Bath Abbey (Cathedral), Bath, England

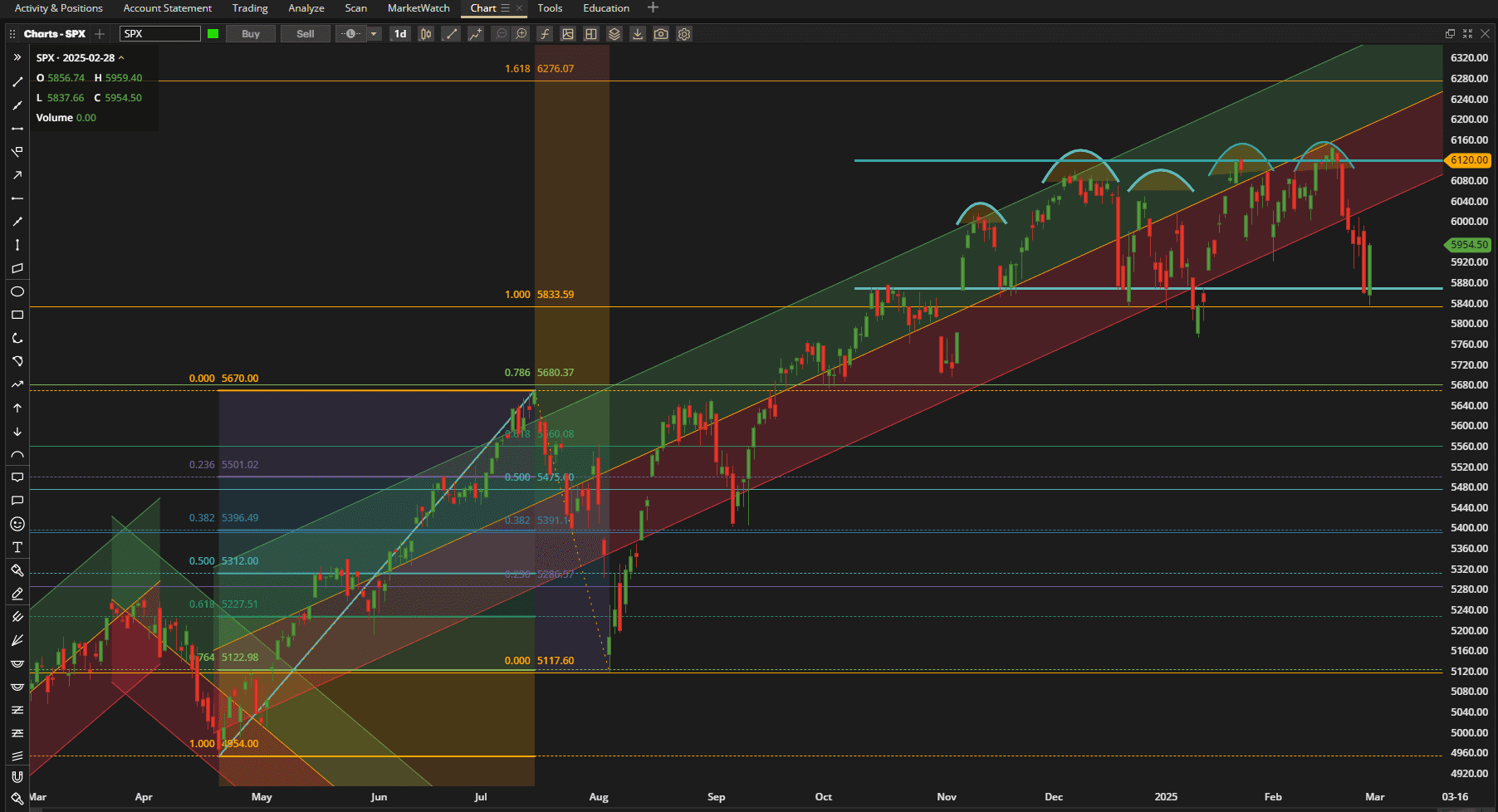

It was another volatile week in the US Equity markets with the bears beating the bulls by ~1%:

