Garage Sale Clock

Headline news this morning – “Trump’s tariffs have left businesses in a ‘state of near paralysis’.” Advanced planning is nearly impossible do to an erratic administration that is in the hands of one person. A person who was not even able to make casinos a success.

Based on a rough economic market ahead I have been setting Trailing Stop Loss Orders (TSLOs) under U.S. Equities such as VOO and SCHG. These are two holdings in the Millikan portfolio.

The outlook for the U.S. economy is anything but bright. Check out Steve Rattner’s economic report from this morning.

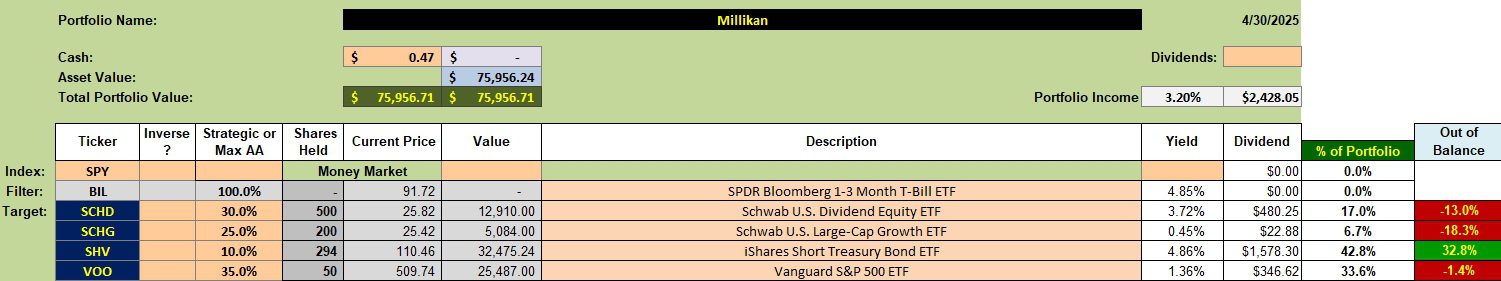

Millikan Security Holdings

Below are the current holdings in the Millikan. This morning I added another 10 shares of SHV, a short-term treasury that is currently paying 4.86%.

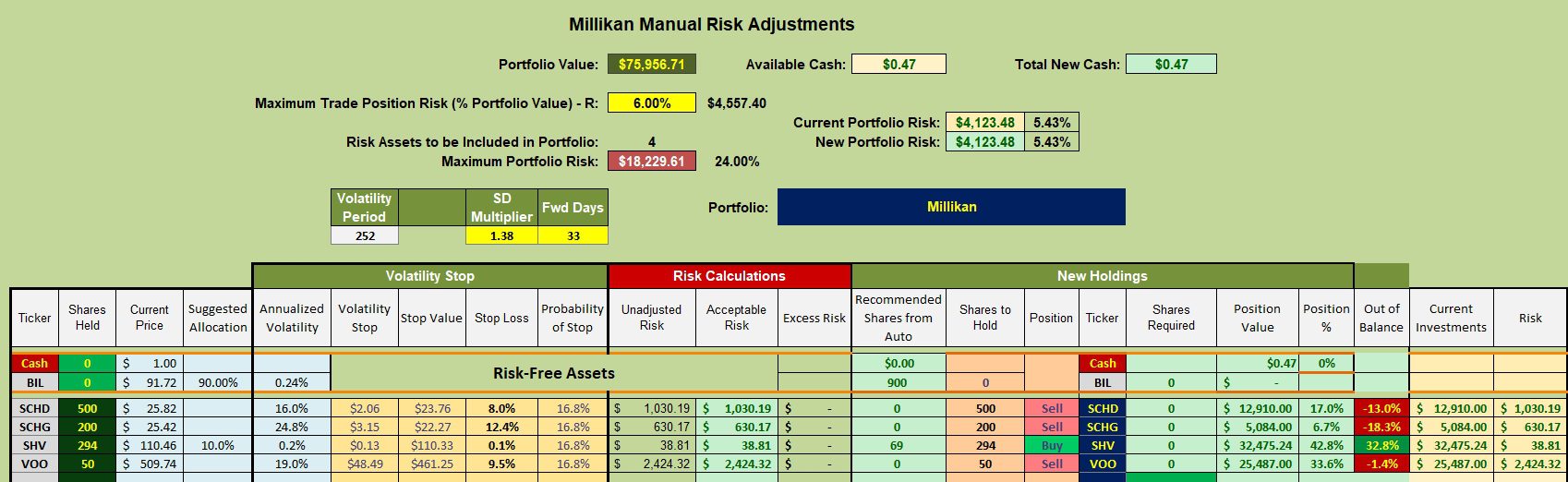

Millikan Rebalancing Recommendations

No rebalancing is required. Note that the three equity ETFs are not a Buy. As mentioned above I have TSLOs set for VOO and SCHG. If sold I will invest in SHV unless SCHD shows up as a Buy. TSLOs range from 3% to 4% below the current price.

