Dahlia from Swan Island Dahlias.

Bohr is one of the growth-income portfolios that is essentially a passive portfolio. Passive in the sense that dividends are reinvested in additional shares either on the growth or income side of the portfolio. While the Kipling spreadsheet is used to keep track of the asset allocations, it is not used in the same way it is for portfolios such as the Kepler, Millikan, Gauss, and Einstein. With the Bohr, the philosophy is to keep adding shares and only sell if the asset allocation falls out of balance in a major way.

Bohr Investment Quiver

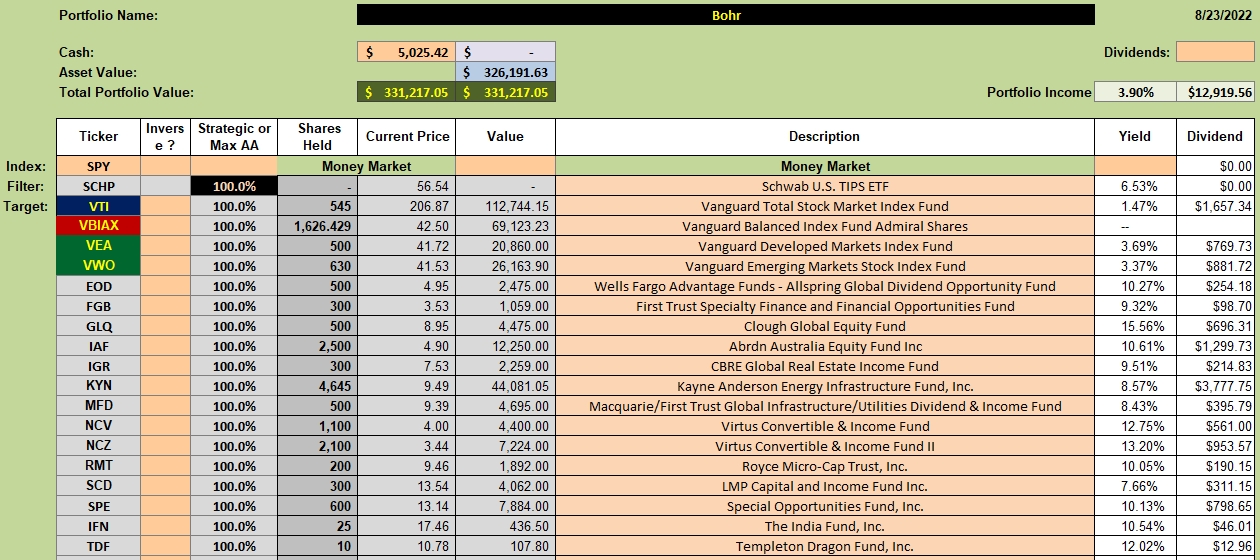

Below is the current investment quiver for the Bohr portfolio. The growth side of the portfolio comes from VTI, VBIAX, VEA, and VWO. The Closed-End-Funds (CEFs) with the gray background provide the bulk of the income.

Bohr Security Recommendations

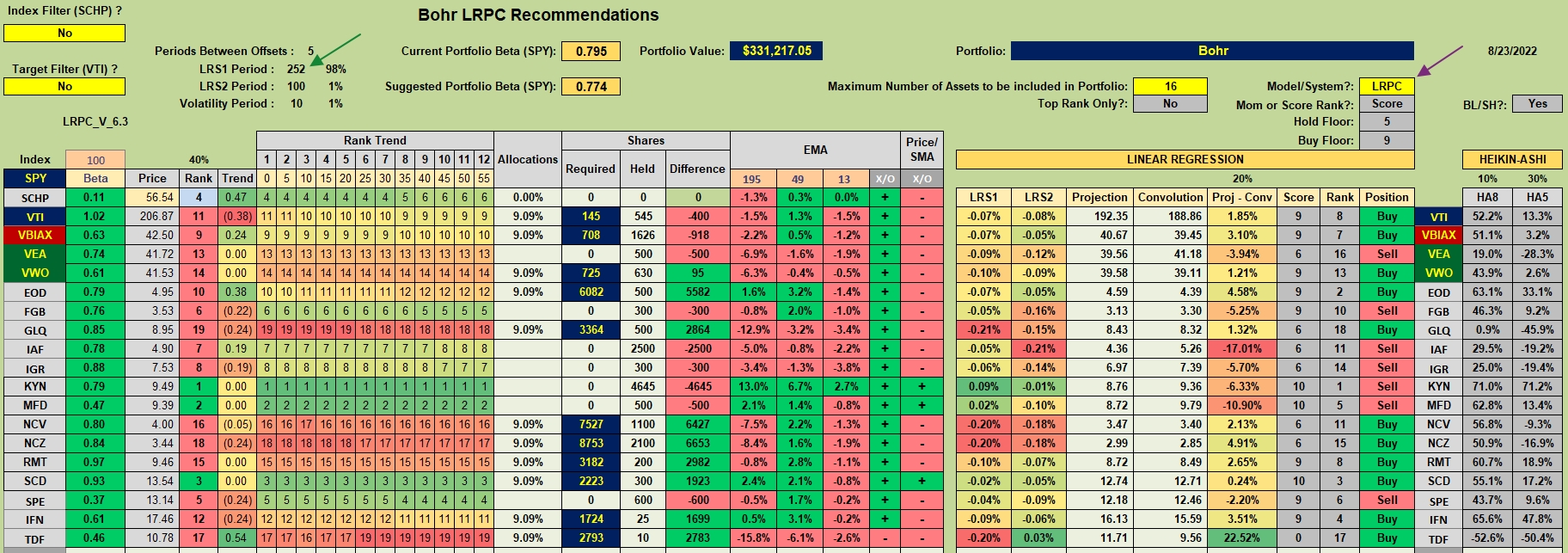

Below is the tranche worksheet from the Kipling spreadsheet. With the Bohr I use the Kipling primarily as a guide as to where to invest available cash. One way an investor might use this worksheet is to check the Proj-Conv column and see which securities are projected to have the greatest gain. Using this criteria, one would invest the available cash in TDF.