with Friday’s bounce off the ~5840-5880 zone that is providing strong support we are back into the sideways consolidation channel that we have been in for the past ~4 months but are now ouside the upward trend channel that is shown in the above screenshot. There is obvious strong resistance at ~6120 and we have tested this level at least 3 times (possibly 5 depending on how strongly we define a “touch”) and pattern traders would say that this is looking very bearish. Should we close below the ~5860 zone again it looks as though 5680 might be our next level of support. This would be a ~7% pullback from the highs but still not a technical correction in trend until we got to ~5500 (10% pullback)

with Friday’s bounce off the ~5840-5880 zone that is providing strong support we are back into the sideways consolidation channel that we have been in for the past ~4 months but are now ouside the upward trend channel that is shown in the above screenshot. There is obvious strong resistance at ~6120 and we have tested this level at least 3 times (possibly 5 depending on how strongly we define a “touch”) and pattern traders would say that this is looking very bearish. Should we close below the ~5860 zone again it looks as though 5680 might be our next level of support. This would be a ~7% pullback from the highs but still not a technical correction in trend until we got to ~5500 (10% pullback)

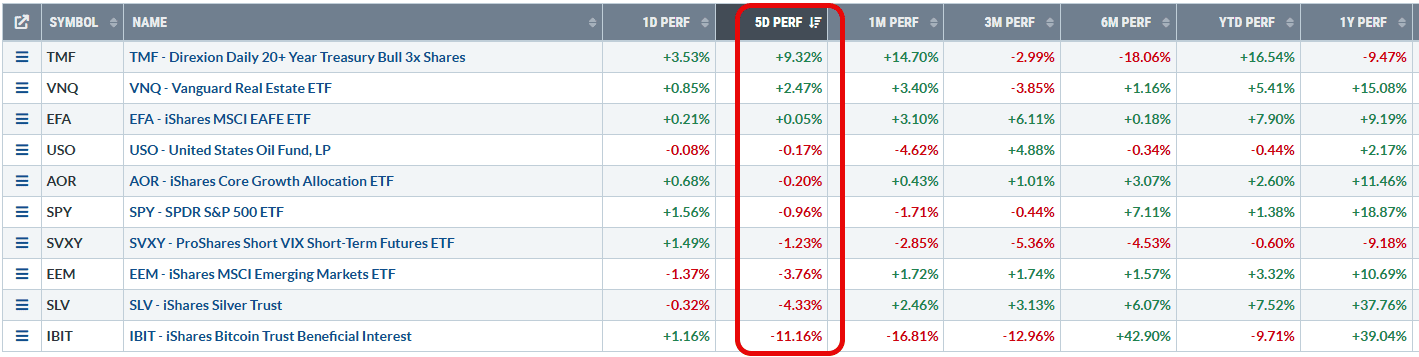

Relative to other major asset classes US Equities fell in the middle of the rankings:

with Bonds and Real Estate topping the list. Crypto’s were the hardest hit.

with Bonds and Real Estate topping the list. Crypto’s were the hardest hit.

