Flower from Swan Island Dahlias

Schrodinger had an excellent August with a 3.5% return on investments. This computer manage portfolio is performing very well as readers will see as they read through this blog. Should we see a recession in 2026 it will be interesting to see how this Robo Advisor portfolio responds to a draw-down.

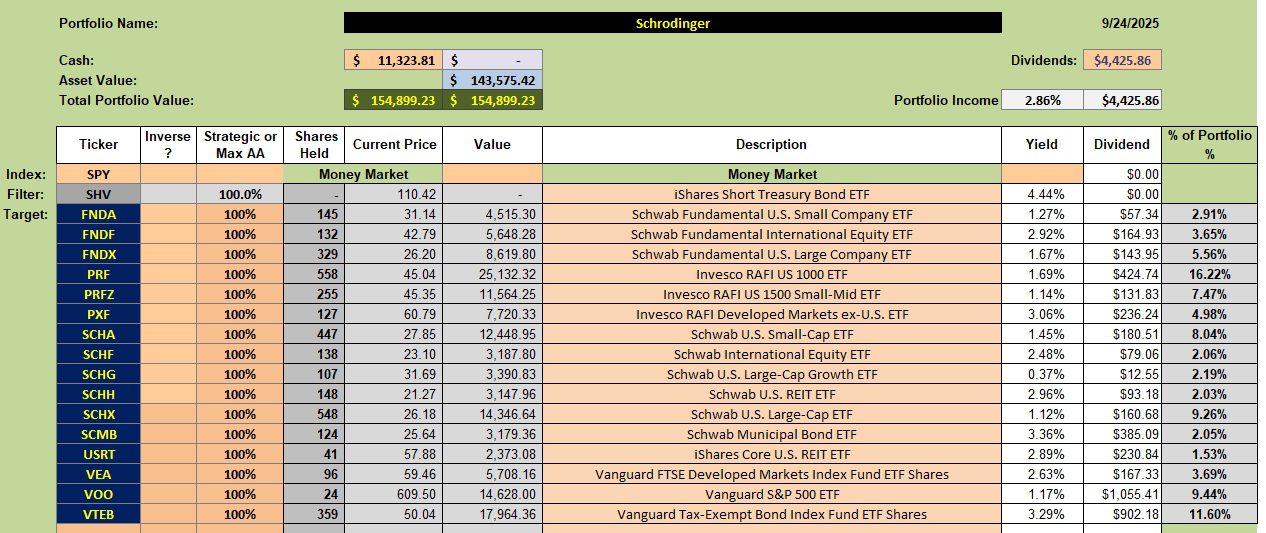

Schrodinger Asset Allocations

Below is the asset allocation model for the Schrodinger. At the bottom of the page I include the August update so readers can easily compare the shares in each asset class with the number of shares this past August. The Schwab computer purchased a few shares as cash became available.

The Schwab Intelligent Portfolio carries between 7.0% and 8.0% in cash and they loan this money out at a higher rate than they pay in interest. This is how Schwab provides this portfolio management service free.

Since the account is greater than $50,000 it is also tax managed.

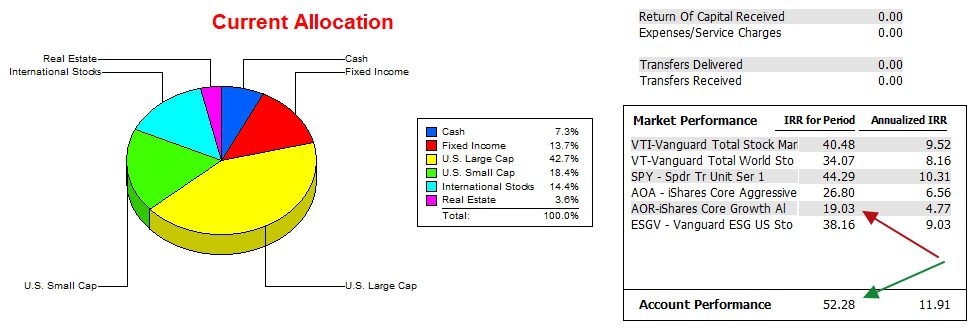

Schrodinger Performance Data

As for performance since 12/31/2021, I cannot complain. It is no mean accomplishment for a computer managed portfolio to outperform the S&P 500 (SPY) as well as all other benchmarks I am tracking.

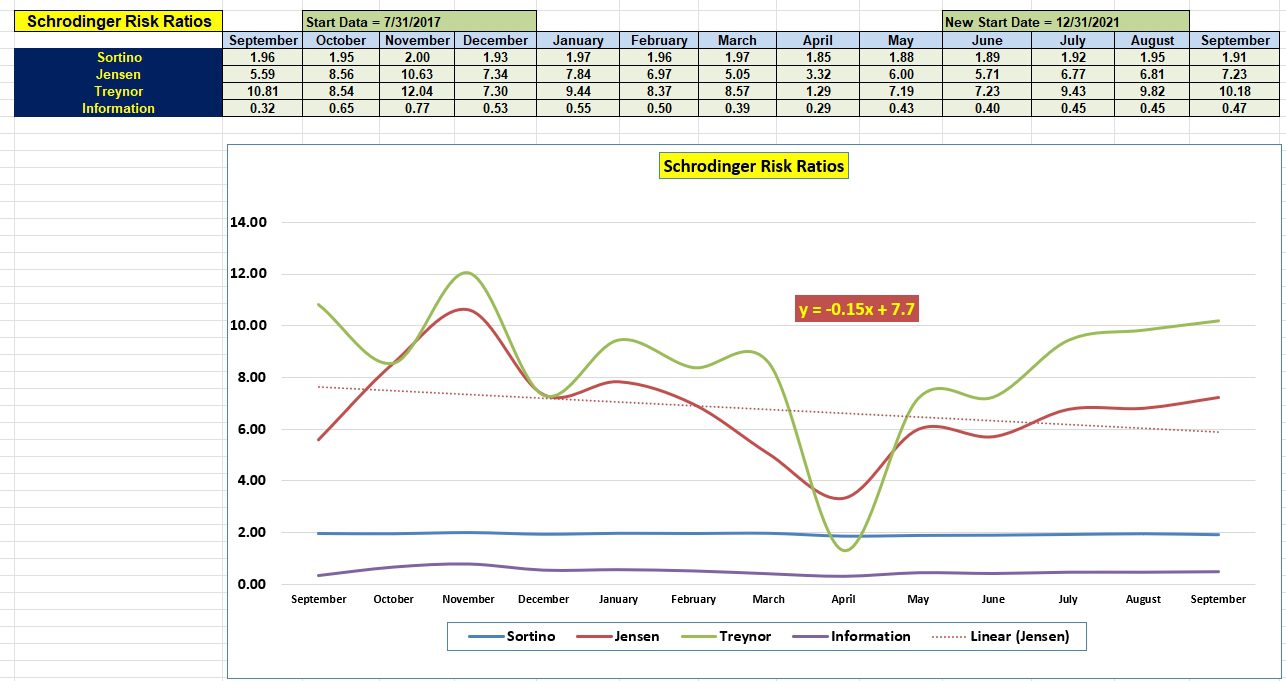

Schrodinger Risk Ratios

Over the past year the Sortino Ratio is hovering around the 1.9 mark which is quite high. The Jensen Alpha is a very high value at 7.23. It is also improving since last January.

The Treynor Ratio is the least important of the four metrics.

While the Information Ratio is not at its peak, it is also very high and improving.

The link below is available for readers to compare current data with information from one month ago.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question