Restoration/Repairing damage caused by 2011 earthquake at Old Cathedral, Christchurch, New Zealand

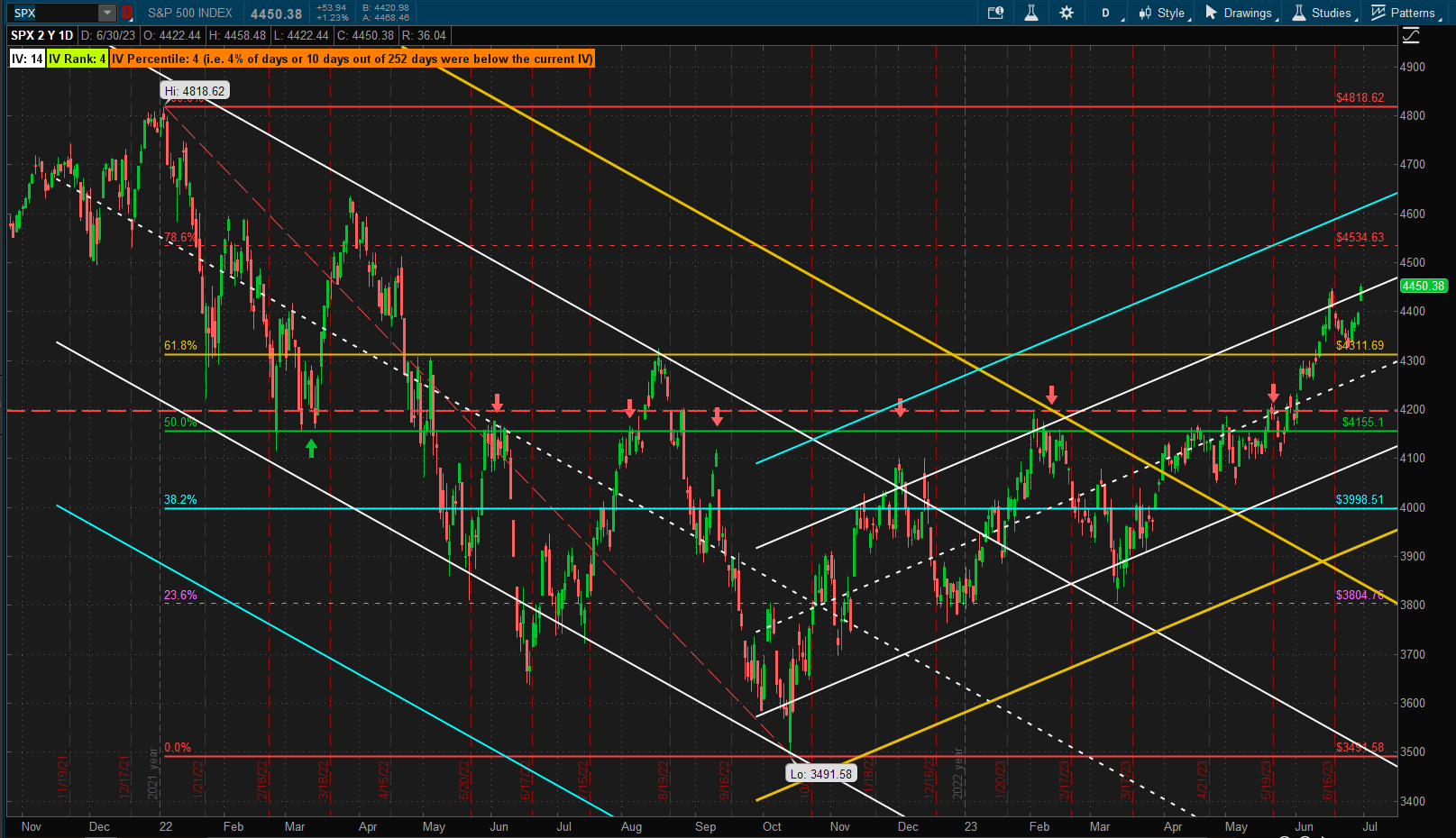

After a pullback to test support at ~4300, US equities bounced to finish the week strongly, closing at the top boundary of the 1 SD uptend channel:

Should the trend continue there does not seem to be serious resistance until ~4600 – but this may just have been some early 4th July fireworks, so we’ll wait to see what happens after the holiday. Volatility is currently relatively low only recording lower levels on 4% of the days over the past 12 months.