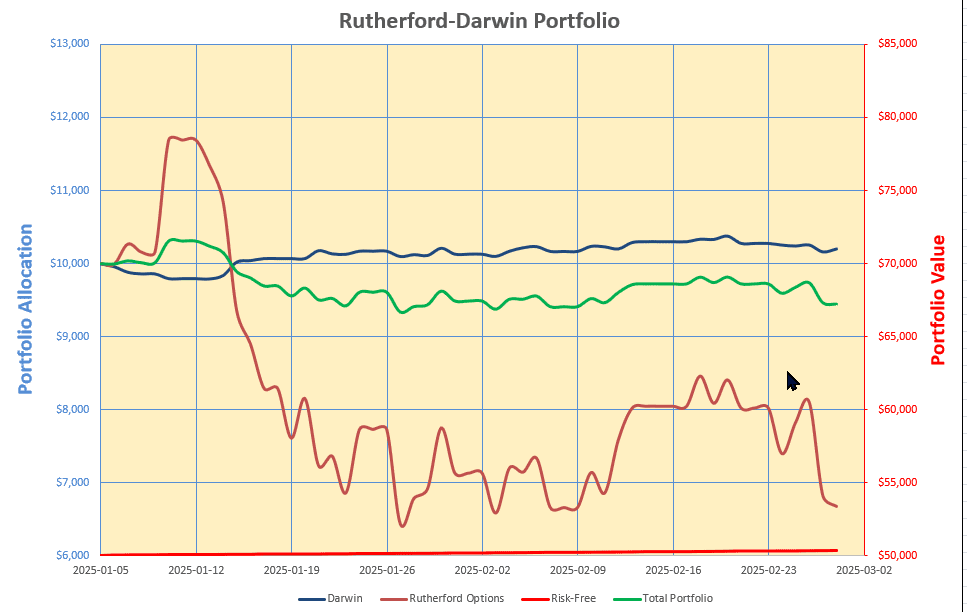

Checking the Rutherford-Darwin Portfolio we know that $50,000 of the $70,000 is invested in BIL, the short-term treasury ETF, and continues to plod along and contribute ~4-5% (annually) to the portfolio. Total returns to date from T-Bills is ~$348 in the first 2 months.

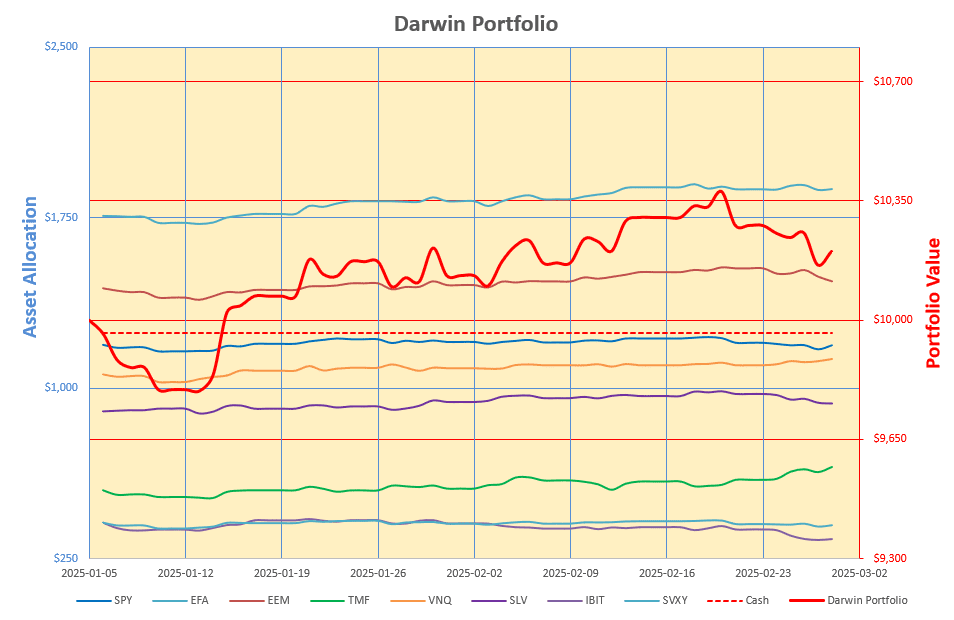

The $10,000 “Buy-And-Hold” (Darwin) diversified portion of the portfio saw a predictable drop in value this week:

giving up $77 (~0.75%) – so slighty less than the average S&P 500 market loss. As noted above Bonds led the way with the 3x leveraged TMF ETF (green line) generating the best returns.

giving up $77 (~0.75%) – so slighty less than the average S&P 500 market loss. As noted above Bonds led the way with the 3x leveraged TMF ETF (green line) generating the best returns.