Another possible method is to check the Difference column and see which securities are most in need of adding shares. Three CEFs stand out and they are: EOD, NCV, and NCZ. Since NCV and NCZ are such similar CEFs, select one of the two. I recommend NCZ as it currently has the higher yield.

Bohr Performance Data

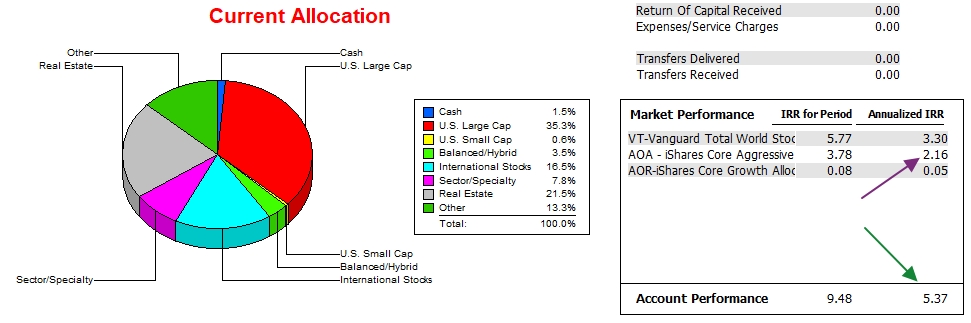

Since 11/30/2020 the Bohr has generated an annualized return or IRR of 5.4% while the AOA benchmark is 2.2% and Vanguard’s Total World Equities fund is 3.3%.

Bohr Risk Ratios

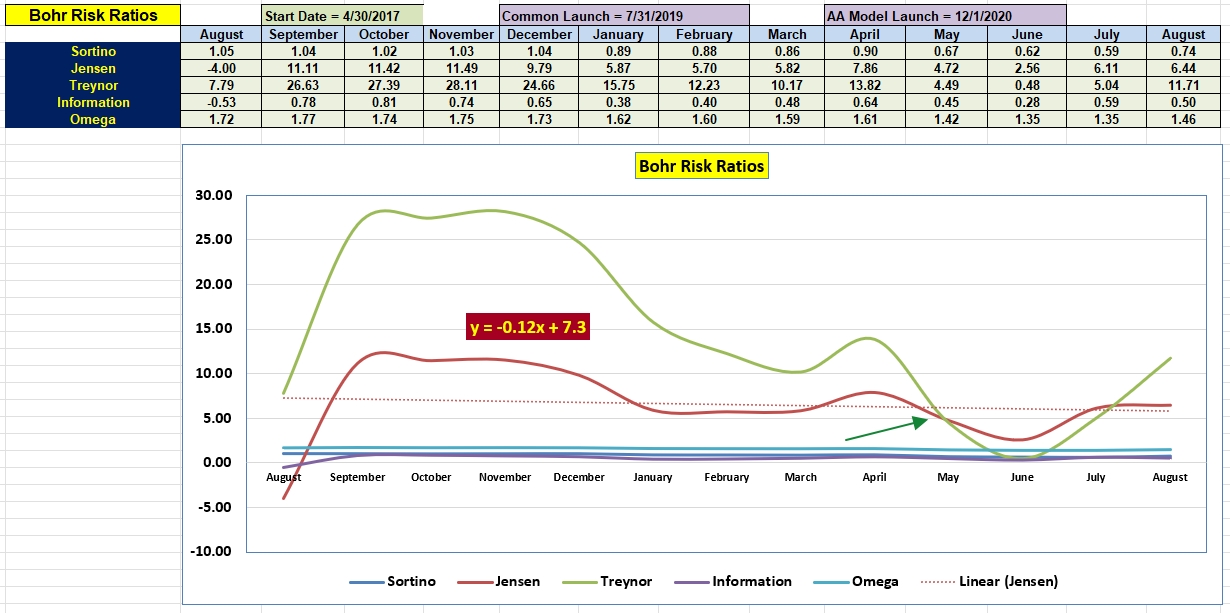

When taking risk into account, the Bohr continues to maintain a positive Jensen Alpha. While not as high as it was in the fourth quarter of 2021, we need to remember that 2021 was an unusually high performer for U.S. Equities. Those years do not come along all that frequently.

As a result of the banner year of 2021 the slope of the Jensen is negative. We should see the slope turn positive by next summer if not sooner. This depends a great deal on the type of equities market we have going forward.

Other than purchasing more shares of TDF and NCZ, the Bohr is ready to go into “neglect” mode for another 33 calendar days.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

I just checked the CEF Connect website and both TDF and NCZ are priced below their Net Asset Value (NAV). I should have mentioned this in the blog post.

Lowell