Grand Palace, Bangkok, Thailand

My apologies for not posting a Tranche 5 review last week but adjustments were made as reported below. Now that I am back from my travels, with reliable internet connections, I will get back to my regular posting schedules.

US equities closed relatively unchanged from last week’s close and are still sitting at the center of an uptrend channel that began in October 2022:

From here we still have to see whether we pull back further or continue the uptrend.

From here we still have to see whether we pull back further or continue the uptrend.

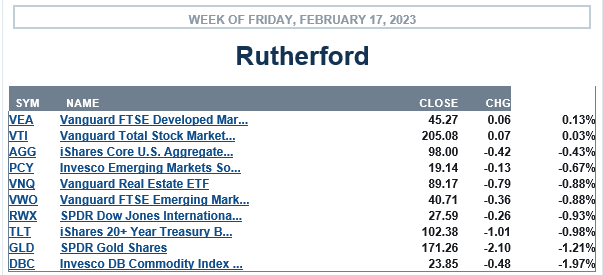

Performance of US equities was still relatively strong compared with other asset classes:

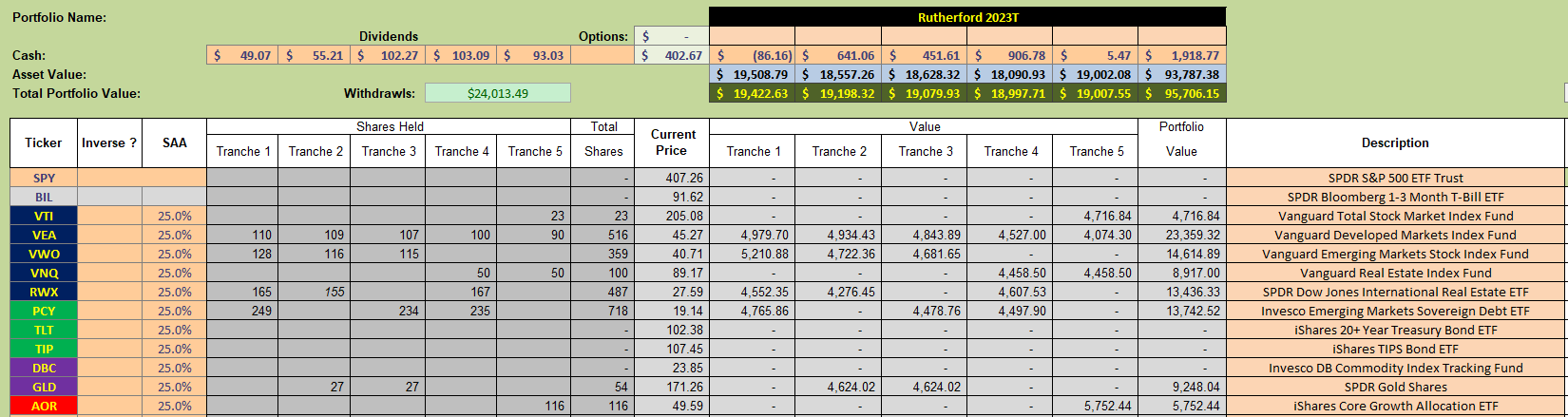

Current holdings in the Rutherford Portfolio (following adjustments to holdings in tranches 4 and 5 since the last review) look like this:

Current holdings in the Rutherford Portfolio (following adjustments to holdings in tranches 4 and 5 since the last review) look like this:

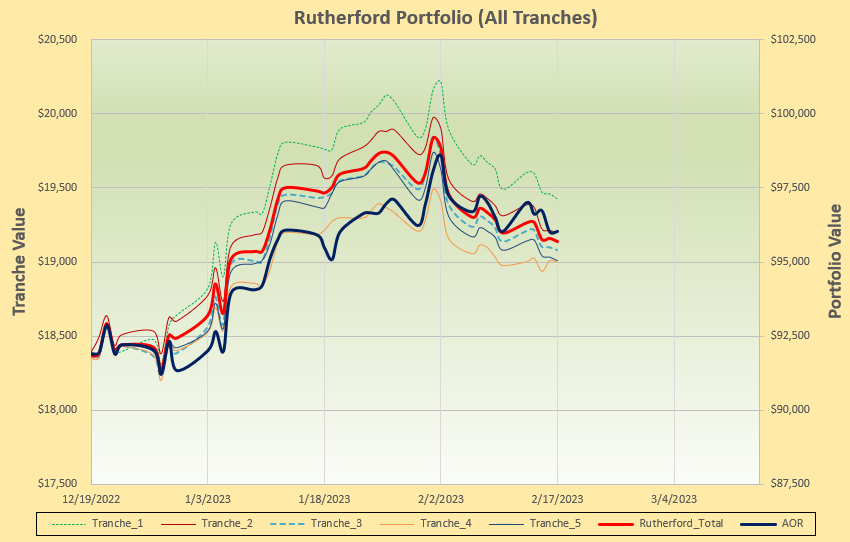

with performance (since changing to the rotation model) looking like this:

