Bangkok,Thailand

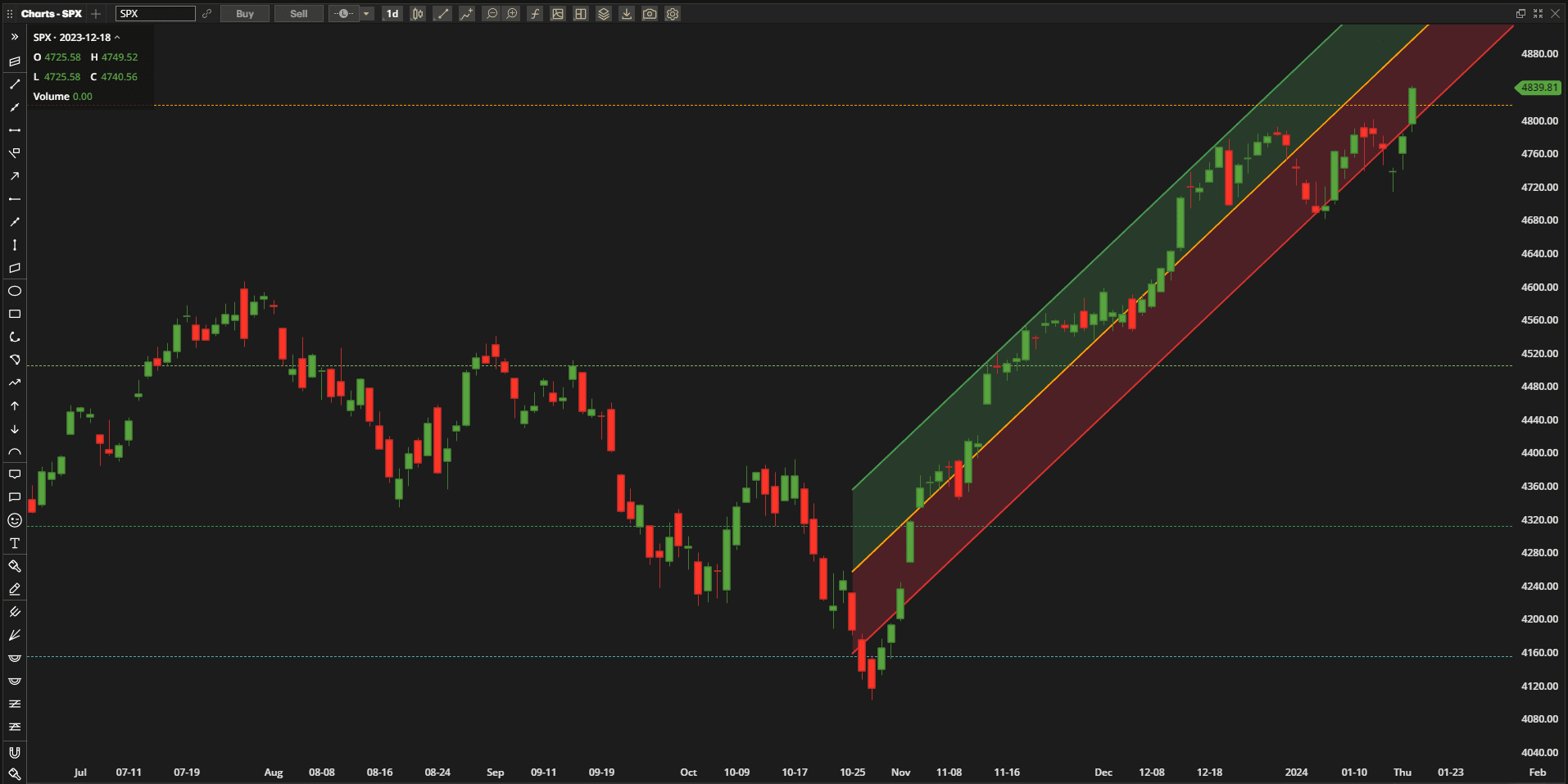

My apologies for being late with this post – I’ve moved to a new location and I’ve had a few problems with my new internet connection – but, this is real life and the issues we come across. Hopefully it doesn’t have a significant impact on our investments and we can survive the frustrations. In addition my broker moved one of my accounts to a new platform – that I’m not too keen on – so we’ll start out with my usual look at the behavior of the SPX (S&P 500 Index) over the past week without a lot of my usual studies/reference levels:

the only studies on this chart are the 2 Standard Deviation regression trend channel (that I will have to check because it looks narrow to me) and the Fibonacci retracement lines from the Jan 2022 High to the Oct 2022 Low where we see that we have just closed above the Jan 2022 high and have now reached new all-time highs after 2 years in the doldrums. Now we wait to see if this (~4800) level will offer strong resistance and result in another pullback – or whether the bulls are in control and we move higher to new all-time highs.

