HJM TriHauler Pro trike.

Franklin is the Sector BPI portfolio up for review this last day of January. Of the portfolios I track here on the ITA investment blog, the Sector BPI investing model requires the most attention to details. Even so, it is a rather simple investing approach to portfolio management. At the bottom of this blog are several articles from Seeking Alpha that explain in more detail how the Sector BPI model operates.

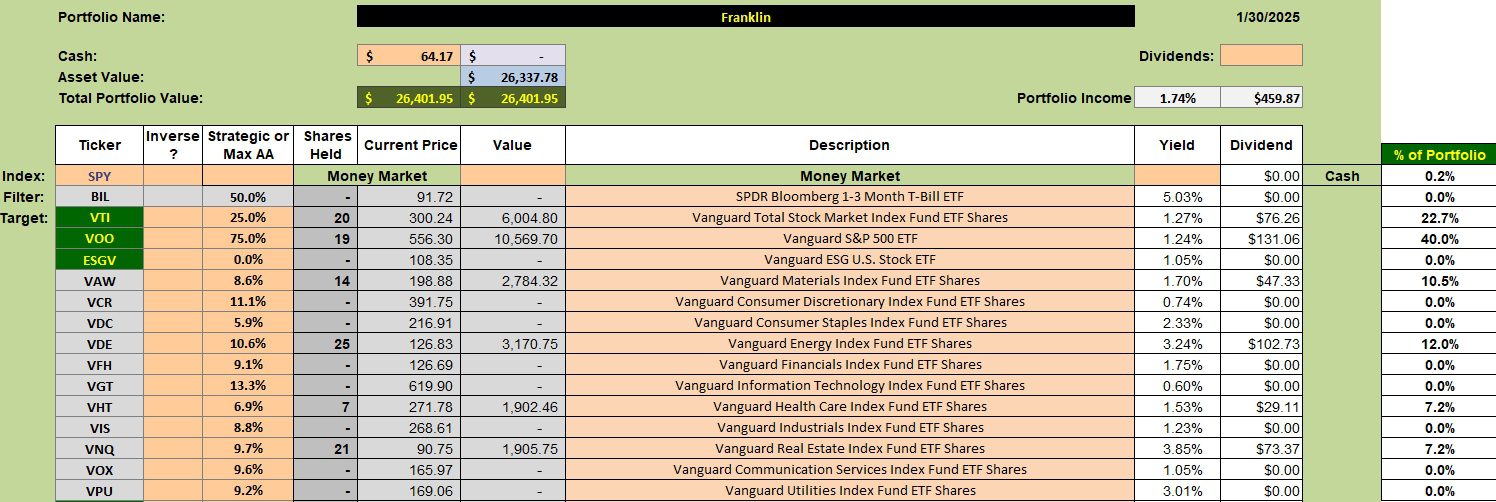

Franklin Security Holdings

Over the last several weeks four sectors dropped into the oversold zone. What this means is that Materials, Energy, Health, and Real Estate dipped below the 30% bullish line when examining the Point and Figure (PnF) graphs. Here is the link to a sample Bullish Percent Indicator graph or chart.

When the percent of bullish stocks within a sector drops to 30% or below we purchase shares of the Exchange Traded Funds (ETFs) that mirrors that sector. When the percent of bullish stocks move to 70% or higher, we place a 3% Trailing Stop Loss Order (TSLO) under the ETF. Should we hold cash in lieu of sectors, we invest in U.S. Equities such as VOO. This is done so the market does not walk away to the upside.

In the portfolio below we are below target with the Real Estate (VNQ) position. We should hold 9.7% of the portfolio in VNQ and we only hold 7.2%. The Real Estate sector is no longer in the Buy zone so instead of selling shares of either VTI or VOO to raise cash we simple let everything ride as is.

Franklin Portfolio Data

Since 12/31/2021 the Franklin nearly matches its SPY benchmark. The difference is within one percentage point, or an excellent result. The Franklin is outperforming the other possible benchmarks shown in the following screenshot.