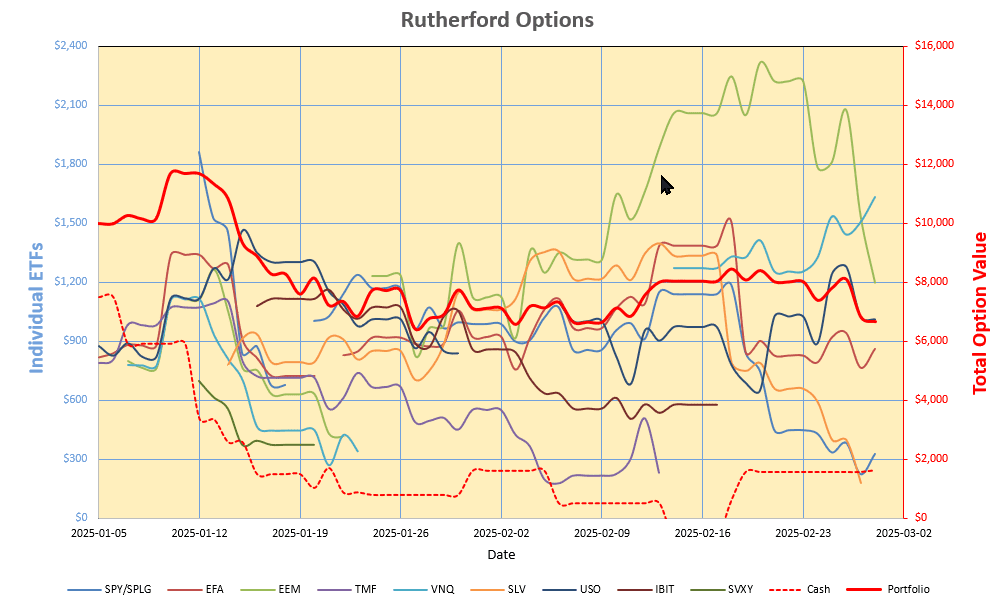

The journey in the (Rutherford) Options portion of the portfolio was a little rougher going, as a result of the volatlity of the markets and the leveraged nature of the Options used to represent the assets held:

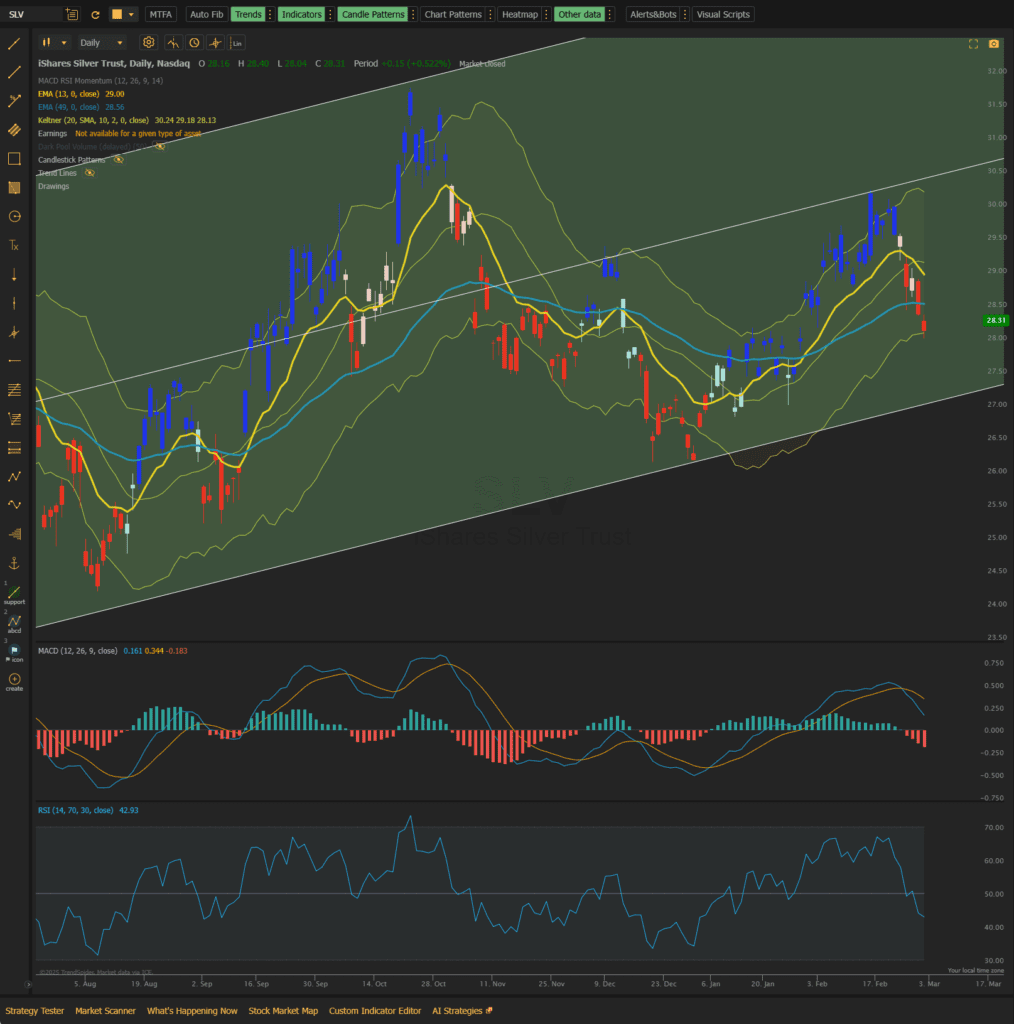

The biggest hit was taken by EEM (light green line), the Emerging Markets ETF (down 3.76% on the week), that previously had been showing the strongest performance. When the dust had settled the Darwin portion of the portfolio lost ~14% on the week. My long Call position in Silver (SLV) was closing this week and I closed it down with a $630 loss. Silver started out as one of the best performers but lost a lot of ground over the past 2 weeks (orange line in abouve screenshot). SLV is presently pulling back in a bullish channel and if we see a bounce off the lower boundary I will re-enter:

The biggest hit was taken by EEM (light green line), the Emerging Markets ETF (down 3.76% on the week), that previously had been showing the strongest performance. When the dust had settled the Darwin portion of the portfolio lost ~14% on the week. My long Call position in Silver (SLV) was closing this week and I closed it down with a $630 loss. Silver started out as one of the best performers but lost a lot of ground over the past 2 weeks (orange line in abouve screenshot). SLV is presently pulling back in a bullish channel and if we see a bounce off the lower boundary I will re-enter:

The MACD indicator is confirming that we are in a short-term downtrend and the RSI is showing negative momentum (hence the red bars in the chart). Although we saw a loss on the last position we are now out of the market and protected from further declines/losses and we can re-enter if we see a bounce and a possible continuation of the longer term uptrend. At present SLV is sitting at the lower boundary of the Kelter Channel (similar to Bollinger band channels but calculated from Average True Range (ATR) values rather than Standard Deviation values as a measure of volatility). Any signs of a reversal between where price is sitting right now and the bottom of the trend channel might be a good entry point since it would represent a higher low following a higher high. SLV is still signalling bullish on the weekly and monthly charts.

The MACD indicator is confirming that we are in a short-term downtrend and the RSI is showing negative momentum (hence the red bars in the chart). Although we saw a loss on the last position we are now out of the market and protected from further declines/losses and we can re-enter if we see a bounce and a possible continuation of the longer term uptrend. At present SLV is sitting at the lower boundary of the Kelter Channel (similar to Bollinger band channels but calculated from Average True Range (ATR) values rather than Standard Deviation values as a measure of volatility). Any signs of a reversal between where price is sitting right now and the bottom of the trend channel might be a good entry point since it would represent a higher low following a higher high. SLV is still signalling bullish on the weekly and monthly charts.

Overall the total portfolio picture looks like this:

with the Rutherford (Options) portion holding us down in this choppy sideways market. However, volatility remains at an acceptable 12.7%.

with the Rutherford (Options) portion holding us down in this choppy sideways market. However, volatility remains at an acceptable 12.7%.