with performance (since changing to the rotation model) looking like this:

i.e with total returns (heavy red line) slightly below the benchmark AOR fund.

i.e with total returns (heavy red line) slightly below the benchmark AOR fund.

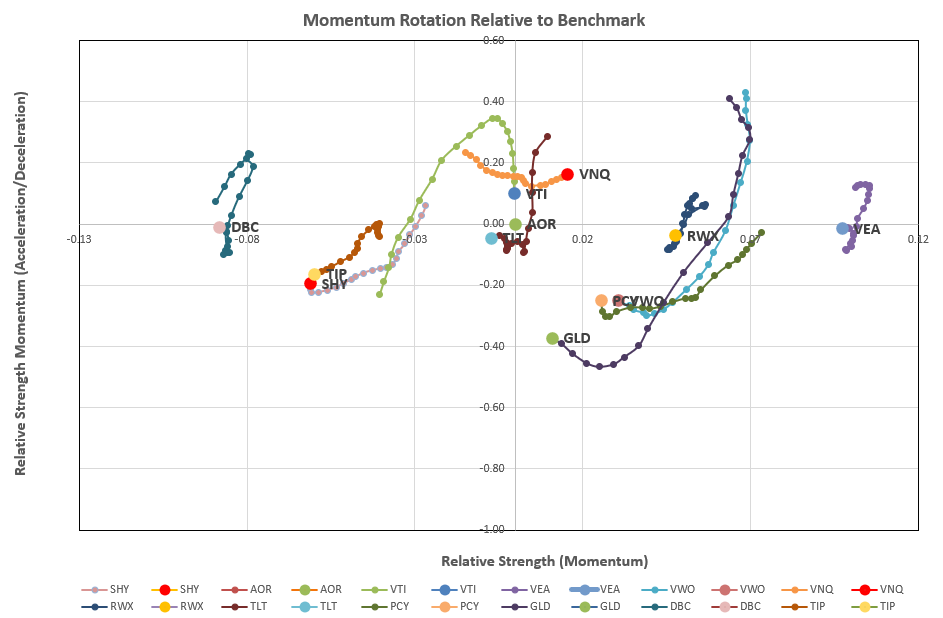

So, let’s take a look at the current rotation graphs:

where we see VEA (Developed Market Equities) showing the strongest longer term strength (furthest to the right).

where we see VEA (Developed Market Equities) showing the strongest longer term strength (furthest to the right).

