Orchids – Botanic Gardens, Singapore

Due to the disruption in access to Yahoo price data, and the fact that I am presently travelling, I was not able to post a review of the Rutherford Portfolio last week so I will attempt to play catch-up this week.

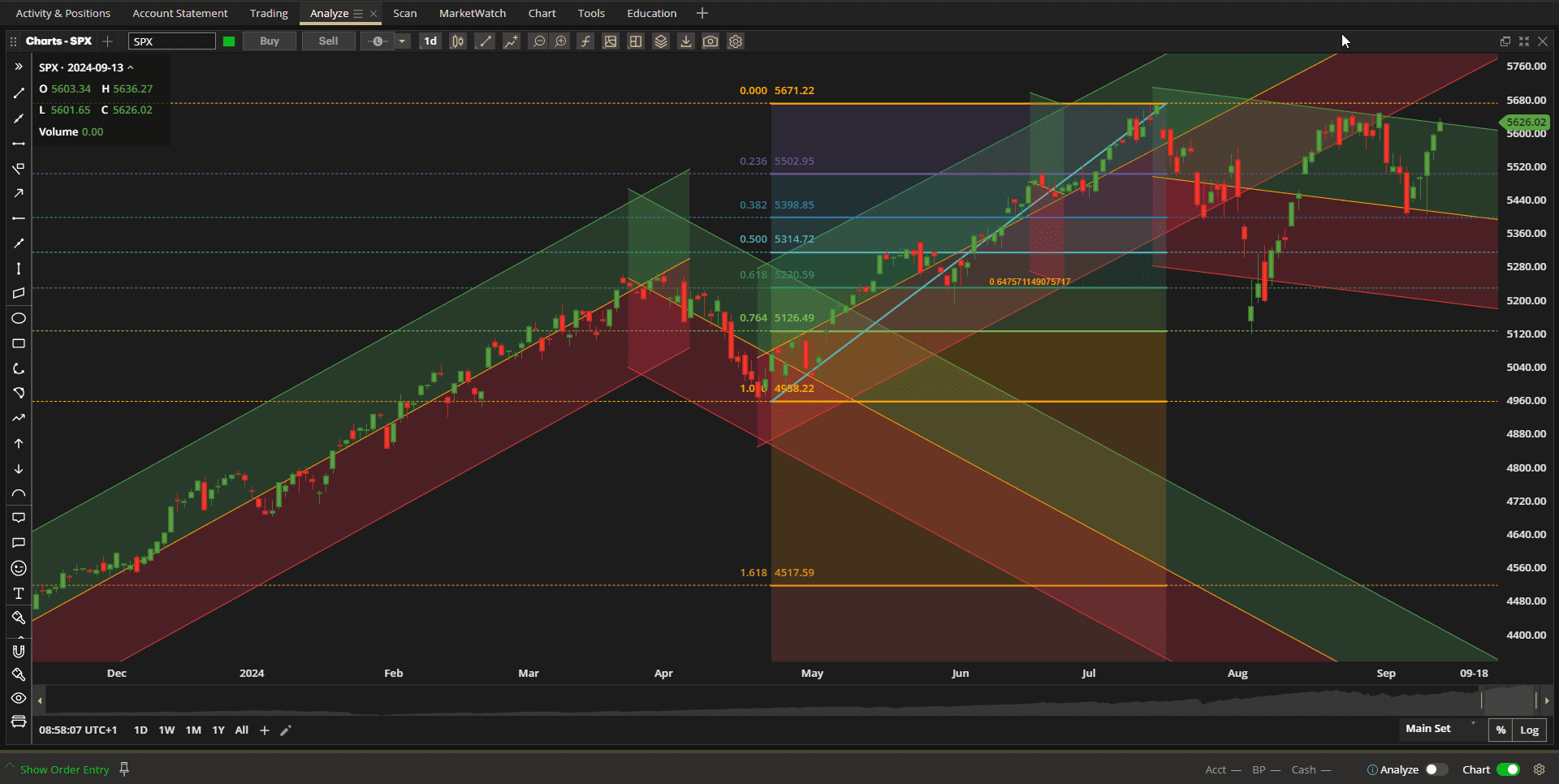

After a minor pull-back last week it was a bullish week in US Equity markets with prices again closing near the resistance level of the July all-time highs (triple top?):

