National Park Walker

Asset Allocation is a long-standing portfolio management model. What sets such portfolios apart is the choice of assets used to populate the portfolio. Readers will find the Pauling is well diversified across many different asset classes giving exposure to different size stocks, international equities as well as an array of income generating ETFs. This approach is relatively new with the Pauling so we do not have much history to draw conclusions. The best we can do is watch for trends among the risk ratio data.

Pauling Asset Allocation Portfolio

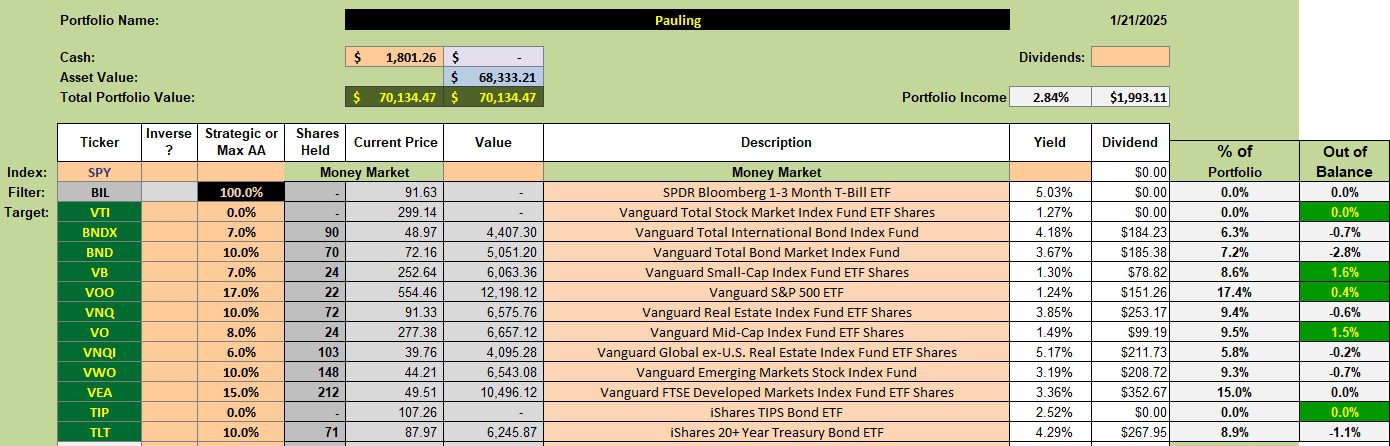

Below is the asset allocation model for the Pauling. A few asset classes are out of balance. I don’t pay attention if the holding exceed the target percentage. New cash and dividends are used to bring asset classes most below target up to the recommended percentage. That means focusing on TLT, BND, BNDX, VNQ, and VWO.

For smaller portfolios (<$100,000) the goal is to keep assets within 1% of the target percentage.

