Bugatti Aerolithe – Reproduction

Schrodinger is the gold standard when it comes to passive investing. This portfolio answers the question, “Who will manage the family portfolio when I die?” This style portfolio goes by several titles. The general classification is Robo Advisor where the portfolio is managed by computer. Eventually I expect Artificial Intelligence will be or is currently being used as an aid in management. The Schrodinger happens to be housed with Schwab and is called an “Intelligent Portfolio.” Regardless of what title is assigned to the portfolio, it is strictly managed by computer. Several brokers provide this type of service. With Schwab the cost is zero. Yes, there are the usual expense ratios associated with Exchange Traded Funds (ETFs), but otherwise there is no additional cost for this portfolio management service.

All one does is open up an account with Schwab, answer a few risk oriented questions and from then on just add money to the account. Once the portfolio reaches the $50,000 limit Schwab will begin to tax manage the account. With the Schrodinger I made a few requests. I asked Schwab to concentrate on U.S. Equities as the original portfolio was invested too heavily in International Equities for my liking. In addition I asked Schwab to be more aggressive than is generally recommended for an investor my age. I did not want as much emphasis placed on bonds. Once the portfolio is operating, as an owner you can change the stock/bond percentage ratio. I don’t recall ever changing the Schrodinger stock/bond ratio.

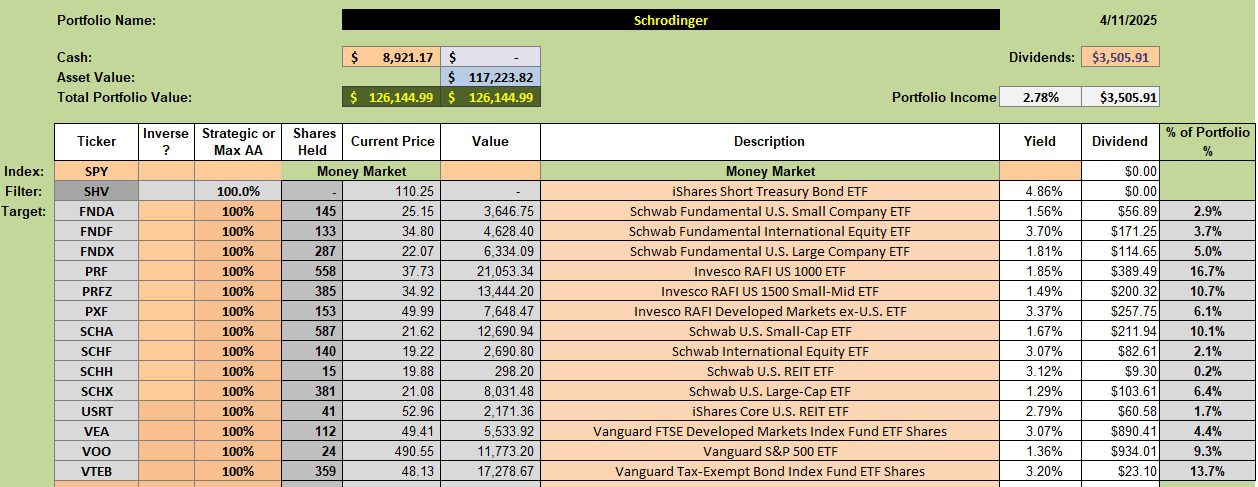

Schrodinger Asset Allocation Holdings

Below are the current security holdings for the Schrodinger. As I’ve mentioned before, a few assets don’t make much sense as percentage holdings below 3.0% don’t add much value to the portfolio.

One of my favorite Schwab ETFs is SCHD and it is not included in the Schrodinger. You will find it in numerous other ITA portfolios.

