Cobra Replica

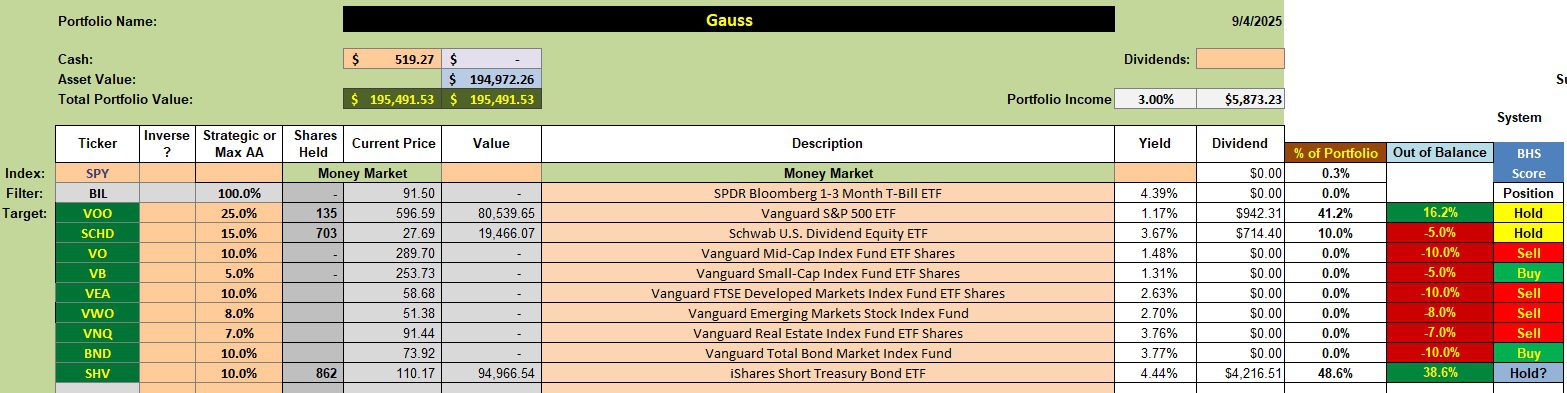

Instead of a complete review of the Gauss portfolio, I am laying out a new and expanded asset allocation model for this account. This new asset allocation plan is global compared to the mini-asset allocation model currently in place. Check the Gauss portfolio at the bottom of this post to compare the asset allocations.

This new model for the Gauss provides additional diversification and is slightly less dependent on U.S. Equities.

Gauss Revised Asset Allocation Model

The Gauss will continue to be equity oriented. BND and SHV will provide the 20% of low volatile holdings. VEA and VWO provide exposure to international equities.

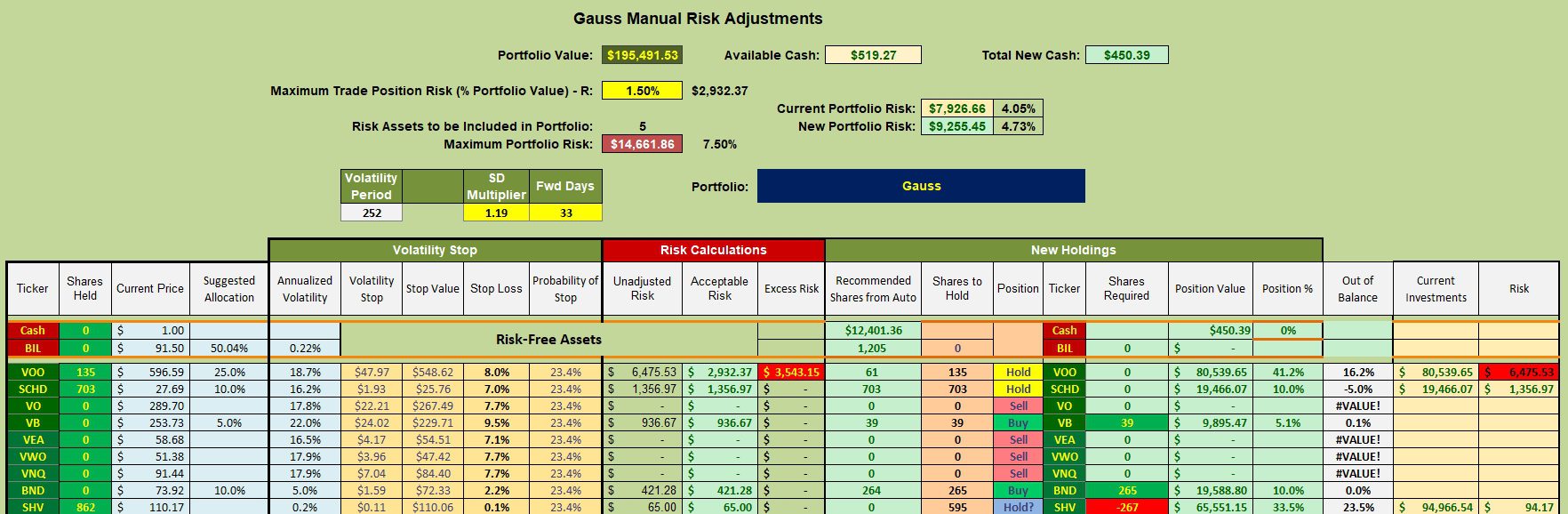

Gauss Rebalancing Recommendations

How will the rebalancing take place? When the Gauss comes up for a full review I will sell shares of SHV if buying opportunities are still recommended. Based on recommendations from the Kipling spreadsheet, small-cap value (VB) and bonds (BND) are calling for a Buy. VOO is out of balance to the high side and I have a TSLO already in place to sell shares of VOO.

Once a position is in place the goal is to maintain that allocation unless the recommended percentage moves above or below the target by 5%. I will likely lower this to 3% for a low volatile ETF such as BND.

The following Gauss update provides a reference as to what the prior portfolio looked like. As readers can see, I am expanding the asset allocation model.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Hi Lowell,

Some comments on the asset allocation line-up…

1) Cash equivalents: both VBIL and VGUS have lower expense ratios than SHV and BIL (and a resultant higher SEC yield rate)

2) Since you have VO and VB in the portfolio, shouldn’t you be using VV instead of VOO? VV, VO and VB are based upon the CRSP deciles and are internally consistent, while VOO uses the S&P 500. At least recently, VV has had (slightly) better returns than VOO.

3) Using SCHD probably overweights large-cap value. Is that is your intention?

Thanks,

Craig

Craig,

Thank you for the suggestions. Always open to new ideas.

As for VBIL and VGUS, while the expense ratio is lower by approximately half, the higher yield for SHV will likely more than make up the difference. I’ll do more checking as I am not “married” to SHV.

I’ll run some number over on Portfolio Visualizer and compare VOO with VV.

Using SCHD is to increase the income. That may not be necessary. Again, I will run numbers using Portfolio Visualizer.

Thanks for the suggestions and watch for adjustments to my initial thinking. Keep the ideas coming.

Lowell

Craig,

Using Portfolio Visualizer I substituted VV for VOO and the return results were the same for investing dates running from 2016 through August 2025. I think 2016 is as far back as I can go based on the launch date for other ETFs used in the Gauss Portfolio. Hope this makes sense.

Lowell

Return results improved if I dropped SCHD and moved that asset class over to VOO.

Lowell