Botanic Gardens, Singapore

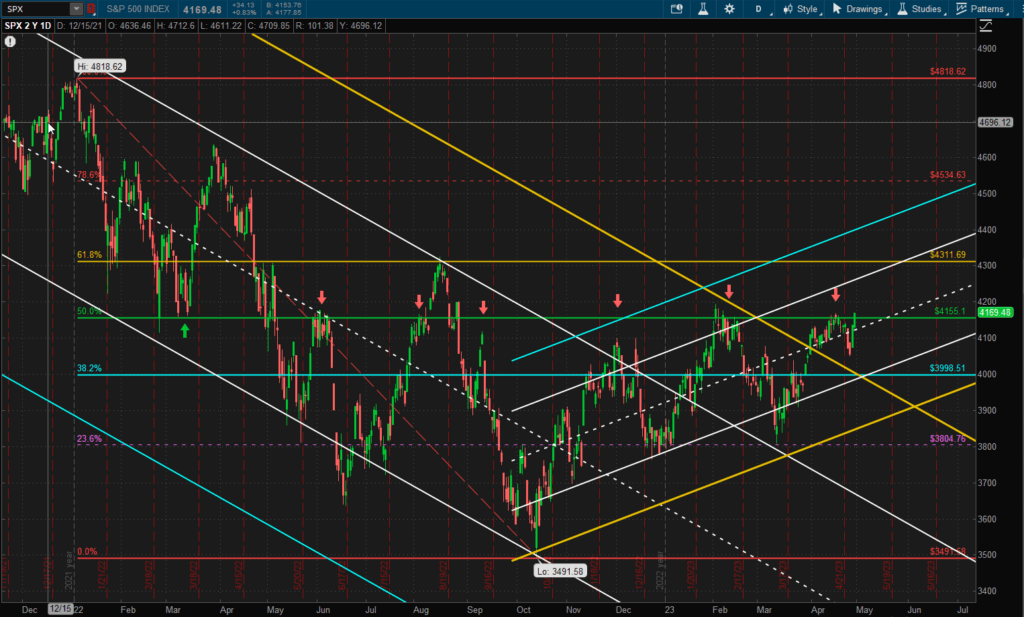

A relatively uneventful week in US equites, despite the high day-to-day volatility, with the SPX (S&P 500 Index) up a little over 0.5% from last week’s close:

The index is still banging its head against the 50% retracement resistance zone that has been difficult to penetrate a number of times over the past few months. However. we did manage to close slightly above the 4160 level so we’ll see if we get any continuation next week.

The index is still banging its head against the 50% retracement resistance zone that has been difficult to penetrate a number of times over the past few months. However. we did manage to close slightly above the 4160 level so we’ll see if we get any continuation next week.

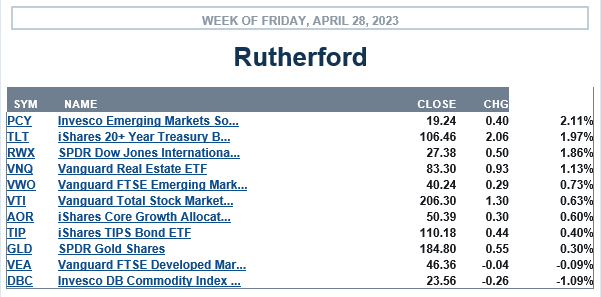

In terms of relative performance:

US equities (VTI) remain in the middle of the pack being outperformed over the past week by Bonds and Real Estate.

US equities (VTI) remain in the middle of the pack being outperformed over the past week by Bonds and Real Estate.

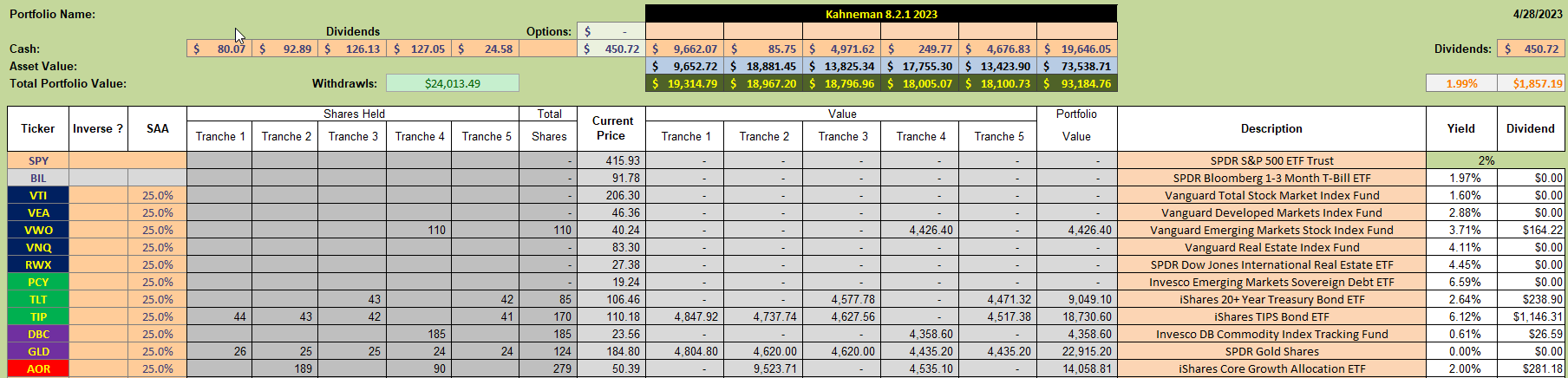

Current holdings in the Portfolio look like this:

and performance like this:

and performance like this:

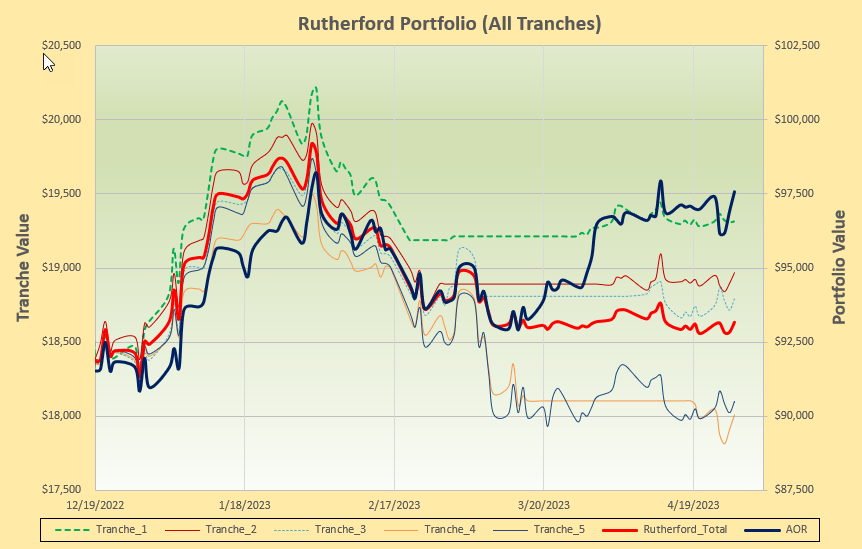

….. pretty static and a little below the benchmark AOR Fund.

….. pretty static and a little below the benchmark AOR Fund.

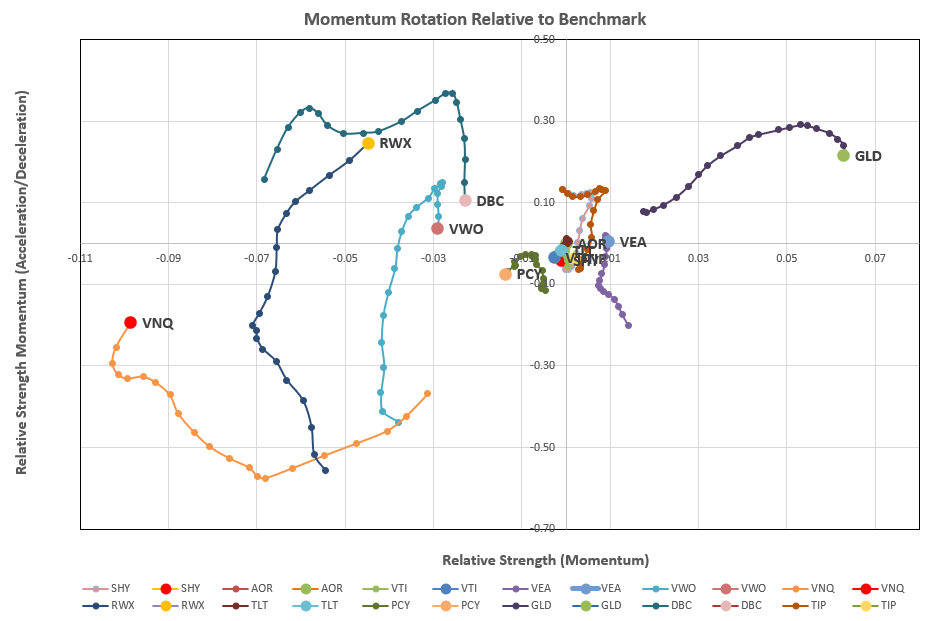

Let’s take a look at the rotation graphs:

where GLD looks best, although weakening in the short term (downward movement).

where GLD looks best, although weakening in the short term (downward movement).