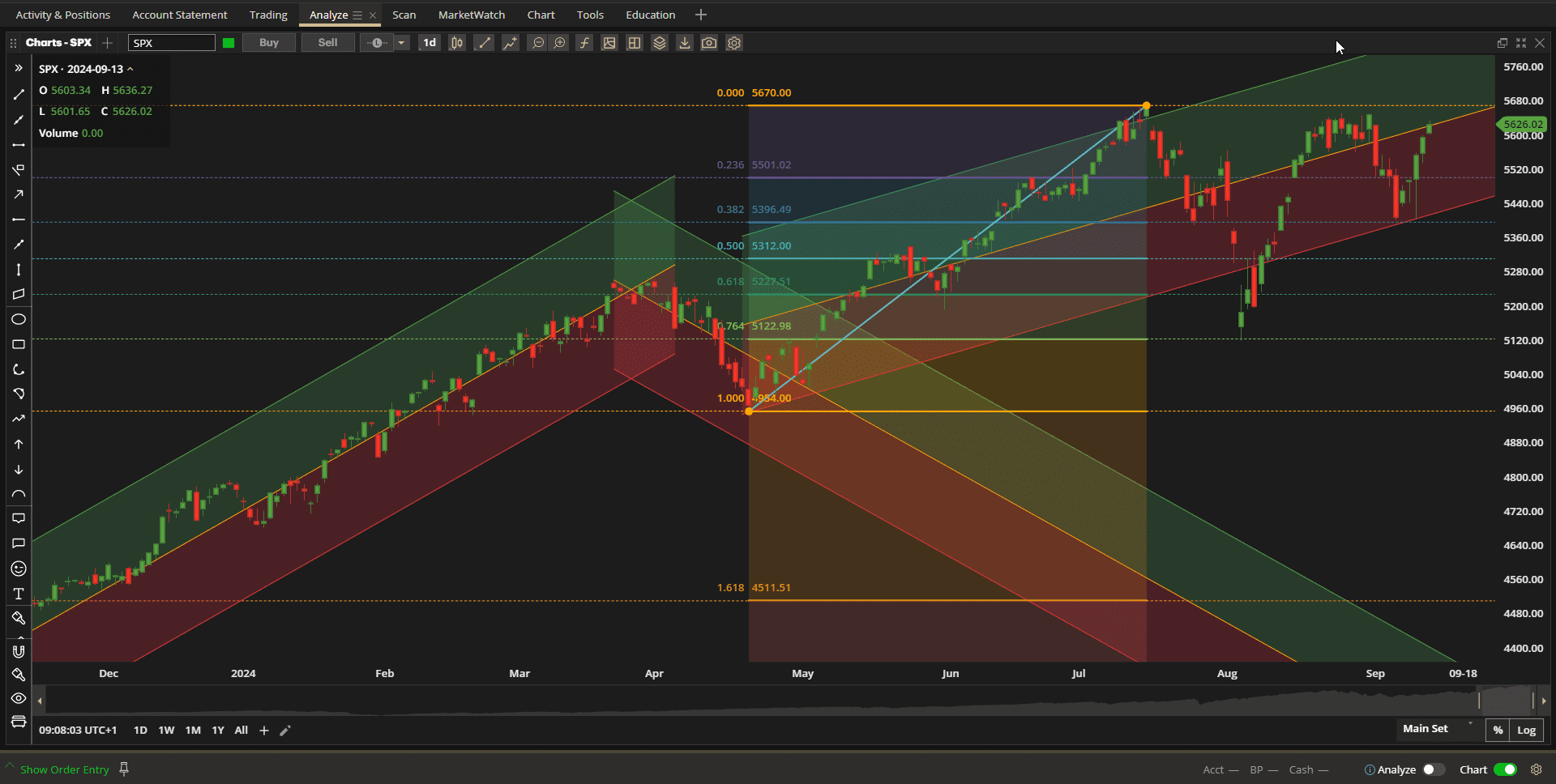

This has created a higher low at the ~5400 level in the SPX (S&P 500 Index) and the August pull-back may well be relatively insignificant in terms of longer term trend:

This has created a higher low at the ~5400 level in the SPX (S&P 500 Index) and the August pull-back may well be relatively insignificant in terms of longer term trend:

This will be confirmed should we break through the ~5680 level in the next couple of weeks (creating a higher high).

This will be confirmed should we break through the ~5680 level in the next couple of weeks (creating a higher high).