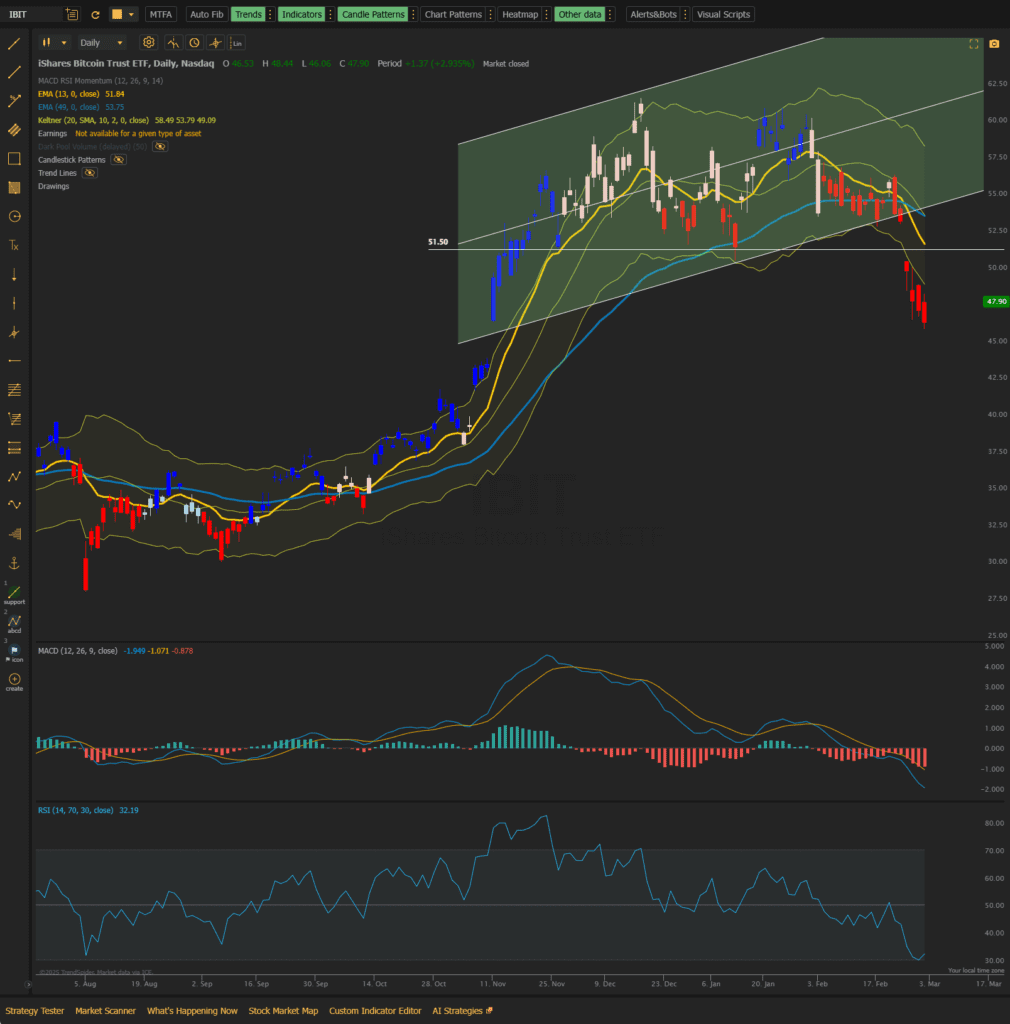

At the moment I have no positions in IBIT (cryptocurrency ETF) or TMF (3x Long-term Bond ETF). IBIT is looking bearish on all time frames but is presently sitting outside the Kelter Channel and is heading towards the oversold zone on the RSI:

I will wait for a pullback and possible reversal to a continuation of this short-term bearish move or until I see a more convincing signal that crypto’s will return to a bullish mode – right now this doesn’t look too bullish with lower highs and lower lows.