the only studies on this chart are the 2 Standard Deviation regression trend channel (that I will have to check because it looks narrow to me) and the Fibonacci retracement lines from the Jan 2022 High to the Oct 2022 Low where we see that we have just closed above the Jan 2022 high and have now reached new all-time highs after 2 years in the doldrums. Now we wait to see if this (~4800) level will offer strong resistance and result in another pullback – or whether the bulls are in control and we move higher to new all-time highs.

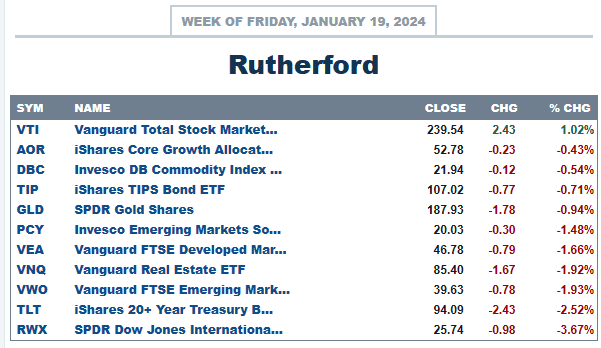

In terms of performance relative to othe major asset classes:

US equities topped the list by a good margin over the past week.

US equities topped the list by a good margin over the past week.

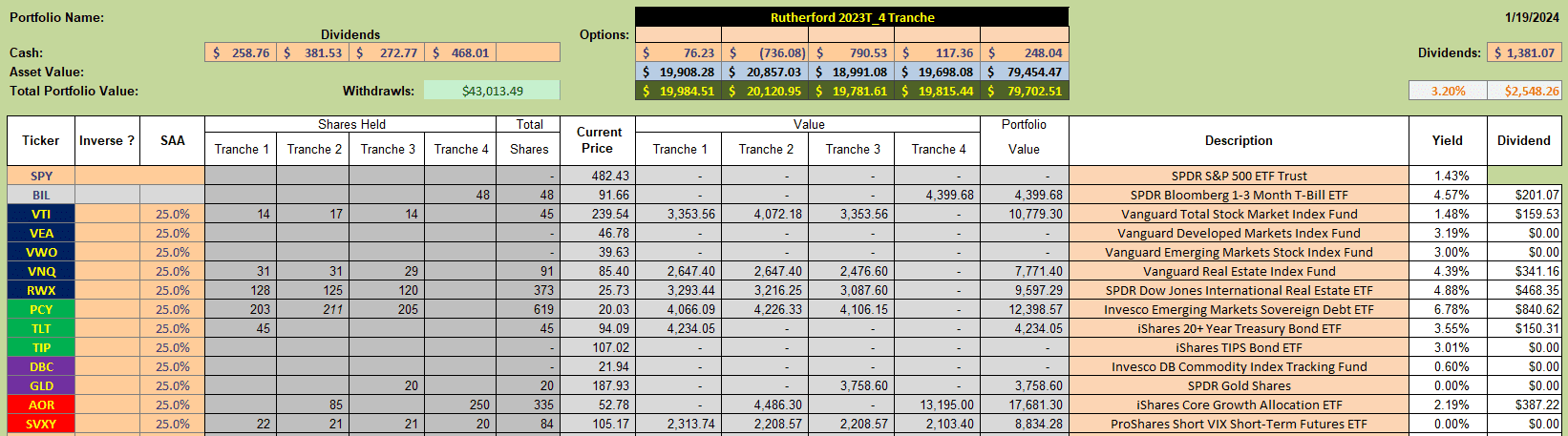

Current holdings in the Rutherford Poortfolio look like this:

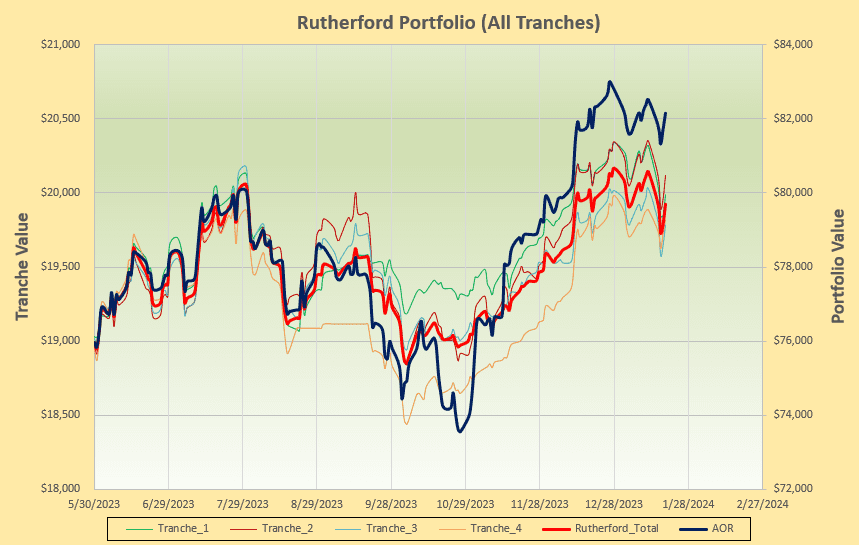

and performance like this:

and performance like this:

so, although lagging the benchmark slightly, more or less in sympathy with the diversified fund.

so, although lagging the benchmark slightly, more or less in sympathy with the diversified fund.

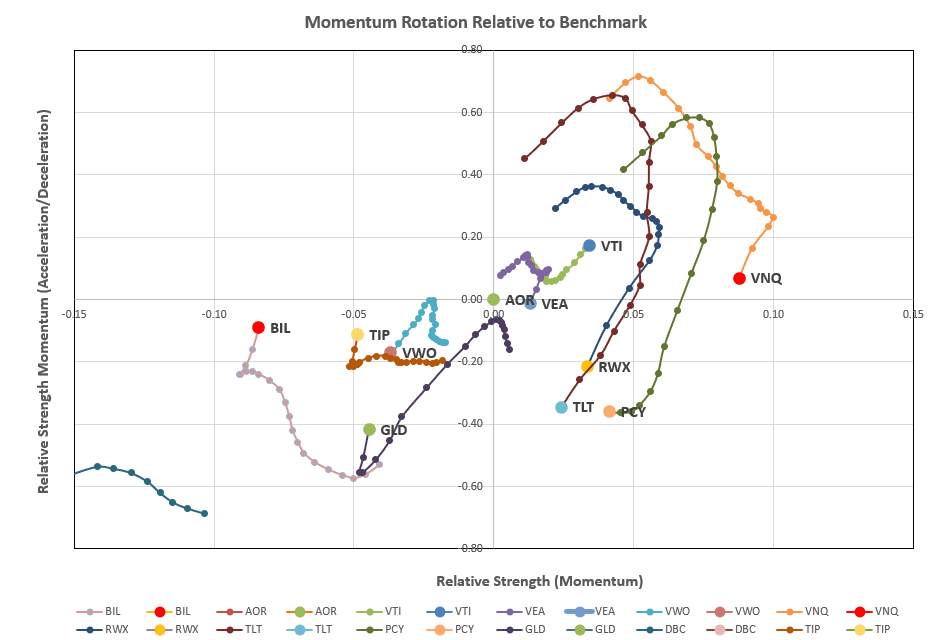

Taking a look at the rotation graphs: we note that only VTI (US Equities) is moving up and to the right in the desirable top right quadrant. So, checking the recommendations from the rotation model:

we note that only VTI (US Equities) is moving up and to the right in the desirable top right quadrant. So, checking the recommendations from the rotation model:

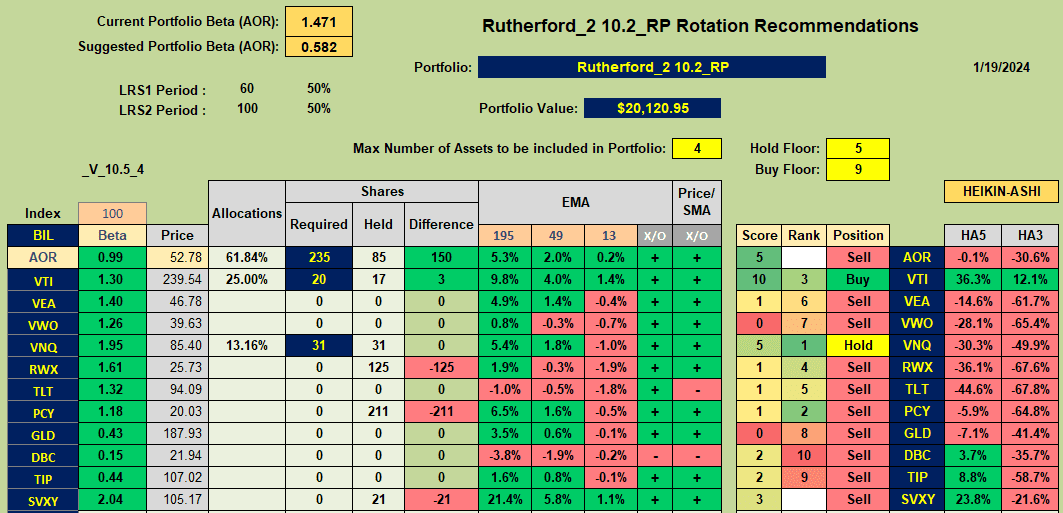

it is not surprising to see VTI as the only buy recommendation and VNQ (US Real Estate) as a Hold.

it is not surprising to see VTI as the only buy recommendation and VNQ (US Real Estate) as a Hold.

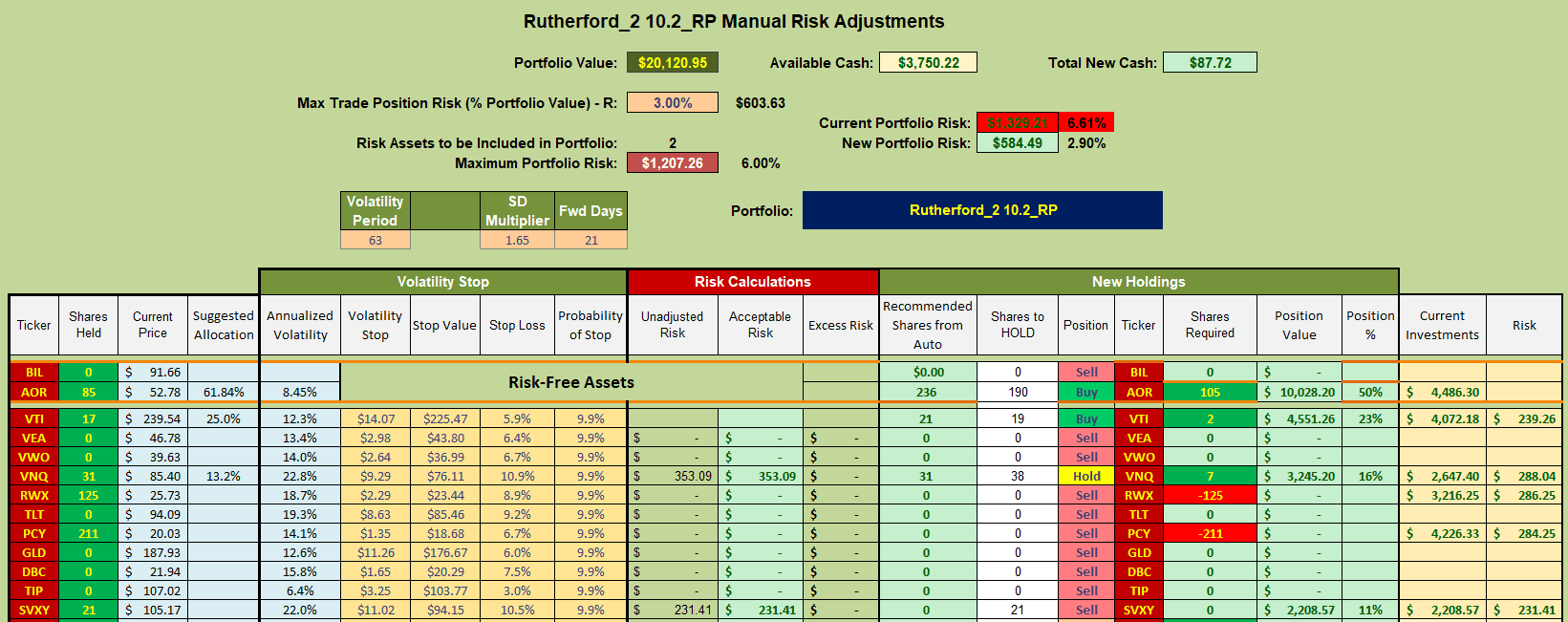

This results in the following picture for this week’s adjustments:

i.e. I will be selling current holdings in RWX and PCY in Tranche 2 (the focus of this week’s review), adding a few shares to VTI and VNQ (currently held) and adding more shares in the benchmark AOR fund with the remaining available Cash.

i.e. I will be selling current holdings in RWX and PCY in Tranche 2 (the focus of this week’s review), adding a few shares to VTI and VNQ (currently held) and adding more shares in the benchmark AOR fund with the remaining available Cash.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.