I should mention that I have parameters within the Kipling Spreadsheet set to react quickly should the market turn around. This could happen if the 10% tariffs were lifted. The current 145% levy set on China will shut down that market.

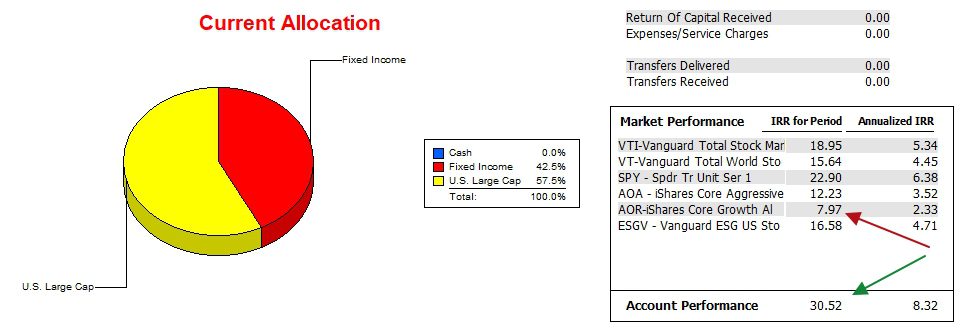

Millikan Performance Data

Since 12/31/2021 the Millikan has performed quite well. Outperforming all tracked benchmarks is quite an accomplishment.

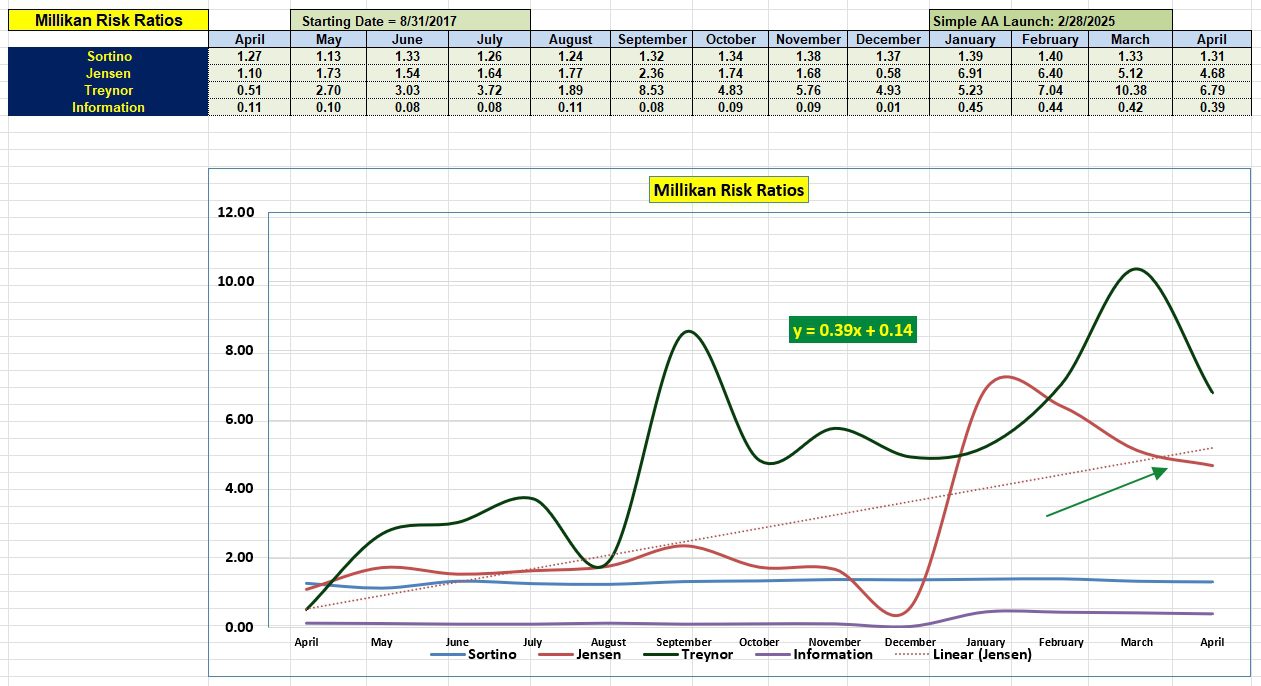

Millikan Risk Ratios

Looking back one year the Millikan shows improvement for all four risk measurements. Current draw-downs is having an impact on the Jensen Performance Index, a favorite of all the risk measurements.

The next half year is going to be a challenge, particularly if the president continues to dig a deep tariff hole.

Millikan Sector BPI Portfolio Review: 10 May 2024

Millikan Sector BPI Portfolio Review: 6 September 2024

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Leave a Comment or Question