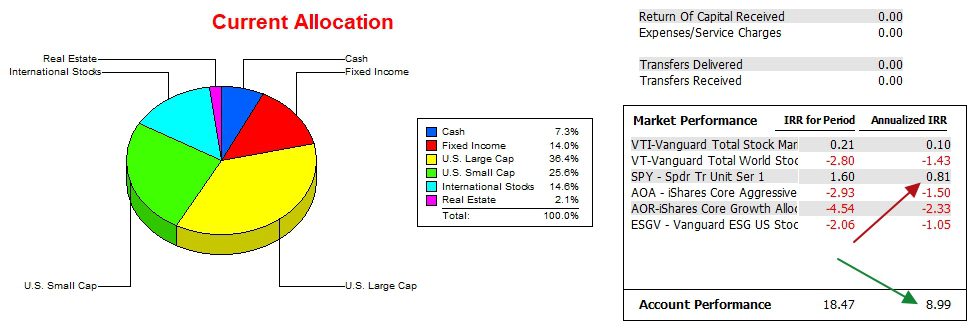

Schrodinger Performance Data

The following data spans from 12/31/2021 through 12/19/2023 or nearly two years. The portfolio is actually older, but I use 12/31/2021 as a starting date as several new portfolios were launched at that time and I want to compare performances. Approximately once a month I post comparison data showing how all the different portfolio are performing. Platinum and Lifetime members have access to that information.

Thus far the Schrodinger is crushing the S&P 500 (SPY) as well as the other potential benchmarks. This data comes from the Investment Account Manager software. A new version of this software is coming and if interested I think I can arrange a discounted price. Stay tuned.

In general, the Schrodinger should outperform SPY in down markets, but may have a difficult time keeping up with the market in bull markets.

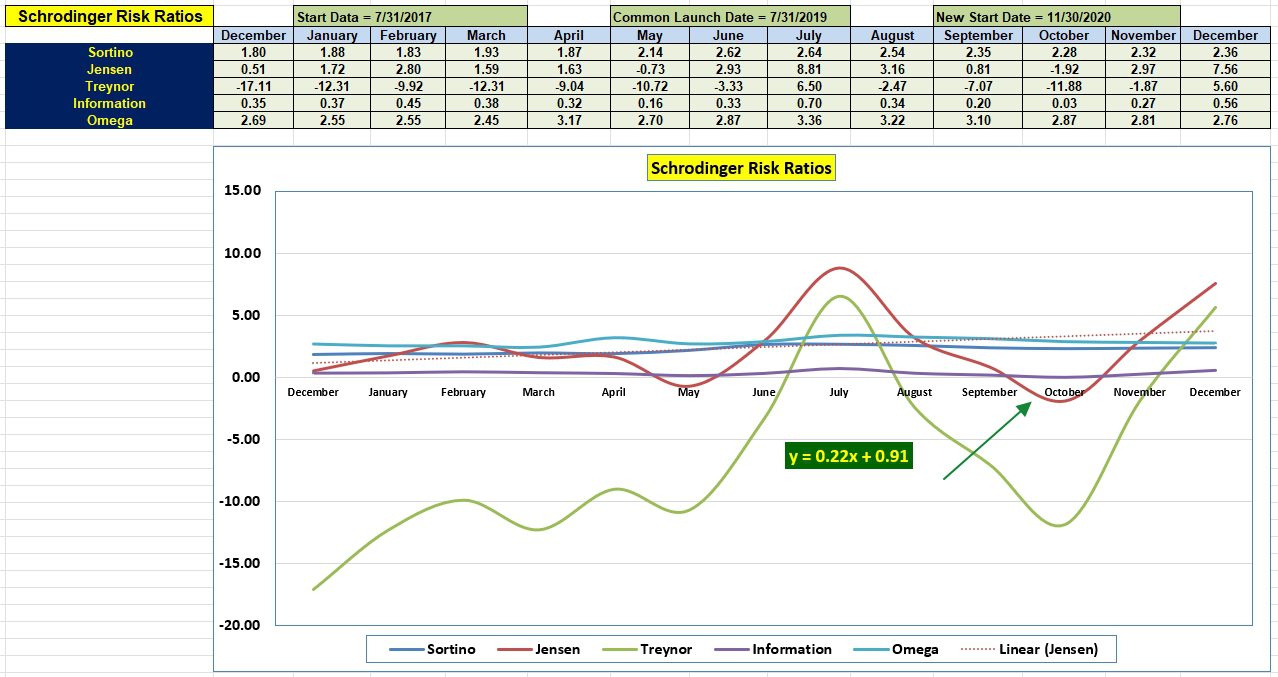

Schrodinger Risk Ratios

The following data table is proprietary to the ITA blog. These five metrics are risk measurements with the Jensen Alpha or Jensen Performance Index the most important. Uptick in stocks have given the Jensen a nice boost in December despite the increase in the risk-free short-term interest rates.

If there are Comments or Questions, post them in the Comment section provided below. If you are not a Platinum member, register as a Guest and wait for me to move you to the Platinum level. This blog is free to all who register as a Guest.

Copernicus Buy & Hold Portfolio Review: 18 May 2023

Schrodinger Computer Manage Portfolio Update: 7 June 2023

Tweaking Sector BPI Plus Model: 20 May 2023

Tweaking Sector BPI Plus Investing Model: Part II

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Lowell,

Impressive performance by the robo system. Looks eerily like the current portfolio positions in my own relative strength system, with heavy emphasis on US asset classes, particularly mid- and small cap assets.

Do you know (generally) what the RoboAdvisor algorithm is? Looks like it is using the state of the market a measure for what assets to be in…

Craig

Craig,

As best I can tell, the Schwab Intelligent Portfolio is built around principles of Asset Allocation. The portfolio has not changed much over the past four or five years so I doubt they are using any type of AI.

I anticipate there will be a few new purchases after the dividend season is over. Since 2023 has been a good year for equities I doubt there will be much tax harvesting. I should know more by the first week of January.

As for the portfolios I track, Schrodinger consistently ends up in the top quartile. Not a bad record.

Lowell

I’m still waiting for Schwab to transfer my TD Ameritrade accounts. Your post here has me thinking I should look at it. Do you have any max drawdown or CAGR over your entire portfolio life?

Craig,

My Schrodinger data goes back as far as 7/31/2017. Since then the IRR is 10.13% and the IRR for the entire period is 85.35%.

For comparison, SPY has an IRR of 12.3%. AOR, for comparison is 5.3%. These are annualized values so compare 10.1% with 12.3% and 5.3%.

The S&P 500 turned in an IRR of 10.1% over this period or the same as the Schrodinger.

I don’t know what the maximum draw-down was during this period.

Lowell

Also, very impressive Sortino ratios. These numbers mimic my RS system with regard to downside protection.

Lowell,

I have Intelligent portfolios for my great children and they are entirely Schwab funds and then only 7. About 6% is in International.

I’m not sure why the Schrödinger has so many assets.

Bob Warasila

Bob W.,

I too question why they are holding ETFs that make up percentages below 3% as those securities add little to the performance.

Maybe the size of the portfolio is a factor. I can’t complain about performance.

Lowell