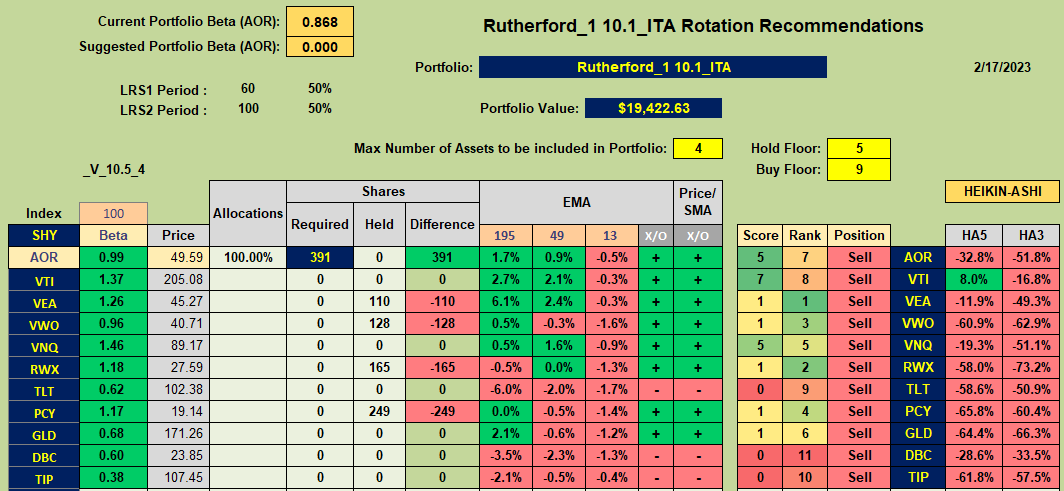

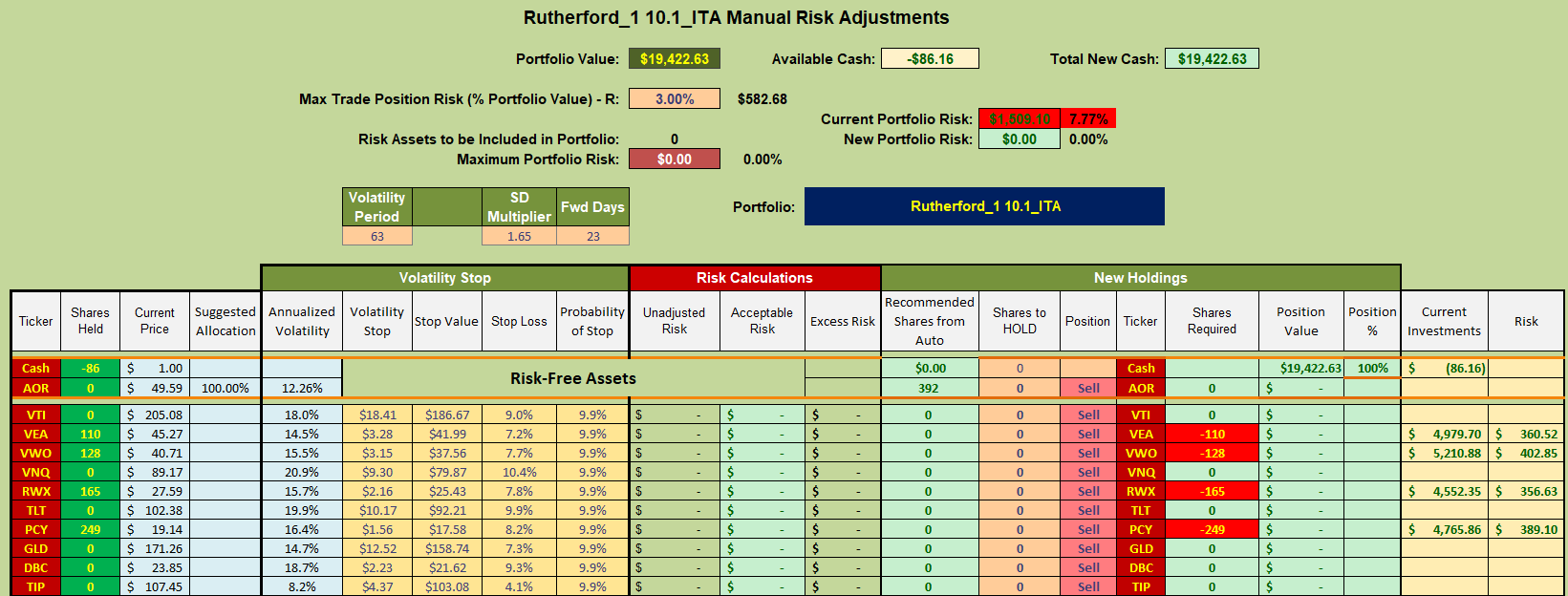

Checking on recommendations from the system:

it comes as a little surprise to see Sell recommendations for all assets in the Rutherford quiver. Unlike Lowell’s BPI model – that is a contrarian investment model – the rotation model is a momentum model that requires assets to be moving in an uptrend in order to be recommended for buying/holding. It will be interesting to see how the different models perform from here but I will be following the recommendations and moving to Cash in Tranche 1 of the Rutherford Portfolio (note that this is only 20% of the total portfolio holdings):

it comes as a little surprise to see Sell recommendations for all assets in the Rutherford quiver. Unlike Lowell’s BPI model – that is a contrarian investment model – the rotation model is a momentum model that requires assets to be moving in an uptrend in order to be recommended for buying/holding. It will be interesting to see how the different models perform from here but I will be following the recommendations and moving to Cash in Tranche 1 of the Rutherford Portfolio (note that this is only 20% of the total portfolio holdings):

David

David

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.