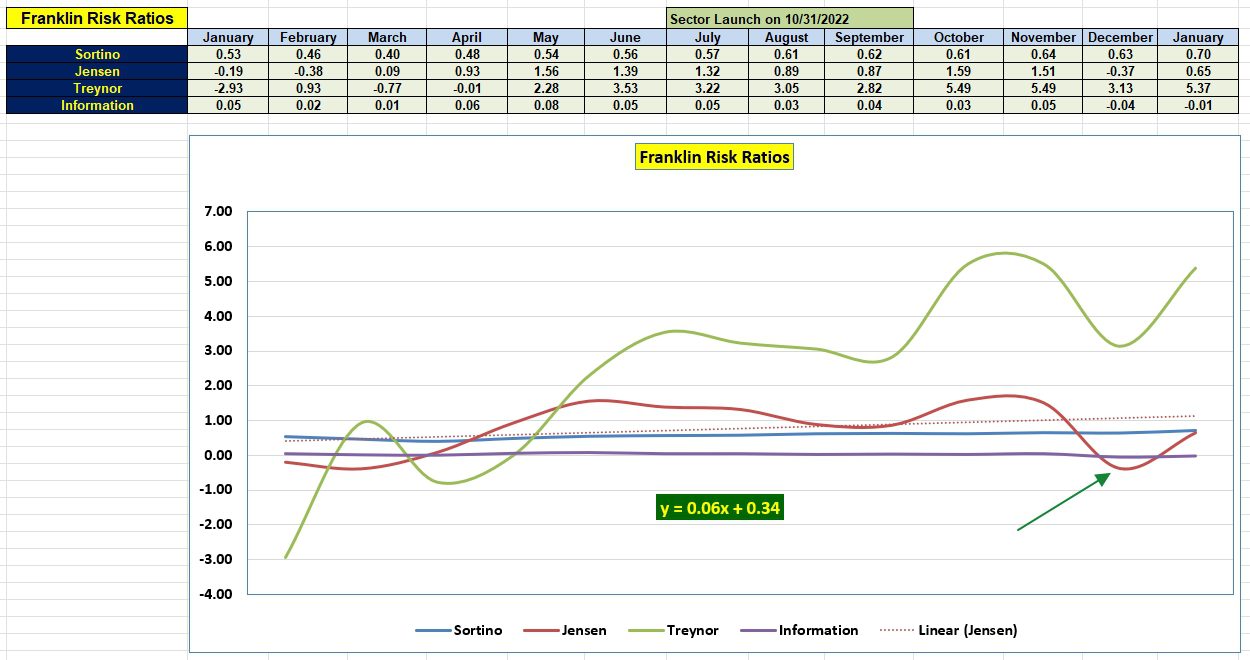

Franklin Risk Ratios

Even though the Franklin lags the SPY benchmark, it is sufficiently close that when risk is part of the analysis the Jensen Alpha is positive (o.65). Anything above zero for the Jensen is a victory. During the month of January we see improvements in each of the risk ratios.

While not a strong slope, the Jensen at least is showing improvement over this past year.

Franklin Portfolio Review: 21 July 2023

https://seekingalpha.com/article/4616279-sector-bpi-investing-a-contrary-investing-model

Questions and comments are always welcome.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

I meant to mention in the above post that the ITA blog is free to all interested investors. Sign up as a Guest and wait for me to elevate you to a higher level so you can see all the posted material.

Just to reiterate, the ITA blog is an educational site. We do not tell investors what to do. Rather, both Hedgehunter and I post portfolio reviews showing what we are doing with a variety of accounts. The portfolios vary from active investing to passive investing. In several cases, very passive.

The Schrodinger portfolio is an example of a computer managed portfolio. As artificial intelligence (AI) gains additional footing in society I expect we will see it have a greater impact on portfolio management. I don’t know if Schwab employs AI in their “Intelligent Portfolios” but it would not surprise me if they already use it or are testing it.

Lowell Herr