Wooden Toys – Let’s check out the tractor trailer.

In case you were unaware, all three Sector BPI portfolios are named after women scientists. All three portfolios are performing quite well and if the Vanguard projection (see link at the bottom of this page) comes close reality these three portfolios should perform above average.

I’ve been bearish on U.S. Equities for a number of weeks based on a chaotic government combined with over valued Buffett Indicator and the Schiller Ratio. If interest rates are cut, as expected, we are likely to see an upward bump placing equities at an even higher risk of a future draw-down. Then look for the draw-down. Also keep in mind that predictions are frequently wrong.

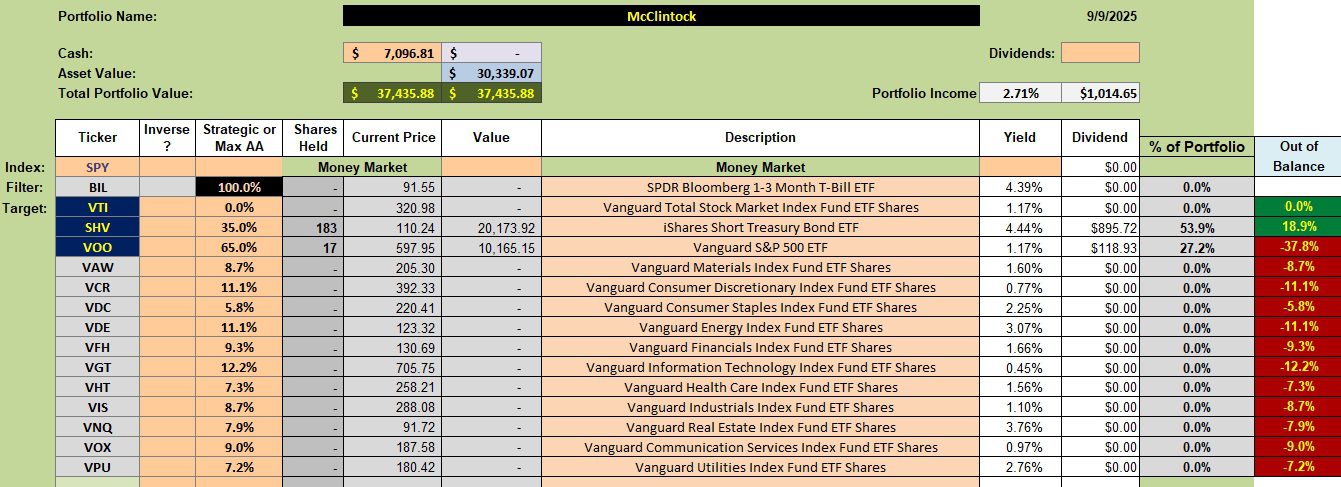

McClintock Sector BPI Holdings

No sector ETFs are currently in the McClintock. We are patiently waiting for one or more sectors to drop into the oversold zone.

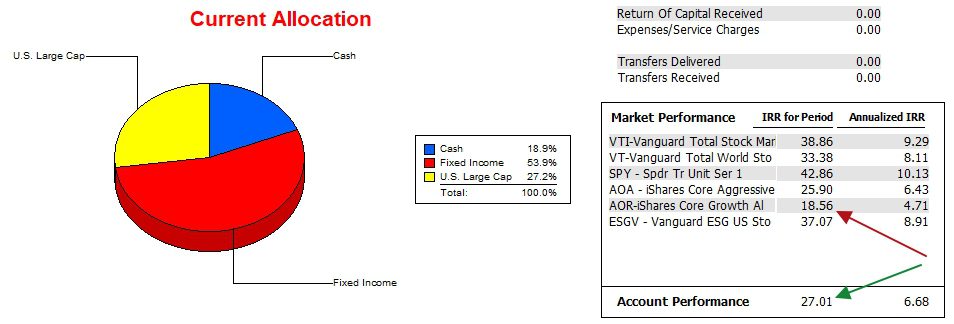

McClintock Performance Data

Since 12/31/2021 the McClintock continues to outperform the AOR benchmark, but trails the S&P 500 by a wide margin.

