The Episcopal Chapel of Transfiguration – Jackson Hole, Wyoming.

One of two reference portfolios is the Schrodinger. The other is the Copernicus. Were one to lose all spreadsheets and access to databases, these two different investing models would survive and serve the investor quite well. As for the term reference, I compare all the other portfolios tracked here at ITA with the Schrodinger as it is truly a passively managed portfolio.

For new ITA readers, the Schrodinger is what Schwab calls an Intelligent Portfolio. The attached records keep track of just how intelligent the Schrodinger actually is. This portfolio is what I call a Robo Portfolio as it is managed by a computer using an asset allocation algorithm. Over the last several years the Schrodinger consistently performs in the top third of all ITA portfolios.

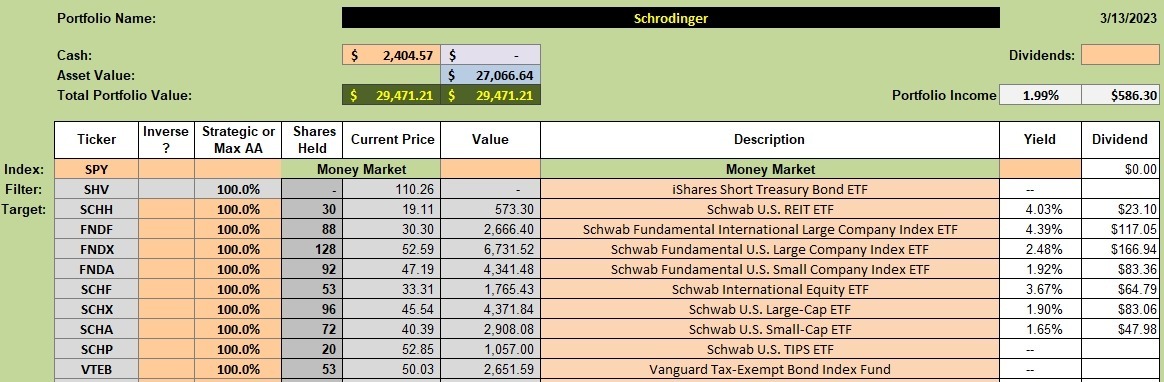

Schrodinger Investment Quiver

Below is the current investment quiver and holdings for the Schrodinger. Readers could easily follow this model and invest similar percentages in the ETFs shown below. One advantage the individual investor has is that they need not keep 8.0% of the portfolio in cash.

This link will take you to the oldest Schrodinger post currently on the blog. From time to time I go back and clean out old blog posts in an effort to hold the size of the backup in check.

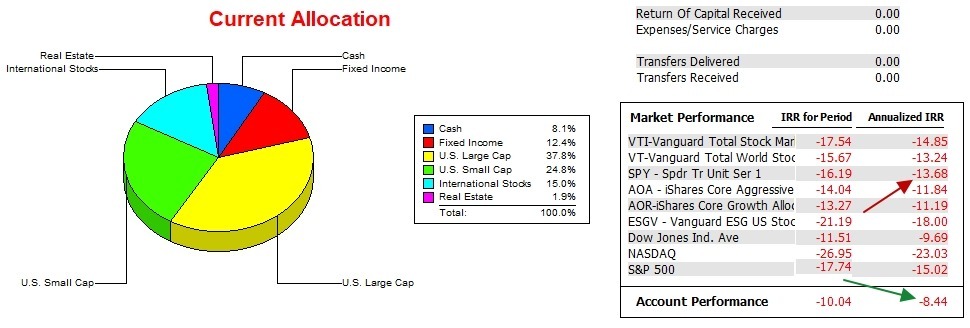

Schrodinger Performance Data

Over the past 14.5 months the Schrodinger lost an annualized 8.4% while the S&P 500 (SPY) dropped 13.7%. In good times the Schrodinger tends to lag SPY and in bear markets, such as this one we are still in, the portfolio outperforms the S&P 500.

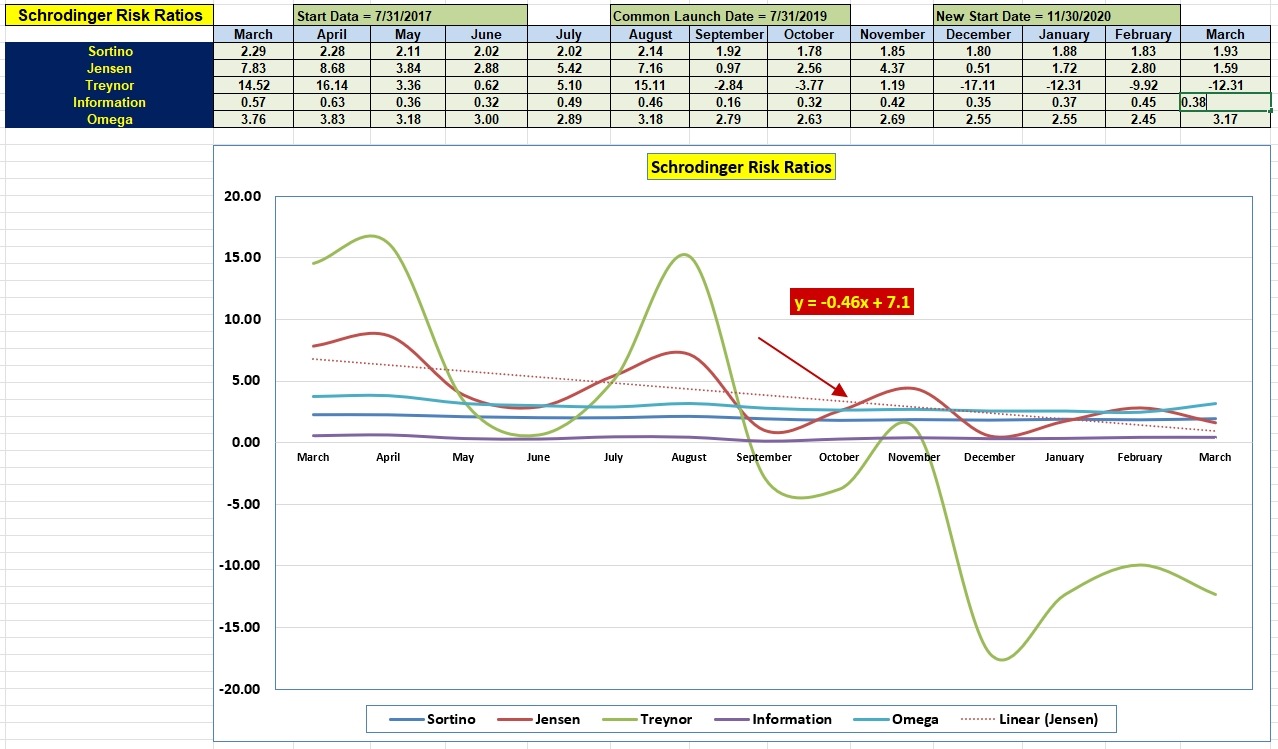

Schrodinger Risk Ratios

The following risk data indicates the Schrodinger continues to do quite well when all is taken into consideration. It is going to take a good equities market before we see a positive slope for the Jensen.

When going over risk data, pay attention to the Information Ratio as it tells one how the portfolio is performing with respect to the benchmark.

Schrodinger Interim Update: 19 October 2022

Discover more from ITA Wealth Management

Subscribe to get the latest posts sent to your email.

You must be logged in to post a comment.