Cutsforth Market Truck

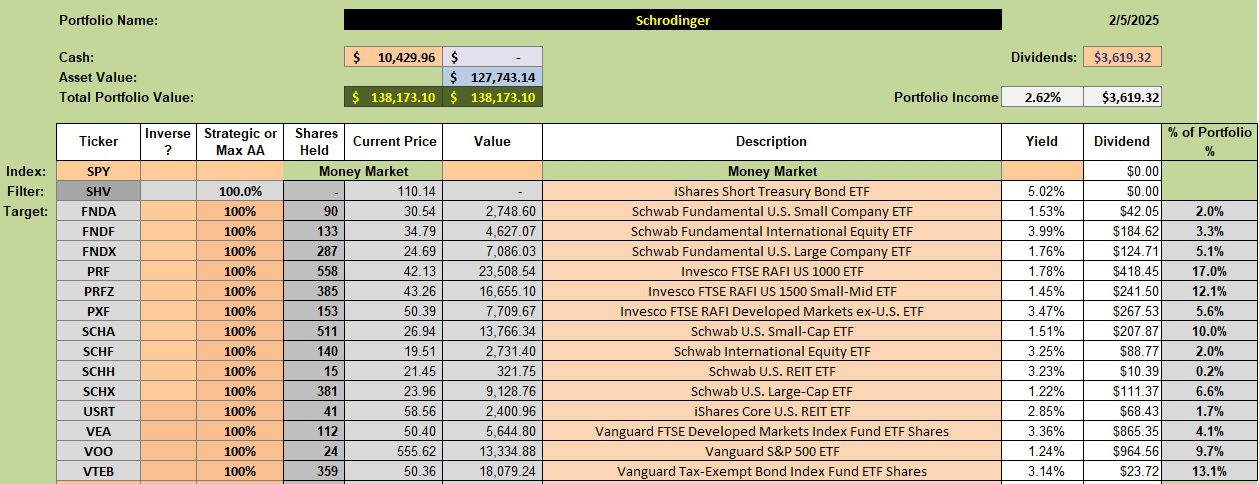

Once more it is time to update the highly touted Schrodinger portfolio. This account is a Schwab “Intelligent Portfolio” managed by computer. I think of this style of portfolio as a Robo Advisor portfolio. As an investor interested in setting up such an account, all one needs to do is invest the minimum amount of money, answer a few risk oriented questions, and then sit back and let the computer do its managing work.

If you an older investor the computer model will set up a more conservative portfolio. I did not want that so I requested a more aggressive growth oriented asset allocation mix. In addition I requested less emphasis be given to international equities and to focus more on U.S. Equities. Otherwise, a computer is managing the Schrodinger.

If the account is above $50,000 Schwab will tax manage the account. All this for no cost other than the normal expense ratios one incurs when investing in ETFs.

Schrodinger Asset Allocation Computer Model

Below is the current asset allocation mix for the Schrodinger. I continue to question why more is not invested in SCHH as such a small holding adds little value to the overall performance.

When the market dipped on Monday I thought the computer might pick up a few shares for one or more of the asset class. No trades occurred since the last review.

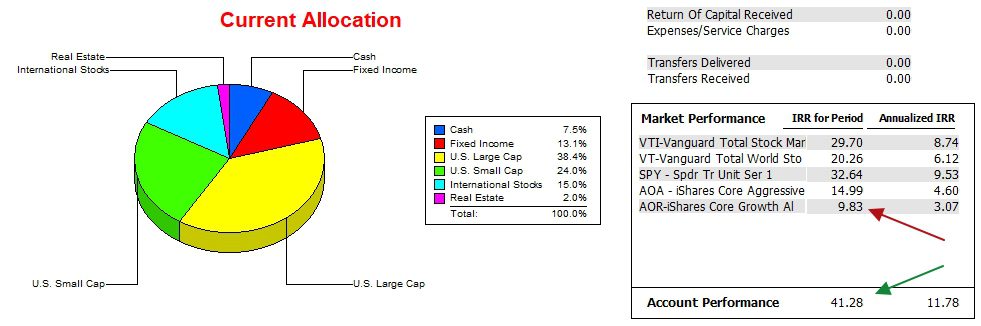

Schrodinger Performance Data

Since 12/31/2021 the Schrodinger has outpaced the AOR by a wide margin. What continues to surprise me is that the performance is also besting the S&P 500 (SPY). It does not get much better than this. In addition, the Schrodinger is very tax efficient.