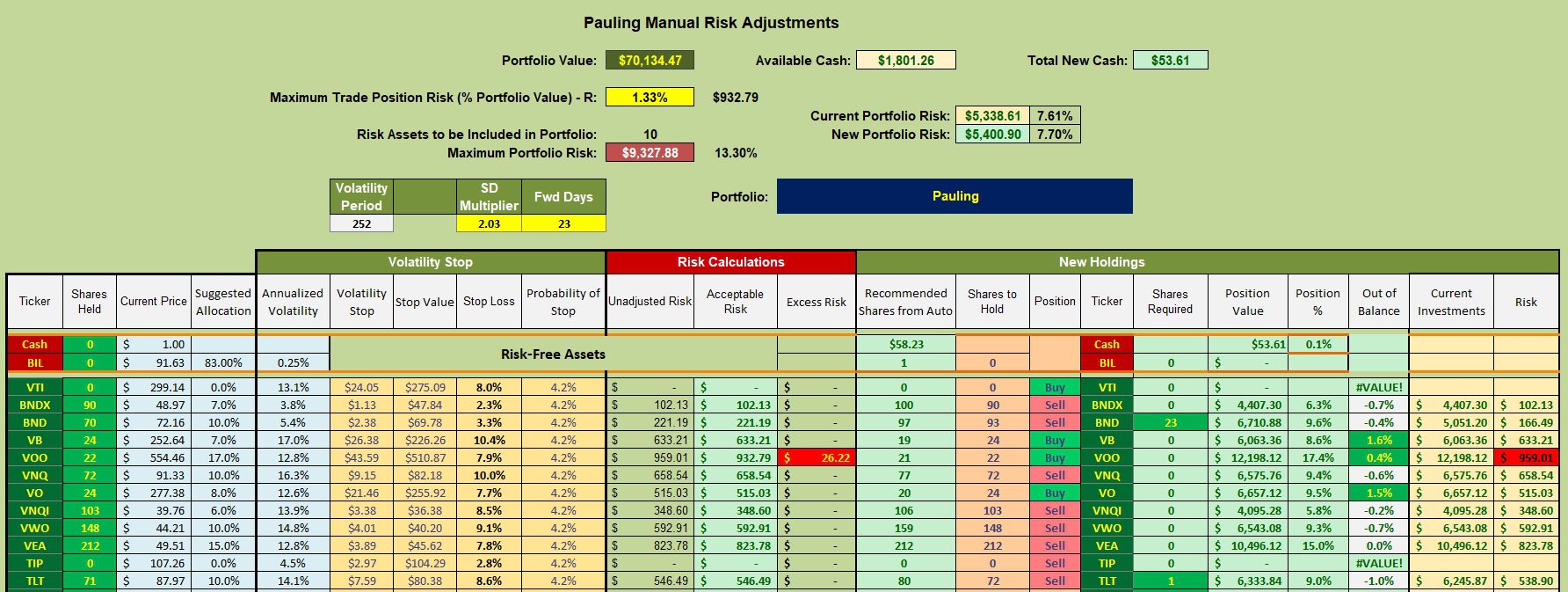

Pauling Rebalancing Recommendations

The two ETFs to receive most attention are: TLT and BND, both income generators.

Due to price fluctuation from review to review it is to be expected one or more asset classes will almost always be out of balance. If one continues to add securities that are below target we tend to be purchasing shares when prices are down while letting the better performers run. Over the long haul this approach should add alpha to the Pauling.

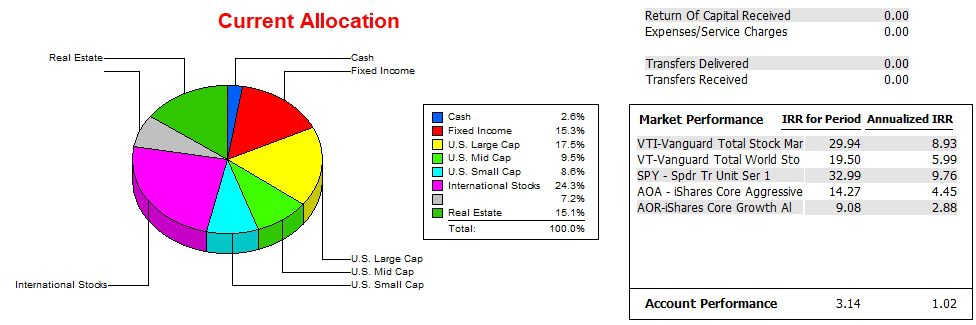

Pauling Portfolio Performance

Since 12/31/2021 the Pauling continues to lag the AOR benchmark as well as all other potential benchmarks. Now we need to check the more recent growth graphs to see how well the Pauling is performing with the new AA approach.

Pauling Risk Ratios

The Sortino Ratio indicates the Pauling has been increasing in value over the past year. While still negative, the Jensen Alpha is also improving. This is a particularly good sign. Watch the slope of the Jensen to see if this continues.

The Information Ratio is also improving indicating the Pauling is gaining on the benchmark, yet lost ground over the past two months.

Questions and Comments are always welcome. Post them in the Comment section provided with each blog post.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question