I will wait for a pullback and possible reversal to a continuation of this short-term bearish move or until I see a more convincing signal that crypto’s will return to a bullish mode – right now this doesn’t look too bullish with lower highs and lower lows.

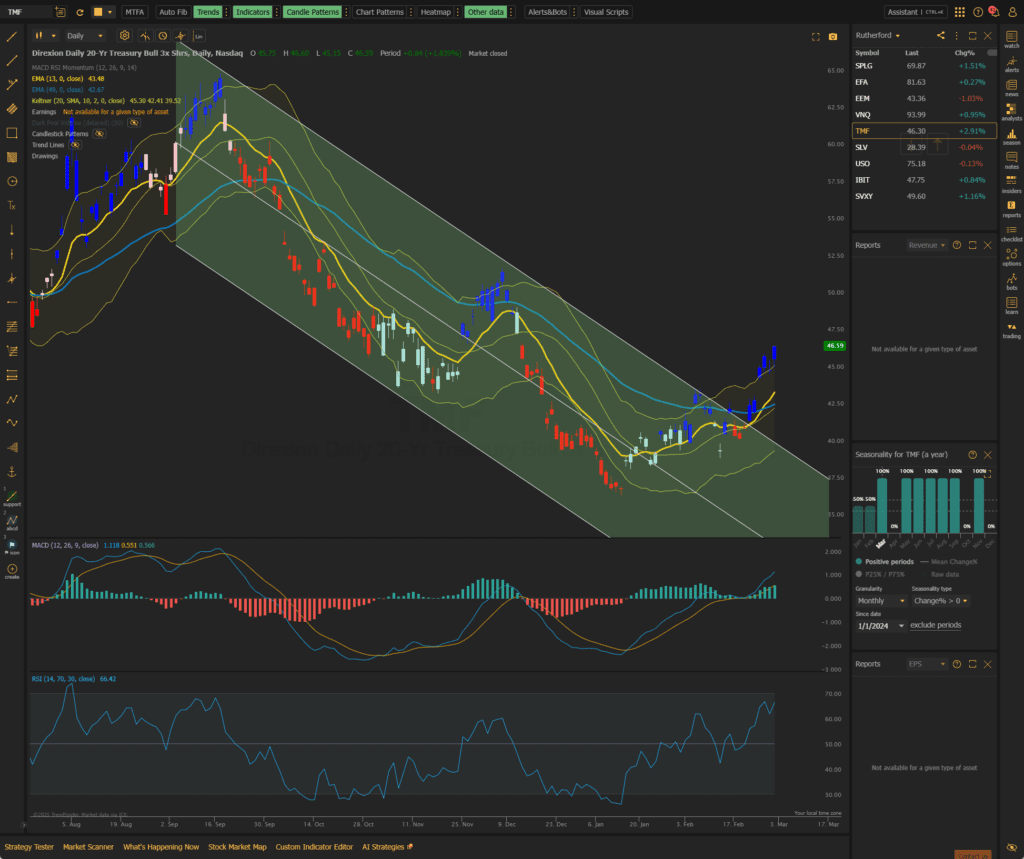

As for TMF:

although I am long-term bearish on TMT it has made a strong break-out from the bearish trend channel so, if I see a pullback and subsequent bullish bounce, I may enter a long (Call) position. MACD is showing a bullish trend and RSI is showing strong positive momentum – but heading towards the overbought zone – so I’ll wait and see.

although I am long-term bearish on TMT it has made a strong break-out from the bearish trend channel so, if I see a pullback and subsequent bullish bounce, I may enter a long (Call) position. MACD is showing a bullish trend and RSI is showing strong positive momentum – but heading towards the overbought zone – so I’ll wait and see.

All other present holdings expire 21 March so there shouldn’t be too much action unless we see some wild swings. VNQ (Real Estate) has performed quite nicely since it’s aquisition a few weeks ago with equities (SPLG, ETA and EEM) and Oil (USO) treading neutral water on high volatility.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question