Gardens by the Bay, Singapore

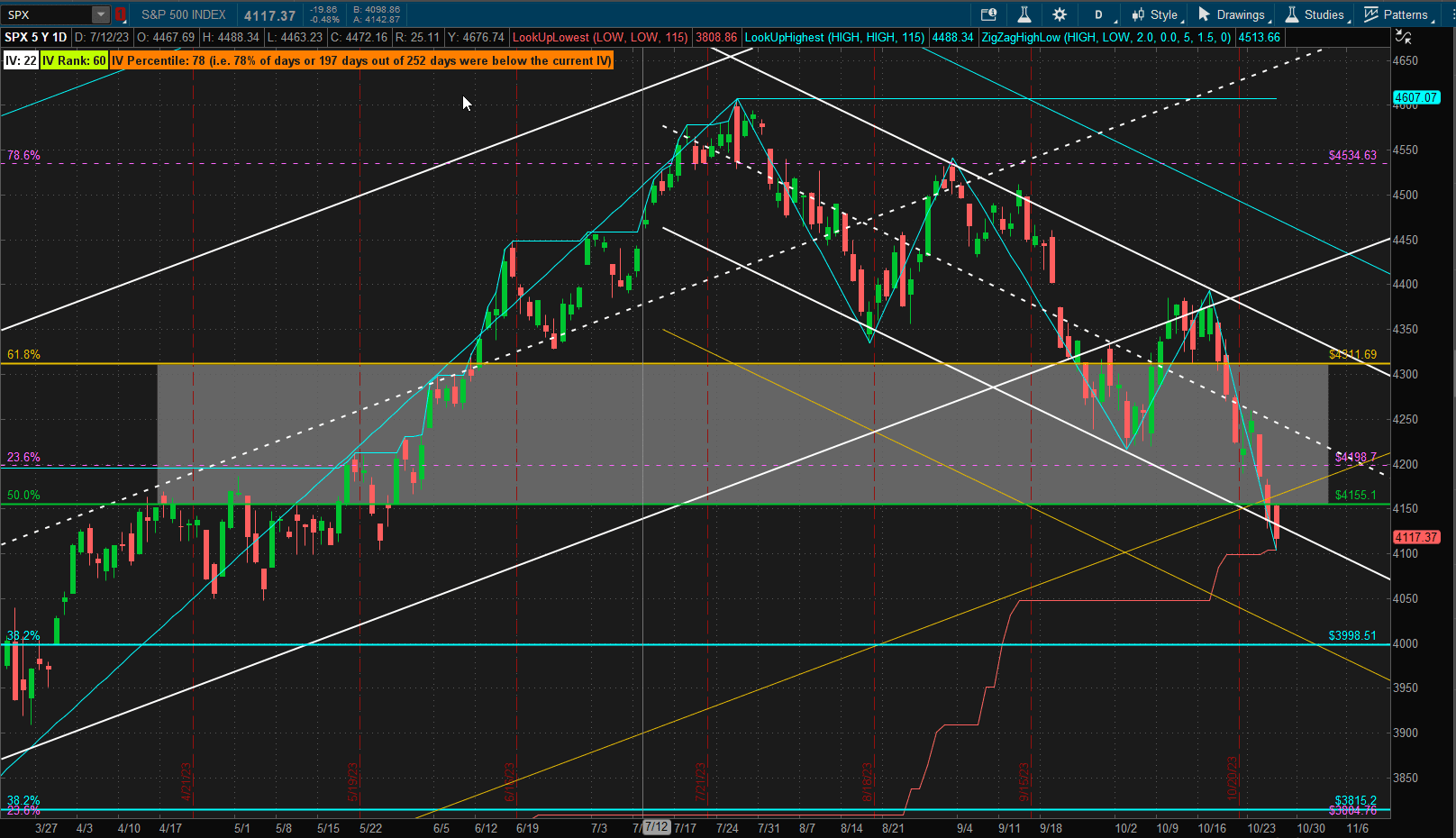

It was a bad week for US equities with the SPX (S&P 500 Index) dropping over 2.5% from last week’s close:

It has also now closed below the lower 2 Standard Deviation boundary of the early 2023 bullish uptrend channel (yellow line) and the 50% retracement level of that uptrend (green line) for 2 days in a row. We are now also below the lower boundary of the potentially strong support zone (shaded area). At this point, with lower highs and lower lows we are definitely in a trchnical downtrend. We could see a bounce to the top of the zone at ~4300 but that would still be well within the limits of the new downtrend channel.