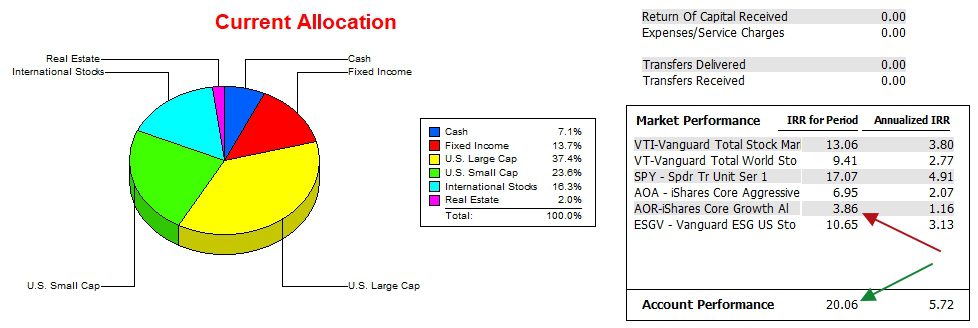

Schrodinger Performance Data

Since 12/31/2021 the Schrodinger managed to outperform all possible benchmarks I track using the Investment Account Manager software. As I frequently write, serious investors benchmark their portfolios and the S&P 500 (SPY) is a high bar to outperform. Recent market volatility cut into the lead over various benchmarks, but the passive Schrodinger continues to hold a substantial lead over the AOR benchmark.

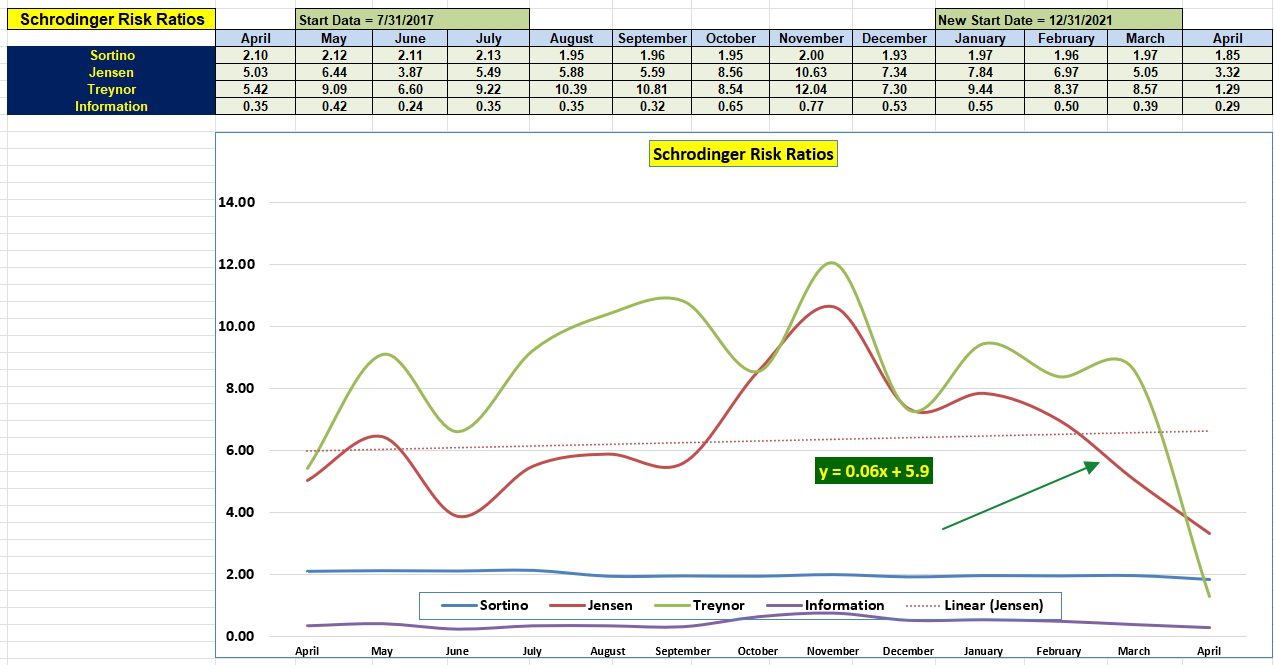

Schrodinger Risk Ratios

The stock to bond ratio of the Schrodinger is 80% in equities and 20% in bonds and cash. Is this ratio too risky? The Jensen Performance Index (frequently called Jensen Alpha) says no. So long as the Jensen remains above zero I am quite pleased. Readers can see the portfolio took a hit here in April, as did most portfolios. Even portfolios heavy in bonds were shaken due to total mismanagement of tariffs.

New readers to the ITA blog should pay particular attention to the Jensen and Information ratios. Of all the portfolios tracked here at ITA, the Schrodinger and Copernicus continue to sport high values for both the Jensen and Information ratios.

As for the slope of the Jensen, it is barely holding on to a positive value. Once we get to November expect the slope to turn negative.

Comments are always welcome. Pass the ITA link on to your family and friends. This blog is free to all who register as a Guest.

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

Looks like the Comment and Question option is back after re-activating the JetPack plugin.

Lowell