Forgotten Oregon

Are you looking for a portfolio that requires no decisions? If so, the Schrodinger is for you. This portfolio was initially set up to answer the question – “Who Will Manage the Family Portfolio When I Die? The following analysis of this Robo Advisor portfolio answers this fundamental question. Schwab refers to these computer managed portfolios as Intelligent Portfolios.

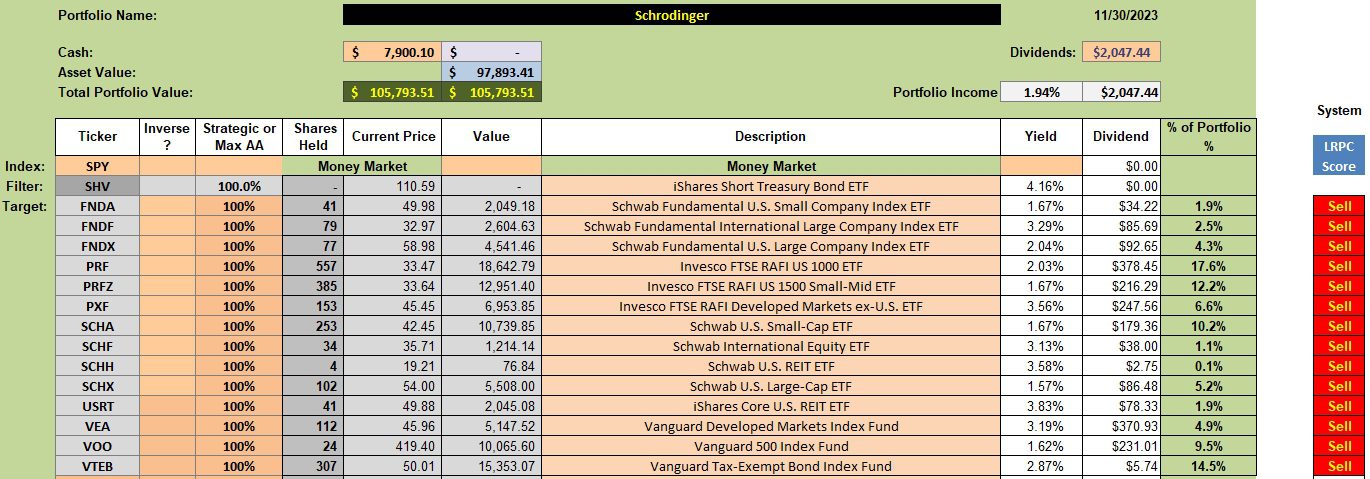

Schrodinger Holdings

The Schrodinger is set up with a Stock/(Bond-Cash) ratio of 80/20. Some investors may prefer to be less aggressive. As readers will see in the last screenshot, this heavily oriented stock portfolio is not all that risky as it is well diversified. Initially, Schwab invested more in international stocks than I preferred for this client so I requested they lower the percentage of international equities and concentrate more on U.S. Equities. This is a special request one needs to make with Schwab.

Below are the current holdings. My only quibble with Schwab’s computer model is that they hold more cash than I prefer. However, I recognize this is how they can provide this service free of charge. The fact that the portfolio is greater than $50,000 means Schwab will tax harvest investments if this is in the best interest of the investor. I think that base line requirement is still in effect.

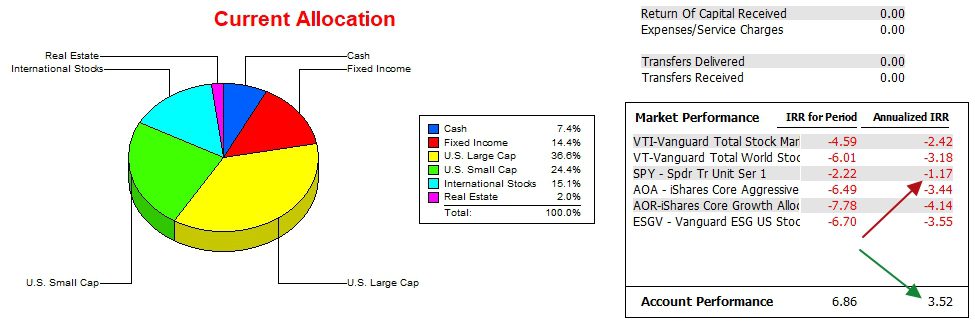

Schrodinger Performance Data

As readers can see, there are no expenses associated with the Schrodinger other than the expense ratios attached to the different ETFs. Over the past 23 months the Schrodinger managed to outperform the S&P 500 (SPY) by nearly 4.7 percentage points. The margin or IRR for Period is quite comfortable.