It has also now closed below the lower 2 Standard Deviation boundary of the early 2023 bullish uptrend channel (yellow line) and the 50% retracement level of that uptrend (green line) for 2 days in a row. We are now also below the lower boundary of the potentially strong support zone (shaded area). At this point, with lower highs and lower lows we are definitely in a trchnical downtrend. We could see a bounce to the top of the zone at ~4300 but that would still be well within the limits of the new downtrend channel.

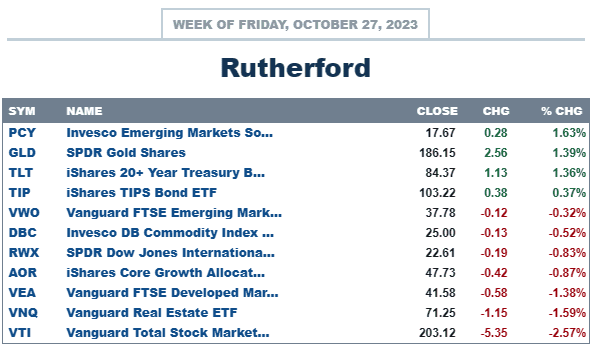

Relative to other major asset classes, VTI (US Equities) comes in as the weakest asset class over the past week:

with “safe-haven” assets, Bonds and Gold, leading the way.

with “safe-haven” assets, Bonds and Gold, leading the way.

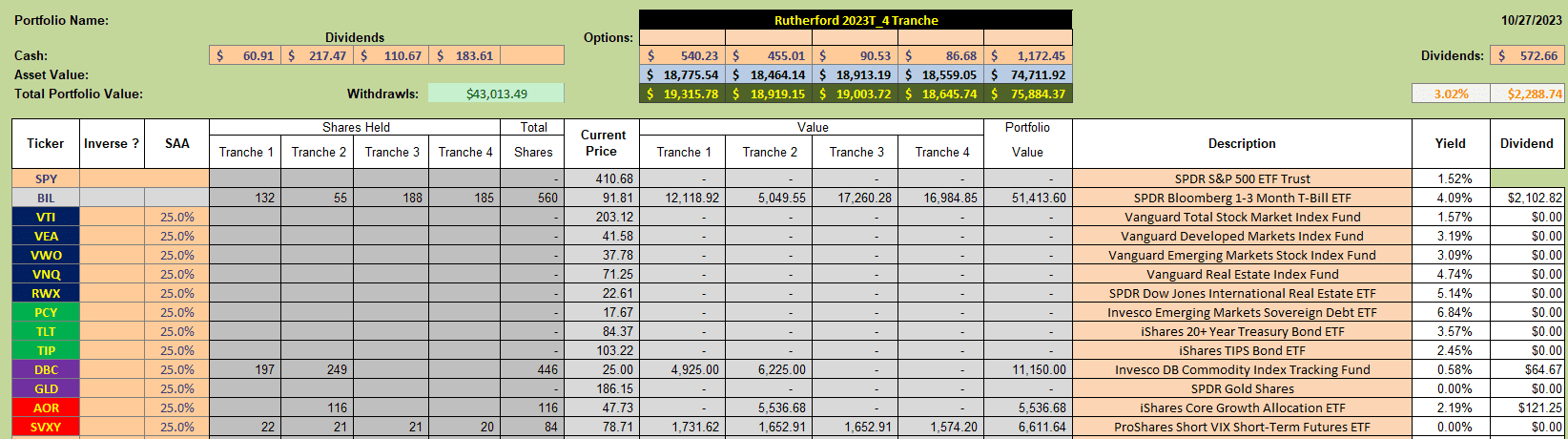

Holdings in the Rutherford Portfolio look like this:

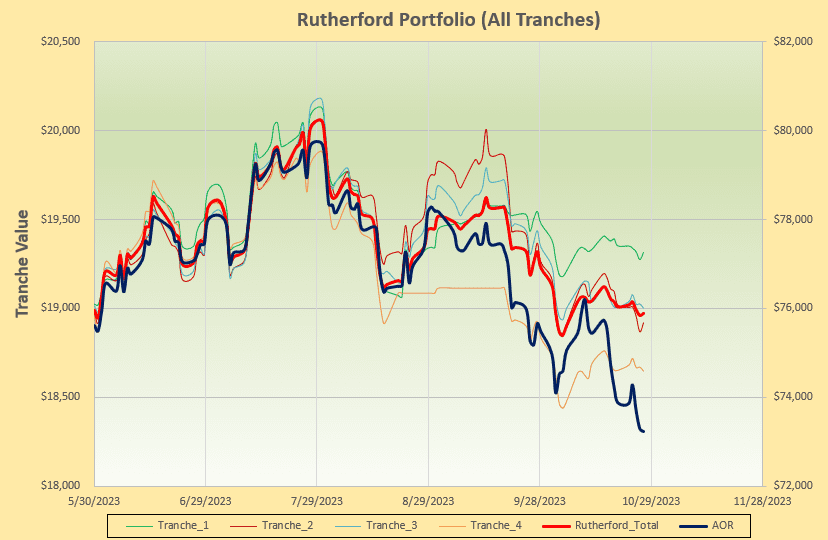

with ~65% held in short-term treasury notes (BIL) and few holdings in equities. Performance has therefore been fairly neutral and better than the negative performance of the benchmark AOR Fund:

with ~65% held in short-term treasury notes (BIL) and few holdings in equities. Performance has therefore been fairly neutral and better than the negative performance of the benchmark AOR Fund:

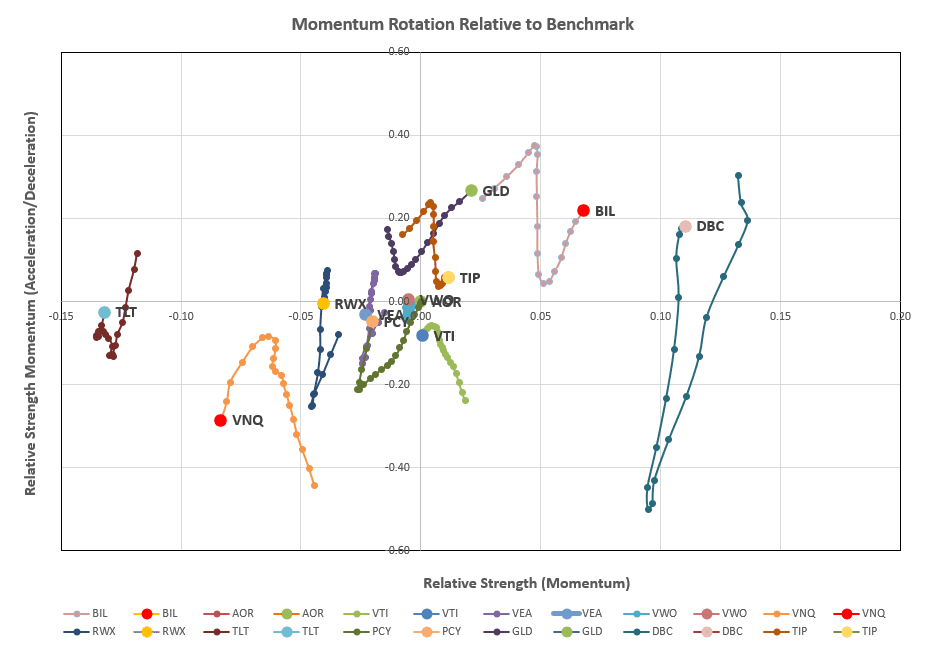

The focus of this week’s review is Tranche 2 – so we’ll check the rotation graphs:

The focus of this week’s review is Tranche 2 – so we’ll check the rotation graphs:

where we see a recovery in Commodities (DBC) and continued strength in Gold (GLD), although BIL (a weak mover) is still showing strong on a relative basis.

where we see a recovery in Commodities (DBC) and continued strength in Gold (GLD), although BIL (a weak mover) is still showing strong on a relative basis.