Schrodinger Risk Ratios

With a growth orientation, is the risk higher for the Schrodinger? Not so according to the following four risk metrics. The slope of the Jensen Alpha is a robust 0.27 and the Information Ratio is not far off the November high.

There is little to criticize when it comes to the Reward/Risk ratio for the Schrodinger “Intelligent Portfolio.”

Comments are always welcome. Send this URL on to your friends and relatives.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

WOW, Schrodinger IRR out-performing the AOR and SPY benchmarks!. Do you have or could you post, year-long risk ratio charts for these two benchmarks? With the current environment, seeing charts of the relative risks for these benchmarks could be very useful.

Lee,

I don’t have risk information you are requesting on the AOR or SPY ETFs. The current three-year volatility average for the S&P 500 is running a little below 13%. I suspect AOR is a bit lower. A few years ago the S&P 500 was up closer to 20%, much of the volatility was on the high side during a very good year.

A good assumption for market volatility in a given year is 15%.

The Jensen Alpha takes four variables into consideration. 1) Portfolio IRR. 2) Benchmark IRR. 3) Portfolio Beta. 4) Interest rate of risk-free U.S. Treasury bill. I use the interest rate of SHV in my calculations.

I don’t have this detailed Jensen information for either AOR or SPY.

As a point of interest, the Beta for the Schrodinger is a very low 0.69. With a beta this low it is a surprise the portfolio is performing as well as it is.

Thank you for your question.

Lowell

Hummm . . . . guess I’ll attempt some “back of the envelope” trials. The Shrodinger Beta of 0.69 is very useful. Thank you. LC

Lee,

The beta of AOR is nearly equivalent to SPY yet the S&P 500 index outperformed AOR by nearly a factor four over the past five years.

Lowell

New user here, but long time investor and student of investing. Great investing blog site! Love the pics!

I am baffled by the Schrodinger portfolio (SP) risk/return performance presented above. Is the SP a strategic asset allocation portfolio with periodic rebalancing and no new funds added during the reporting period? When I put the SP into Portfolio Visualizer (PV) for the time period Jan 2022 – Jan 2025, using monthly rebalancing and no new funds added, I get a (non-inflation adjusted) CAGR of 5.68% which is about half of the 11.78% “Annualized IRR” you show. However, as a sanity check, PV shows a CAGR of 9.53% for SPY which matches your value for Annualized IRR for SPY, and PV shows a CAGR of 3.22% for AOR, which is pretty close to your value of 3.07%. Also, a “generic” 70/30 stock/bonds portfolio of VTI/AGG has a CAGR of 5.54%

What am I missing? You even seem surprised at SP’s results: “With a beta this low it is a surprise the portfolio is performing as well as it is.”

Thanks!

Ray

Ray,

New money was added to the Schrodinger during the period when the market was down. That is the reason the portfolio is performing so well compared to the SPY ETF. The same is true for the Copernicus. Both portfolios benefited from dollar-cost-averaging.

In the case of the Copernicus, no shares were sold. Schwab rarely sells shares in the Schrodinger unless there is a tax advantage. Several ETFs were added to the Schrodinger (Schwab) portfolio since launch and those additions benefited from market variations.

Hope this explains the different results from the Portfolio Visualizer.

In the other “extreme” neither the Einstein or Kepler are in the black. The owners of these portfolios needed educational funds and sold shares when the market was down. Sort of the reverse of what happened with the Schrodinger.

A word to the young when building a portfolio for retirement. Save regularly and when the market is down, attempt to increase the savings rate. Not easy to do, but it is a good plan. Here is the link to the Golden Rule of Investing.

https://itawealth.com/the-golden-rule-of-investing/

Lowell

Yes – that does help explain it! Thanks!

When the performance table says “Transfers delivered” and “Transfers received”, it does not mean that money was transferred into or out of the portfolio? I guess I miss-interpreted what that meant.

Thanks again!

Ray

Raymond,

I don’t pay any attention to Transfers delivered and Transfers received.

Lowell