In a strong Bull market the Schrodinger will not keep pace with SPY. In a down market, as we experienced in 2022, the Schrodinger will likely outperform SPY. The down period in 2022 is why the Schrodinger currently holds the advantage over SPY. As readers can see, the margin is even higher when compared with other potential benchmarks.

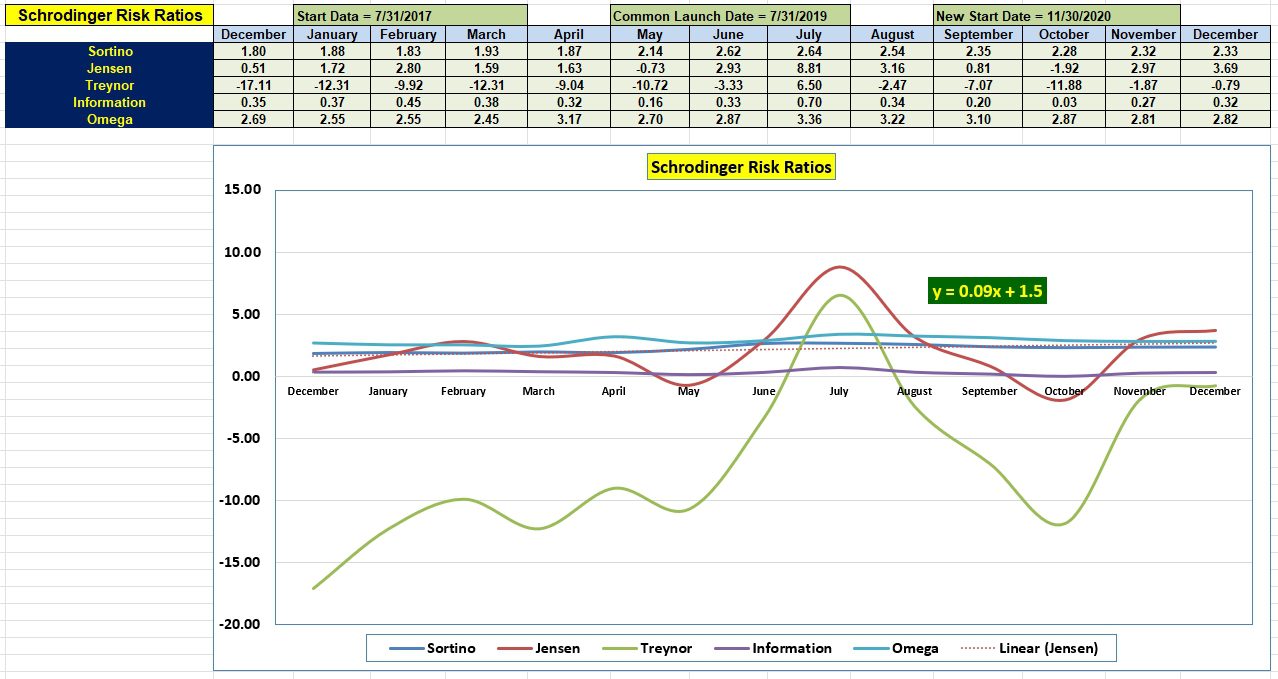

Schrodinger Risk Ratios

Since the last review the slope of the Jensen flipped from negative to positive. That is good news. Of more importance is the Information Ratio value and its growth since last summer.

Only the July value for the Jensen Alpha is higher than it is today. Keep in mind this is the first day of December so discount or play down the December values. I’ll look at this portfolio again in December as I expect Schwab may do some rebalancing near the end of the calendar year.

Schrodinger Computer Manage Portfolio Update: 7 June 2023

Tweaking Sector BPI Plus Model: 20 May 2023

Tweaking Sector BPI Plus Investing Model: Part II

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.