Dahlia from Swan Island Dahlia farm

Once more it is time to review or update the Schrodinger portfolio. This Robo Advisor portfolio continues to perform very well despite the large percentage held in cash. Should we experience a major draw-down, it will be interesting to see how the Schwab computers manage this account. Will they begin to invest the cash and if so, what asset classes will be selected for purchase?

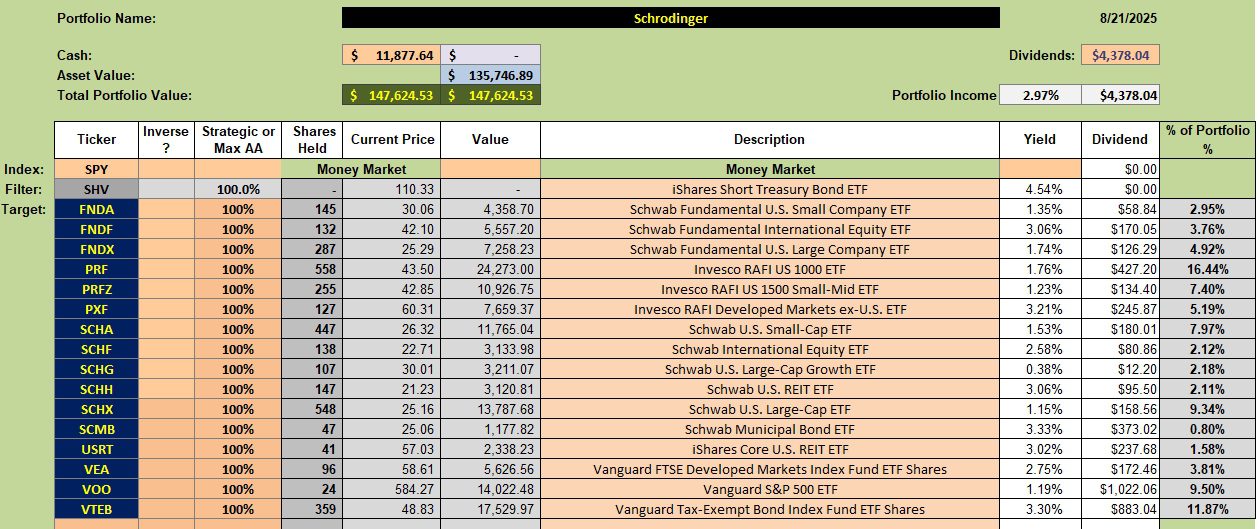

Schrodinger Asset Allocation Model

Below is the current asset allocation makeup of the Schrodinger. Keep in mind that I requested Schwab to play down international investments and concentrate on U.S. Equities. In addition, the portfolio is rather aggressive in that the stock/(bond-cash) ratio is approximately 80/20. Check the pie chart below for the asset allocation breakdown.

Schrodinger Performance Data

Since 12/31/2021 the Schrodinger has performed very well. As readers can see the Schrodinger is outperforming all benchmarks I track using the Investment Account Manager software.

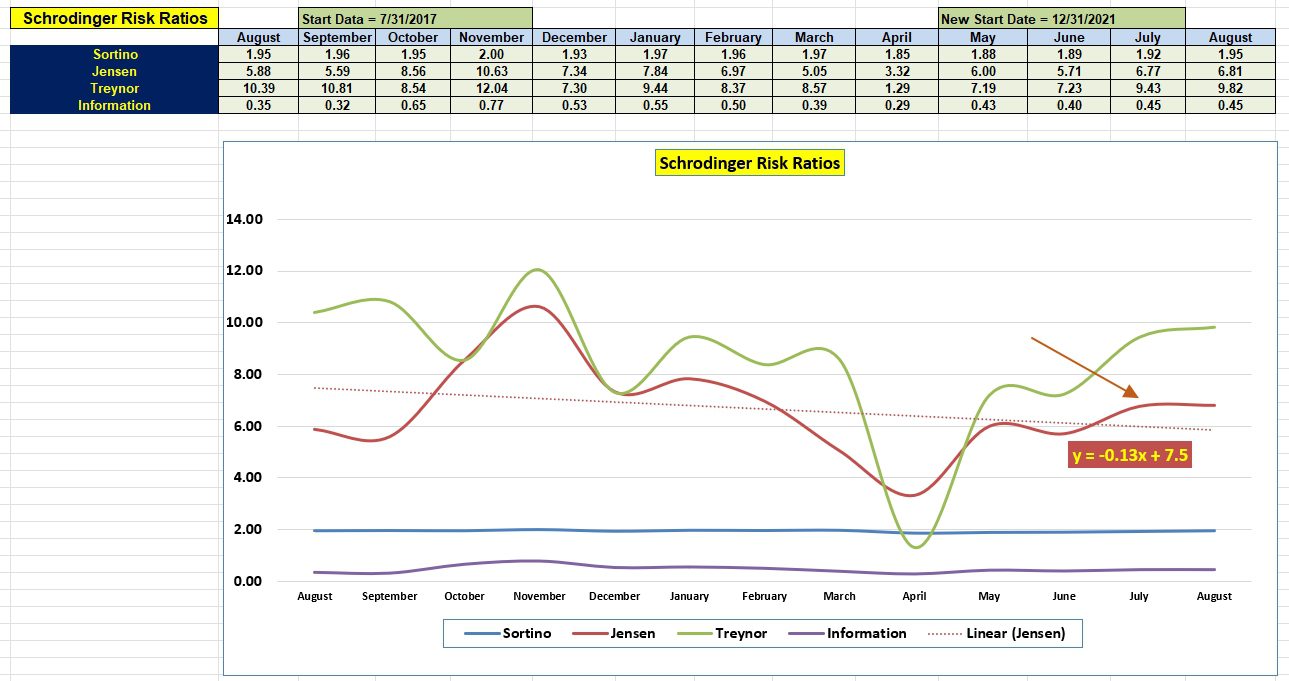

Schrodinger Risk Ratios

Over the past year the Schrodinger is holding its own when risk enters the equation. The Jensen Alpha stayed in the black over the entire year. As a well diversified portfolio the performance tends to track the broad market. The low in April is reflected in the graph so the portfolio is not immune to market movements.

Pass on this link to folks who have little time or interest in portfolio management.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question