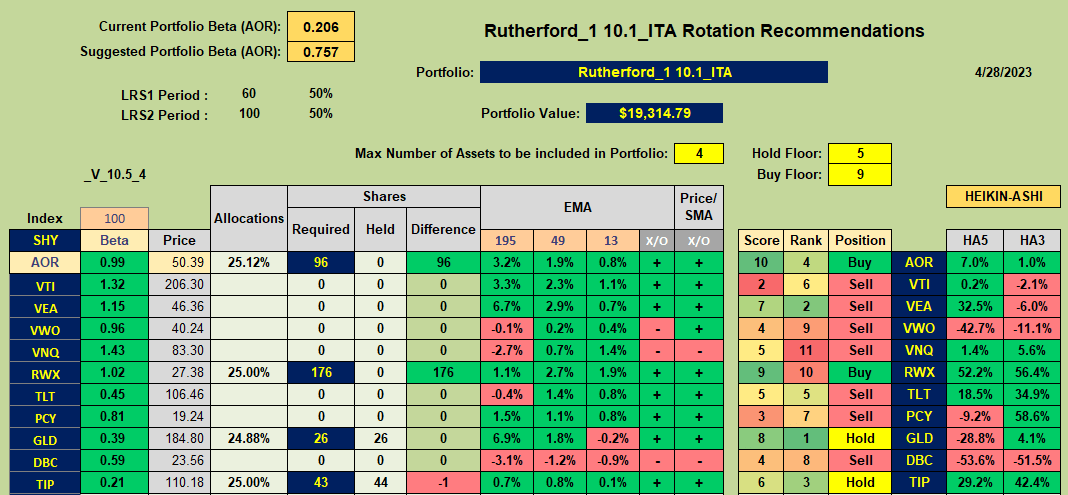

This leads us to the recommendations from the rotation model:

where we see Hold recommendations for GLD and TIP and Buy Recommendations for RWX and AOR (benchmark).

where we see Hold recommendations for GLD and TIP and Buy Recommendations for RWX and AOR (benchmark).

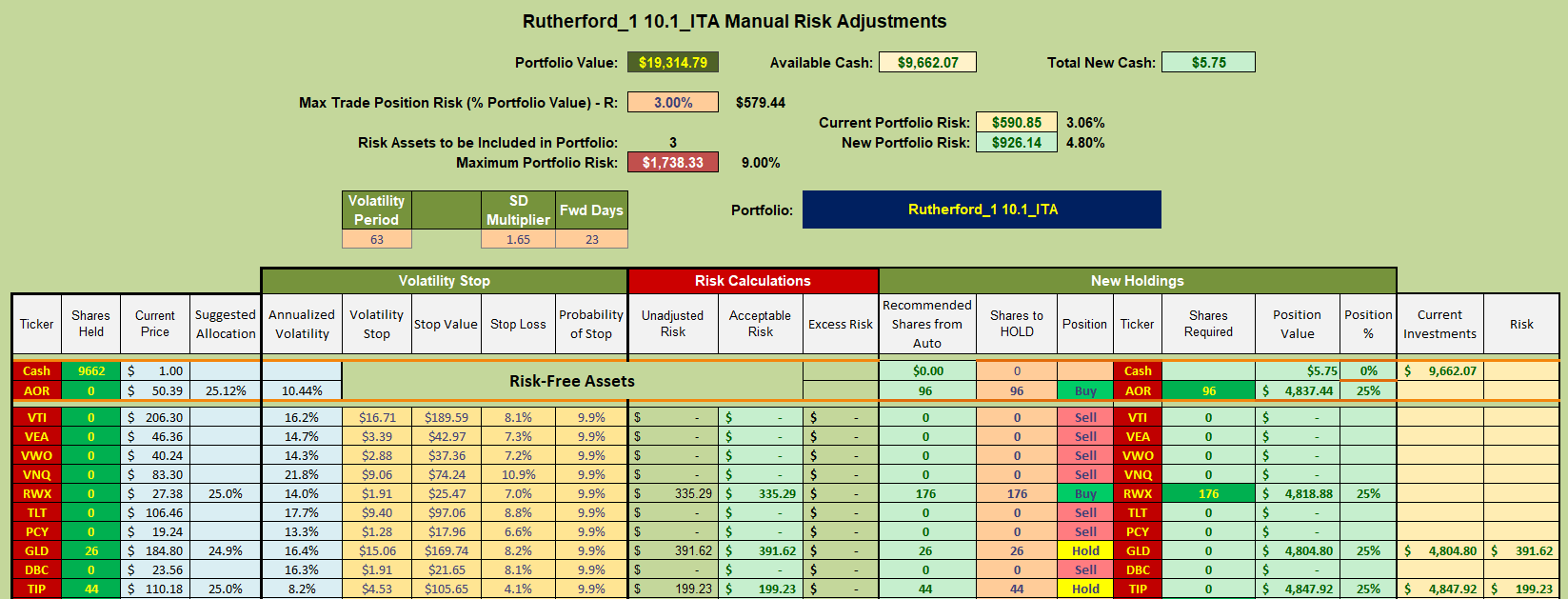

This leads to the following adjustments to Tranche 1 (the focus of this week’s review):

i.e I will use the available Cash to purchase shares in RWX and AOR.

i.e I will use the available Cash to purchase shares in RWX and AOR.

Visually, looking at the rotation graphs, VNQ might be an interesting choice if we were “bottom fishing” – but it’s difficult to build this into a sensible algorithm and we might be close to data snooping/curve fitting rather than establishing a “robust” trading system.

David

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.