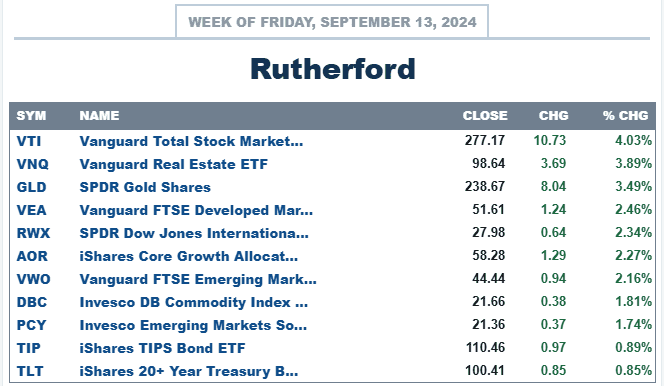

Although US Equities showed the greatest relative strength of all major asset classes (~4% return), all classes generated positive returns over the past week:

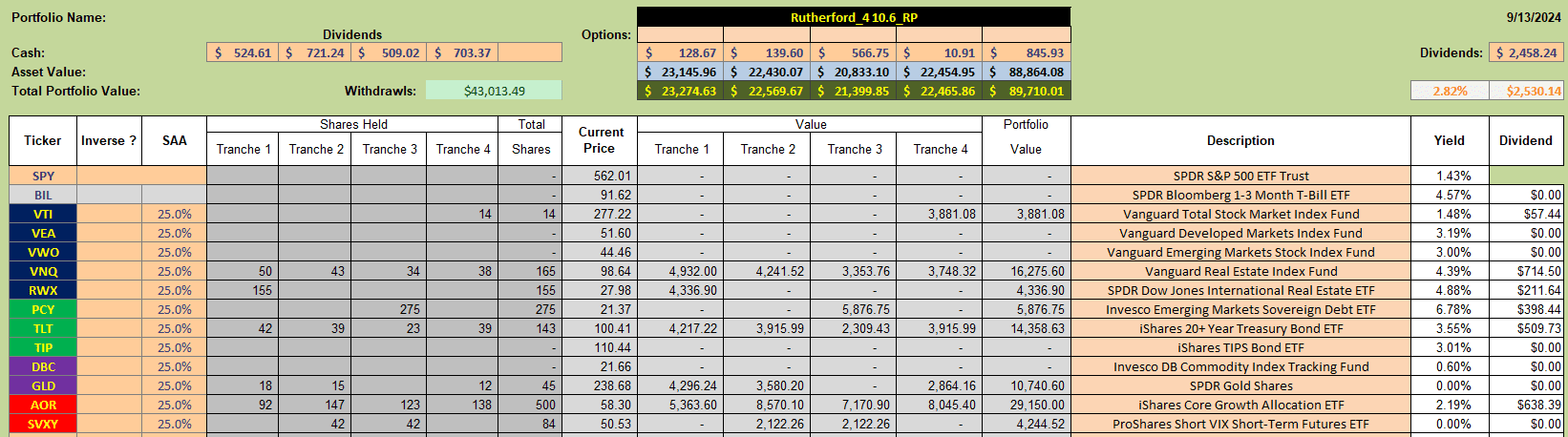

Current holdings in the Rutherford Portfolio look like this:

Current holdings in the Rutherford Portfolio look like this:

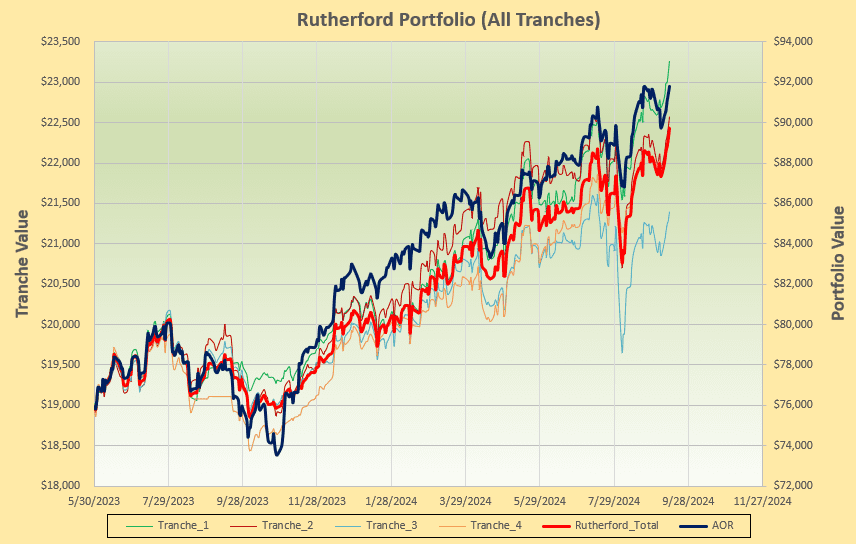

with the following performance:

with the following performance:

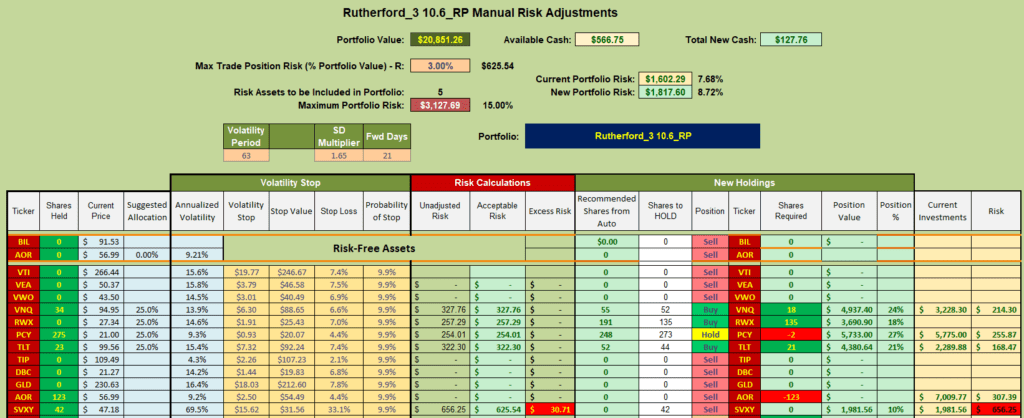

No adjustments were made to the portfolio (Tranche 3) last week due to the interuption in access to price data. However, backtracking, the recommended adjustments would have looked like this:

No adjustments were made to the portfolio (Tranche 3) last week due to the interuption in access to price data. However, backtracking, the recommended adjustments would have looked like this:

where I would have sold shares in AOR to add a position in RWX (International Real Estate).

where I would have sold shares in AOR to add a position in RWX (International Real Estate).

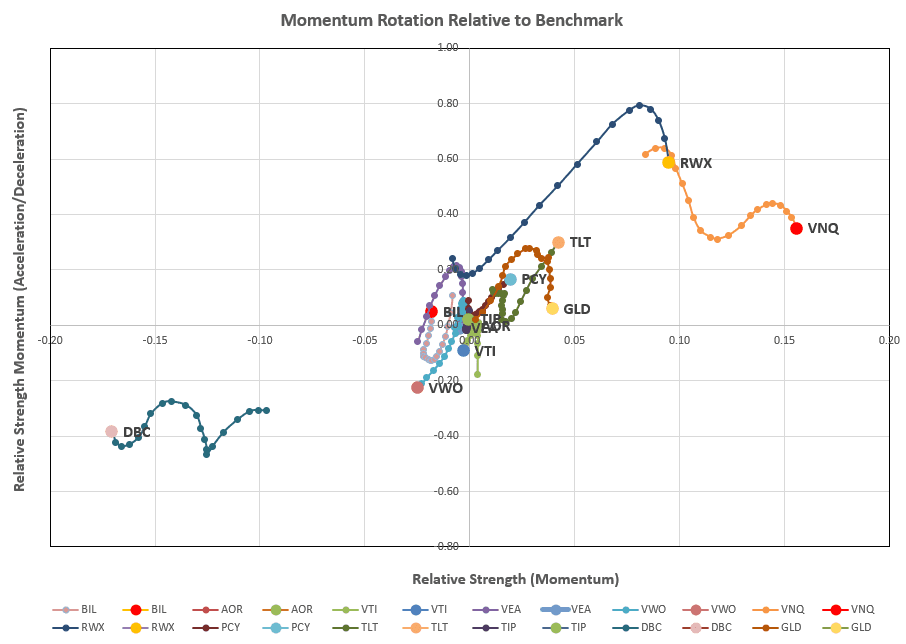

Checking the current rotation graphs:

Real Estate sectors (VNQ and RWX) remain strong, although weakening a little in the shorter term.