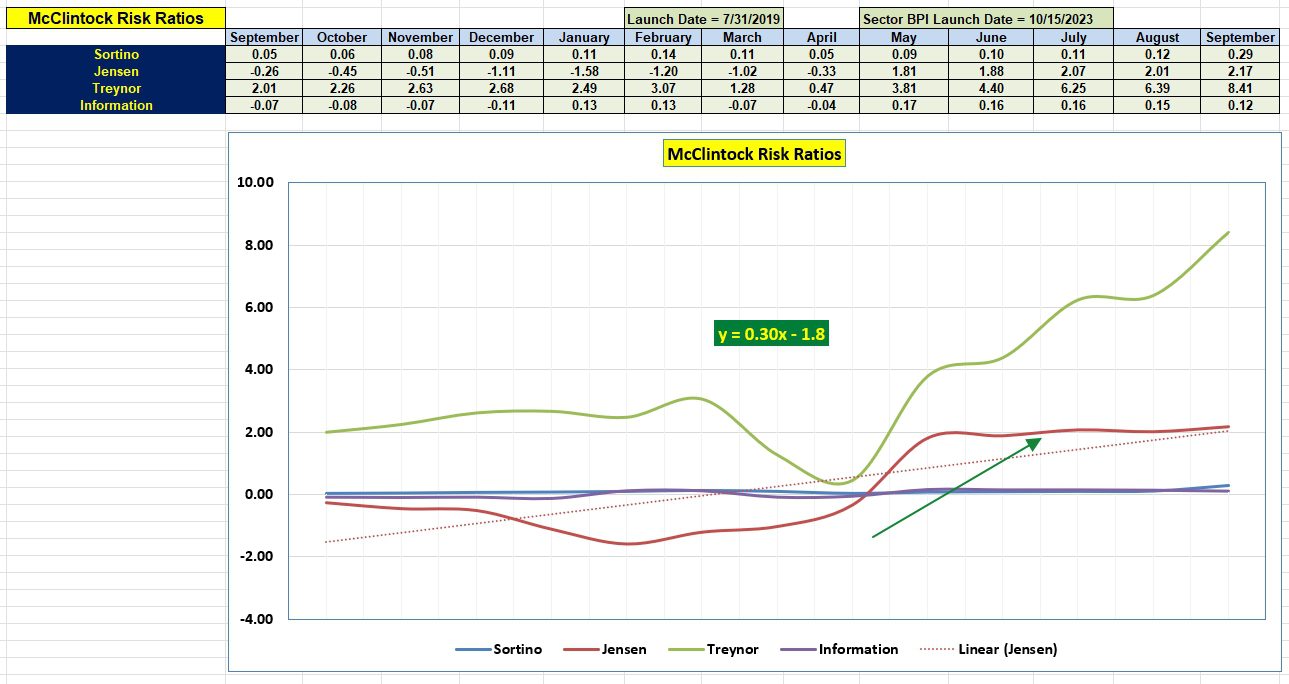

McClintock Risk Ratios

If we look back to September of 2024, the McClintock has improved significantly. The next three years are going to be a true test of the Sector BPI investing model.

One disappointment within the following data is the decline in the Information Ratio since last May. This ratio indicates the McClintock is not keeping pace with the AOR benchmark.

Move past the advertisement and concentrate on the Vanguard prediction. The following market outlook will not influence the Schrodinger or any of the three Sector BPI portfolios. The three Sector BPI portfolios should capitalize on a “flat” market with average volatility. Where I am likely to make some asset allocation changes is with portfolios that operate using the Asset Allocation investing model. At this point I am unsure what to do with the Copernicus as it is definitely driven by U.S. Equities or securities expected to flounder according to Vanguard.

Pass this link on to friends and relatives.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question