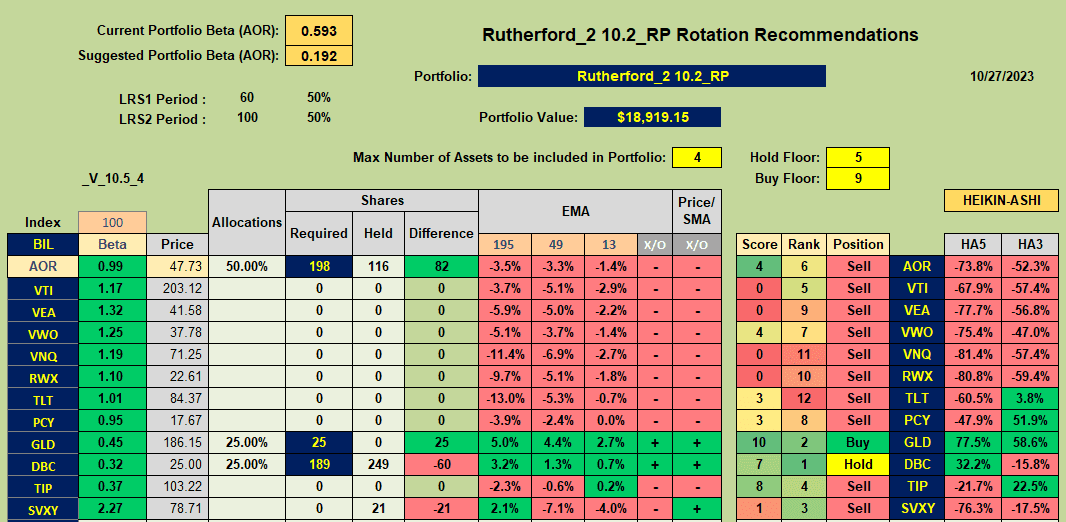

Looking at recommendations from the Rotation Algorithm:

we have a Buy Recommendation for GLD and a Hold recomendation for DBC.

we have a Buy Recommendation for GLD and a Hold recomendation for DBC.

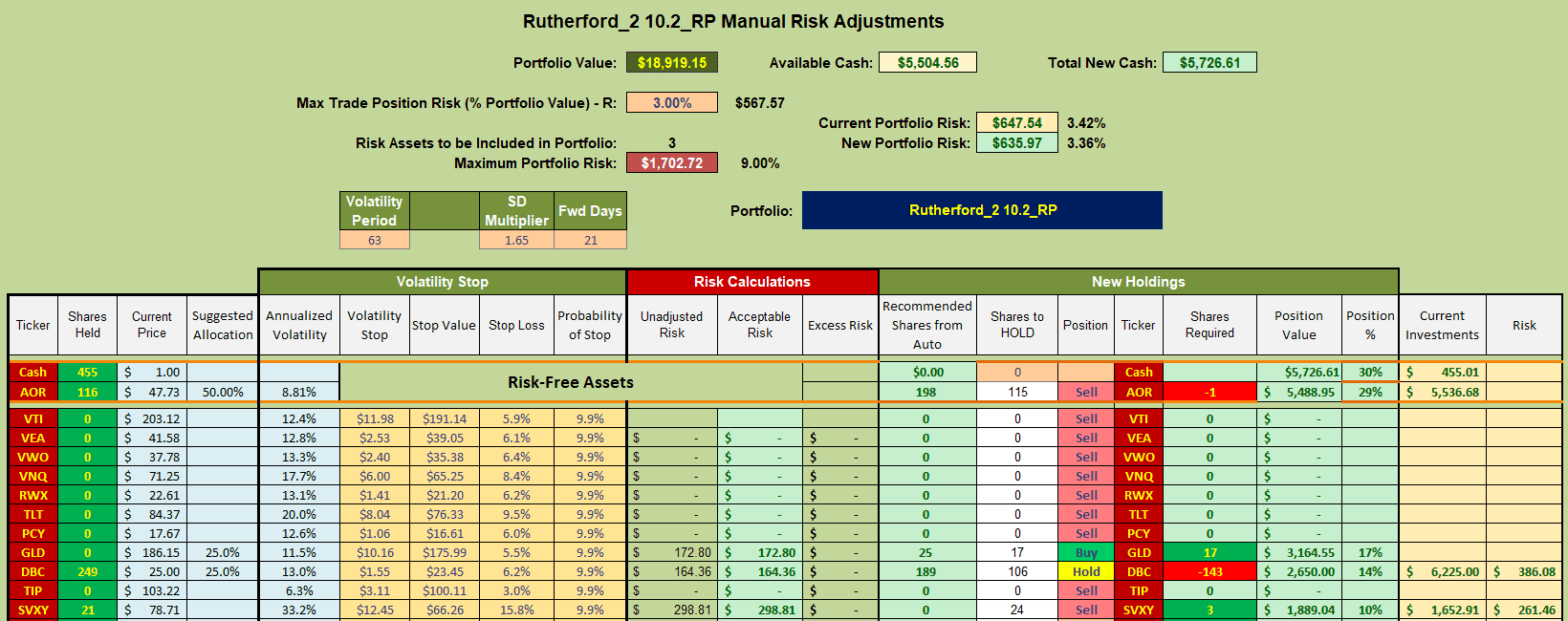

My likely adjustments for this week will look something like this:

although I will likely sell shares of AOR, a recommended Sell, rather than DBC, to add a position in GLD.

although I will likely sell shares of AOR, a recommended Sell, rather than DBC, to add a position in GLD.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.