Should the trend continue there does not seem to be serious resistance until ~4600 – but this may just have been some early 4th July fireworks, so we’ll wait to see what happens after the holiday. Volatility is currently relatively low only recording lower levels on 4% of the days over the past 12 months.

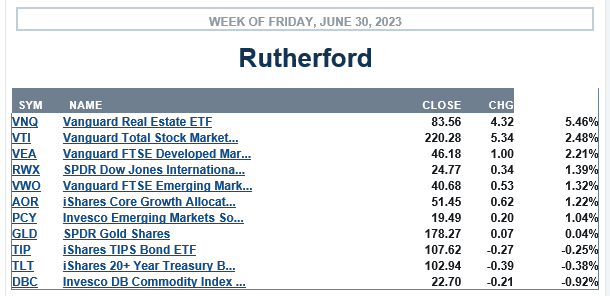

In terms of performance relative to the other major asset classes, US equities remains close to the top of the list closing ~2.5% higher than last weeks close:

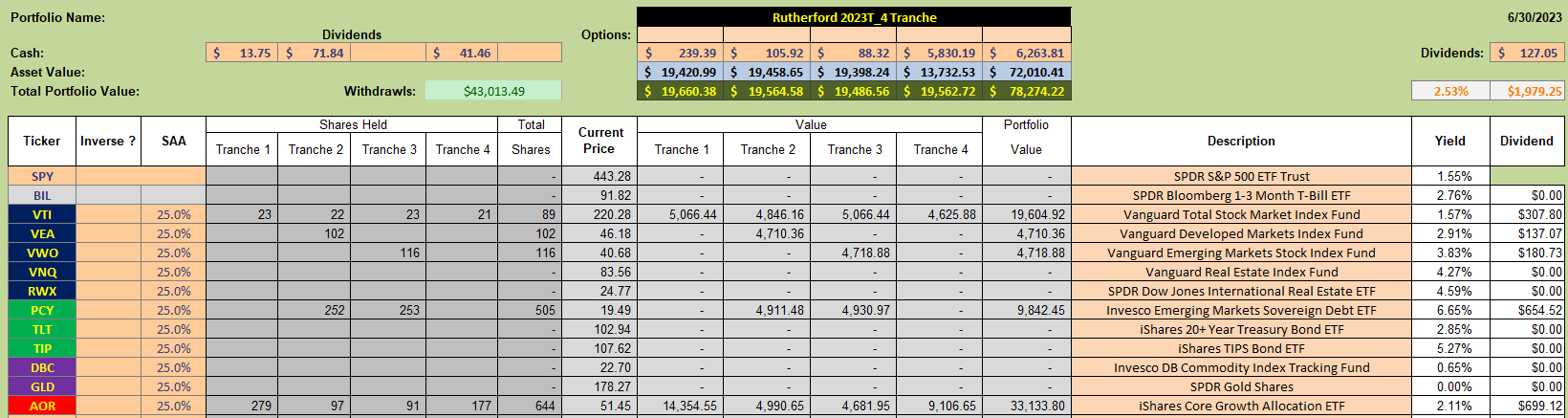

Current holdings in the Rutherford Portfolio look like this:

Current holdings in the Rutherford Portfolio look like this:

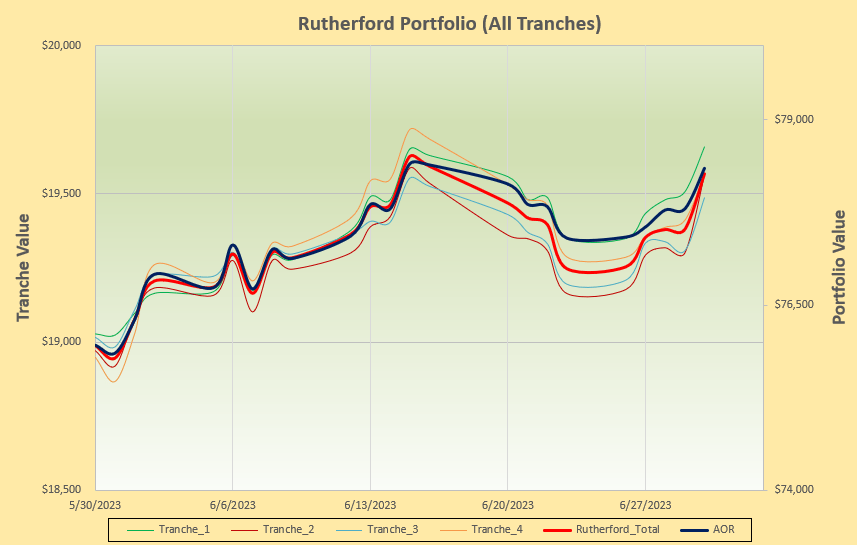

and recent performance:

and recent performance:

shows the portfolio recovering the losses generated last week and once again matching the returns of the benchmark AOR Fund.

shows the portfolio recovering the losses generated last week and once again matching the returns of the benchmark AOR Fund.

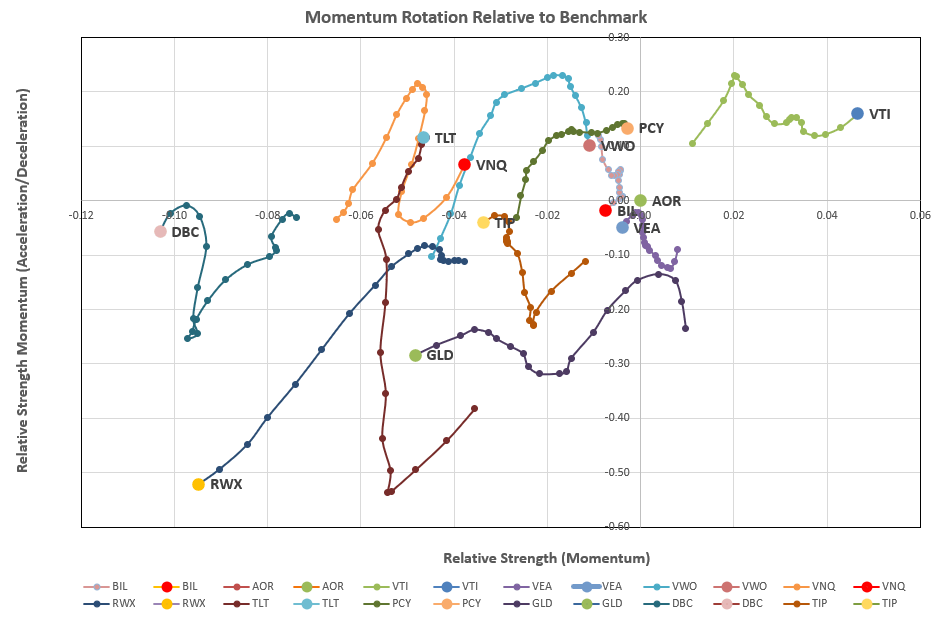

This week we focus on Tranche 1 that is currently holding only VTI and the benchmark AOR Fund. Checking the rotation graphs:

only VTI stands out as showing strong long and short term momentum.

only VTI stands out as showing strong long and short term momentum.

