Hibiscus

Pauling is another “easy to manage” asset allocation portfolio. All asset classes have yet to be fully populated. That should take place over the next three to six months. I am still waiting to see what the FEDs do with interest rates and how tariffs impact the U.S. economy.

Here in the Northwest regular gas spiked 50 cents a gallon in just a few days. It is now running over $4.00 a gallon for regular at the cut-rate stations. This increase will hit the 40% of citizens who have a difficult time putting their hands on $400.

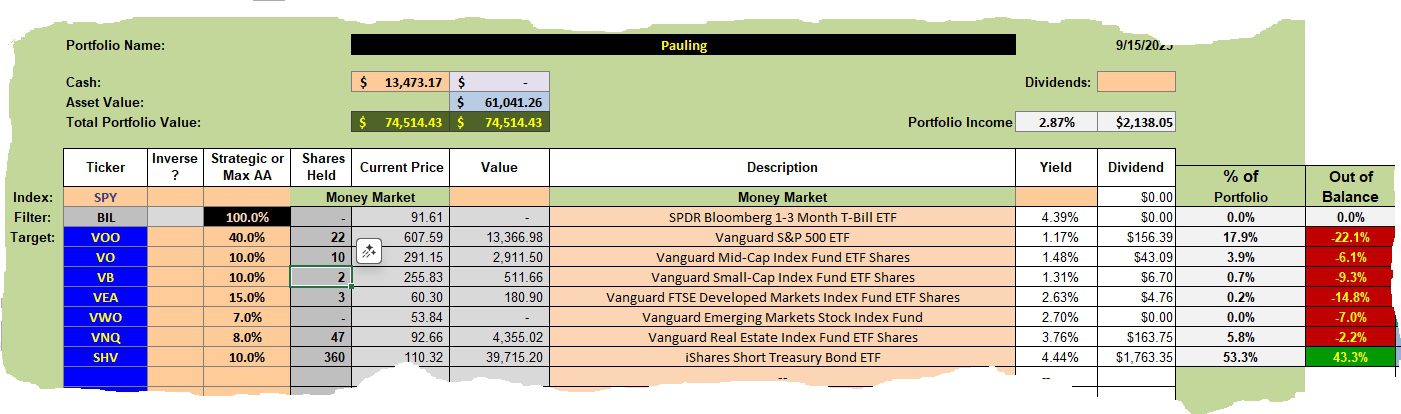

Pauling Asset Allocation Portfolio

Below is the current asset allocation layout for the Pauling. All equity ETFs are well under target as I am holding a large percentage of the portfolio in either cash or short-term treasuries.

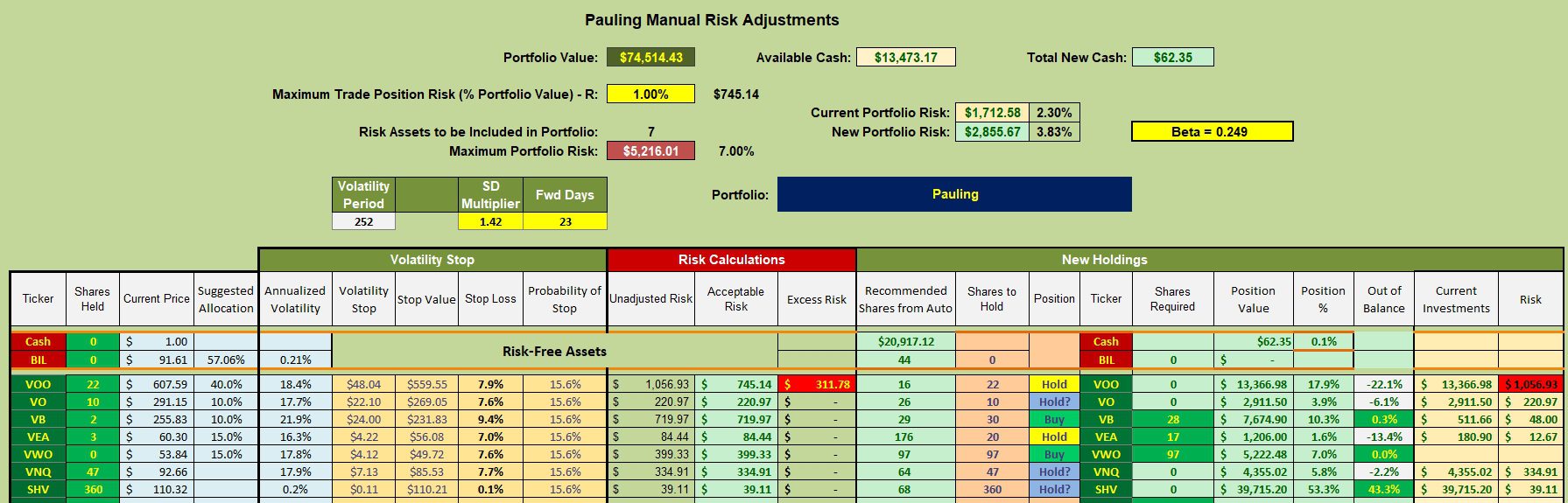

Pauling Rebalancing Recommendations

Over the next few months I plan to slowly bring the various asset classes into balance. This morning I sold some shares of SHV and used that cash to purchase a few shares of different equity ETFs.

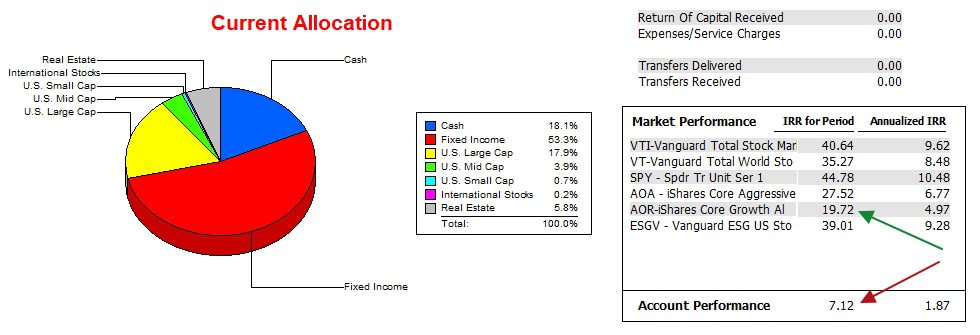

Pauling Performance Data

The conservative approach is impacting overall performance or the Internal Rate of Return (IRR). Since 12/31/2021 the Pauling has fallen well behind the AOR benchmark.

Pauling Risk Ratios

As important as the IRR is the Jensen Alpha is even more important as it calculates how well the portfolio is performing based on the underlying risk. By holding a high percentage of the portfolio in cash and SHV the portfolio beta is low. This in turn aids the Jensen Alpha or Jensen Performance Index. Right now the Jensen is back close to February levels.

A lowering of the Information Ratio tells me the Pauling is not keeping pace with the AOR benchmark.

The Pauling is very easy to manage. Once the asset classes are selected and the target percentage for each ETF is established, all one needs to do is save and keep the different asset classes in balance. By in balance I recommend keeping the percentage within 3% to 5% of target.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question