Real Estate sectors (VNQ and RWX) remain strong, although weakening a little in the shorter term.

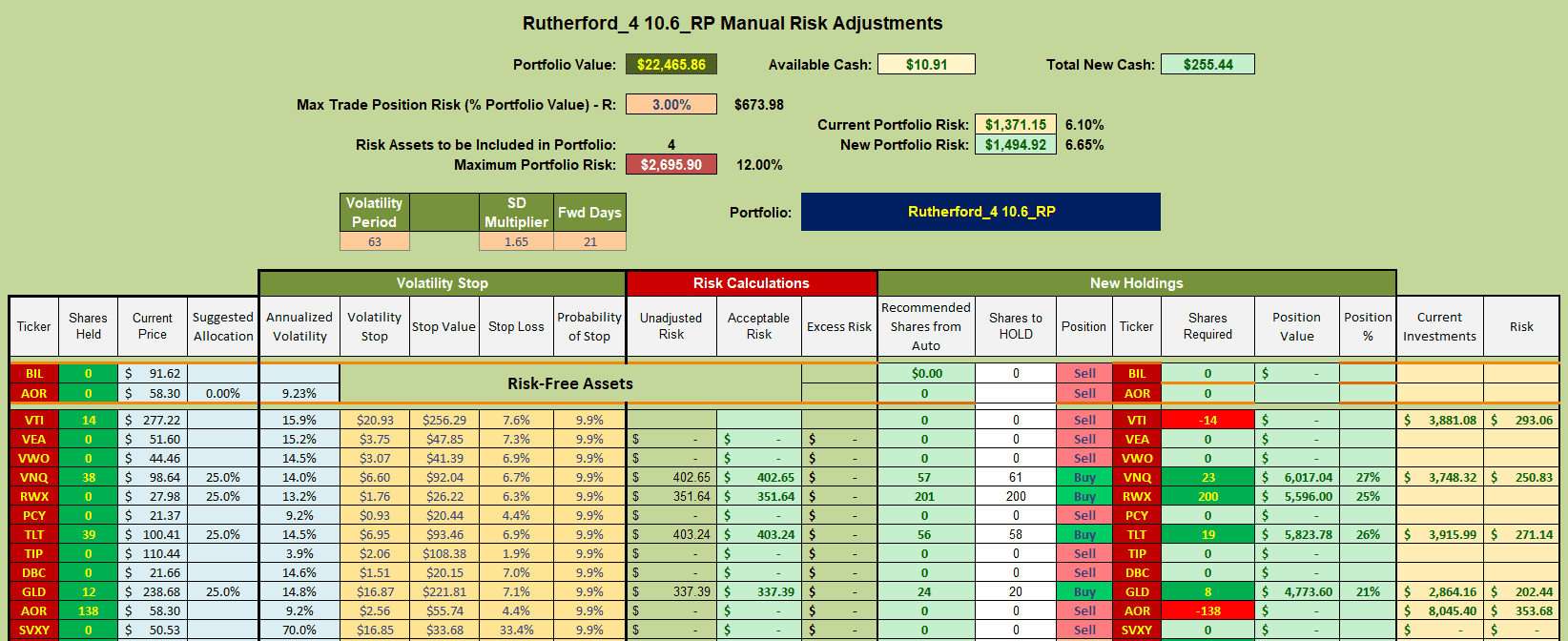

Checking the recommendations from the rotation model:

we see Buy recommendations for VNQ, RWX, TLT (US Treasuries) and GLD (Gold). Since all these ETFs are currently held in Tranche 4 with the exception of RWX I will sell current holdings in VTI and AOR and add a new position in RWX. Combined with last week’s recommended adjustments I will be adding RWX to both Tranches 3 and 4 and will use any excess cash to rebalance positions in VNQ, TLT and GLD.

we see Buy recommendations for VNQ, RWX, TLT (US Treasuries) and GLD (Gold). Since all these ETFs are currently held in Tranche 4 with the exception of RWX I will sell current holdings in VTI and AOR and add a new position in RWX. Combined with last week’s recommended adjustments I will be adding RWX to both Tranches 3 and 4 and will use any excess cash to rebalance positions in VNQ, TLT and GLD.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question