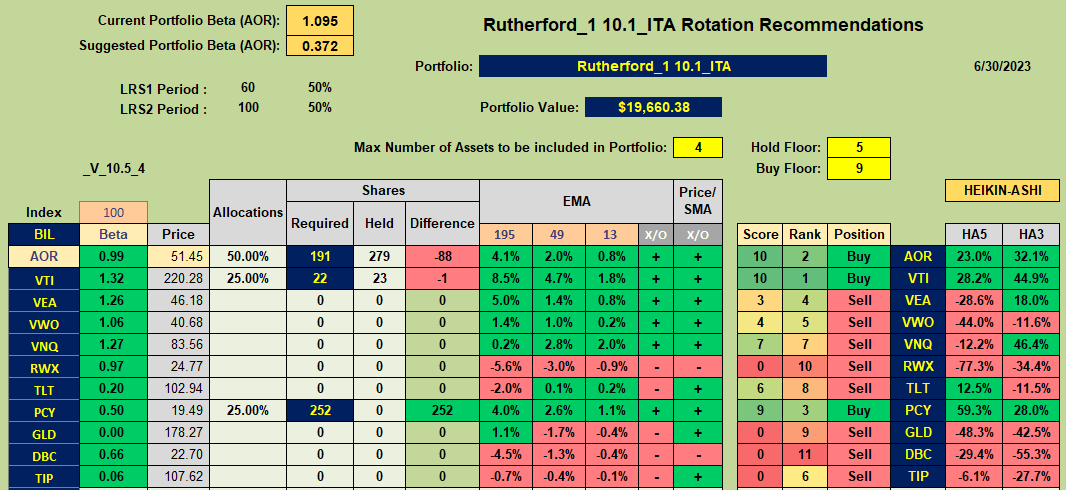

Looking at recommendations from the rotation model algorithm:

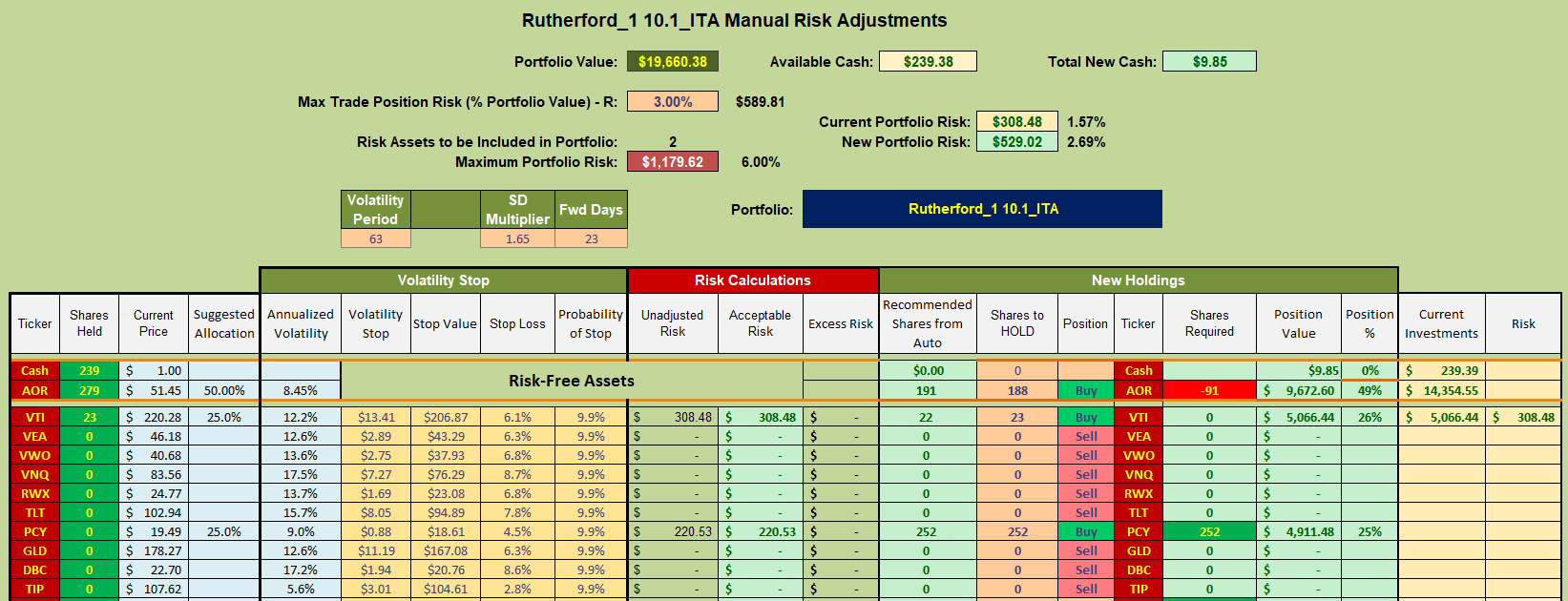

we see Buy recommendations for VTI, PCY and AOR. This means that this week’s adjustments will look like this:

we see Buy recommendations for VTI, PCY and AOR. This means that this week’s adjustments will look like this:

i.e. I shall be selling 91 shares of AOR to free up enough cash to add another 252 shares of PCY to the portfolio.

i.e. I shall be selling 91 shares of AOR to free up enough cash to add another 252 shares of PCY to the portfolio.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.