Grand Tetons

Since the Schrodinger is computer managed and therefore on “automatic pilot” as far as the owner is concerned, updating this portfolio can occur at anytime. Now that we are close to the middle of August, I want to bring all portfolios last updated in July into August updates so I can compare performance values between the various investing models.

Here is the link to the last Schrodinger review. Since the July review the Schrodinger slipped backward on both return and risk. Readers can use this update and compare with the July review to compare holdings. I continue to be puzzled why Schwab holds shares in PRF, PRFZ, and PXF and yet do not add to these securities when new money is added to the account.

Schrodinger Securities

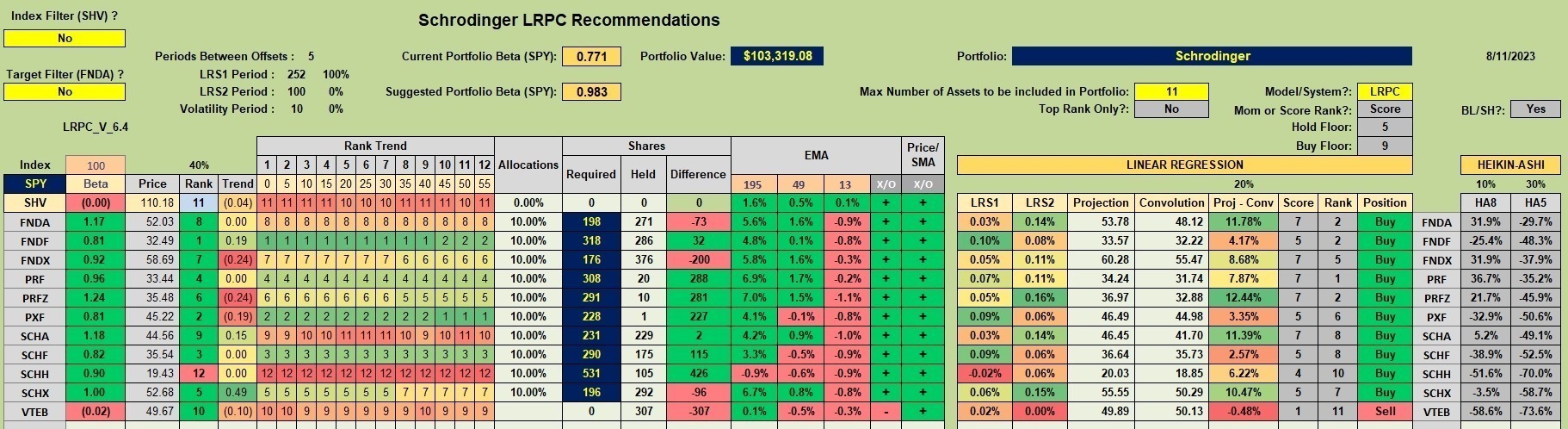

Below is the current Schrodinger portfolio. If one were using the Kipling to manage the portfolio and the LRPC model is used in conjunction with the one-year look-back period, all but VTEB are recommended for purchase.

Schrodinger Performance Data

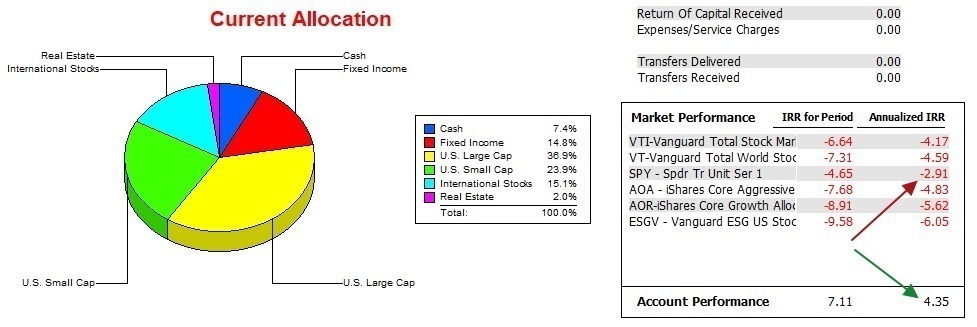

Based on the past 18.5 months of operation, the Schrodinger continues to hold a comfortable margin over the S&P 500 (SPY). Should we experience a strong bull market in the near future, it will be difficult for the Schrodinger to maintain this lead due to holding approximately 20% in fixed income and cash.

Schrodinger Risk Ratios

By dropping the July Jensen value, the slope of the Jensen moved from negative to a small positive (+0.11). Otherwise the critical risk values such as Sortino, Jensen, and Information dropped in value since July. This is a reflection of the tepid U.S. Equities market thus far in August. We are in the dog-days of summer.

Schrodinger Interim Update: 19 October 2022

Schrodinger Computer Manage Portfolio Update: 7 June 2023

The ITA blog is free to all who register as a Guest. Send the https://itawealth.com link to your family members and friends. Post on your social media sites if you think this information might be of use to a prospective investor.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

This coming week is a busy one for portfolio updates as those scheduled include: McClintock, Einstein, Gauss, and Bohr.

Lowell

Lowell,

I got my 2 GGC’s accounts on track. The two parameters that were out of synch were the target for when the money was needed and the risk tolerance. Current cash is ~8%.

Bob W.

Bob W.,

It is common for Schwab to carry 7% to 8% in cash. It is my understanding they use this cash to finance their bank and that is how they can provide this service for no fee.

Lowell